summary

US stocks have some pricing, but it is not high, only about 5 percentage points higher than the normal level:

The recent market concerns about the risk of tariffs on April 2 may be at a critical turning point. If the negative impact of the final tariff measures does not exceed expectations, it is expected that after a short-term decline, the funds that were sold due to concerns in the early stage may re-enter the market, coupled with the positive outlook for US dollar liquidity, which may drive the US stock market and Bitcoin to rebound.

However, although the US dollar liquidity may provide some support, we also have to wait and see how the tariff measures on April 2 actually unfold. The main risks are that the tariff measures may exceed expectations, and the market may be insufficiently hedged. The positive effect of the US dollar liquidity may be weakened, as well as the continued low confidence of consumers and investors. In addition, whether the first-quarter earnings of companies entering the earnings season can exceed the expectations that have been continuously lowered is also a key determinant.

1. Tariff pattern on April 2

Expected reciprocal tariffs:

The market generally expects the Trump administration to announce reciprocal tariffs on April 2, 2025, which may target countries with long-term trade deficits with the United States. Key affected countries include Australia, Brazil, Canada, China, the European Union, India, Japan, Mexico, South Korea, Russia and Vietnam. These tariffs may cover all imported goods, but Trump also said that a small number of industries will be exempted.

The rationale for imposing these tariffs could include correcting unfair market access practices, reducing trade deficits, and protecting U.S. manufacturing jobs. These potential new tariffs build on tariffs already in place on China, Canada, and Mexico.

The wide range of target countries and potential commodities indicates that trade tensions may escalate significantly, so there will be more or less "negative impact", it is just a matter of degree. What makes me most uncertain is that Trump's strategy is explicitly used to support tax cuts, which is different from traditional trade policy goals. That is, the U.S. fiscal revenue must rely on tariffs to increase in the long run, rather than just as a bargaining chip to improve the competitiveness of U.S. exports. This increases the possibility of a long-term market downturn.

Industry-specific tariffs and surveys:

In addition to broad reciprocal tariffs, the United States may also initiate investigations into specific countries and industries under Section 301 of the Trade Act of 1974 and Section 232 of the Trade Expansion Act of 1962.

A 25% tariff on imported vehicles was announced today and is expected to go into effect on April 2 or 3. This tariff is likely to affect not only finished vehicle imports, but also auto parts, which could have a wide-ranging impact given the highly integrated North American auto supply chain.

In addition, investigations into copper and lumber/timber imports are ongoing, and future tariffs may also be imposed on industries such as agricultural products, semiconductors and pharmaceuticals.

The early announcement of auto tariffs and the launch of other industry-specific investigations suggest that the April 2 announcement may not be limited to broad reciprocal tariffs but may also include targeted measures on key industries that will have a significant impact on the relevant industries.

In particular, automobile tariffs have caused market concerns, and General Motors, Ford, BMW, Volkswagen, Nissan and Toyota have all plummeted.

Tariffs against countries importing Venezuelan oil:

Trump's executive order provides for the possible imposition of a 25% tariff on all goods imported from countries that purchase Venezuelan oil starting April 2, 2025. Potentially affected countries include the Dominican Republic, the European Union, India, Malaysia, Russia, Singapore and Vietnam.

This secondary tariff adds a layer of complexity and potential negative surprises because it targets specific countries based on geopolitical factors rather than pure trade imbalances.

Broad application to “all goods” from these countries could lead to an increase in retaliatory measures.

The possibility of "unexpected" negative shocks cannot be ignored:

Based on my observations from the interest rate derivatives market, most people currently believe that the actual tariff measures may not be as severe as initially feared, as there may be some countries that are exempted or have reached agreements in advance. In other words, the significant economic dislocation, slower growth and higher inflation that may be caused by tariffs are not deeply priced in at present.

The Federal Reserve has already cut its U.S. economic growth forecasts, in part because of the potential impact of tariffs. While administration officials may signal a more accommodative approach, the risk of a larger-than-expected negative shock on April 2 remains high given the breadth of announced and threatened tariffs and the historical precedent of the first Trump administration. The initial market reaction to the March 26 announcement of auto tariffs also illustrates the market’s sensitivity to such news.

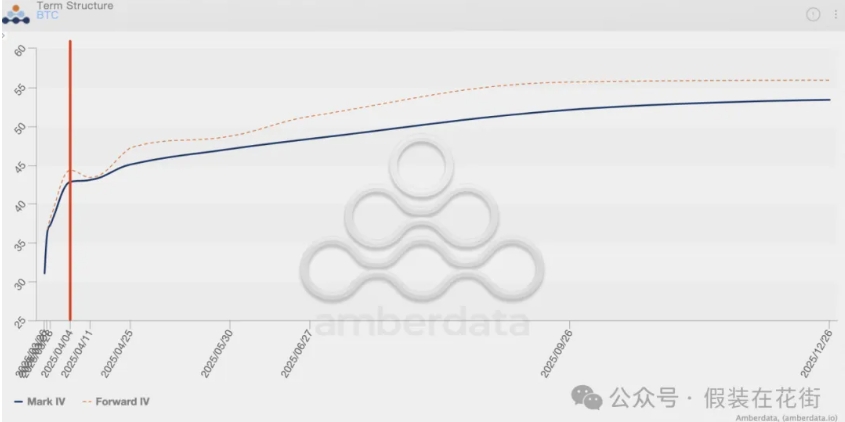

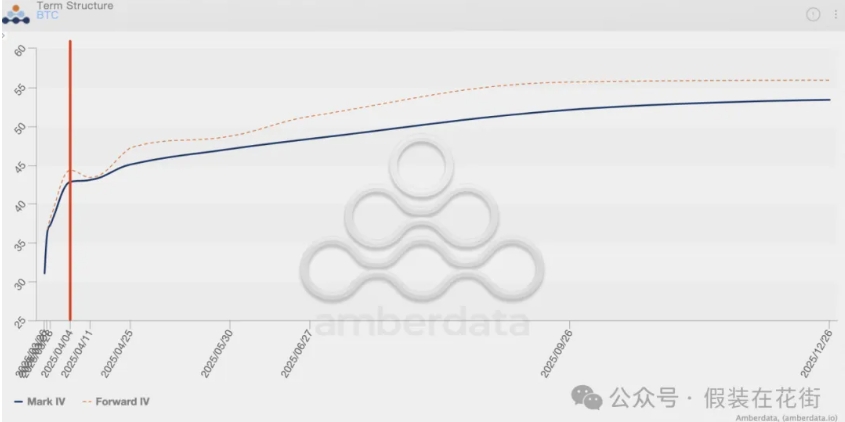

Currently, the cryptocurrency market is under-priced or even completely unpriced for this, as can be seen from the fact that on April 4, option volatility had almost no premium:

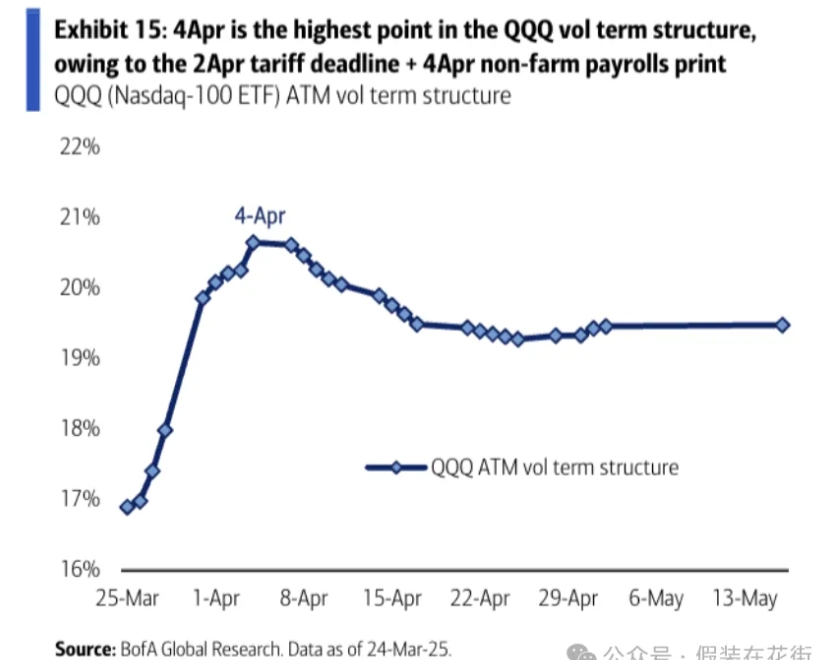

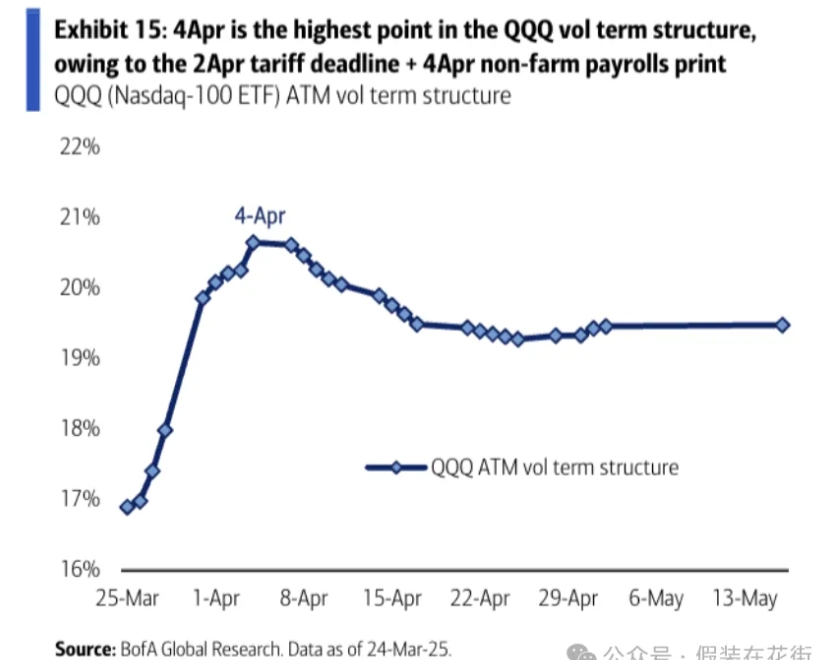

US stocks have some pricing, but it is not high, only about 5 percentage points higher than the normal level:

The VIX index is only around 18, indicating that market concerns have increased, but it is far below the crisis threshold. In fact, it has been falling since it hit a high of 29 two weeks ago, which is much calmer than the stock index:

2. The good news is that US dollar liquidity is expected to continue to recover

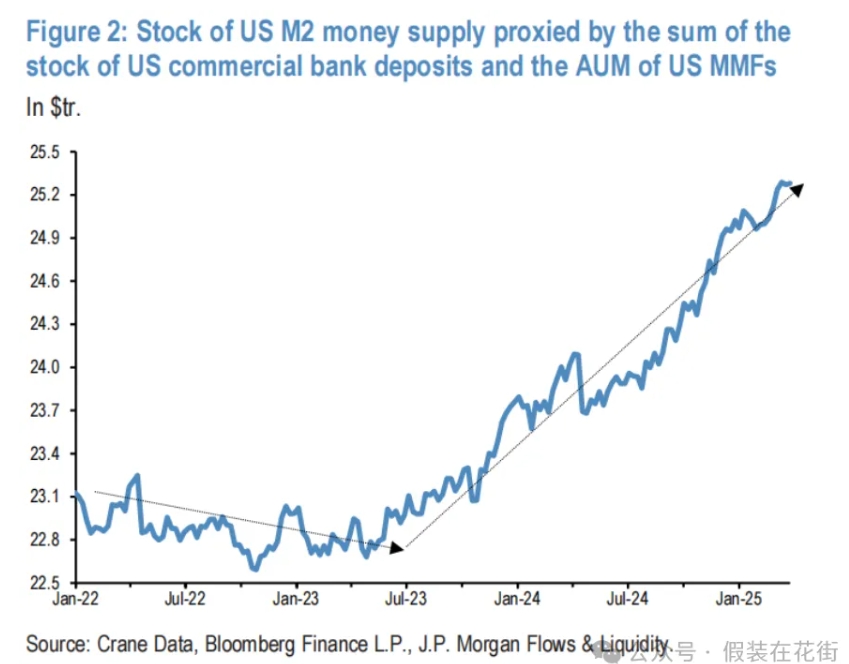

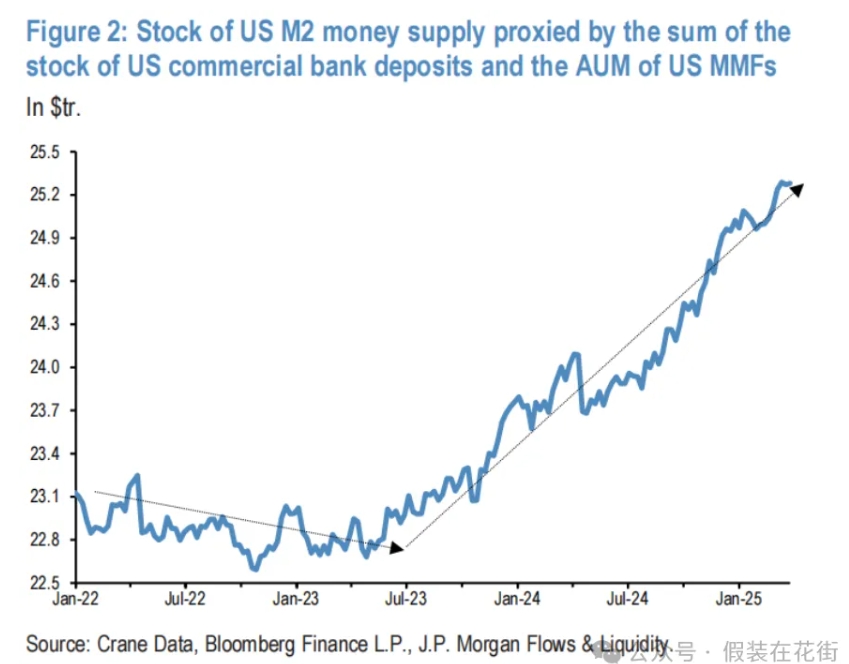

$1.6 trillion

JPM measures total liquidity by the sum of U.S. commercial bank deposits and U.S. money market funds (MMFs) AUM, and finds that it has increased by $320 billion since the beginning of the year. This data can be annualized to get a full-year liquidity expansion of $1.6 trillion. Considering the subsequent acceleration of bank loans and the slowdown of QT trends, this forecast should be reasonable. This is equivalent to a 6.4% liquidity expansion, which is much higher than the potential 3.5% nominal GDP growth in the United States.

The current outlook for US dollar liquidity is optimistic

The Fed's early slowdown of quantitative tightening (QT) and signs of accelerated lending by US banks support the strong pace of money creation observed so far this year, and are expected to drive this pace to continue throughout the year. The pace of QT has slowed from $60 billion per month to $25 billion, which could mean an additional $35 billion in funds per month, with an annual effect of about $420 billion. The increase in lending creates more deposits, which amplifies the money supply through the money multiplier effect, and at least an additional hundreds of billions of dollars may be added at the current level.

Potential impact on risky assets:

In the middle of the figure below is US dollar liquidity, and above and below are S&P 500 and BTC respectively. It can be seen that BTC is more sensitive to changes in US dollar liquidity, while the stock market is more dependent on the cycle of changes in corporate profits, so the correlation is weaker. But in any case, improved liquidity will not be a bad thing.

The flip side of USD liquidity:

It is possible that a more hawkish Fed stance (fewer rate cuts or potential rate hikes) could further strengthen the dollar, which could exacerbate the negative impact of tariffs on corporate earnings and reduce the attractiveness of risk assets. The interaction between tariffs, inflation, Fed policy, and dollar liquidity forms a web of mutual ties. If tariffs lead to higher inflation, prompting the Fed to take a more hawkish stance, the resulting stronger dollar may not provide a positive liquidity stimulus for risk assets as optimistic expectations would.

3. Tariff announcement and market reaction

Historical experience

History shows that tariff announcements can initially disrupt markets, leading to increased volatility and potential declines.

We have calculated the impact of similar events surrounding the official announcement of the tariff war on the traditional stock market and the cryptocurrency market. We divided it into changes in the day before and after the official announcement, and changes in the week after. It can be seen that basically all of them have a negative impact. Bitcoin reacts more violently to announcements related to the tariff war. However, since the stock market has priced in the tariff war in advance, the short-term impact is small and it can basically rise back after a few days. In history, cryptocurrencies will further decline after a short decline.

However, longer-term impacts are less clear and often depend on the specifics of the tariffs, the responses of trading partners, and the overall economic environment. Market adaptability and the likelihood of reaching a trade resolution also play an important role. For example, during the 2018-2019 U.S.-China trade war, initial tariff announcements led to market volatility and sell-offs, but markets tended to rebound as investors gradually adapted or trade negotiations resumed. The S&P 500 fell in 2018 but rose sharply in 2019.

Today's reaction

Today, the market reacted negatively to the 25% auto tariff announced on March 26, 2025, with all three major stock index futures falling, and corporate stocks falling more, indicating that despite expectations, investors are still sensitive to trade policy developments. Pay attention to the recovery of some of the losses today and tomorrow, which can serve as a preview of the 4.2 comprehensive tariffs. If auto industry stocks stabilize quickly, there is no need to be too pessimistic about the 4.2 market.

Bitcoin's limited reaction: As a risk asset, Bitcoin's price movements tend to be closely tied to the overall risk appetite of the market. Recent tariff-related news and broader market sentiment swings have had an impact on Bitcoin's price. Coincident with the tariff threat and announcement, Bitcoin's price fell, but soon rebounded to around 87,000 levels before the New Year, indicating Bitcoin's recent resilience. However, this is also likely related to the recent thin trading volume, with yesterday's trading volume only 60% of YTD in the face of news stimulus, indicating that big players are temporarily on the sidelines and not participating in market pricing.

In addition, the CME premium has continued to decline in the recent rebound, indicating that Wall Street funds seem to be still leaving the market:

4. The key role of Q1 2025 earnings season

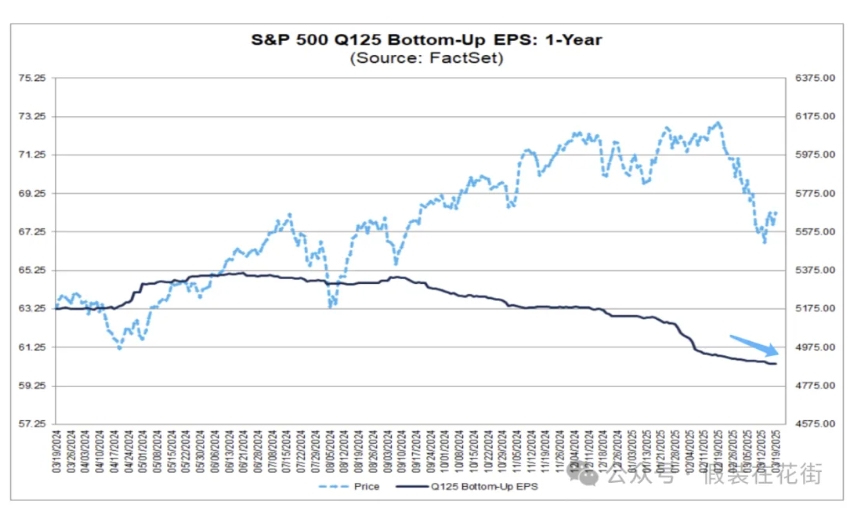

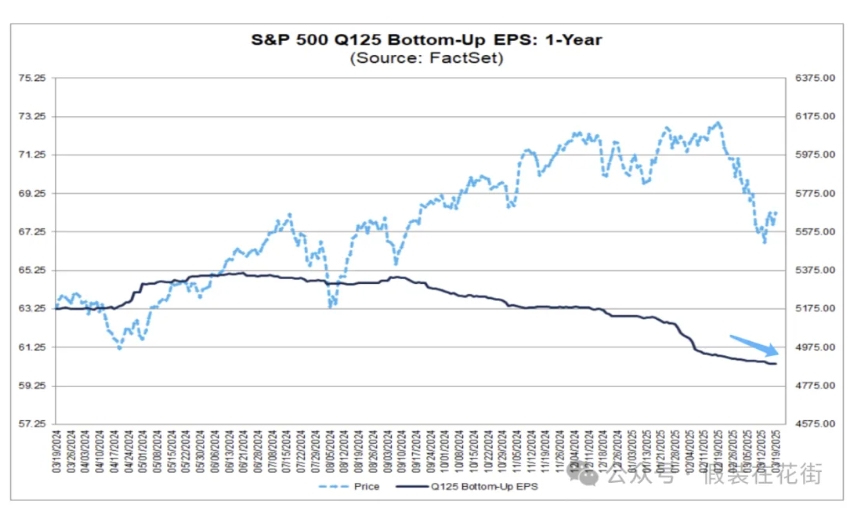

April typically marks the start of earnings season, when public companies release their first-quarter financial results. In the current macroeconomic uncertainty, whether companies can exceed earnings expectations, which have been continuously lowered, will be another key factor in determining the direction of the market.

Earnings Revisions Downward: Analysts generally expect S&P 500 earnings to grow year-over-year in the first quarter of 2025, but it is worth noting that earnings estimates have been revised down several times since the beginning of the year. This downward revision reflects concerns about slowing economic growth, inflationary pressures, and the potential negative impact of tariffs.

Importance of beating expectations: If companies are able to report earnings and revenues that beat these lowered expectations, it could inject confidence into the market, ease concerns about the economic outlook, and potentially offset some of the negative sentiment from tariffs. Conversely, if a large number of companies fail to meet expectations or give pessimistic future guidance, it could exacerbate market concerns and lead to further selling.

Sectors and factors of interest: Investors will closely monitor the performance of various sectors. For example, the profitability of the technology sector, especially in the field of artificial intelligence, will be in focus. Meanwhile, the consumer discretionary sector may be tested by changes in consumer spending and the impact of tariffs. In addition, corporate management's comments on the impact of tariffs, supply chain adjustments, and future demand prospects will also be crucial.

Financial sector: As one of the best performing sectors in the fourth quarter of the U.S. stock market, financial stocks are particularly noteworthy because they have fallen back to the price before Trump won the election a week ago. However, Goldman Sachs PB data shows that hedge funds have accelerated their purchases of stocks in economically sensitive sectors of the U.S. stock market. Last week, hedge funds bought stocks of banks, energy producers and other sectors closely related to the economic cycle at the fastest rate since December last year. Therefore, although tariffs may bring some uncertainty, a stable or even slightly growing economy and continued capital market activities may provide support for this sector.

5. Conclusion

A comprehensive analysis of tariff risks, USD liquidity dynamics, historical reactions, industry-specific outlooks, Fed policy, and market sentiment suggests that the most likely scenario is that the market will see short-term volatility following the tariff announcement. If the negative impact of the tariff measures is less than expected and USD liquidity remains relatively loose, a decent rebound is possible.

However, if tariffs remain strong and widespread, and markets factor in a more hawkish monetary policy stance from the Federal Reserve in response to inflationary pressures, markets could continue to face significant downward pressure.

To put it simply, focus on the 5% and 10% lines:

Regarding the reciprocal tariff measures on April 2, institutional surveys generally estimated 9-10%.

However, the market-priced implied tax rate is lower, the implied tax rate of inflation derivatives is about half of what institutions predict, and the foreign exchange market has hardly priced in tariff risks, indicating that investors may underestimate the impact.

If Trump's idea of filling the fiscal gap of tax cuts with tariffs is to be realized, the tax rate needs to be 4%-7.5%, with annual revenue of about US$380 billion.

The United States also does not want to "trigger retaliation" and may set a maximum tax rate to test the bottom line of various countries - that is, below 10%.

If the final tax rate is lower than 10% (especially close to 5%), it may trigger a rebound in risky assets; on the contrary, a tax increase of more than 10% may impact the global trade chain. The key variables are negotiations with China and the EU, automobile tariff exemptions, agricultural policies and the intensity of retaliation from other countries.

In addition, the upcoming first quarter earnings season and its results will provide important information for assessing corporate profitability and the overall economic health, further influencing market sentiment and direction.