Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Last night, community users reported the most "wild" governance attack on Polymarket recently. A large UMA token holder manipulated the oracle's voting weight at the last moment in a market about to incur losses, causing the market to settle according to an outcome that did not actually occur in reality, successfully turning the tables and profiting.

When the rules of gambling become "change the answer if you can't afford to lose", is this still a fair market?

A Blatant "Casino Cheating"

The prediction market issue involved was: "Will Ukraine agree to sign a mineral agreement with Trump before April?"

At the time of market settlement, no official statement or decision confirmed that the agreement had been reached. On March 25, Trump stated that he "expected soon" to sign a US-Ukraine mineral agreement, but in fact, this deal was neither formally signed nor publicly announced.

However, Polymarket ultimately ruled the result as YES.

Image source: Polymarket

How Was the Polymarket Governance Attack Implemented?

According to community users @Web3Marmot and @hermansen_folke, the Polymarket governance attack was mainly achieved through UMA oracle vote manipulation.

Polymarket relies on UMA's decentralized oracle to verify results. UMA has its own arbitration system to resolve disputes, with arbitrators being real people - participants in the UMA ecosystem, especially UMA token holders. This system is called DVM (Data Verification Mechanism).

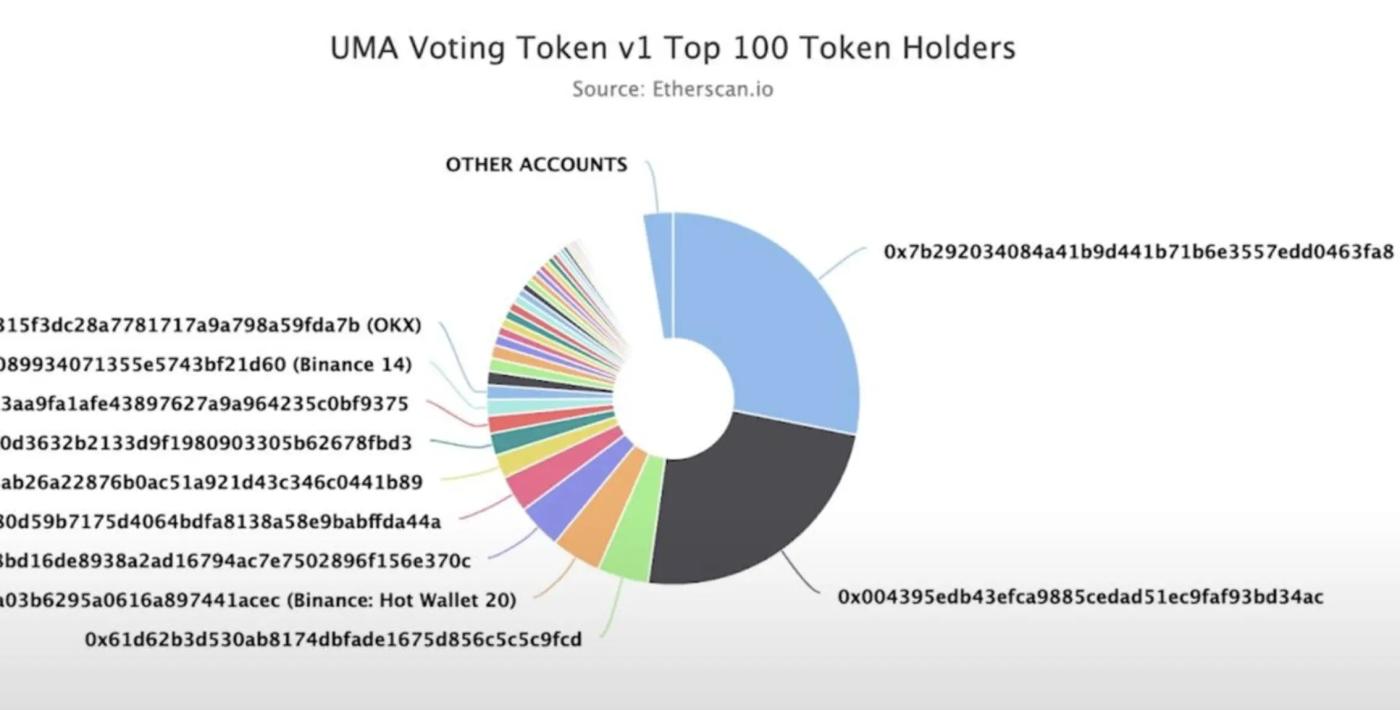

However, the ruling power of the UMA oracle is concentrated in the hands of a few "whales" holding large amounts of UMA tokens. According to community analysis, just two large holders control over 50% of the voting rights, and they are not only voters but also players on Polymarket.

According to @hermansen_folke's analysis, UMA is theoretically a neutral oracle, but in practice tends to "follow the crowd". In the UMA oracle, voters must stake tokens to vote, and if their vote differs from the majority, they will lose these tokens. This means voters may not necessarily choose the true result, but tend to follow large token holders with a history of substantial profits.

Additionally, proposing a market resolution as "yes" or "no" requires a deposit (usually 750 USDC), and challenging also requires the same amount. If the voting result is unfavorable to the challenger, they will lose this deposit, and even if they are correct, the final reward is minimal. This mechanism creates a serious asymmetric situation: whales with large stakes and UMA voting rights can easily pay the deposit and sway the market ruling, while ordinary users are afraid to challenge due to potential financial loss.

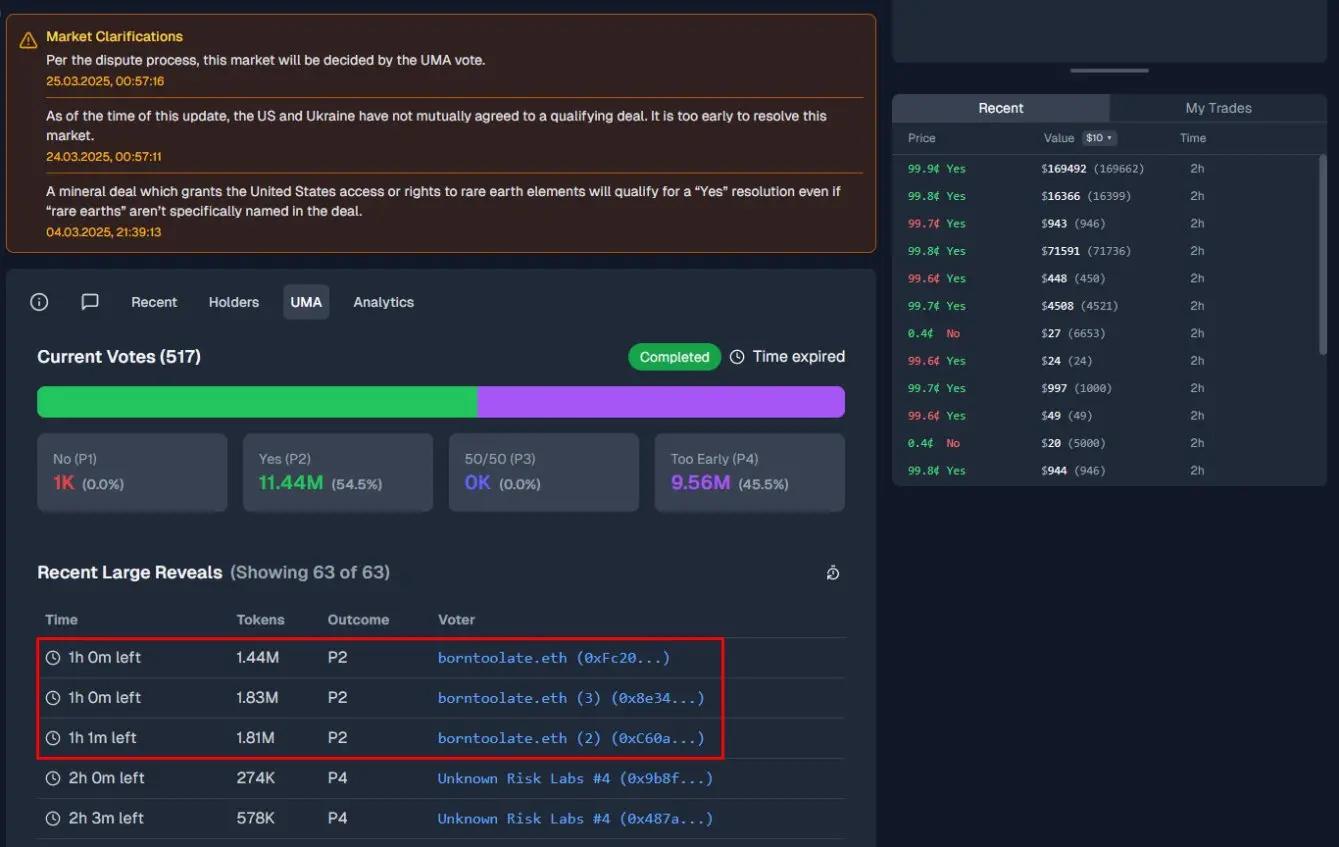

In this incident, a large UMA token holder manipulated the voting near market settlement to tilt the result in their favor.

The image below shows that this whale voted 5 million tokens through three accounts, representing 25% of the total votes.

Image source: betmoar.fun

Official Response: Acknowledging Ruling Dispute, but Refusing Refunds

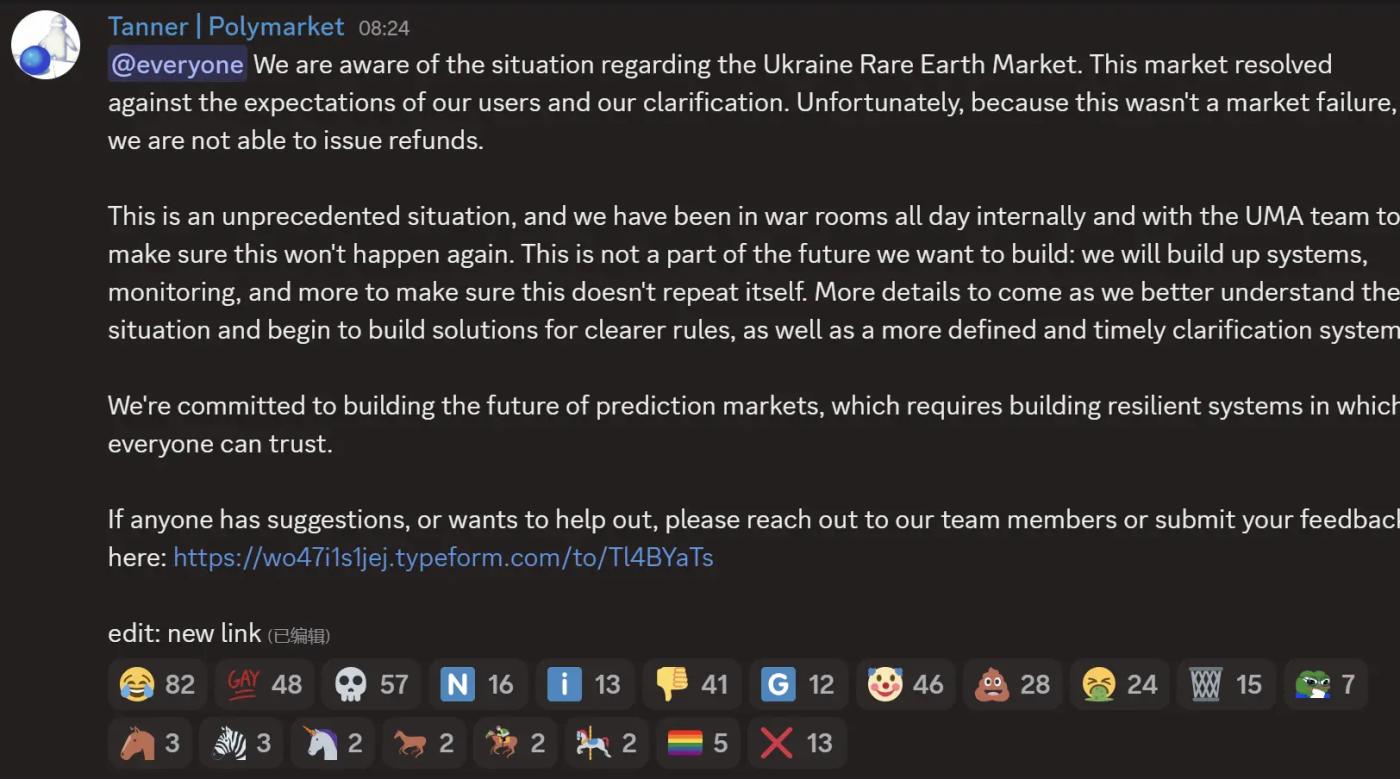

Polymarket officially posted an announcement on Discord after the incident, acknowledging that the ruling for the Ukrainian rare earth market deviated from user expectations and official clarification, but since this was not a failure of the market mechanism itself, the platform cannot provide refunds.

Polymarket stated that they have engaged in emergency discussions with the UMA team and promised to enhance system monitoring and improve rules to prevent similar situations in the future. They will further optimize the ruling mechanism to ensure clearer rules, more transparent and timely clarification processes, with more details to be published subsequently.

The oracle should have been an impartial referee but ultimately became a tool for capital manipulation.

Although Polymarket officially acknowledged that this ruling result did not match user expectations, they firmly claimed it was not a market mechanism failure and refused refunds. This decision not only causes losses for affected users but also drops market trust to a freezing point.

When ordinary players realize that even betting in the right direction cannot compete with a whale's ability to change the outcome at will, who would continue to be a lamb for slaughter in this manipulated game?