Bitcoin Is More Likely to Surge to a Historic High of $110,000 Due to Easing Monetary Policy Concerns, Rather Than Pulling Back Below $77,000.

Bitcoin might first reach a new historic high of $110,000 before experiencing any significant pullback. Some market analysts believe that easing inflation pressure and increasing global liquidity are key factors supporting Bitcoin's price rise.

Bitcoin has been rising for two consecutive weeks and successfully closed above $86,000 on March 23, showing a strong weekly closing trend, according to TradingView data.

BitMEX co-founder and Maelstrom Chief Investment Officer Arthur Hayes suggests that as market concerns about inflation gradually subside, this could lay the groundwork for Bitcoin to surge to a historic high of $110,000.

BTC/USD, 1-week chart. Source: Cointelegraph/TradingView

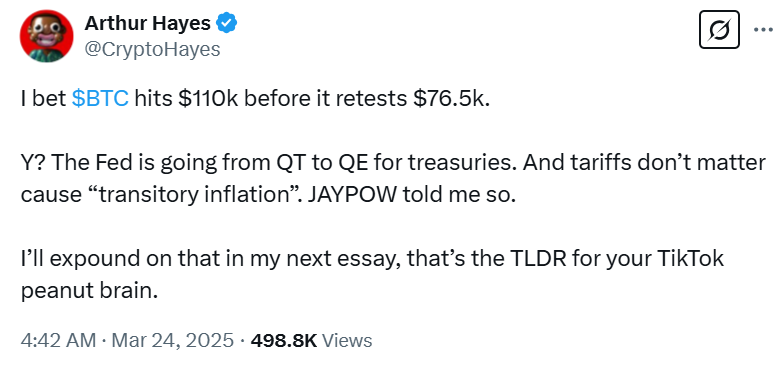

Hayes wrote in an X (Twitter) post on March 24:

"I bet $BTC will hit $110,000 before pulling back to $76,500. Why? Because the Fed is moving from Quantitative Tightening (QT) to Quantitative Easing (QE) on Treasuries. Tariff issues are irrelevant because inflation is 'just transitory'. JAYPOW told me so."

He added in a subsequent post:

"I mean, Bitcoin is more likely to hit $110,000 first before dropping to $76,500. If we break $110,000, it's like Yahtzee, we're not looking back, and the target is $250,000."

Quantitative Tightening (QT) refers to the Federal Reserve reducing its balance sheet by selling bonds or allowing bonds to mature without reinvesting. Quantitative Easing (QE) means the Fed purchases bonds and injects funds into the market to lower interest rates and stimulate consumption during economic difficulties.

However, other analysts point out that while the Fed has slowed QT, it has not yet fully shifted to an expansionary policy.

IntoTheCryptoVerse founder and CEO Benjamin Cowen stated:

"QT is not 'basically ending' on April 1. They are still reducing $35 billion in assets from mortgage-backed securities (MBS) monthly, just slowing down from a monthly balance sheet reduction of $60 billion to $40 billion."

Meanwhile, market participants are waiting for the Fed's anticipated shift to Quantitative Easing (QE), which has historically been favorable for Bitcoin prices.

BTC/USD, 1-week chart, 2020–2021. Source: Cointelegraph/TradingView

During the previous QE round in 2020, Bitcoin's price surged over 1000%, rising from around $6,000 in March 2020 to the historic high of $69,000 in November 2021. Analysts believe a similar market environment may be forming again.

Macro Environment May Support Bitcoin's Rise to $110,000

Bitcoin rebounded above $85,000 after last week's Federal Open Market Committee (FOMC) meeting, which is considered a bullish sentiment signal or indicating further potential for growth.

Enmanuel Cardozo, market analyst at RWA tokenization platform Brikken, told Cointelegraph that the current macroeconomic environment is also "supporting" Bitcoin's rise to $110,000.

He noted: "Increasing global liquidity and discussions around the U.S. establishing a strategic Bitcoin reserve could drive BTC towards $110,000. Additionally, the continued decline of BTC available liquidity on exchanges may lead to supply tightening."

However, he added: "A pullback to $76,500 also aligns with Bitcoin's historical volatility, typically triggered by profit-taking or unexpected market changes."

Other analysts also believe Hayes' prediction is likely to come true.

Bitget Research Director Ryan Lee told Cointelegraph: "Given Bitcoin's recent close above the 21-day and 200-day moving averages, this upward momentum is consistent with his view. However, the $88,000 resistance remains a key threshold."