Sonic's "Dangerous Game": The Second Charge of Algorithmic Stablecoins

When Andre Cronje, co-founder of Sonic Labs, announced an annual yield of up to 23% for its algorithmic stablecoin on X platform, the crypto market seemed to press the "historical rewind button" - the tragic scene of Terra's collapse three years ago resurfaced. This new project, originating from the former Fantom public chain, is attempting to rewrite the fate of algorithmic stablecoins through technical upgrades and yield reconstruction.

Recommended Reading: Sonic DeFi Ecosystem Explosion: USDC Whale Entry, TVL Surges 83% Against the Trend, How Much More Can Token S Rise?

Sonic's "Yield Curve" Design: From POC to Scaled博弈

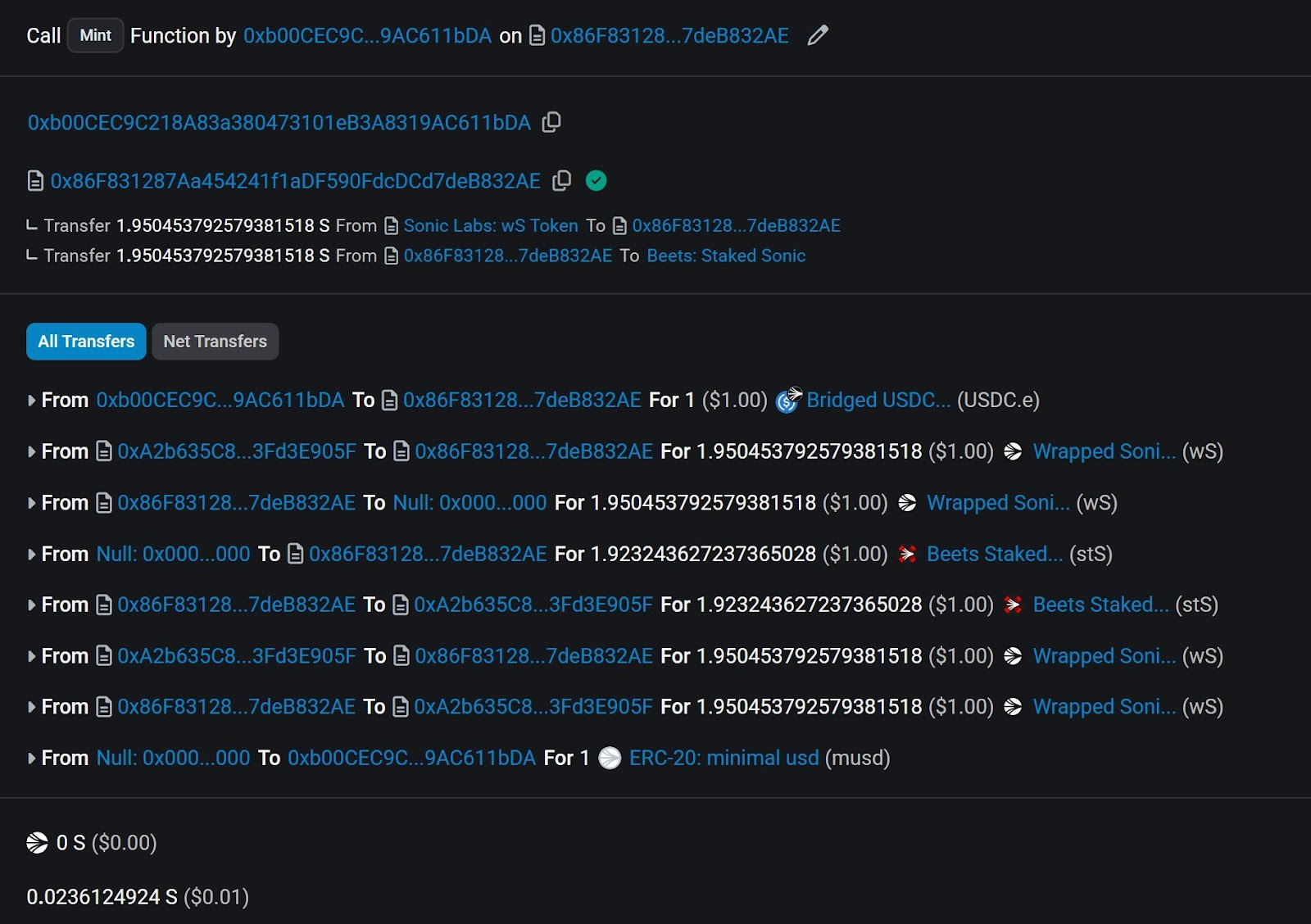

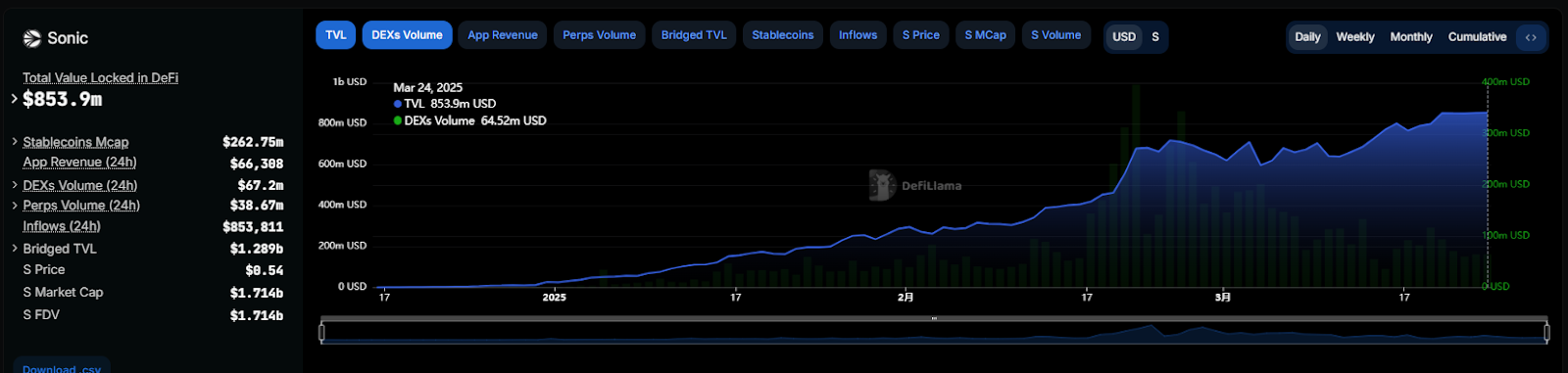

According to data disclosed by Cronje, the stablecoin's yield rate shows a significant inverse relationship with Total Value Locked (TVL): over 200% annual yield at $10 million TVL, dropping to 23.5% at $100 million, and stabilizing at 4.9% when reaching $1 billion. This design intends to avoid Terra-style high-yield dependency through dynamic yield rate adjustment.

Technical Bottom Layer Innovation:

- 720ms Finality: Sonic's testnet transaction irreversibility speed far exceeds Ethereum's 12 minutes and Solana's 2-second level, theoretically supporting high-frequency arbitrage and rapid liquidation

- EVM Compatibility: Seamlessly accessing Ethereum ecosystem, attracting developers to migrate existing DeFi protocols, forming a yield stacking effect, with current Sonic TVL increasing to $850 million

Risk Controversy Focus:

- TVL and Yield Rate Dynamic Balance: Yield rate dropping sharply to 4.9% after TVL exceeds $1 billion, potentially triggering an early high-yield chaser exodus

- Arbitrage Mechanism Not Disclosed: Terra's fatal wound was lack of effective arbitrage buffer when UST de-pegged, and Sonic has not yet revealed specific algorithmic logic

Terra Collapse Dissection: The "Death Spiral" Gene of Algorithmic Stablecoins

Looking back at May 2022, Terra ecosystem's collapse was not a coincidental event, but a result of the "time bomb" in its mechanism design triggered by market behavior. UST's 20% fixed APY and LUNA's unlimited issuance mechanism formed a self-reinforcing destruction loop.

Four Stages of Death Spiral

- Yield Dependency Period: Anchor Protocol maintained 20% APY through subsidies, attracting $39 billion TVL, but reserve could only support 3 years of consumption

- Liquidity Siege Period: On May 8, 2022, institutions exploited UST liquidity gaps for concentrated selling, withdrawing $2 billion in a single day, UST first de-pegged to $0.98

- Panic Trampling Period: Users exchanged UST for LUNA, causing LUNA circulation to surge from 700 million to 6.35 trillion, with price going to zero

- System Collapse Period: Terra chain shut down, LUNA market value evaporated 99.9%, triggering $2 trillion crypto market value contraction

Survivor Bias: Why Does LUNA Still Have $18 Million Daily Trading Volume?

CoinMarketCap data shows LUNA price has dropped 98% from its historical peak, but still maintains an average daily trading volume of $18 million. This "zombie token" phenomenon reflects:

- Speculative Psychology: Some investors bet on Terra Classic ecosystem reconstruction possibility

- Cognitive Disconnect: New entrants lack historical memory, mistaking low price for investment opportunity

- Liquidity Residue: Decentralized exchange long-tail effect maintains basic trading scenarios

- MEME Narrative: Investors now treat luna as blockchain's biggest bubble meme

Algorithmic Stablecoins' Double Paradox: Innovation Necessity and Systemic Risk

The essence of algorithmic stablecoins is to replace central institutions with code, achieving automated monetary policy execution. This design contains both the potential to subvert traditional finance and risks far exceeding fiat stablecoins.

Unavoidable "Three-Body Problem"

- Yield Source Dilemma: High yield rates must depend on external input (like Sonic's TVL growth, Terra's Bitcoin reserves), otherwise becoming a Ponzi structure

- Price Stability Illusion: UST's "stability" was built on continuous LUNA market value growth, forming a unidirectional value transmission fragility

- Regulatory Vacuum: Currently, 90% of algorithmic stablecoins have not disclosed reserve audits, leaving room for opaque operations

Regulatory "Wall-Breaking Action": MiCA Law's Paradigm Revolution

The implementation of EU's Market in Crypto-Assets (MiCA) regulation marks algorithmic stablecoins entering the "regulatory target zone". Its core measures include:

- Issuance Ban: Directly prohibiting algorithmic stablecoins without asset support

- Reserve Penetration: Requiring stablecoin issuers to hold 100% equivalent liquid assets and publicly audit daily

- Usage Scenario Restriction: Non-euro stablecoins' daily transaction volume in EU payment scenarios cannot exceed €200 million

- This law has caused USDT, DAI, and other mainstream algorithmic stablecoins to exit the European market, with USDC benefiting most due to compliance

Sonic Experiment's Revelation

Even facing a 99% failure probability, algorithmic stablecoin innovation attempts still hold value.

Stablecoins essentially represent a code-based trust encapsulation. While Terra proved with $40 billion that "code ≠ trust", Sonic's adventure seems more like a crypto native's self-redemption. The future stablecoin market will likely diverge: compliant fiat stablecoins dominating payment layers, hybrid experimental products navigating DeFi deep waters, while pure algorithmic models may retreat to geek forum code repositories.

The most critical insight in this game might be: No financial innovation can override system stability, and when yield becomes the sole belief, collapse is just a matter of time. As Andre Cronje hesitated before launching the project - "The PTSD from algorithmic stablecoins runs too deep" - the crypto world needs not just faster chains, but a deeper understanding of human greed