Author: Spirit, Jinse Finance

I. Full Event: A Traceable Exploit

1. Precise Layout of Manipulation Chain

Short Position Ambush: On March 26, address `0xde9...f5c91` opened a $4.08 million JellyJelly short position on Hyperliquid, with an entry price of $0.0095 and a margin of 3.5 million USDC.

Price Manipulation: Another address `Hc8gN...WRcwq` intensively bought JellyJelly through Solana DEX (such as Raydium), causing spot price to surge 560% within 4 hours, from $0.0095 to $0.0627.

Liquidation Trigger: The attacker withdrew $2.76 million in margin, forcing Hyperliquid's HLP vault to take over the short position, with potential unrealized losses reaching $13.5 million, approaching the $240 million cross margin liquidation threshold.

2. CEX Market Boost

Futures Lightning Listing: CEX announced the listing of JellyJelly perpetual contracts during the price surge, attracting speculative funds and further causing JellyJelly price volatility, creating a fund transmission between "CEX and DEX".

Public Opinion Amplification: KOL @thecryptoskanda launched a "List Jelly on Binance" campaign, accelerating market FOMO sentiment.

3. Hyperliquid's Life-or-Death Choice

Emergency Intervention: Validator committee voted to delist Jelly contract, forcibly closing at $0.0095 (80% below market price), with HLP vault gaining $703,000 in revenue.

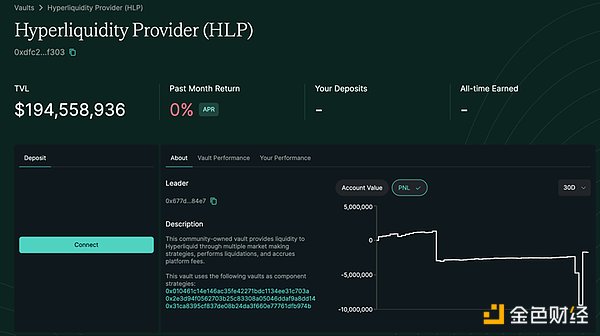

Cost and Controversy: Platform USDC net outflow of $140 million, TVL shrinking by 30%, governance transparency questioned.

II. Data Perspective: DeFi Mechanism Flaws and Market Undercurrents

1. Systemic Risk Exposure

2. Fatal Mechanism Design

Oracle Dependency Trap: Hyperliquid uses CEX spot price weighted median, making low liquidity tokens easily manipulated via DEX transmission.

Liquidity Island Effect: HLP vault concentrates counterparty risk, lacking cross-chain liquidity buffer, leading to "single point collapse" risks.

3. Capital Hunting Logic

Cross-Platform Arbitrage Strategy: Attackers exploit CEX and DEX price transmission delays through "CEX price pump → DEX liquidation" closed loop harvesting.

Regulatory Arbitrage Space: Asymmetry between CEX compliance risk control and DEX anonymity becomes a channel for risk transfer.

III. Industry Reflection: Decentralization's Ideals and Reality

1. Positive Significance: DeFi's Perpetual Spark

Technical Experimental Value: Hyperliquid's on-chain order book and HLP mechanism proves decentralized derivatives' feasibility, with daily average $5 billion trading volume occupying 37% of DEX perpetual contract market.

Community Governance Exploration: Despite centralization decision-making controversy, validator voting mechanism provides a paradigm for handling extreme DeFi risks.

2. Governance Paradox: Power and Responsibility Imbalance

Pseudo-Decentralization Doubts: Top 10 stakers control 15.9% voting rights, with foundation-led decisions contradicting "community self-governance" narrative.

Compliance Interrogation: Industry OGs sharply point out: "If DEX cannot solve KYC and anti-manipulation, it will ultimately become a breeding ground for illegal liquidity."

3. Inevitable Ecological Symbiosis

Liquidity Collaboration: CEX may become DeFi's liquidity reserve pool, initiating cross-platform price smoothing mechanisms during extreme market conditions.

Transparency Revolution: Real-time public disclosure of validator identities and decision logs, introducing third-party stress tests to rebuild community trust.

IV. Cold Reflection: Lessons from the Frozen and Future Sparks

Hyperliquid's "pulling the network cable" decision tears apart the DeFi romantic narrative while revealing the brutal industry survival rule: Only by surviving can one discuss revolution before paving the way on the bodies of idealists.

Those who carry firewood for everyone must not be left to freeze in the wilderness: Although the HLP vault's community liquidity experiment is imperfect, it is a crucial spark against CEX monopoly. Completely negating it due to one crisis would push the industry back into VC coin and centralization narratives.

Survival Wisdom Under Capital Hunting: DeFi needs to learn to dance with CEX, transforming CEX's market depth into its own risk buffer, rather than treating it as an opponent.

This event might be the turning point for DeFi's maturity - when technical idealists learn to build dams in capital undercurrents instead of futilely fighting against the flood, the decentralization spark can truly spread.