Bitcoin (BTC) has long been called "digital gold". However, as global economic tensions escalated during Trump's second term with trade war pressures, institutional investors are moving towards physical gold.

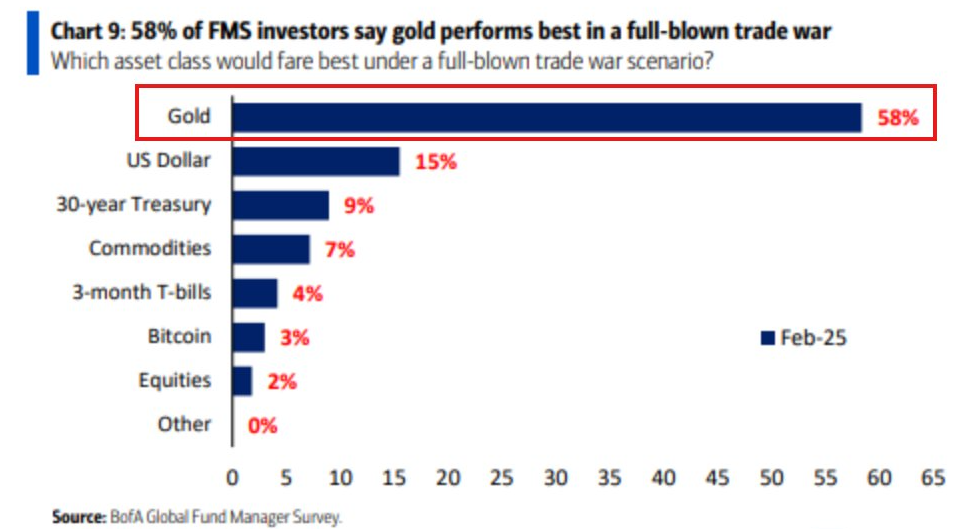

According to a recent Bank of America (BofA) survey, 58% of fund managers view gold as the best-performing safe asset during trade wars, while Bitcoin only gained 3% preference.

Bitcoin's Safe Haven Status, Reality Check

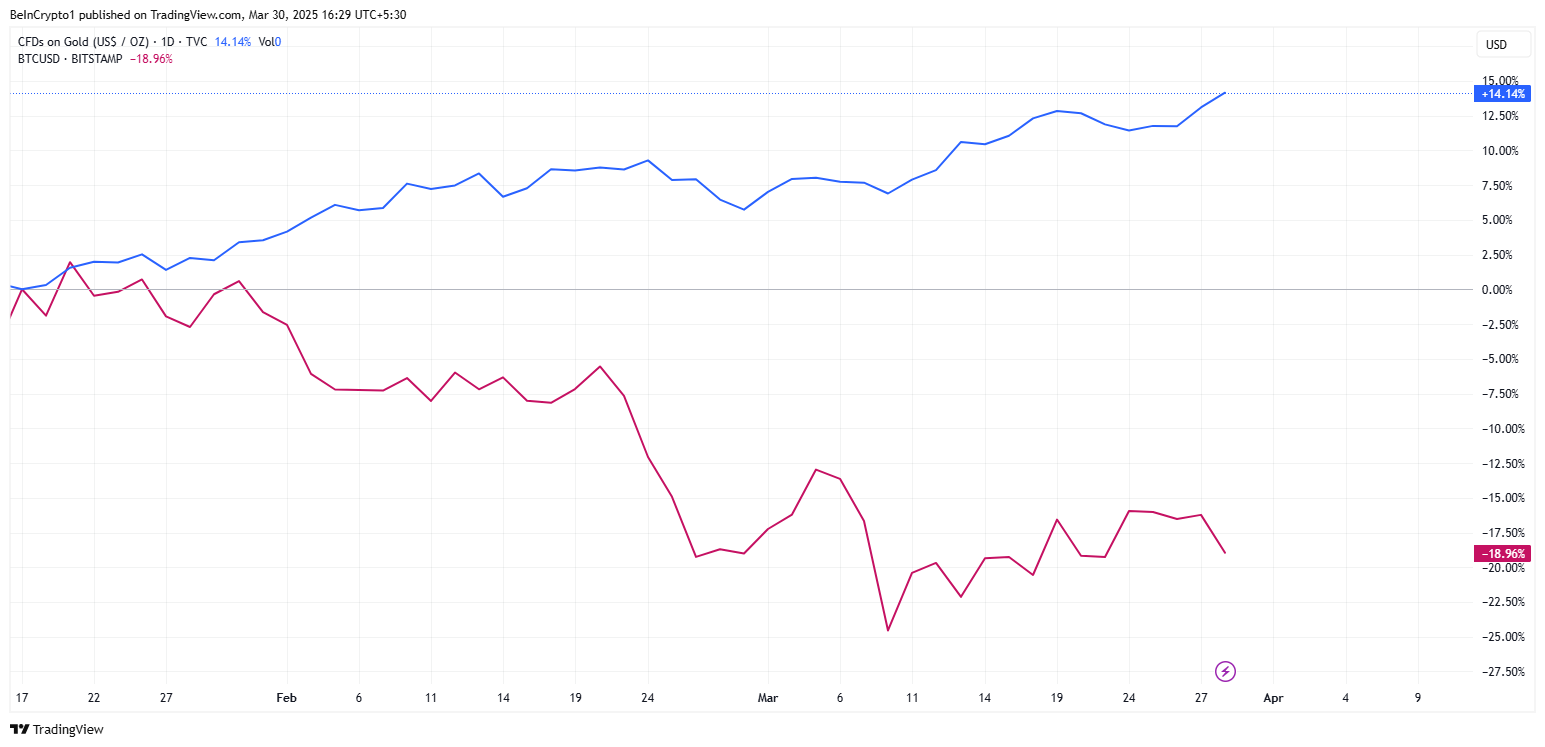

Gold is proving its dominance as a crisis asset, while Bitcoin is struggling to maintain its position. This is occurring amid increasing geopolitical risks, expanding US deficits, and capital outflows due to uncertainty.

"In a recent Bank of America survey, 58% of fund managers said gold performed best in trade wars. This is higher compared to 9% for 30-year bonds and 3% for Bitcoin." – Kobeissi Letter mentioned.

For years, Bitcoin supporters have argued it as a hedge against economic instability. However, in the volatile macro environment of 2025, Bitcoin is struggling to gain full institutional investor confidence.

The Bank of America survey reflects this situation, with trade wars and financial chaos shaking market confidence, causing long-term US Treasury bonds and even the US dollar to lose appeal.

The US deficit crisis is expected to exceed $1.8 trillion, further weakening trust in traditional safe assets like US Treasury bonds.

"This happens when the global reserve currency no longer functions as a global reserve currency," a trader joked.

Instead of seeing Bitcoin as an alternative, institutions are overwhelmingly choosing gold, doubling their physical gold purchases to record levels.

Bitcoin's Institutional Adoption Barriers

Despite fixed supply and decentralization, Bitcoin's short-term volatility remains a major obstacle to institutional adoption as a true safe asset.

Some traders still view Bitcoin as a long-term value storage mechanism, but it lacks the immediate liquidity and risk-aversion appeal that gold provides during crises.

Additionally, President Trump is expected to announce new tariffs on "Liberation Day". Experts warn this event could trigger extreme market volatility.

"April 2nd is like election night. It's the most important event of the year, 10 times more significant than FOMC. And anything can happen," – Alex Kruger predicts.

Trade tensions have historically prompted capital movement to safe assets. As this announcement approaches, investors prefer gold over Bitcoin and are proactively adjusting positions.

"Gold is no longer just a hedge against inflation. It's being treated as a hedge against everything: geopolitical risks, de-globalization, financial chaos, and now weaponized trade. When 58% of fund managers say gold performs best in trade wars, it's not just sentiment but asset allocation flow. Even when long-term bonds and dollars take a back seat, it's a signal: the old playbook is being rewritten. In a world of rising tariffs, forex tensions, and twin deficits, gold might be the only politically neutral store of value," – Trader Billy AU observes.

While Bitcoin struggles to capture institutional safe asset flows in 2025, its long-term narrative remains valid.

Particularly, the global reserve currency system is changing, US debt issues are increasing, and monetary policies continue to evolve. Despite all this, Bitcoin's censorship resistance and value proposition as a borderless asset remain relevant.

However, in the short term, gold leads due to volatility and lack of widespread institutional adoption as a crisis hedge.

The crucial question for Bitcoin enthusiasts is not whether Bitcoin will challenge gold, but how long it will take for institutions to adopt it as a safe asset.

Until then, gold remains the undisputed king during economic chaos. Meanwhile, Bitcoin (excluding BTC ETFs) is fighting to prove its position in the next financial paradigm shift.

"ETF demand was real, but some was simply for arbitrage... There was genuine demand to own BTC, but not as much as we believed." – Analyst Kyle Chassé recently said.