In the first quarter of 2025, Bitcoin experienced its weakest performance in nearly a decade. Despite a strong initial rise that once reached a historical high of $109,590, it ultimately closed with a decline of nearly 11%. The market was optimistic about Donald Trump's potential re-election and possible pro-crypto policies, but this sentiment was quickly replaced by a typical "buy the rumor, sell the news" trading pattern, as actual regulatory changes were slow to materialize.

Since its historical peak, Bitcoin has dropped nearly 29%, reaching a low of $77,041, and has mostly oscillated between $78,000 and $88,000.

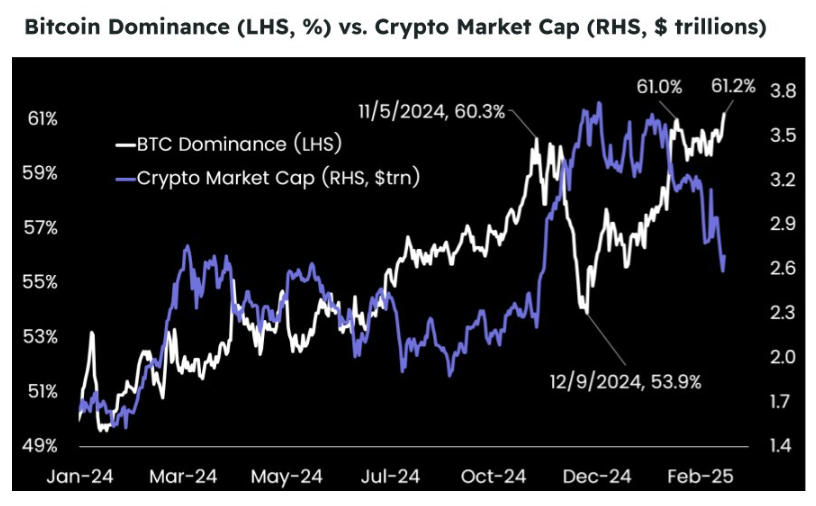

Bitcoin Dominance vs Total Crypto Market Capitalisation

Despite the overall crypto market's significant decline, market breadth remains favorable for Bitcoin. BTC Dominance has risen to over 61%, indicating that funds are flowing back to Bitcoin from riskier Altcoins amid increasing macroeconomic uncertainty.

Ethereum, Solana, and other Altcoins have fallen more than 35%-50% from their cycle highs, further reinforcing Bitcoin's position as a digital market reserve asset.

As the second quarter begins, Bitcoin's price remains highly sensitive to macroeconomic signals, with Federal Reserve policies and ETF fund flows expected to be key factors driving market direction. Currently, signs of panic selling have somewhat subsided, but breakthrough still requires significant catalysts due to ongoing tight liquidity.

From a macroeconomic perspective, some sectors of the US economy show resilience, such as narrowing trade deficits and increased durable goods spending. However, these highlights are overshadowed by deeper structural issues. Inflation has accelerated beyond expectations, partly due to new tariff policies increasing import costs. Core inflation rose 0.4% in February, the largest monthly increase in over a year, while consumer expectations suggest inflation may remain high for an extended period.

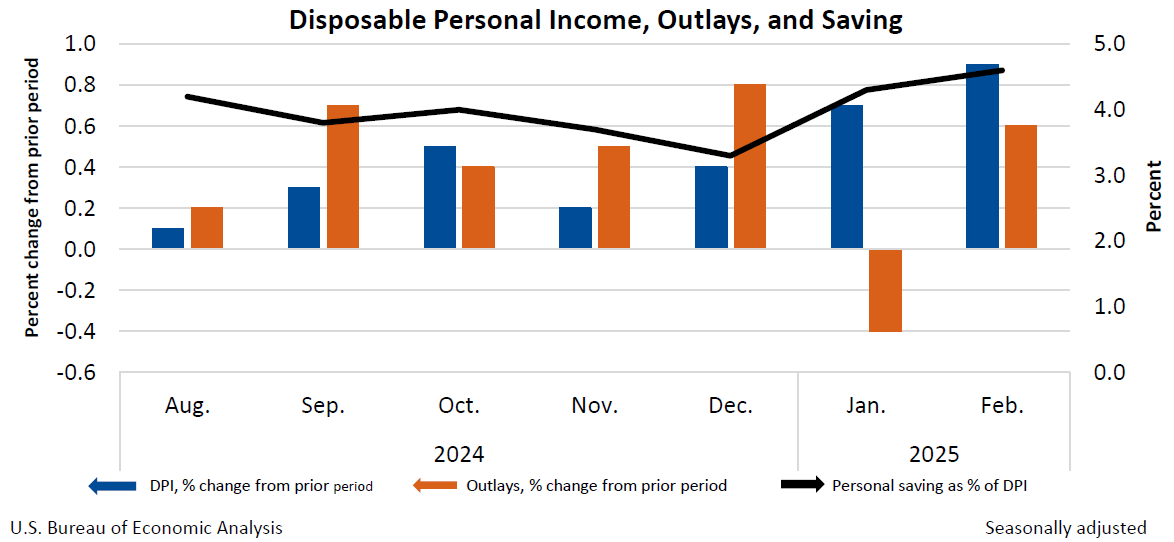

Disposable Personal Income, Outlays and Saving (Source: US Bureau of Economic Analysis)

Meanwhile, economic growth is slowing. Real income growth remains weak when excluding government transfer payments, and service sector spending—a key economic driver—has begun to shrink. Consumer confidence is declining, with the Conference Board Consumer Confidence Index falling to its lowest level in two years, and more Americans anticipating rising unemployment. These trends indicate increasing caution among US households, reflected in rising personal savings rates.

Trade policy remains a core market pressure point. Recent tariff increases and market expectations of further tariffs in April and May are prompting businesses and consumers to adjust behaviors—accelerating purchases, delaying investments, or reducing hiring. Although the US trade deficit narrowed in February, this data was influenced by January's import surge and may have distorted GDP expectations. Therefore, economic growth in the first quarter is expected to significantly slow down.

Despite ongoing economic uncertainty, the crypto industry continues to benefit from improved regulatory clarity, a trend further driven by political support and growing institutional interest.

The SEC has officially withdrawn lawsuits against three industry giants: Kraken, ConsenSys, and Cumberland DRW. This move marks a shift from the SEC's previously enforcement-focused hard stance to a more collaborative regulatory approach, signaling the regulator's commitment to establishing clear and constructive rules for the crypto industry.

Further solidifying this direction, the SEC's crypto-specific task force announced four roundtable meetings between April and June 2025. These meetings will invite industry stakeholders to discuss key issues such as crypto trading regulation, digital asset custody, tokenization, and the future of DeFi. The public nature of these events reflects the SEC's dedication to promoting open dialogue and transparency in shaping crypto policy.

Simultaneously, Trump Media & Technology Group (TMTG) announced a high-profile collaboration with Crypto.com, planning to launch a series of crypto-focused ETFs. This move marks TMTG's official entry into financial products, aiming to capitalize on the growing market demand for digital asset investment tools. While the plan requires regulatory approval, its successful implementation could significantly enhance TMTG and Crypto.com's influence in traditional financial markets.