Author: Nancy, PANews

Ethereum is experiencing a long growth pain, with continuous price pressure, significantly declining on-chain activity, and continuous outflow of spot ETF funds... These signs are gradually eroding market confidence in its growth potential. As the U.S. crypto regulatory environment quietly changes, several ETF issuers have recently submitted Ethereum ETF staking proposal applications to the SEC. For Ethereum, which currently lacks a clear demand catalyst, this change is also viewed by the market as a key variable for emerging from its low point in the short term.

ETF Funds Severely Bleeding, ETF Staking Approval Potentially Announced This Month

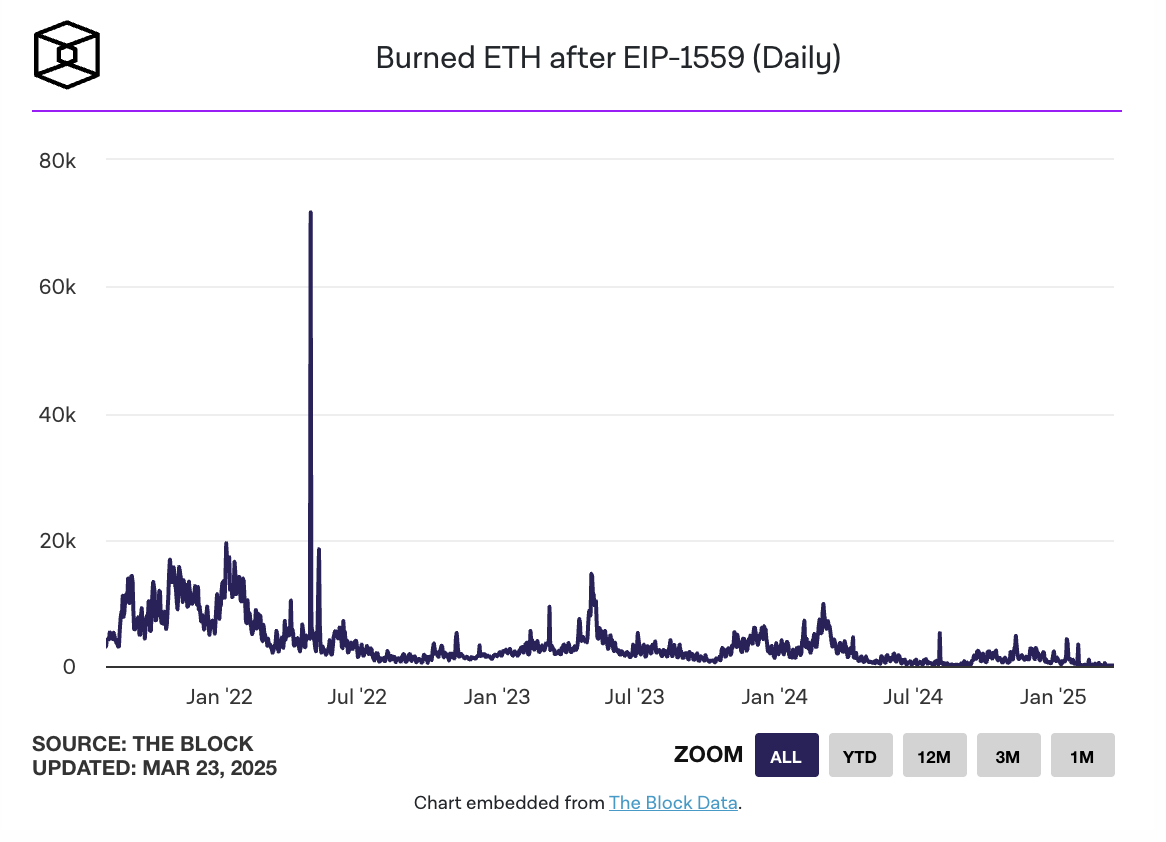

[The rest of the translation follows the same professional and accurate approach, maintaining technical terminology and preserving the original meaning.]The continuous decline in on-chain activity data further highlights the fatigue of the Ethereum ecosystem. According to The Block data, as of March 22, the amount of ETH burned due to transaction fees on the Ethereum network dropped to 53.07 coins, approximately $106,000, hitting a historical low. Ultrasound.money data shows that the annual ETH supply growth rate is 0.76% over the past 7 days. Moreover, the number of active addresses, transaction volume, and transaction count on the Ethereum chain have been simultaneously declining in recent weeks, indicating a diminishing vitality in the Ethereum ecosystem.

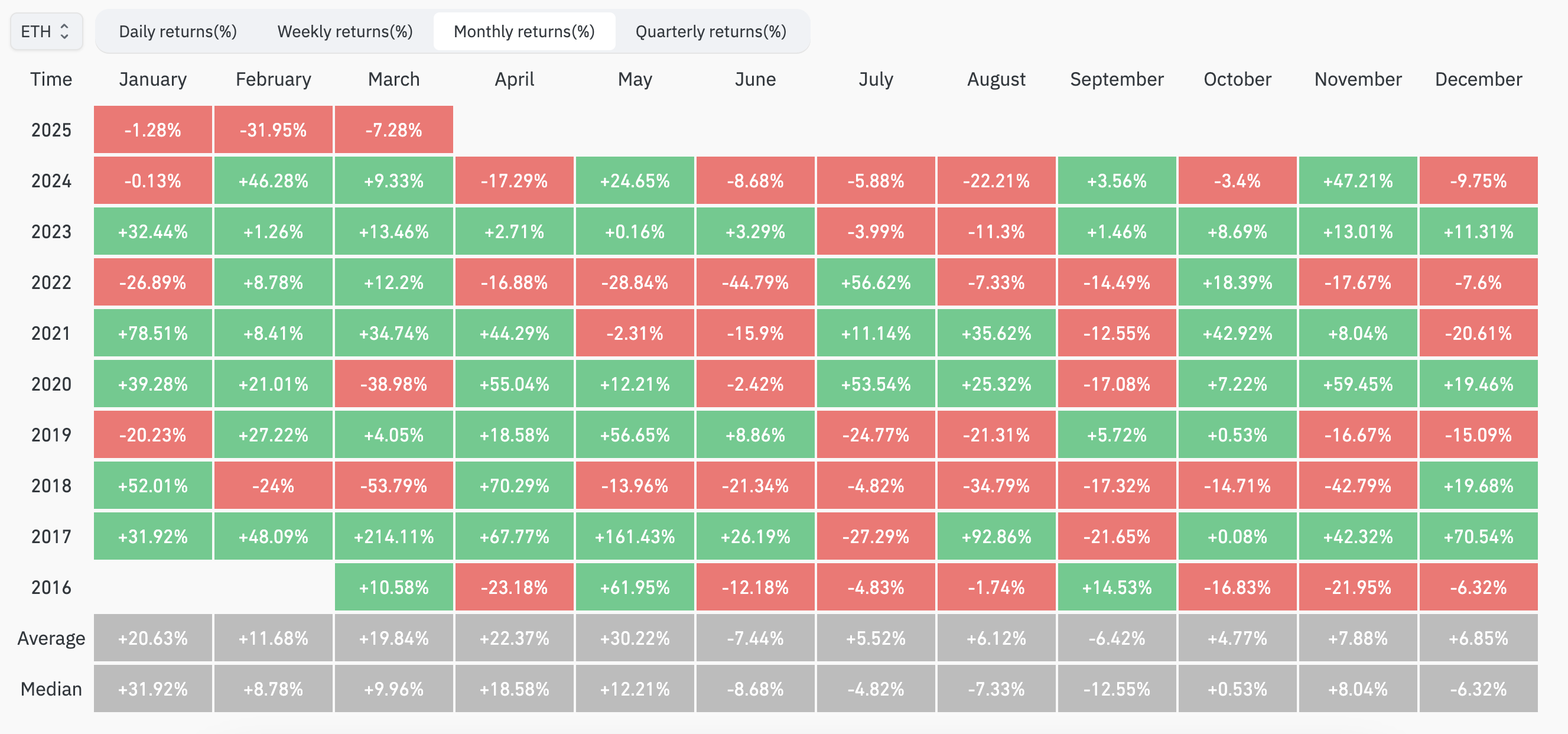

Meanwhile, Ethereum experienced its worst performance in Q1 this year. Coinglass data shows that Ethereum had its most dismal start in recent years, with negative returns for three consecutive months for the first time: January: -1.28% (historical average return: +20.63%, median: +31.92%); February: -31.95% (historical average return: +11.68%, median: +8.78%); March: -7.28% (historical average return: +19.55%, median: +9.96%).

Ethereum's challenges stem from multiple structural issues. For instance, while L2 solutions like Arbitrum and Optimism significantly reduced transaction costs through Rollup technology, they have also diverted transaction volume from the mainnet, with L2 transactions now exceeding mainnet transactions, leading to a decline in both mainnet gas fees and ETH burning. More critically, transaction fees generated by L2 mostly remain within their ecosystem (such as Optimism's OP token economy) rather than flowing back to ETH. Additionally, Ethereum's market share is being eroded by other public chains like Solana due to its insufficient competitiveness in high-performance application scenarios.

Standard Chartered Bank has also lowered its ETH price target for the end of 2025 from $10,000 to $4,000 in its latest report, presenting several key judgments: L2 expansion weakens ETH market value (L2 solutions originally meant to improve Ethereum's scalability have caused a $50 billion market value evaporation); ETH/BTC ratio expected to continue declining (projected to fall to 0.015 by the end of 2027, the lowest since 2017); future growth may depend on RWA (if RWA tokenization develops rapidly, ETH might maintain its 80% security market share, but the Ethereum Foundation needs to adopt a more proactive business strategy, which seems unlikely).

Overall, while Ethereum ETF staking can somewhat impact ETH supply and holder returns, it cannot directly address core challenges such as ecosystem competition, L2 diversion, or low market sentiment. Ethereum still needs to seek a breakthrough in both technology and narrative.