Author: Biraajmaan Tamuly, CoinTelegraph; Translated by: Bai Shui, Jinse Finance

Since reaching a weekly high of $88,752 on March 24, Bitcoin's price has formed a series of lower highs and lower lows on the 1-hour timeframe chart.

As the weekend approaches, Bitcoin's price failed to effectively break through the $88,000 resistance level, reducing the chance of retesting $90,000 before the end of the first quarter.

Bitcoin 1-hour chart. Source: Cointelegraph/TradingView

What is keeping Bitcoin's price below $90,000?

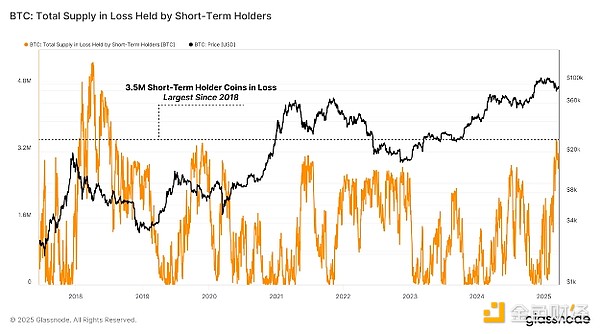

1. A major reason for Bitcoin's current price struggle is the continuous selling pressure from Short-Term Holders (STH) or investors holding Bitcoin for less than 155 days

glassnode noted that the current Bitcoin cycle witnesses a "top-heavy" market, with investors who bought BTC at higher prices holding a significant portion of the Bitcoin supply. As a result, the STH group has been the most affected by price drops since Bitcoin retraced 30% from its all-time high.

In the report, glassnode analysts stated,

"The supply loss for short-term holders has surged to 3.4 million BTC. This is the largest STH supply loss since July 2018."

Total Bitcoin supply loss held by STH. Source: glassnode

The selling pressure faced by short-term holders is reflected in Bitcoin's cumulative trend score.

Since BTC's price dropped from $108,000 to the $93,000-$97,000 range, Bitcoin's cumulative trend score (a metric quantifying selling pressure) has remained below 0.1. A score below 0.5 indicates distribution (selling) rather than accumulation, and a value below 0.1 highlights intense selling pressure.

2. Another reason Bitcoin struggles to break the $90,000 threshold is the contraction of liquidity conditions

Data shows on-chain transfer volume has dropped to $5.2 billion daily, a significant 47% decrease from the peak during the rebound to all-time highs. Similarly, active addresses have reduced by 18%, from 950,000 in November 2024 to 780,000.

Meanwhile, BTC futures market open interest (OI) has declined from $71.85 billion to $54.65 billion, a 24% drop, with perpetual futures funding rates also decreasing.

This deleveraging and liquidity contraction, coupled with only 2.5% of total supply being in profit during the correction, limit the market's ability to rebound above $90,000 as buy orders are insufficient to absorb sell orders.

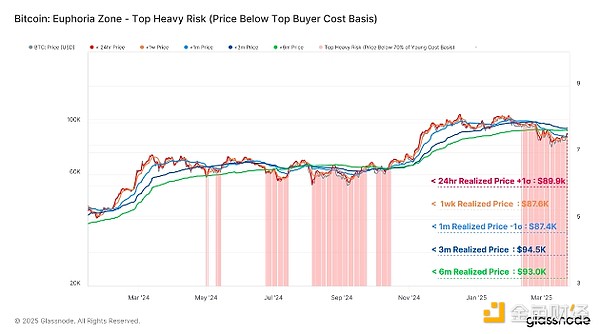

3. Continued decline in Bitcoin's new demand

The current BTC market lacks new demand (buyers) entering the market. The Cost Basis Distribution (CBD) heatmap shows supply concentrated at higher price levels ($100,000 to $108,000), but without significant buyer inflow to drive price recovery at lower levels.

Bitcoin heat zone, top buyer cost basis. Source: glassnode

The lack of demand is exacerbated by macroeconomic uncertainty, which hinders new investor participation, as seen in the net capital outflow transition when the 1-week to 1-month STH cost basis falls below the 1-month to 3-month cost basis.

However, glassnode analysts note, "The other side of these observations is that the long-term holder group still retains a considerable portion of network wealth, holding nearly 40% of investment value."

Essentially, these periods of long-term accumulation will ultimately limit supply and create better conditions for a new wave of demand once the market establishes a stronger upward trend.