The market, project, currency, and other information, views, and judgments mentioned in this report are for reference only and do not constitute any investment advice.

Written by 0xWeilan

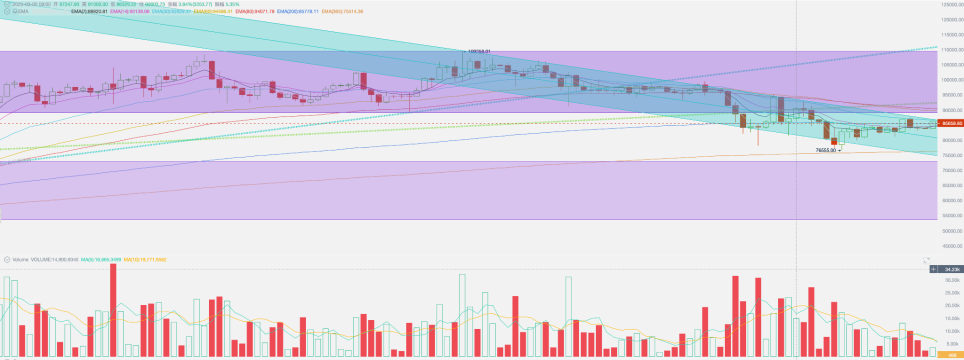

This week, BTC opened at $82,562.50 and closed at $86,092.94, rising 4.28% for the week with a volatility of 7.71%. It has been rising for two consecutive weeks, with trading volume declining for three weeks. BTC price is running within a downward channel, approaching the upper boundary.

This week, the Federal Reserve adopted a dovish tone at the monetary policy meeting, indicating they would intervene if economic issues arise and hinting at two rate cuts this year.

After US stocks stabilized and ETF channel funds flowed in massively, BTC stabilized and rebounded to the upper boundary of the downward channel.

With the US PCE data to be released next week, BTC price will also face a directional choice.

Macroeconomic and Economic Data

On March 19, the Federal Reserve made a decision widely expected by the market, maintaining the benchmark interest rate unchanged at 4.25-4.5%. Additionally, the Fed hinted at another 50 basis point rate cut in 2025 and announced adjustments to its bond sell-off speed.

Fed Chair Powell stated they lowered economic growth expectations and emphasized that Trump's tariff policy is the biggest factor driving inflation. However, the US stock market, which has been declining for three consecutive weeks, focused on their most anticipated assurance - the Fed will take action if the economic situation deteriorates.

A clear "market rescue" signal is slowing down the balance sheet reduction from April 1, adjusting the US debt sell-off cap from $25 billion to $5 billion per month. The slowdown in balance sheet reduction is seen as a boost to the bond market. The Fed's relatively "dovish" response to market declines indicates they are monitoring job market and equity market stability while pursuing inflation targets to prevent a larger crisis.

In the ongoing interplay of rate cuts and US presidential tariff chaos, while the Fed maintains its stance, its attitude has undoubtedly begun to soften. Both the two-rate-cut guidance and the lowered US debt sell-off cap are understood as protection against stock and bond declines.

Therefore, although fundamental issues like "tariff policy chaos" and "economic stagflation" remain unchanged, the market that experienced declines is beginning to stabilize and recover. The US dollar index rose 0.25% for the week. Nasdaq, S&P 500, and Dow Jones rose 0.17%, 0.51%, and 1.2% respectively. 2-year and 10-year US Treasury yields fell 1.59% and 1.39% to 3.9670% and 4.2580%.

Another portion of funds continues to choose safe-haven gold. London gold achieved a 3-week consecutive rise, rising 1.23% this week, closing at $3,023.31 per ounce.

Stablecoins and BTC Spot ETF

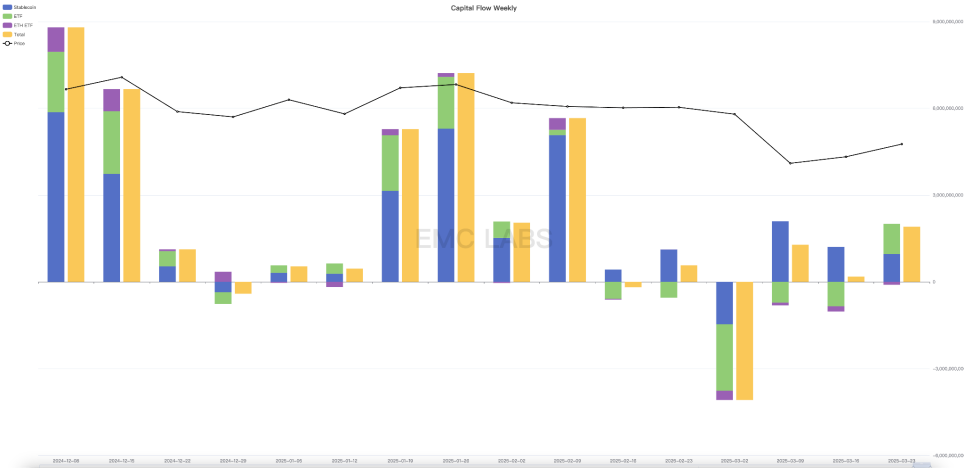

In terms of funds, the biggest variable BTC Spot ETF showed a breakthrough signal, receiving positive inflows this week after five consecutive weeks of decline. All five trading days recorded net inflows, totaling $1.05 billion. Such massive inflows have become a strong support for BTC price's bottom reversal.

In the stablecoin sector, a total of $958 million flowed in for the week. Across all channels, a total of $1.95 billion flowed in, providing material support for a market filled with panic.

Crypto Market Fund Inflow and Outflow Statistics (eMerge Engine)

The BTC Spot ETF channel funds once again demonstrated a stabilizing effect. Future market trends require close attention to this. Of course, BTC Spot ETF funds are essentially controlled by US stock market trends, making BTC price prediction extremely difficult.

Selling Pressure and Sell-offs

Accompanying the price rebound, market selling pressure significantly weakened to 114,992 coins. According to eMerge Engine data, long-term holders sold 3,284 coins this week, while short-term holders sold 111,709 coins.

Long-term holder positions increased by 73,000 coins for the week, with exchange holdings decreasing by nearly 7,000 coins. The selling pressure from short-term groups continues to be absorbed, indicating long-term groups' acceptance of the current price.

Cycle Indicators

According to the eMerge engine, the EMC BTC Cycle Metrics indicator is 0.375, indicating the market is in a rising continuation period.

EMC Labs was established in April 2023 by crypto asset investors and data scientists. Focusing on blockchain industry research and crypto secondary market investment, with industrial foresight, insights, and data mining as core competencies, committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and crypto assets' benefits to humanity.

For more information, please visit:https://www.emc.fund