This week, the market oscillated amid mixed bullish and bearish signals. Due to Trump's upcoming reciprocal tariff measures that have sparked trade war concerns, along with rising PCE inflation data and frozen consumer confidence, US stocks and crypto markets have fallen again.

VX: TZ7971

Key Points:

Regulatory Shift: The US SEC withdrew lawsuits against Kraken and ConsenSys and ended crypto investigations, while the Treasury Department lifted Tornado Cash sanctions and Ripple reached a settlement with the SEC, seen as significant signals of potential regulatory pressure easing. Meanwhile, Japan approved USDC as the first compliant stablecoin.

Institutions Continue Buying BTC: Corporate Bitcoin acceptance is increasing, with MicroStrategy adding nearly 7,000 BTC again, and GameStop also announcing Bitcoin as part of its corporate reserve assets.

Market Infrastructure and Product Expansion: Coinbase is reportedly in talks to acquire Deribit, a large options exchange; the world's first tokenized money market ETF has emerged, with BlackRock launching a Bitcoin fund in Europe; traditional financial giant Fidelity is rumored to be issuing its own stablecoin, intensifying market competition.

Exchange Dynamics and Challenges: The BNB chain ecosystem supported by Binance remains active; decentralized exchange Hyperliquid faces a trust crisis due to price manipulation.

RWA and AI Trends: Real-world asset (RWA) tokenization continues to develop, with tokenized US Treasury market value breaking $5 billion; OpenAI updated GPT-4o and opened Agents SDK, with AI and blockchain integration remaining a focus.

As Trump's reciprocal tariff measures are set to be announced on April 2nd, sparking trade war concerns, and the US February Personal Consumption Expenditures (PCE) price index unexpectedly heated up, reflecting persistent inflation pressure, Bitcoin has been declining for consecutive days, dropping to as low as $81,644.

At the time of writing, it slightly rebounded to $83,306, down 0.9% in the past 24 hours.

If macro liquidity cannot be sustainably improved, and as market risk aversion sentiment rises, leading to increased implied volatility premium, a significant further decline in US stocks could potentially drag Bitcoin prices down to the $75,000 range.

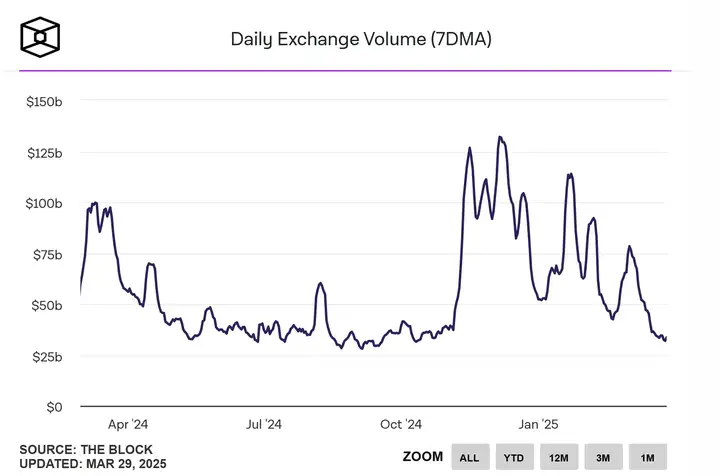

Crypto Trading Volume Plummets 70% from Post-Election Peak

After last year's US presidential election, market sentiment and speculative activity peaked, with daily trading volume reaching as high as $126 billion. However, trading volume has now dropped about 70% from its peak to $35 billion, quickly returning to pre-election levels.

Trump's recent frequent tariff measures on major trading partners have added uncertainty, causing trading enthusiasm in both traditional and crypto asset markets to cool down.

The historical correlation between crypto trading volume and total market capitalization remains, with total market cap previously reaching around $3.9 trillion and now falling to about $2.9 trillion, a decline of approximately 25%.

This trading volume contraction might be a harbinger of significant market changes in the coming months. Historically, prolonged trading volume decline often brings market volatility, as reduced liquidity can amplify price movements when whales start adjusting positions.

The market may currently be waiting and watching Trump's overall approach to crypto regulation. Under unclear policy conditions, participants are choosing to remain cautious. While trading volume is low, total market cap remains relatively stable, suggesting the market might be in an accumulation phase where investors focus on positioning rather than frequent trading. Future policies defining crypto and its regulatory framework could potentially reignite market momentum.

Next Week's Market Focus

3/31 (Monday)

China: March Manufacturing PMI, previous value 50.2

Germany: March Consumer Price Index (CPI) month-on-month, forecast 0.4%

4/1 (Tuesday)

Australia: April Rate Decision, previous value 4.10%

Eurozone: March Consumer CPI year-on-year, forecast 2.3%

US: March Manufacturing PMI, previous value 52.7

US: ISM Manufacturing PMI, previous value 50.3

4/2 (Wednesday)

US: March Non-Farm Employment Change, forecast 77K

US: Crude Oil Inventories, previous value -3.341M

4/3 (Thursday)

US: March Initial Jobless Claims, previous value 224K

US: March Services PMI, previous value 51.0

US: ISM Non-Manufacturing PMI, previous value 53.5

4/4 (Friday)

US: March Average Hourly Earnings Month-on-Month, forecast 0.3%

US: March Non-Farm Employment, forecast 128K

US: March Unemployment Rate, forecast 4.2%

US: Federal Reserve Chair Powell Speech