Written by: BUBBLE

Recently, the well-known blockchain venture capital firm HackVC announced the launch of a community round investment group on Echo. As one of the first regulated US crypto fund management companies to launch a "community round" on Echo, they hope to transform HackVC into a truly community-oriented VC. As the Crypto market gradually loses trust in VCs, these firms seem to be seeking transformation, hoping to get closer to the market.

Alexander Pack, the founder of HackVC, made his first cryptocurrency investment at age 22 in a fintech venture capital firm in Hong Kong. At that time, the crypto market was still in its early stages, but Pack believed it would be a future trend. He later returned to the US and joined Bain Capital, helping to invest in crypto products. In 2018, Alexander first established his own venture, co-founding the crypto venture capital fund Dragonfly Capital with Feng Bo and serving as the first managing partner. The firm has since become one of the largest crypto funds in Asia. In 2020, Alexander left Dragonfly Capital and founded Hack VC.

From the name alone, it's clear that HackVC's investments are heavily focused on technology. In Pack's own words, HackVC is a group of hackers investing in another group of hackers. Managing partner Ed Roman initiated the famous hackathon event hack.summit(), while research partners Christopher Maree and Sean Brown come from the UMA oracle team. The former was a member of the Ethereum Foundation Devcon V Scholar, while the latter served as a senior blockchain advisor at IBM. It can be said that HackVC's investment preferences are to some extent focused on the feasibility and scalability of technology.

This has also led to HackVC's quite impressive investment performance in this round, investing early in high-quality projects such as Berachain, EigenLayer, Morpho, Grass, and Soon.

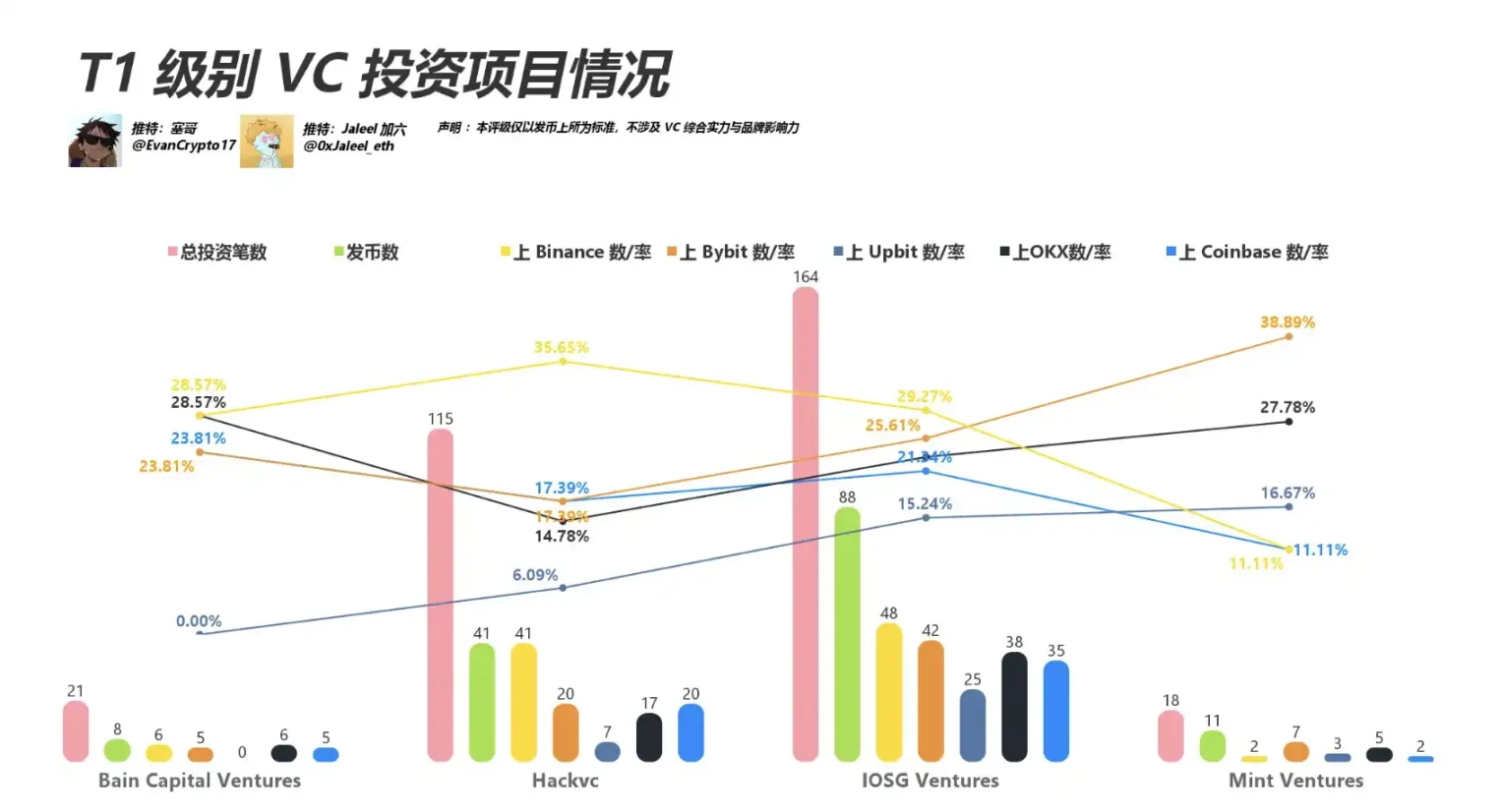

Related reading: 《Everyone is Criticizing VC Coins, Let's See How VCs Perform This Round?》

Finding the Original Intention of the "Echo Mode"

[Rest of the translation continues in the same professional and accurate manner, maintaining the specified translations for specific terms]

Today, under the background of a mature compliance framework and on-chain infrastructure, Echo reconstructs the crowdfunding process through a non-custodial Syndicate model, and Legion introduces an on-chain reputation system to optimize investor screening, marking the entry of community financing into the next stage. This approach inherits the open genes of ICO while balancing efficiency and fairness through technical means, potentially signaling the arrival of a new golden age of compliant and refined operations.