Bitcoin (BTC) is showing signs of a rebound this week, giving hope to investors after recent market declines.

Despite this temporary rise, analysts warn that the upward trend may not last long.

Will Bitcoin's Upward Trend Continue?

According to Beincrypto's data, Bitcoin's price recovered by 2.0% last week. Profits increased more than twofold over two weeks, with the coin rising 5.0%. At the time of writing, the largest cryptocurrency is trading at $87,381, showing a 0.1% decline over the past day.

Spot Bitcoin ETFs have recorded 9 consecutive days of inflows. According to Sosovalue's data, ETFs have recorded total inflows of $944 million since last Friday.

This continued interest suggests increasing confidence among institutional investors. However, analysts are not certain about the rally's potential.

In the latest Crypto Compass newsletter, research firm Fairead Strategies predicted that Bitcoin's rebound rally could continue for 1-2 more weeks. However, founder Katie Stockton warned that a price decline could follow.

"Medium-term momentum is downward, and weekly stochastics are not yet oversold, increasing the risk that the rally will be temporary. I have the same expectation for most risk assets." – Katie Stockton, Founder of Fairead Strategies

Despite the pessimistic outlook, Stockton acknowledged short-term positive factors. Bitcoin's short-term momentum has improved, and there is room for price increases before reaching the overbought area. However, she warned that this opportunity might close by the end of the month.

This could potentially lead to an adjustment or "digestion" phase. This means Bitcoin's upward momentum could slow down or stop, potentially lasting for a longer period while the market adjusts and absorbs recent gains.

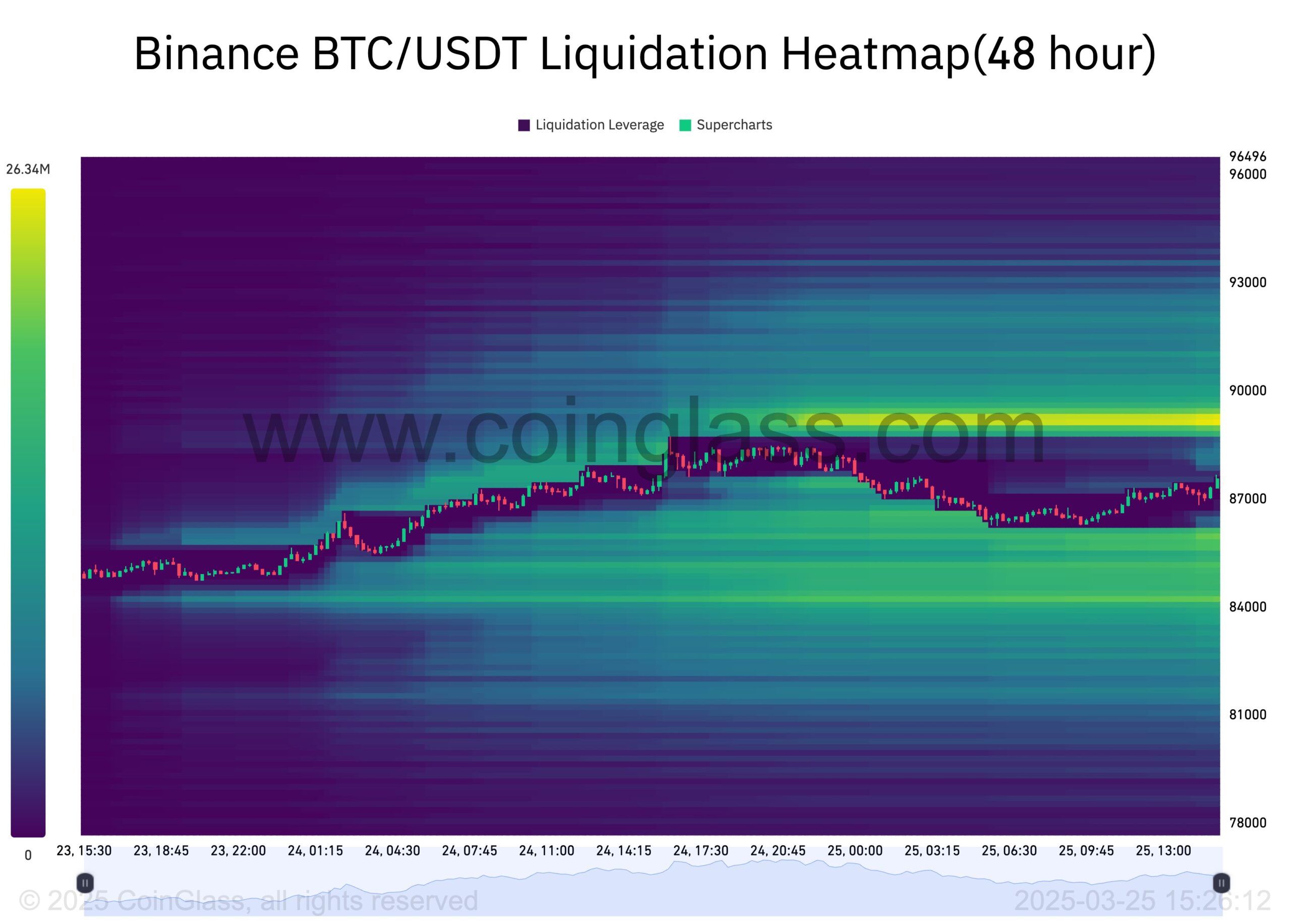

Another analyst also shared a cautious perspective. In a recent X (formerly Twitter) post, Koroush AK estimated Bitcoin's potential price movements using a liquidation heatmap.

He mentioned significant selling pressure around $89,000 (major supply) and buying interest around $85,000 (demand).

"The idea of an HTF dead cat bounce is still valid if the price reverses around the major zone of about 90K." – Koroush AK

Notably, a "dead cat bounce" refers to a temporary recovery or brief rise in an asset's price after a long-term decline, which leads to a continuation of the downward trend. However, he added that if Bitcoin breaks through the resistance level, the pessimistic scenario would be invalidated.

Meanwhile, changing macroeconomic conditions are causing increasing concern, especially with US President Donald Trump's tariff announcement scheduled for April 2nd. In a recent report, K33 Research emphasized that while the market is currently stable, the upcoming tariff decision could cause significant market volatility.

"Tariffs continue to produce major headline-moving events, and as the big tariff announcement date of April 2nd approaches, most traders are becoming risk-averse." – K33 Research Report

The report also recommended caution and advised avoiding leverage due to the expected volatility from potential tariffs.

Beincrypto recently explored the potential impact of Trump's tariff plans on the cryptocurrency market. High tariffs could pressure risk assets like Bitcoin, which may reflect the market response in February. Conversely, if tariffs are postponed or selectively applied, investor fears could be alleviated, potentially leading to a recovery in cryptocurrency prices.