Bitcoin (BTC) touched $88,700 this week and then pulled back to below $87,000 on March 27. After a brief rebound today, it further dropped to around $85,000 support level, with the market movement remaining within our expectations.

VX: TZ7971

BTC failed to maintain its position above the $88,000 resistance level, raising questions about whether prices will continue to weaken in the coming days.

Will Tariffs Put Pressure on Bitcoin Prices?

On March 26, 2025, Trump announced a 25% tariff on all passenger cars and light trucks imported to the United States, with the policy set to take effect on April 3. This move raised concerns about cryptocurrency sell-offs, causing Bitcoin prices to decline.

Key Points:

This tariff measure directly impacts major trading partners such as Mexico, Canada, Japan, and Germany.

Although Trump believes this will promote the US automotive industry, its direct impact could shake global markets.

When Trump imposed tariffs on Canada, Mexico, and China in early March, Bitcoin plummeted overnight from $105,000 to $92,000 before recovering.

New tariffs could exacerbate this trend, especially if affected countries retaliate.

Any retaliatory actions by affected economies could increase uncertainty in the already volatile global trade landscape.

Despite the market witnessing GameStop (GME) unexpectedly raising $1.3 billion and potentially using these funds to buy Bitcoin, market sentiment has not significantly improved. The only bright spot is the inflow of funds into spot Bitcoin ETFs, totaling $944.9 million since March 11.

Bitcoin May Further Decline as Demand Weakens

Bitcoin demand remains low, reflecting a decrease in investor risk appetite.

Key Points:

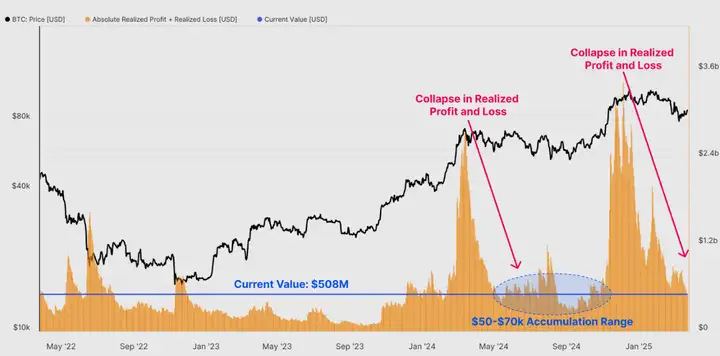

Glassnode's on-chain report shows that Bitcoin demand is declining, measured by investors' realized profits and losses.

From the all-time high of $109,000, total realized profits and losses have dropped 85% by March 26, from $3.4 billion to $508 million.

The current index level is similar to the accumulation phase in 2024 (around $50,000 to $70,000), indicating similar demand patterns.

Sustainable bull markets are typically characterized by steady inflows of new capital, but this trend is now weakening.

The gap between long-term holders' (LTH) profits and short-term holders' (STH) losses has significantly narrowed to a neutral level, indicating a balance between STH selling pressure and LTH buying pressure.

The Bitcoin supply held by long-term investors is expected to continue increasing in the coming weeks and months.

Important Bitcoin Levels to Watch

Traders are currently focusing on the key price level around $88,000.

Support Levels:

200-day moving average (SMA) is at $85,500.

Important support is around $82,700.

Recent bottoms are $81,138 (formed on March 18) and $76,600 (formed on March 11).

If the $82,000 support is lost, Bitcoin could drop to the $72,200 - $74,500 range.

Resistance Levels:

$88,700 - $92,000 area, where the 50-day SMA and 100-day SMA converge. If Bitcoin breaks through this area, the downward trend may end, paving the way for a new rally to break $100,000.

The 20-week EMA at $88,600 is currently the most important level for Bitcoin.

Bitcoin needs to reclaim the 2025 opening level of $93,300 to confirm the continuation of the bull market cycle.