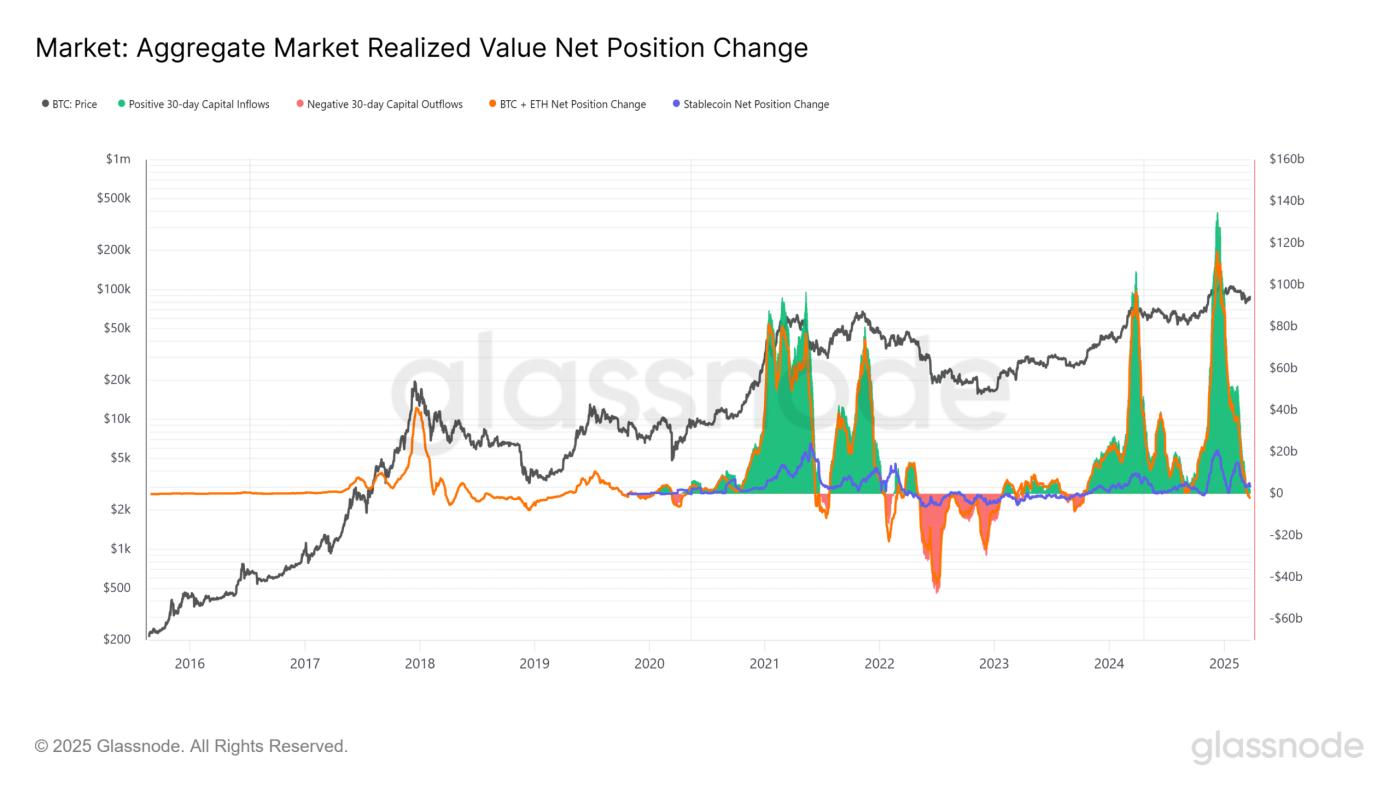

- Capital inflow into the cryptocurrency market decreased to 1.8 billion USD, the lowest level since 2023, signaling a lack of new capital.

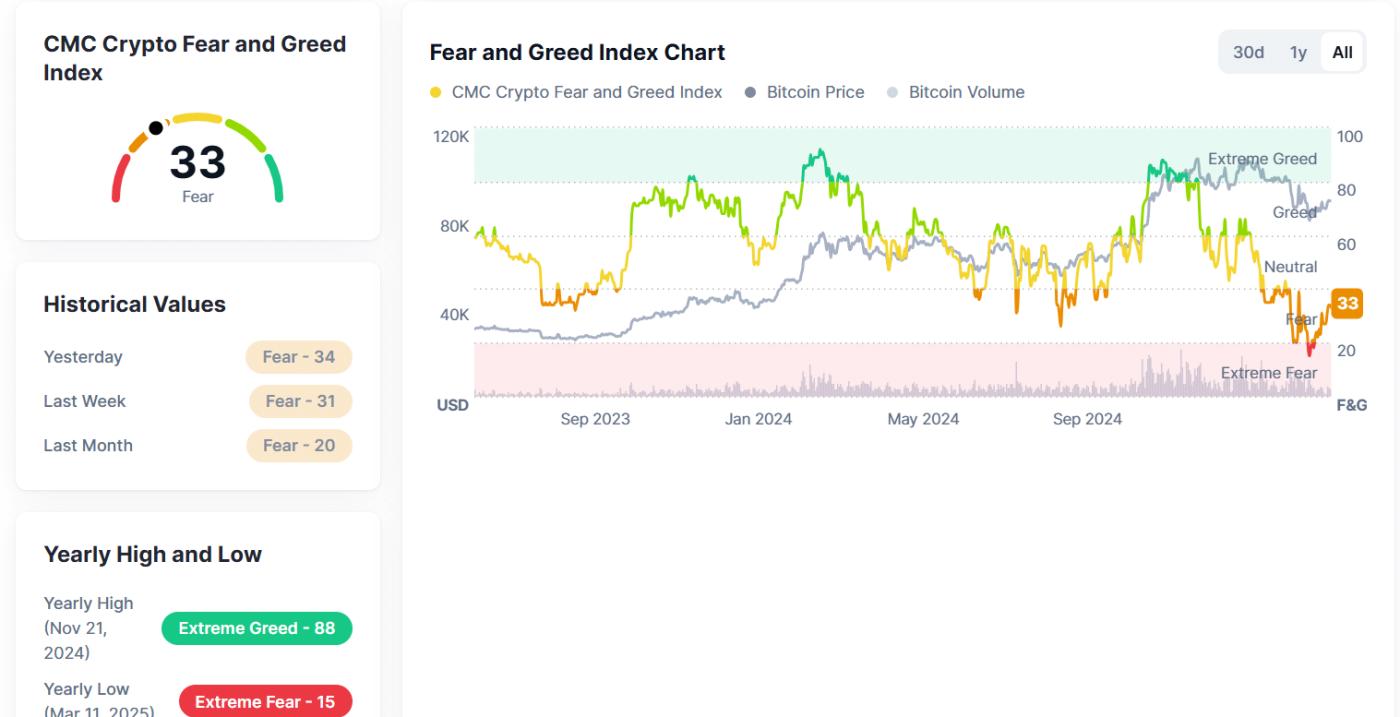

- The Fear and Greed Index remains in the "Fear" zone, reflecting continuous investor hesitation despite stable prices.

The circulating capital in the cryptocurrency market seems to be rapidly declining, with total capital inflow dropping to a two-year low.

A significant drop in the realized value change index has raised concerns about market momentum, with many investors choosing to stay on the sidelines due to increasing uncertainty.

Actual Capital Inflow in the Cryptocurrency Market Sharply Declines

The Aggregate Market Realized Value Net Position Change chart highlighted a significant decline in capital flow into BTC and ETH. Total net capital flow fluctuates around 1.8 billion USD, a level not seen since 2023.

History shows that such low capital inflow periods in the cryptocurrency market often coincide with accumulation trends or even prolonged downward trends.

Source: glassnode

Despite relatively stable bitcoin prices, weak capital inflow indicates a lack of trust from new capital sources.

Capital outflow also remains low, suggesting that current holders are not rushing to exit but are cautious about increasing exposure.

Fear Dominates Cryptocurrency Market Psychology Despite Recovery from Lows

Data from CoinMarketCap shows the Cryptocurrency Fear and Greed Index at 33, firmly in the "Fear" zone.

This indicates a moderate improvement from the previous week's value of 23, but it is still far from neutral, let alone greedy.

The index reached a low of 15 on March 11, showing the intensity of panic just two weeks ago.

Source: CoinMarketCap

The overall sentiment remains fragile despite price increases and recovery from those lows.

The inconsistency between price performance and chain volume suggests that the recent recovery may be driven more by existing capital rotation than new market entry.

Low Capital Inflow May Limit Price Increase Potential

If capital inflow remains this lukewarm, the potential for significant increases may be limited.

A meaningful recovery requires stronger stable capital flow, increased derivative open interest, and a shift in investor sentiment from fear to greed or neutral.

The cryptocurrency market seems to be stuck between maintaining its position and lacking fuel to move further.

Unless there are macro catalysts or changes in institutional flow dynamics, market action may remain sideways in the short term.

Traders should monitor signs of risk appetite reappearing, such as increased trading volume, stablecoin creation, and improvements in investor confidence indicators.