Author: David C, Bankless; Translated by: AIMan@Jinse Finance

New stablecoins continue to emerge, signaling the arrival of a new era where asset managers, banks, nations, and even presidents coexist on-chain with us.

Honestly, this is not surprising. Stablecoins have long been considered one of the fundamental use cases of cryptocurrency, just like BTC. Although they might feel a bit "boring" in crypto products, they are indeed effective, and the market continues to expand.

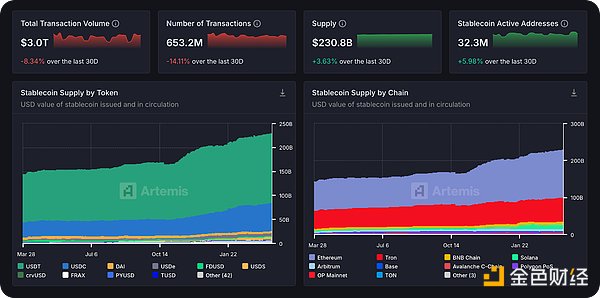

In 2024 alone, fiat-backed stablecoins have grown by 53%, with a circulating supply exceeding $200 billion (with Ethereum accounting for 58%), and facilitating $5.8 trillion in on-chain transactions.

Source: artemis

This growth has far surpassed DeFi speculation, entering mainstream commercial domains, with major tech and fintech companies like PayPal, Venmo, and Stripe entering the blockchain space through stablecoins. Add to this the generally favorable legislation being drafted by Congress - from the GENIUS Act to the STABLE Act of 2025. Everything is almost ready.

Everyone wants a piece of the pie. Last week's announcements further fueled the excitement:

Financial giant Fidelity (with $5.9 trillion in assets under management) is expected to launch a dollar-pegged currency.

Trump-backed World Liberty Fi launched the USD1 stablecoin on Ethereum and BSC.

Wyoming announced the issuance of its own state stablecoin, currently being tested and expected to launch in July.

Custodia Bank and Vantage Bank Texas launched the first stablecoin issued by US banks on a permissionless infrastructure.

All these initiatives emphasize the same story: stablecoins have quickly proven themselves to be a superior payment method, and institutions see a golden opportunity to create value by issuing their own stablecoins.

Today, let's delve into why stablecoins are a significant opportunity, why institutions are joining, and how to seize this trend!

Why Stablecoins Will Win

Before we discuss the advantages for institutions, let's quickly review how stablecoins have become a simpler, faster payment tool - especially compared to the slow, expensive, and fee-laden traditional payment methods.

Traditional payments are dominated by intermediaries: Credit card networks, banks, and other intermediaries earn nearly $2.4 trillion annually, charging 1.6-3% per transaction.

Stablecoins offer a cheaper alternative: A stablecoin transaction fee of one cent compared to over $12 for traditional remittances is a massive advantage for anyone making cross-border transfers, not to mention faster and simpler transfers.

Stablecoins as an inflation hedge: In countries with high inflation rates, stablecoins have become a core use case for savings accounts, as their value is pegged to relatively stable assets like the US dollar. This stability helps individuals avoid sudden local currency depreciation, conduct daily transactions with lower volatility, and store wealth more reliably - especially in places where banks or traditional financial systems are difficult to access.

As more people - whether merchants, asset managers, or state governments - realize that our outdated, extremely complex payment systems are wasting billions of dollars, this convenience, accessibility, and cost savings are the reasons why stablecoins are increasingly accepted and used.

Source: a16z crypto

Source: a16z crypto

Why Institutions Need Stablecoins

Thus, institutions at the core of traditional payment systems quickly realized that they must upgrade to compete with fintech companies - because while there are many gains to be made, the losses will be greater if they are late.

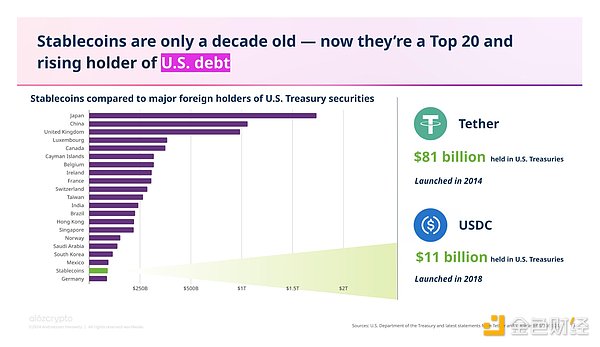

For example, Tether earned $13 billion last year, and Circle made $825 million in just half a year, primarily by holding customer deposits in low-risk, yield-generating assets like money market funds or government bonds. By launching their own stablecoins, banks and financial institutions can leverage this profit model and directly generate revenue from customer deposits.

Even better, institutions can offer reduced fees, preferential loan rates, or entirely new financial products, creating a seamless experience within their platform that incentivizes users to trade using their stablecoins and continually return to their products, thus promoting a loyalty loop.

Now, financial institutions no longer view payments as a pure cost center but can transform it into a profit center. For instance, banks can adopt classic fintech strategies like sharing reserve yields (float) with merchants and partners, similar to how Visa rewards United and Chase to attract credit card users. It's a win-win: institutions build larger deposit pools that can be used to generate returns and expand product offerings, merchants gain income by shifting transactions from credit cards to stablecoins, and customers benefit from loyalty-driven incentives, thereby promoting widespread adoption and retention.

Several reasons for payment companies / fintech to launch their own stablecoins

- Make deposits more useful (= more sticky)

- Retain generated interest (instead of giving it to another issuer)

- Provide instant settlement for users / merchants

- Reduce merchant exchange / fraud costs https://t.co/neva6fsLx7— ria bhutoria (@riabhutoria) September 26, 2024

In addition to increasing profits, institutions can significantly cut costs from intermediaries like Visa and Mastercard, which typically charge 1.6-3% per transaction. Natively issued stablecoins can settle payments at almost zero cost, dramatically improving profit margins and allowing them to offer merchants cheaper, more competitive payment solutions. Moreover, stablecoins' instant settlement reduces fraud risk, helping banks avoid expensive fraud protection services that traditional payment networks often bundle and pass on to users.

Furthermore, institutions issuing stablecoins can expand into previously underserved markets. Stablecoins excel at instant, low-cost international payments - their standout use case - which enables issuers to access high-profit cross-border business and remittance flows. These markets were previously fragmented and costly but suddenly become accessible and profitable, providing banks with a new path to global competition and fundamentally transforming the global landscape.

Finally, with rapidly improving regulatory clarity (such as the EU's MiCA and emerging US STABLE and GENIUS Acts), institutions have significant regulatory advantages. Banks and regulated asset management companies can issue compliant, audited stablecoins, instantly gaining credibility among institutional users who are cautious about crypto-native issuers. Bank-issued stablecoins will inherently be perceived as safer, more trustworthy, and aligned with evolving global standards.

In short, stablecoins provide institutions with an entirely new toolkit to compete in the rapidly evolving financial environment: from capturing billions in reserve yields, cutting expensive intermediaries, and improving merchant profits to driving strategic loyalty incentives and seizing new market opportunities. The question is no longer why institutions are eager to launch stablecoins, but why wouldn't they?

How to Seize Stablecoin Opportunities

Even if you are confident that stablecoins will reshape global finance, there is no simple "stablecoin index" to invest in. Instead, we only have indirect methods to go long.

If you are optimistic about stablecoin adoption, here are some options to explore:

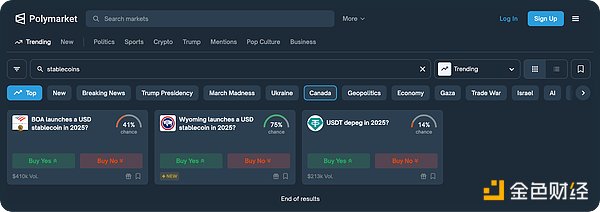

Stablecoin-Related Prediction Markets

Websites like Polymarket allow you to bet on whether institutions like US banks or states like Wyoming will soon issue their own stablecoins. Participating or monitoring new stablecoins is a good choice, but not perfect.

Earn Stablecoin APR

DeFi lending, CEX stablecoin yields, DeFi liquidity provision, reStaking, etc., such as Aave, MakerDAO, Pendle, Kamino, Drift, Hyperliquid

Buy Tokens with Stablecoin Exposure

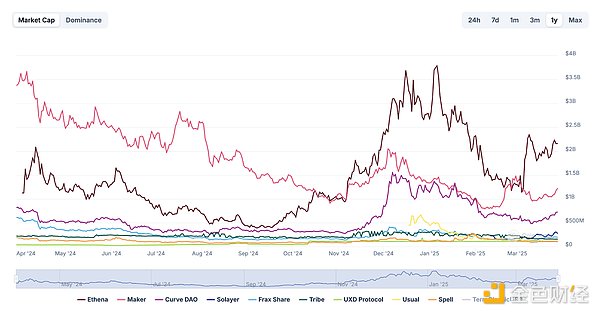

Tokens tied to stablecoin issuance (such as ENA, SKY, or MKR, AAVE, and FXS) could be another good option.

However, for this path, you must remember that cryptocurrency is not an efficient or fundamentals-driven market, which means the growth of these stablecoins may not be reflected in their prices.

If you want to take this route, be sure to choose stablecoin-related tokens on chains with large stablecoin quantities and supply, such as Base, Solana, Ethereum, and TRON.

Early Unissued Tokens of Stablecoin Projects

Early tokenless stablecoin projects offer unique "farming" opportunities, essentially early rewards. Notable projects include Cap Money, Perena, Resolv, Level, Metastable, and Rings. However, given that these projects are still in early stages, you must bear smart contract risks. Additionally, focusing on protocols on chains with numerous stablecoins is absolutely a good thing.

Popular Tokenless Stablecoins (Q1-Q2 2025)

@capmoney——MegaETH USD

@Perena——Solana Native USD

@ResolvLabs——DN Stablecoin with Thicker Reserve Fund

@noble_xyz——Cosmos Short-Term US Treasury USD

@levelusd——Lending/reStaking USD

@Theo_Network - Hyperliquid DN USD

@Rings_Protocol - Sonic Yield USD

@USDai_Official- Depin Backed USD (?)

@hydration_net- DOT USD

@Corkprotocol - Depeg Insurance Protocol

@veda_labs- Yield Infra Made Easy for Launching USD

Monitor New Opportunities

Circle, the giant behind USDC, has applied for listing and may soon provide direct stock market exposure. Considering they earned $825 million in just six months last year and are more regulatory-compliant compared to Tether, it is likely the preferred way to bet on stablecoins. This is the closest method to directly investing in the rising dominance of stablecoins.

Additionally, Plasma, backed by Peter Thiel, is a new USDT-centric Bitcoin sidechain, and if they launch a token, it could be another option to monitor. Moreover, if Tether does not have an IPO, it might be one of the best ways to bet on top stablecoin growth.