Author: The DeFi Investor

Translated by: TechFlow

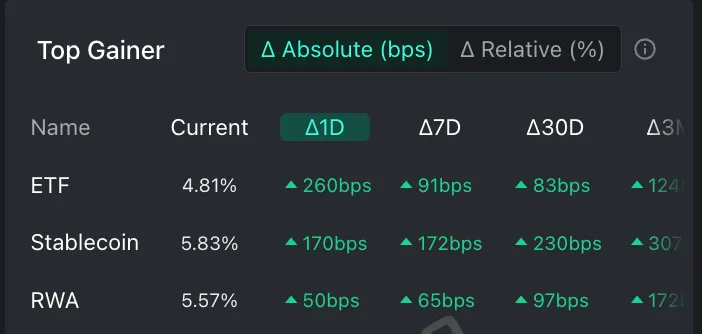

A few months ago, the cryptocurrency community was focused on discussing meme coins and celebrity coins, with many enthusiastic about speculating on the next investment. However, the focus has quietly shifted. Stablecoins and Real World Assets (RWA) have become the core topics of industry discussion.

Image source: Kaito

Stablecoins are showing enormous development potential and are expected to become a trillion-dollar market in the future. In this article, I will share why I am optimistic about the stablecoin sector and explore how to seize the market's growth opportunities.

Why Are Stablecoins Promising?

Currently, the stablecoin sector is experiencing a series of favorable factors:

More Friendly Regulatory Environment

The Trump administration plans to pass stablecoin-related legislation before August and hopes to further consolidate the U.S. dollar's global dominance. This will pave the way for stablecoins' legalization and popularization.

Traditional Financial Giants Entering the Market

Fidelity, with global asset management of $6 trillion, announced this week the launch of its own stablecoin. This marks a significant recognition from traditional financial institutions and injects confidence into the stablecoin market.

High-Yield Stablecoin Products

Some interest-bearing stablecoins provide highly attractive annual yields through decentralized applications (dApps), which can even reach 20%-30%. These products not only attract crypto investors but are also beginning to draw attention from the traditional financial sector.

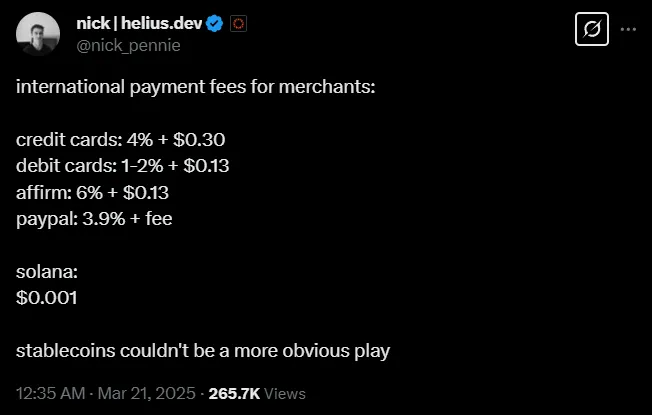

Moreover, stablecoins have particularly significant advantages in cross-border payments. Traditional payment companies' international transfer fees remain high, while using stablecoins for payment makes these fees almost negligible. As the U.S. gradually implements stablecoin-friendly legislation, its penetration rate is expected to rise rapidly in the coming years.

How to Seize Stablecoin Market Growth Opportunities?

Invest in Stablecoin-Related Protocol Tokens

Although mainstream stablecoin issuers (such as Circle and Tether) do not currently provide direct investment channels for ordinary investors, stablecoin-related protocol tokens remain worth noting, such as Ethena ($ENA) and MakerDAO/Sky ($MKR). These protocols have attracted billions of dollars in Total Value Locked (TVL) and are expected to benefit from the stablecoin market's expansion. However, it's necessary to note that these tokens also have their respective issues. $ENA currently has only 34% of tokens in circulation and is expected to have a relatively high inflation rate in the future. MKR's TVL growth has essentially stagnated in recent years and has not benefited from the rapid growth of the stablecoin market. Nevertheless, on-chain data shows that "smart money" is increasing holdings of ENA and MKR, indicating these tokens might perform relatively well in the future.

Image source: Nansen

Additionally, DeFi projects like Aave and decentralized applications like Pendle might also benefit from the stablecoin market's expansion. A significant portion of their TVL comes from stablecoins, and if stablecoin supply continues to grow, these protocols' TVL, revenue, and transaction fees are expected to increase simultaneously.

Participate in Airdrops of Stablecoin Protocols Yet to Issue Tokens

Many emerging stablecoin protocols have launched points reward programs that offer generous rewards for early users. Here are several protocols worth noting and their strategies:

Resolv: A neutral risk stablecoin using a dual-token model.

[Rest of the translation continues in the same manner, maintaining the specific translations as requested]