The curtain opens: the origin and evolution of BNB

Binance was founded by CZ(CZ) and He Yi in 2017. In just a few years, it has become the world's top cryptocurrency exchange. Its native token BNB (Binance Coin) has also gradually transformed from a simple transaction fee discount tool to a pillar of a multi-scenario ecosystem. In July 2017, Binance issued 200 million BNB through ICO, raising about 15 million US dollars, and the initial exchange rate was set at 1 ETH for 2,700 BNB. At that time, the ICO boom was at its peak. Binance entered the market with a low-key and pragmatic attitude, completing the ICO and listing on the exchange in just 14 days, showing its efficient execution. In the white paper, BNB is given three major functions: transaction fee discounts, platform governance participation, and ecological expansion potential. This design laid the groundwork for future take-off.

In 2019, BNB underwent its first major transformation - migrating to Binance Chain (later renamed BNB Chain). This move not only got rid of its dependence on the Ethereum network, but also gave it diversified scenarios such as payment, staking, and Launchpool. For example, early users could use BNB to pay 0.05% of transaction fees on the Binance platform (compared to the normal 0.1%). This discount mechanism quickly attracted a large number of traders. The ecological landscape has expanded to cover DeFi (such as PancakeSwap), Meme coins (such as Four.Meme), and RWA (real-world assets, such as tokenized real estate projects), like a towering tree with deep roots and lush leaves.

However, the road to growth is not a smooth one. The shadow of compliance has shrouded Binance many times: in June 2021, the UK FCA ordered it to suspend its regulated business on the grounds that the lack of effective regulatory measures prevented British users from recharging through bank channels; in November 2023, the US Department of Justice accused Binance of violating anti-money laundering regulations and fined it up to US$4.3 billion. CZ was sentenced to four months in prison and resigned as CEO. This turmoil once caused the price of BNB to fall below US$300, and market confidence was shaken. However, on September 27, 2024, CZ returned as the largest shareholder after being released from prison. His personal influence quickly stabilized the morale of the troops, and the price of BNB rebounded to US$450 within two weeks, showing its ecological resilience and the deep foundation of community trust.

The craze is back: Community Carnival in 2025

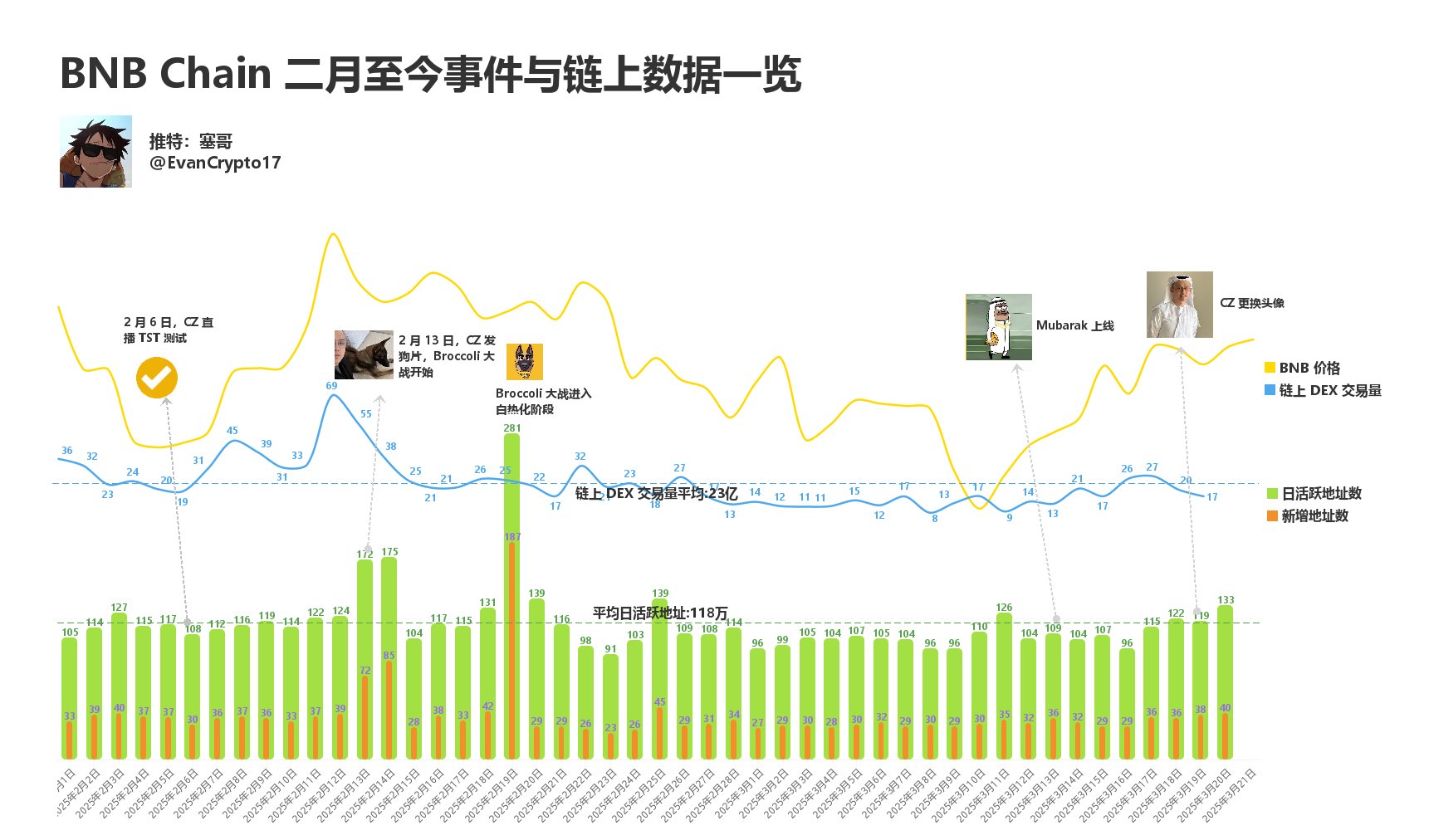

Entering 2025, Binance took the opportunity of the Meme coin craze to rekindle the community's enthusiasm and demonstrated its unique ability to mobilize market sentiment. In February, CZ casually mentioned his pet "Broccoli" on the X platform. As soon as this remark came out, the community responded quickly, and Broccoli-themed Meme coins came into being. The trading volume soared from zero to 30 million US dollars in 24 hours. In March, CZ purchased 20,150 Mubarak (MUBARAK) and 9,161 Test (TST) for 1 BNB. This move was regarded as a "magic operation" by the market: Mubarak's market value soared from US$6,000 to US$200 million in 48 hours, an increase of more than 25,000%, and TST's market value also climbed from insignificant to US$50 million. The daily trading volume once accounted for 15% of the total BNB Chain.

Source: @EvanCrypto17

He Yi to be outdone, He Yi interacted with fans on X in March to promote the art-style meme coin BUBB. She forwarded a user-created BUBB art illustration and said, "The combination of art and blockchain is exciting." This move sparked heated discussions, and the market value of BUBB soared from 3 million US dollars to 34 million US dollars, an increase of more than 10 times, and the number of daily active addresses on the chain surged to 50,000. Community users even spontaneously organized the "BUBB Art Festival" and auctioned related works through the Binance NFT platform, with a transaction volume of 1.2 million US dollars in three days.

The personal influence of the leader has become a catalyst for the craze. CZ publicly disclosed his holdings on February 24, revealing that 98.6% of his assets were BNB, with a total amount of approximately US$1.5 billion. This move was interpreted as a firm endorsement of the long-term value of BNB; He Yi on March 7, "Binance does not make money by listing coins, we make money from the future of the ecosystem," emphasizing that user interests come first; the new CEO Richard Teng pointed out in an internal meeting on March 15 that "the value of BNB is not only in transactions, but also in its security and cross-scenario practicality, such as on-chain payments and staking income."

At the same time, Binance received a major boost in March: Abu Dhabi technology investment company MGX announced that it would invest in Binance in the form of $2 billion in stablecoins and acquire a minority stake in it. This is the first time that Binance has introduced institutional investment and the largest single investment in the crypto industry to date. This transaction not only set a record for the largest investment paid in cryptocurrency (stablecoins), but also marked MGX's official entry into the crypto and blockchain fields. Ahmed Yahia, CEO of MGX, said, "The investment in Binance reflects our confidence in the potential of blockchain to transform digital finance." This capital injection has injected strong momentum into the Binance ecosystem and further boosted the community craze. Binance's deep roots in Abu Dhabi - about 1,000 employees (20% of its 5,000 employees worldwide) are stationed here - also laid the foundation for this cooperation.

Are users buying into the founder's series of initiatives and reforms? The data gives a positive answer.

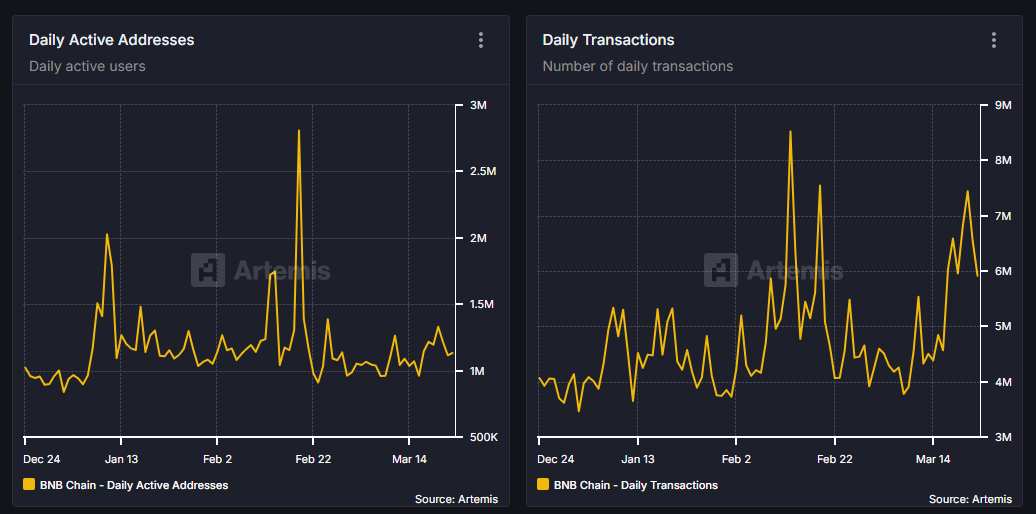

The meme season in February and March brought significant gains for BNB, both exceeding 25%, and the market responded positively to the Binance ecosystem boom. The number of active addresses on the BNB Chain reached 4.4 million, the average daily transaction volume exceeded 4 million, and the chain revenue increased steadily.

According to DeFiLlama data, the cumulative transaction volume of BNB Chain ecological DEX last week reached 14.336 billion US dollars, ranking first among all chains; in the past 24 hours, PancakeSwap generated 3.43 million US dollars in fees and 709,000 US dollars in protocol income, and Four.Meme generated 747,000 US dollars in fees and 711,000 US dollars in protocol income, both of which ranked at the forefront of on-chain protocols. Launchpool attracts an average of 100,000 users to participate every day, with APY of up to 15% for popular projects, and 500,000 people participated in the first round of voting activities. These data show that governance reforms and technological upgrades have effectively activated the ecology, and user participation and market confidence have increased significantly. The price of BNB stabilized at around 600 US dollars in March, with an annual increase of more than 50%.

BNB Chain’s Ecological Closed Loop

The core of BNB Chain is to feed back the centralized exchange (CEX) with the public chain ecology. Through the deep binding of the exchange, public chain and wallet, a super closed loop of resource integration and value capture has been built. This closed loop not only activates the flow on the chain, but also builds BNB into the "cash flow code" of the ecology through innovative currency listing strategies and incentive mechanisms, creating a win-win situation for users, project parties and platforms.

BNB Chain has built a super closed loop of resource integration and value capture through the deep collaboration between the public chain ecology and centralized exchanges (CEX). This closed loop is centered on the exchange, public chain, and wallet. It not only activates the on-chain traffic, but also builds BNB into the "cash flow code" of the ecology through innovative listing strategies and incentive mechanisms, achieving a win-win situation for users, project parties, and platforms.

On-chain ecological drainage: Activating traffic and user growth

The closed loop of BNB Chain begins with the introduction of traffic to the on-chain ecosystem. Binance Wallet and Binance Alpha play a key role in this link. As the exclusive entrance to the TGE (Token Generation Event) event, Binance Wallet has attracted a large number of external users and pure CeFi users to migrate to the chain. In Q1 2025, Binance Wallet had more than 2 million new users, of which 40% first came into contact with BNB Chain through TGE activities. Binance Alpha focuses on incubating early projects, introducing new assets to BNB Chain by selecting high-quality projects (such as Mubarak and $BMT), driving ecological prosperity. Taking Mubarak as an example, its TGE event attracted 3.2 million BNB locks, the daily transaction volume on the chain increased by 30%, and the market value of related tokens soared from US$6,000 to US$200 million.

Binance's new listing strategy further strengthens the drainage effect. At the beginning of 2025, Binance adjusted its listing model and adopted the method of "wallet-side TGE activities + secondary listing at the right time" to attract users to participate in the public sale with low valuations (such as $BMT 4% tokens corresponding to 20 million FDV), and forced the project tokens to be deployed on BNB Chain. This strategy brings multiple dividends: TGE activities drive the activity on the BNB Chain chain, and the on-chain transfer volume increased by 22% in March; BNB must be held to participate in the event, and retail purchase demand has surged, and BNB's average daily trading volume has increased by 15%; the "money-making effect" has spread word of mouth, and the number of active addresses on the chain has exceeded 4.4 million, and the average daily trading volume has reached 4 million transactions.

Launchpool and TGE linkage: binding users and value

The second layer of the closed loop is to deeply bind users and CEX through Launchpool and TGE activities, and strengthen the rigid demand for BNB. Launchpool is the core engine, and users need to pledge BNB to participate in the mining of new projects. Taking the Mubarak project in March as an example, its Launchpool activity provided an APY of 14.8% (far exceeding the 4.2% of the stablecoin FDUSD), attracting 3.2 million BNB locks, accounting for 2.2% of the circulation, and users made an average profit of 1,500 Mubarak. These new tokens need to be traded and cashed out on Binance CEX, driving CEX's monthly trading volume to grow by 18% and handling fee income to increase by approximately US$40 million. In 2024, the average BNB pledged amount will account for 15%-20% of the total circulation, and the high pledge rate will reduce the circulation market value by approximately US$1.2 billion, effectively alleviating selling pressure.

The TGE event further optimized this mechanism through Binance Wallet and Alpha. After the end of TGE, 4%-5% of the unlocked tokens were sold through DEX, resulting in a short-term price oversell ($BMT's first-day circulation was 25%, and the price fell by 40%). Binance deliberately delayed listing the token to transfer the risk of selling pressure to external exchange users. Binance users who did not participate in TGE were protected from the impact of "opening and dumping the market", maintaining the trust of the platform. TGE participants left the market through DEX arbitrage. In Q1 2025, such activities created a total income of more than US$150 million for retail investors, and retail investor sentiment improved significantly. In contrast, Ethereum's PoS verification income is only 3%-5%, Solana relies on the Meme craze to drive gas fees, and BNB upgrades it to an "interest-bearing asset" through the integration of centralized resource scheduling and public chain mechanisms, creating a barrier that other chains cannot reach.

Brand empowerment and value reshaping: amplifying the wealth effect

The third layer of the closed loop is to reshape value and amplify the wealth effect through community activities and secondary listings. During the meme craze, Binance launched various bounty activities, and even users could get BNB rewards by sharing their ideas on Binance Square. Different activities attracted 620,000 participants, indirectly driving the growth of CEX registered users by 8%, and 30% of new users were converted into active users on the chain. Binance Alpha also played an important role in secondary listings. Taking $BMT as an example, in the oversold stage after TGE, the project party repurchased tokens at a low price, and the valuation was underestimated by the market. Binance listed the currency through Alpha at the right time, and $BMT rose by 150% in the first week after listing, bringing significant wealth effects to users. Binance also took the opportunity to obtain more tokens from the project party (such as $BMT's HODLer Airdrop, which distributed an additional $20 million worth of tokens) for subsequent activities to further encourage user participation.

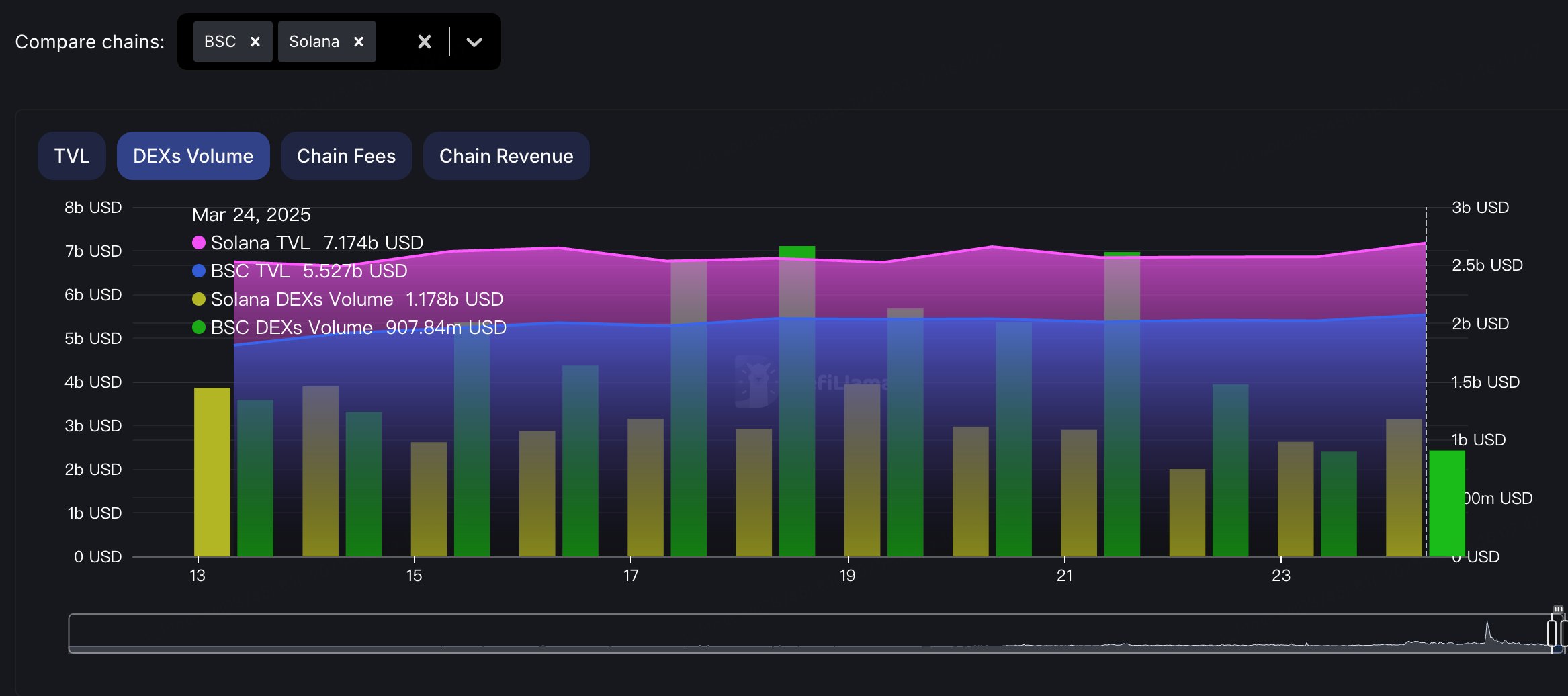

This strategy not only protects the reputation of the exchange, but also appeases the project owners - the second wave of price increases makes the project owners more willing to provide token support activities. In the third week of March 2025, the transaction volume of BNB Chain's ecological DEX reached 14.336 billion US dollars, surpassing Ethereum (13.25 billion US dollars) and ranking first among all chains; the chain revenue increased by 15% month-on-month to 28 million US dollars, and the ecological vitality and economic benefits went hand in hand.

The future of closed loop: the continuous evolution of the trinity

Through the coordination of the exchange, public chain, and wallet, BNB Chain has achieved a closed-loop circulation of traffic and optimized value capture through new coin listing strategies. In the future, this model may further differentiate: for new public chains or second-layer projects (such as @nillionnetwork), Binance may continue the traditional Launchpool model and emphasize deep ecological binding; for non-BNB ecological projects (such as @bubblemaps, @Bedrock_DeFi), they are more inclined to issue coins on BNB Chain through TGE activities, wait for opportunities to list coins, obtain traffic at low cost and amplify the wealth effect. This flexible strategy allows BNB Chain to take the lead in the competition and become a dual engine of ecology and value.

Innovation and innovation: Governance and technology go hand in hand

Binance takes a two-pronged approach in governance and technology, attempting to consolidate the foundation of the ecosystem through innovation.

Governance innovation : Binance optimizes the coin listing mechanism, adds the "vote to list" and "vote to delist" functions, and introduces the "community co-governance" model. On March 21, the first round of the "vote to delist" activity was launched. Users only need to hold 0.01 BNB to participate and vote on whether to delist low-liquidity assets (such as a token with a daily trading volume of only US$20,000). The event attracted 870,000 users, with a voting rate of 63%. This move not only enhances the user's voice, but also optimizes the quality of the ecosystem. In addition, the voting coin listing function has also attracted much attention. BANANAS31, SIREN, and Broccoli (CZ's Dog) are currently ranked in the top three in the voting coin listing list.

Technology upgrade : In January, BNB Chain released its 2025 technology roadmap, proposing an "AI-First" strategy and planning to use AI to optimize dApp performance. For example, AI-driven transaction prediction tools have been piloted on PancakeSwap, reducing user slippage losses by 8% and increasing transaction volume by 14%. The roadmap also promises to achieve sub-second block confirmation (target 0.8 seconds, current 1.2 seconds) and process 100 million transactions per day (current peak 72 million). On March 21, BNB Smart Chain (BEP20) and opBNB Chain completed upgrades and hard forks, shortening transaction confirmation time from 2 seconds to 1.5 seconds, reducing gas fees to $0.02 per transaction, and increasing daily active users on the chain by 9% to 980,000.

The effects of these reforms are beginning to show. On-chain data shows that chain revenue in March increased by 18% month-on-month, and user participation increased significantly. However, community attitudes are divided: some people are enthusiastic about Launchpool's high returns and voting mechanism, believing that this is the "dawn of decentralization"; others are worried about the risks of centralization, pointing out that voting rights are still affected by BNB holdings, and questioning the fairness of "co-governance". The success or failure of the reform still needs time to test.

Ecological game and narrative change of BNB, ETH and SOL

In this round of bull market, ETH, SOL and BNB have shown completely different development trajectories. The logic behind them is not only about technology or capital flow, but also reflects the game of ecological confidence, governance strategy and market narrative at a deeper level.

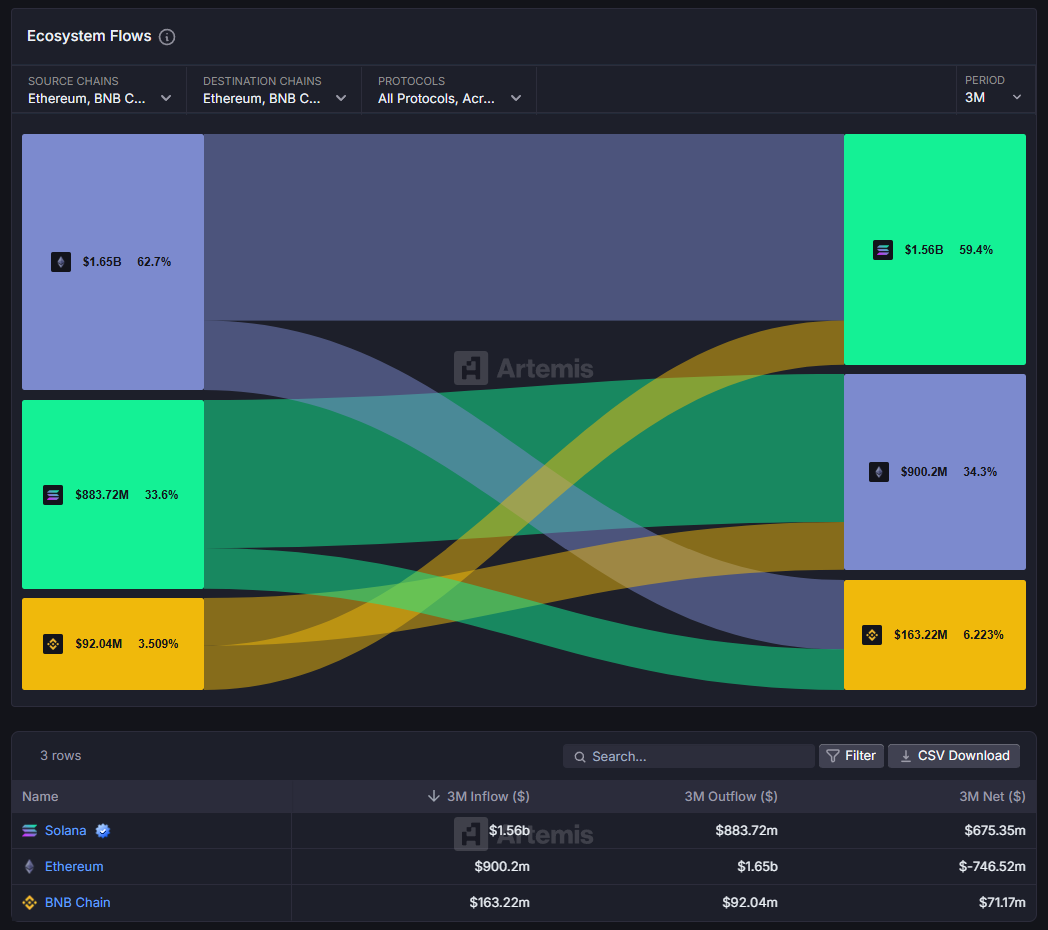

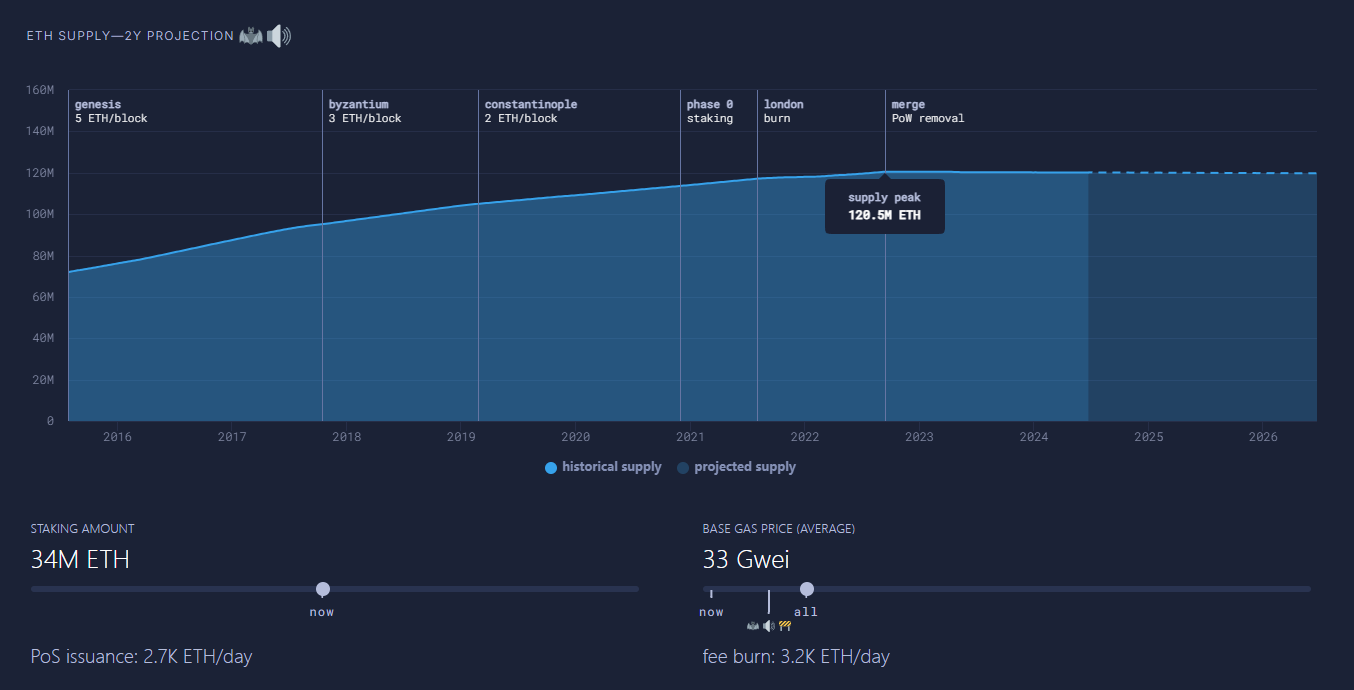

Ethereum (ETH) was once synonymous with smart contracts and decentralized applications, but its performance in 2025 was disappointing. This weakness stems from the Ethereum Foundation's strategic "sexy operation": over-betting on the Layer 2 (L2) expansion plan, but failing to effectively solve the value capture problem of the mainnet. Since the Dencun upgrade, the gas fee of L2 such as Arbitrum and Optimism has dropped sharply to US$0.5 per transaction, the transaction volume has surged, and the TVL (total locked value) has once approached US$20 billion, and developers and users have flocked to it.

However, the mainnet transaction fees have fallen to a historic low (only US$30 million in Q3 2024, a decrease of 80% from the same period in 2021), the burning mechanism of EIP-1559 is ineffective, and ETH's deflation narrative is gradually shattered.

The daily active addresses of the Ethereum mainnet dropped from 1.2 million in 2021 to 600,000 at the beginning of 2025. However, L2 is like a "parasite" sucking the vitality of the mainnet, and the confidence in the ecosystem is shaken.

More worryingly, the Foundation’s delay in the Pectra upgrade (originally postponed to Q3 from early 2025) and its ambiguous attitude towards community governance, such as the unresolved controversy over EIP-4844, further weakened investors’ long-term conviction. ETH’s increase in this round of bull market is only 20%, far less than BTC’s 120%, becoming a “struggle of the old nobility”.

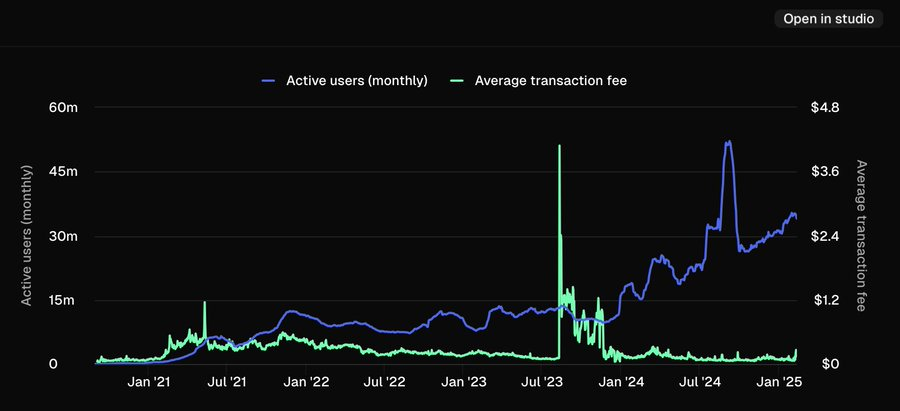

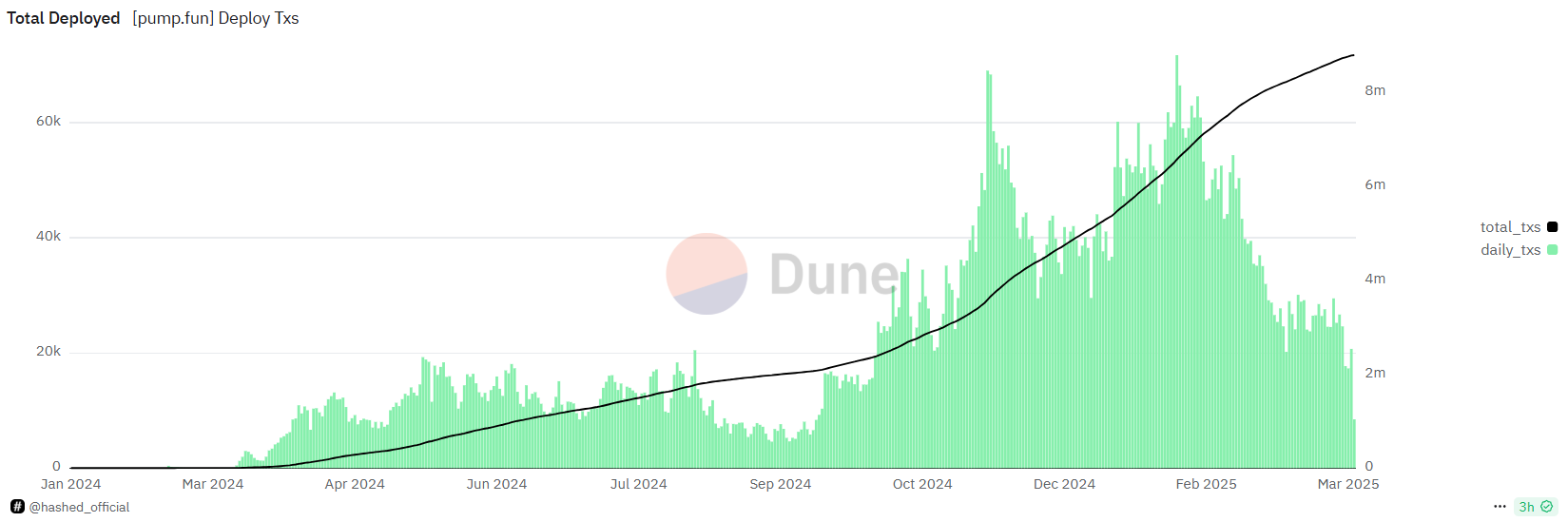

Solana (SOL) has experienced a dramatic turn from peak to trough. From the end of 2024 to the beginning of 2025, SOL became the absolute home of the Meme coin craze with its low transaction costs (average $0.00025 per transaction) and ultra-high throughput (peak 65,000 TPS). Platforms such as Pump.fun have spawned thousands of new tokens, with daily trading volume exceeding $2 billion at one point. The price of SOL has reached a historical high of $260, and its market value has once approached $100 billion.

However, there is a hidden crisis behind the craze: multiple community reports have revealed an "internal conspiracy" between institutions and project owners to manipulate the market. For example, in February 2025, a well-known Meme coin developer was exposed to have conspired with venture capital to quickly sell the tokens after they were launched, causing retail investors to lose more than $500 million. The relevant wallet addresses showed that the sale funds flowed to the associated accounts of a well-known institution.

On March 18, six tokens created on Four.Meme had a market cap of over $1 million in 24 hours, while only one token on Pump.fun had a market cap of over $1 million.

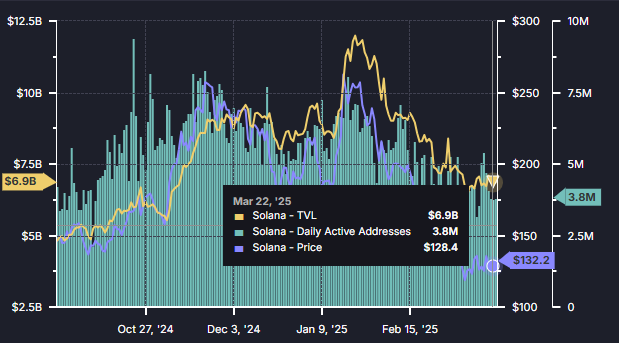

The trust in SOL's ecosystem collapsed, the number of active addresses on the chain dropped from a peak of 9.4 million to 3.8 million, the TVL shrunk to $7 billion, and the price fell below $150 in March, halving from the peak. SOL, which lost the blessing of Meme, exposed its shortcomings of over-reliance on speculative narratives. The doubts about the "computer room chain" within the ecosystem (downtime 3 times in 2024, each time for an average of 4 hours) and the tendency of centralization further exacerbated the market's distrust.

On the other hand, BNB, under the leadership of CZ and He Yi, has shown a completely different vitality. When SOL lost blood due to the scandal, BNB Chain seized the opportunity and quickly seized the exit traffic. In early 2025, Binance launched a number of ecological incentive programs, such as Binance Alpha to support early projects, attracting a large number of developers and users.

On the technical level, BNB Chain has reduced transaction fees to $0.001 per transaction through the opBNB upgrade, and increased TPS to 5,000, comparable to the performance of SOL. More importantly, BNB, backed by Binance's compliance advantages (holding licenses in more than 20 jurisdictions), has been the first to benefit from Trump's "Crypto Capital" policy, attracting capital inflows from European and American institutions. For example, in February 2025, Binance and the Dubai government launched the "Crypto Payment Pilot", with BNB payment transactions reaching $250 million and new institutional users accounting for 25%. In March 2025, the price of BNB exceeded $700, with an annual increase of 80%, and the ecosystem TVL rose to $12 billion, implicitly becoming the new king of this round of bull market.

BNB/SOL exchange rate trend game and market signals

The competition between BNB and SOL is not only reflected in the ecological level, but also directly reflected in the exchange rate trend between the two. As of March 24, 2025, the BNB/SOL exchange rate was 4.46, down 0.23 (4.91%) from the previous day. From the chart, BNB/SOL experienced a wave of increases from April to July 2024, climbing from around 3.0 to around 4.5, and then entered a period of shock adjustment from August to October, falling to a minimum of 3.2, and then ushered in a second wave of increases from November to January 2025, reaching a maximum of 4.56, an annual increase of 59%. However, the recent decline in the exchange rate shows a subtle change in market sentiment.

The current level of 4.46 is in the key support range of 4.4-4.5, which has been the starting point of rebounds many times in the past 12 months (such as October and December 2024). If BNB/SOL continues to fall and falls below 4.4, it may mean that BNB's short-term strong cycle has come to an end, and market funds may flow back to SOL to boost its recovery. The logic behind this is that after the Meme craze subsides, SOL's low valuation (the current P/E ratio is 30% lower than the historical average) and ecological restoration potential (such as Solana Mobile 2 integrating on-chain payments, and daily active users increased to 450,000) may attract speculative funds to flow back.

On the other hand, if BNB can hold the 4.4 support level and break through the previous high of 4.56, it may rekindle bullish sentiment and BNB/SOL is expected to hit the 5.0 mark. This requires the Binance ecosystem to continue to work hard, such as boosting market confidence through more Launchpool projects or favorable policies (such as the Trump administration further relaxing crypto regulations).

In comparison, ETH lost its value capture ability due to governance failures, SOL was seriously injured due to the bursting of the speculative bubble, and BNB stood out with its precise market sense and resource integration capabilities. This division is not only a contest of technology or funds, but also a victory or defeat of narrative and confidence - BNB seized the exit window of SOL and repeated its rise, while ETH is still struggling in its aging glory.

The Future is Here - BNB Compliance and Outlook

In 2025, the Trump administration's "Crypto Capital" plan brought policy dividends to the industry, and Binance took the lead with compliance licenses in more than 20 jurisdictions. For example, its VASP license in Dubai allows local users to purchase BNB directly with fiat currency, and the proportion of new users in 2024 reached 18%; its AMF registration in France made it the second largest CEX in Europe, with monthly trading volume increasing to US$12 billion. In contrast, Solana is deeply involved in the US SEC securities controversy, and the trading platform restricts its launch; the approval of Ethereum ETF has been delayed again and again due to the cautious attitude of traditional finance. BNB's compliance advantages pave the way for its ecological expansion. For example, in March, it cooperated with Singapore's dtcpay to pilot stablecoin payments, with each transaction fee as low as US$0.001, and the monthly transaction volume has reached US$90 million.

Ecological prosperity has injected a steady stream of traffic vitality into BNB Chain, governance innovation has given users unprecedented voice, and technological breakthroughs have made its performance comparable to the industry's top players. In 2025, BNB will be at the top of the public chain with its ecology, governance, and technology. However, the shadow of centralization and the potential recovery of SOL are still concerns on its road to becoming the king. Can BNB truly sit firmly on the throne of the king of public chains? The answer will be left to the final judgment of the market and time.