Written by: Luke, Mars Finance

In the past month, Story Protocol has been remarkable in the crypto market, almost dominating headlines daily. As a Layer 1 blockchain project focused on intellectual property (IP) management, Story Protocol has introduced globally influential cultural assets—such as Justin Bieber's 'Peaches', BTS's 'Like It's Christmas', and the movie 'Balisty x'—into the blockchain through its core protocols Aria and STR8FIRE, sparking a tokenization wave. This not only caught the attention of institutions like Grayscale but also sparked widespread discussion: How does the Story ecosystem operate? How does it generate profits? What benefits can creators and ordinary users obtain? This article will delve into its model, explore how Web3 brings revolutionary changes to the IP industry, and look forward to its future potential.

I. Story Protocol's Operating Model: From Technology to Ecosystem

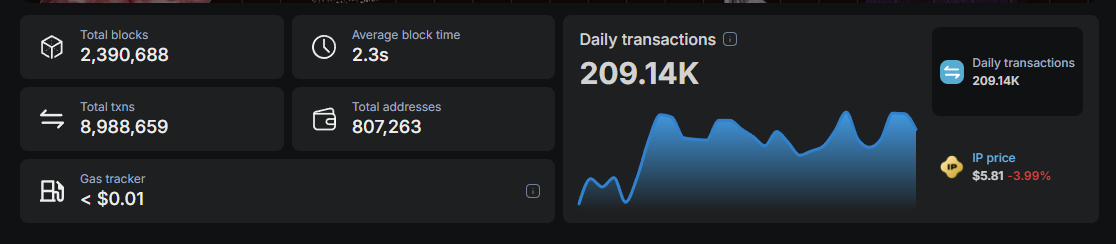

Story Protocol is a Layer 1 blockchain built for IP management, aiming to transform real-world intellectual property (such as music, films, artworks) into tradable digital assets and provide them with liquidity. As of March 27, 2025, Story's mainnet block count has reached 2.39 million, with an average block time of 2.35 seconds, daily transaction volume of 209,000, total transactions approaching 9 million, and over 800,000 participating wallets, demonstrating its strong technological and community momentum.

Founded by Seung Yoon Lee and others in 2022, the project has received multiple rounds of financing led by a16z, totaling over $134 million. Targeting the global $61 trillion IP market, even capturing 1% would be a $61 billion cake. Story's ambition is to become the digital cornerstone of future IP management. Its ecosystem comprises multiple sub-protocols, with Aria and STR8FIRE focusing on music and film/TV respectively, jointly constructing a decentralized IP economic system.

[The translation continues in the same professional and accurate manner, maintaining the specified translations for technical terms and maintaining the original structure and tone of the text.]Users: From Consumers to "Shareholders"

For ordinary users, Story transforms them from mere cultural consumers to IP "shareholders". Taking "Black Mamba" as an example, this song has 200 million plays on Spotify, with annual revenue of around $5 million. If a user invests $1,000 in RWIP tokens, holding 0.2% of the revenue rights, they can earn $10,000 annually, with a return rate of approximately 7%-30%. These tokens can also be traded on DEX, and if the song's popularity rises, the token price might double, bringing additional capital gains.

Users can also earn more rewards by staking RWIP or Aria Points. For instance, staking $1,000 worth of tokens could potentially earn an additional $50-300 in Story token rewards annually. This financial design creates a deeper emotional connection between users and cultural assets—a Katy Perry fan investing in "Daisies" RWIP not only gains returns but also feels part of their idol's success. This experience is unattainable in traditional consumption models.

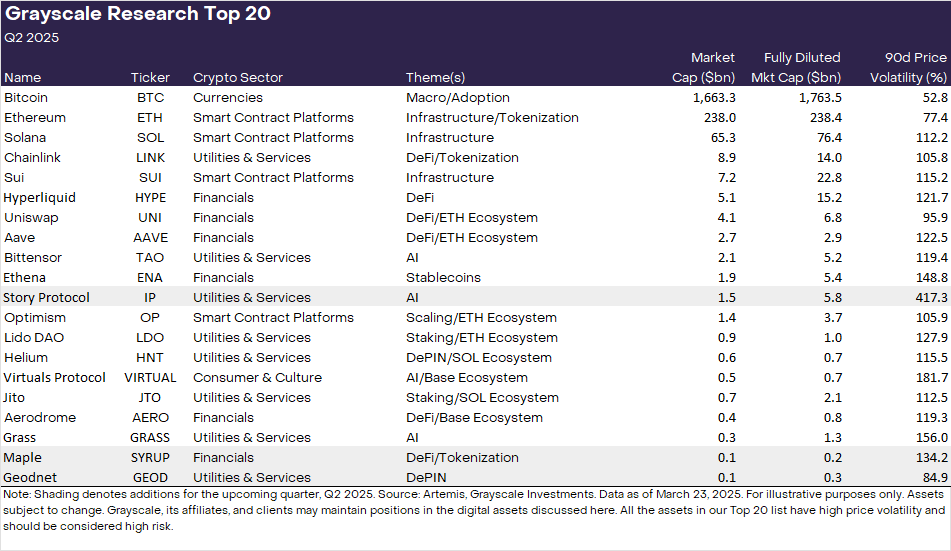

III. Why Grayscale is Optimistic: A Mature Signal of Non-Speculative Use Cases

In their latest report "Grayscale Crypto Sectors", Grayscale included Story Protocol's IP tokens in the "Top 20" list, demonstrating strong recognition of its potential. In the first quarter of 2025, the crypto market was generally sluggish, with overall valuations dropping 18%, but Grayscale focused on application layer assets rather than pure infrastructure projects. Story Protocol perfectly fits this trend, with its focus on non-speculative real-world use cases like RWA tokenization, decentralized physical infrastructure (DePIN), and IP management—viewed as crucial indicators of crypto industry maturity. Notably, after launching a blockchain and tokens focused on IP in February 2025, Story quickly attracted heavyweight IPs like Justin Bieber and BTS, demonstrating execution that impressed Grayscale.

Simultaneously, Grayscale recognized the massive market opportunity behind Story. The global IP market is worth $70 trillion, and in the AI era, intellectual property value is being redefined. For example, AI model training requires extensive music and text data, with unauthorized use already sparking multiple lawsuits (such as The New York Times vs. OpenAI). By putting IP on-chain, Story enables rights holders to track and manage assets while generating revenue through authorized usage. Grayscale believes this model, closely integrated with the real world, represents the future direction of crypto assets.

Furthermore, Story's growth momentum provides data supporting Grayscale's optimism. Although specific details aren't fully disclosed, Aria's $10.95 million deposit activity on February 18th attracted 4,156 wallets, demonstrating community enthusiasm. The Grayscale report mentions that IP tokens appreciated 84.9% in price over the past 90 days. While not matching the explosive growth of some DeFi or AI-related tokens, its low market value and high potential make it an investment option balancing risk and return. Grayscale clearly believes Story is not just a short-term trend but potentially a force transforming the IP industry long-term.

IV. Web3 and IP Industry Fusion: A Quiet Revolution

Story Protocol's rise epitomizes the fusion of Web3 and the IP industry. How does this transformation occur, and what new opportunities does it bring?

1. Tokenization and Liquidity: Breaking Barriers

The traditional IP market lacks liquidity—a hit song's copyright might be worth millions, but ordinary people can't participate. Web3's tokenization technology splits these assets, allowing users to buy RWIP with stablecoins and trade on DEX. For instance, Aria users can invest $100 to own a tiny revenue right in "Peaches", liberating IP from elite control.

2. Distributed Ownership and Collaboration: Redefining Creation

Story supports distributed ownership and permissionless collaboration. Fans can invest in "Black Mamba" copyright and create remixes or Non-Fungible Tokens based on it, with revenues distributed via smart contracts. This mechanism enables creators and investors to jointly participate in cultural asset appreciation.

3. Value Tracing in the AI Era: Technological Empowerment

AI proliferation complicates IP protection, but Story's programmable IP offers solutions. Collaborating with Oxford University to research AI agent negotiation, results will be applied to the Agent TCP/IP framework. Future Story blockchain could automatically track IP usage and negotiate authorization through AI.

4. Revenue Diversification: Financial Design

Users earn not just by holding RWIP but can also stake for up to 30% APY. This DeFi and IP combination enhances investment attractiveness.

Conclusion

Through Aria and STR8FIRE, Story Protocol brings IP to blockchain, benefiting creators and allowing users to share dividends. With Grayscale's endorsement, its non-speculative use cases drive industry maturity. Can this IP revolution reshape the cultural economy? The answer might lie in the next on-chain hit.