Editor | Wu Blockchain about Blockchain

On the evening of March 26th, Beijing time, JELLYJELLY was squeezed by short sellers. It once rose by 429% from 21:00 to 22:00 UTC+8. Hyperliquid Valut took over the JELLYJELLY short position after a trader liquidated it himself, and once suffered a floating loss of more than 10.5 million US dollars. At that time, if JELLYJELLY reached 0.15374, Hyperliquid Vault would lose all of its 230 million US dollars in funds; and as funds from Hyperliquid Vault flowed out, the liquidation price of JELLYJELLY would be further reduced.

JELLYJELLY is a memecoin token released by Sam Lessin, former vice president of product at Facebook, on PumpFun. Hyperliquid launched the contract on January 30 and stated that "this perpetual contract uses on-chain AMM to obtain the underlying oracle price."

At 22:48, Binance co-founder He Yi responded to a tweet from a community member suggesting that Binance list JELLYJELLY, triggering another price fluctuation in JELLYJELLY.

Subsequently, OKX and Binance announced the launch of JELLYJELLY perpetual contracts. The price of JELLYJELLY reached a maximum of $0.62, an increase of more than 380% compared to 4 hours ago, and then the price fell rapidly to around $0.25. After Hyperliquid launched futures contracts on Binance and OKX, it delisted JELLYJELLY, and the huge loss-making short orders of JELLYJELLY in Hyperliquid Vault have also been settled.

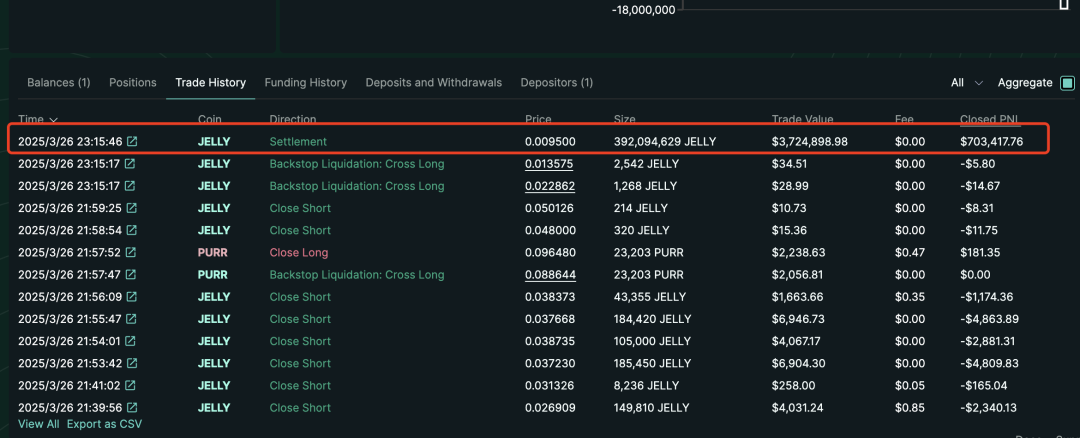

According to historical data on Hyperliquid's official website, the JELLYJELLY short position taken over by Hyperliquid Vault was settled at $0.0095 at 23:15 UTC+8, slightly earlier than Binance's announcement of the contract launch, when the price was about $0.045. However, Hyperliquid Vault settled at $0.0095, and HLP Vault made a profit of $703,000 on the position.

Hyperliquid said in a statement that after finding evidence of suspicious market activity, the validators convened a meeting and voted to delist the JELLY perpetual contract. Except for the marked addresses, all users will receive full compensation from the Hyper Foundation. HLP's 24-hour profit and loss is about 700,000 USDC.

It is understood that this liquidation method is Auto-deleveraging as defined in the official documentation. This is the last option for liquidators to avoid liquidation that causes major drawdowns. Auto-deleveraging strictly ensures that the platform remains solvent. If a user's account value or independent position value becomes negative, users on the position counterparty will be ranked based on unrealized gains and losses and leverage used. The positions of these traders will be closed at the previous oracle price for users who are now losing money, ensuring that the platform has no bad debts. However, Hyperliquid has officially announced its commitment to compensate affected users (except for users who have been marked as violators).

Regarding this incident, OKX CEO Star said: Hyperliquid provides derivatives trading through a decentralized model and smart contracts. Can it be exempt from derivatives regulation?

Bitget CEO Gracy said that Hyperliquid may be expected to become FTX 2.0. The way it handled the JELLY incident was immature, unethical, and unprofessional, which led to the loss of users and cast serious doubts on its integrity. It operates more like an offshore CEX without KYC/AML, which has facilitated illegal flows and bad actors. The decision to close the JELLY market and force settlement of positions at preferential prices sets a dangerous precedent. In addition, the platform's product design exposes worrying flaws: hybrid vaults expose users to systemic risks, and unrestricted position sizes open the door to manipulation. Unless these problems are resolved, more Altcoin may be used against Hyperliquid, making it likely to become the next catastrophic failure of cryptocurrency.

According to Parsec dashboard data, within a few hours of the Jelly liquidation incident, the net outflow of USDC on the Hyperliquid platform reached $140 million. In the four days before and after the ETH whale long liquidation on March 12, Hyperliquid's total net outflow of USDC was close to $300 million. In the past 30 days, Hyperliquid's USDC balance has dropped from about $2.5 billion to $2.07 billion.

This is not the first time that Hyperliquid has encountered similar problems. Earlier, a whale using 50x leverage opened a long order of ETH worth about $300 million on Hyperliquid, with a maximum floating profit of $8 million. However, the user subsequently withdrew most of the principal and profits, causing the liquidation price to be pushed up, and the position was eventually liquidated, with a net profit of about 1.8 million USDC. However, the platform's insurance fund (HLP Vault) suffered a loss of about $4 million.

Hyperliquid uses the mark price provided by the oracle rather than the order book depth to determine the contract price, which improves transaction efficiency under normal circumstances. However, when the market fluctuates violently, this mechanism may not effectively buffer the impact of large transactions. For example, when a whale uses high leverage to quickly open a position, the oracle price may not reflect the market depth in a timely manner, causing the liquidation price to be out of touch with the actual market price. This design was magnified in multiple whale operations in March 2025, which ultimately caused HLP to suffer additional losses.

Hyperliquid's HLP (Hyperliquid Liquidity Provider) mechanism provides liquidity through active market making and plays an important role in liquidation. However, when the market is extremely volatile or a single account holds too large a position, HLP's liquidity may not be able to respond in time. For example, in the above-mentioned ETH long-order liquidation event, HLP had to make up for the huge losses. This situation shows that the design of HLP may have loopholes when facing abnormally large positions, especially in the absence of sufficient external liquidity support, and the platform has to pay out of its own pocket to make up for the shortfall.

In response to this, Hyperliquid also issued a statement on March 13, stating that a recent incident exposed the need for further strengthening of the margin system under extreme conditions. It announced that it will upgrade the network after 08:00 UTC+8 on March 15, adjust the margin transfer requirements, and set the margin ratio to 20%, involving the transfer of funds from cross-margin wallets and independent margin positions.

Hyperliquid is a high-performance decentralized derivatives trading platform developed by the Hyper Foundation, focusing on providing a low-latency, high-throughput perpetual contract trading experience, supporting up to 50 times leverage. It integrates liquidity through the innovative HLP (Hyperliquid Liquidity Provider) mechanism and uses oracle prices to optimize trading efficiency, attracting a large number of whale and high-frequency traders.

The platform was co-founded by founder Jeff Yan and iliensinc, both of whom are Harvard alumni. Jeff Yan worked as a quantitative analyst at high-frequency trading company Hudson River Trading, and then entered the cryptocurrency field and founded Chameleon Trading, one of the largest market makers in the industry. After the collapse of FTX in 2022, he turned his attention to Hyperliquid. iliensinc also has a strong technical background and co-leads the team with Jeff, whose members include elites from Caltech and MIT, and have worked in well-known companies such as Airtable, Citadel and Nuro. The Hyperliquid team is self-funded and does not accept external investment.