Reading:https://docs.google.com/spreadsheets/d/1JSmI-YDvbdxXJ1Tud2sK8mly33zh1VmcH8i5wUgSYs0/edit?usp=sharing

TG Channel:https://t.me/SleepinRain

Binance Registration, Fee Reduction: https://www.binance.com/join?ref=MPQ4JG9S

UniversalX Trading: https://universalx.app/user/x/0xSleepinRain?inviteCode=M8G9SL

Paid Group: 3 SOL/year, Interested Parties DM on Twitter

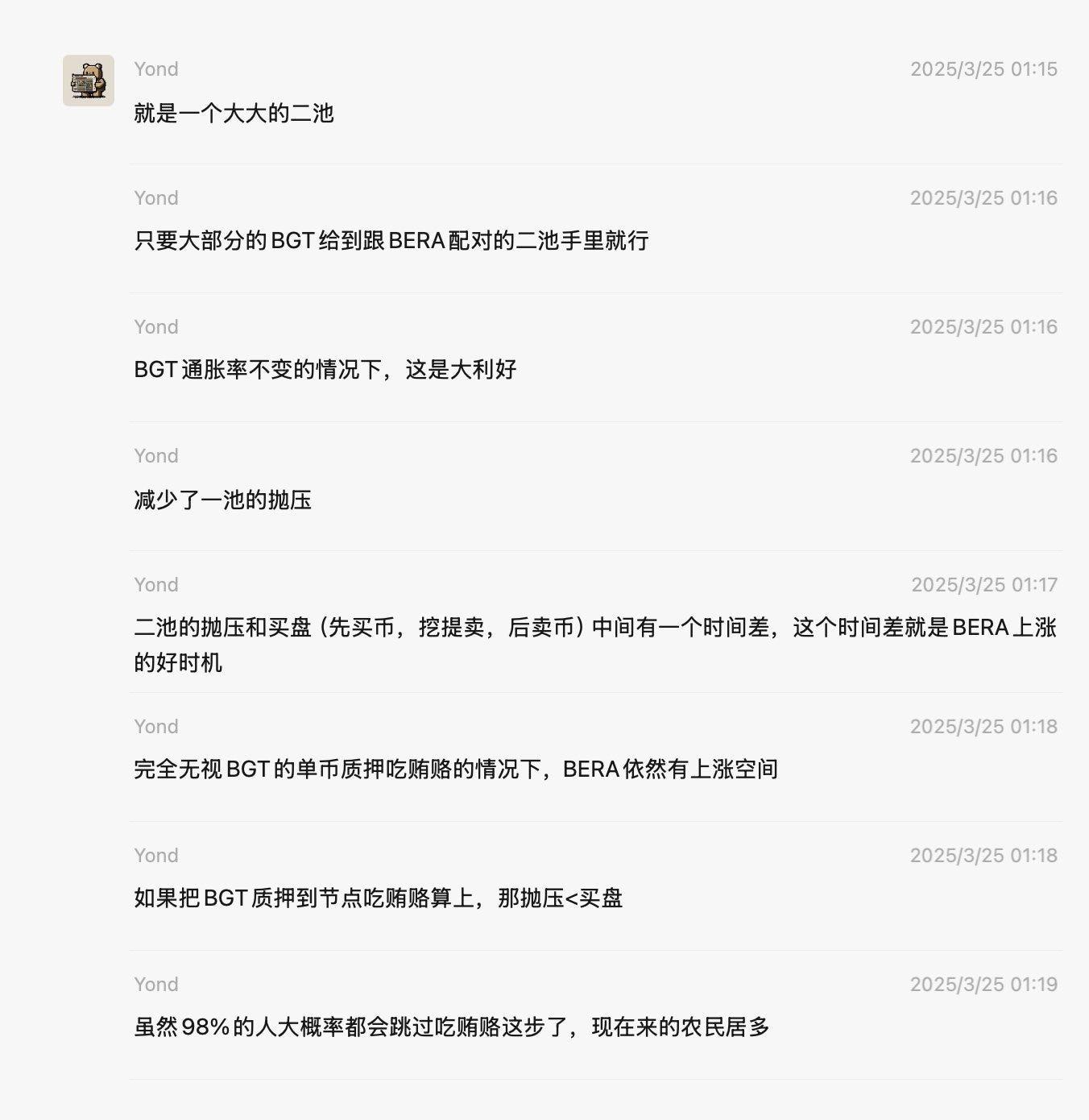

1. Berachain's PoL is essentially a larger second pool. @0xYond has already explained this clearly in his tweet.

At least in the short term, I am optimistic about the price performance of $BERA.

2. I was more involved with Sonic before, and now I only hold a little $S, with minimal ecosystem participation, so I won't comment. However, Sonic's heat seems sustainable, and it's worth keeping an eye on and participating more.

Personally, I believe $SUI is forming a bottom, so I bought ZLP from @zofaiperps, which consists of 60% $SUI, 20% $DEEP, and 20% USDC.

Link: https://app.zofinance.io?r=sleeping

After the UUU incident, BSC cleared all coins except $BID. During the community voting process, $BID received support from many AI projects, such as $IO and $ATH. This was quite surprising to me.

3. Bittensor $TAO

I haven't seen any major catalysts recently, but the dTAO model has indeed driven internal competition among subnets, with promising product progress. However, this hasn't significantly impacted the price of subnets' dTAO. I'm optimistic about SN52 (Yzi invested in Tensorplex), SN64 (Bittensor infrastructure), and SN34 (underperforming). Some new subnets have emerged recently that I haven't had time to review, but I'll look into them and provide updates later.

4. Base

Two narratives I'm currently bullish on are humanoid robots and US stocks on-chain. Base has projects in both categories, but the discussion is low, such as @BackedFi, @AukiNetwork, and @SamIsMoving.

Additionally, $CLANKER looks promising for two reasons:

Clanker is already scheduled to be listed on Coinbase;

Many projects are already building products based on Clanker - its ecosystem is rapidly growing. In fact, Clanker can be simply seen as a token-issuing machine for Base.

Base also has a Layer3 direction, but I haven't seen any major catalysts recently (Parallel/Wayfinder's Colony is launched on Solana, with the next game to be launched on B3).

By the way, Injective is also working on US stocks on-chain, which could be the next growth point for $INJ.

5. AI Agent

I'm particularly interested in "prediction" related Agents, so I bought $BILLY. I've already taken profits. I will continue to follow this track.

In the current stage of DeFAI, I've only seen one decent product: ARMA by @gizatechxyz, which helps with financial management. Its growth data is impressive. Giza is better than ElizaOS and less susceptible to Context Manipulation attacks.

https://x.com/renckorzay/status/1904192278572179583

I find his reasoning very convincing⬇️, many people underestimate the complexity of UI/UX for systems like ChatGPT. This has led to too many abstraction layers in DeFAI and extremely low user numbers. Although the vision of DeFAI is great, most teams are struggling with the "inference" layer - platforms require users to provide very specific prompts (unlike ChatGPT, which tries to interpret and understand user intent).

https://x.com/Defi0xJeff/status/1903078552981172558

This is why I think Giza ARMA is strong.

In terms of Gaming, I'm currently most optimistic about @AIWayfinder. So I bought a Parallel Avatar Non-Fungible Token - unsure if there will be a $PROMPT airdrop, consider it a small gamble. At the time, I could have also stored $PRIME, but I didn't want to engage with the locked staking approach. Additionally, the launch of the Colony game will be beneficial for Avatar Non-Fungible Tokens.