Author: Aaron Wood, CoinTelegraph; Translated by: Deng Tong, Jinse Finance

March was a challenging month for the market - the uncertain tariff policy of U.S. President Donald Trump led to volatility in the Bitcoin and cryptocurrency market; meanwhile, DeFi was struggling with security issues.

Retaliatory tariffs imposed by China and the EU on U.S. goods impacted the market on March 10 and 12, respectively. Amid the tensions between the U.S. and its largest trading partners, Bitcoin successfully rebounded to $88,000 on March 24, then fell back to around $82,000 at the time of writing.

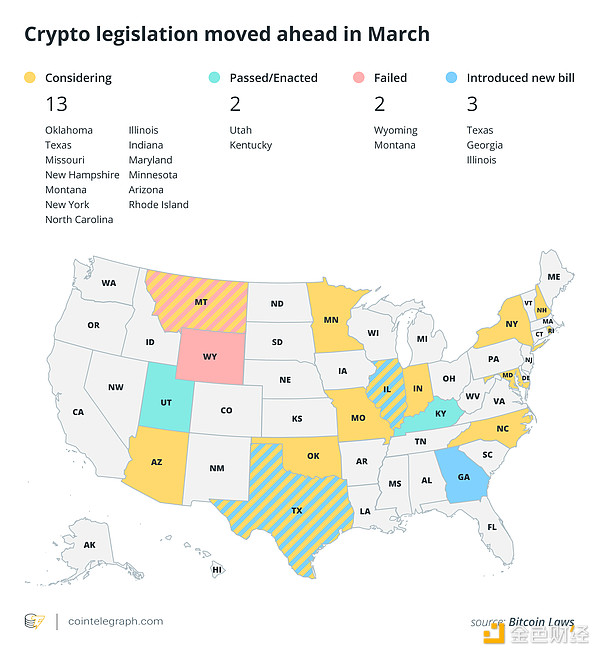

Many state legislatures are considering legislation related to Bitcoin and cryptocurrencies, from bills establishing Bitcoin reserves to crypto tax enforcement and exploring pension fund investments. This month, such bills passed in 13 U.S. states through voting or committee processes.

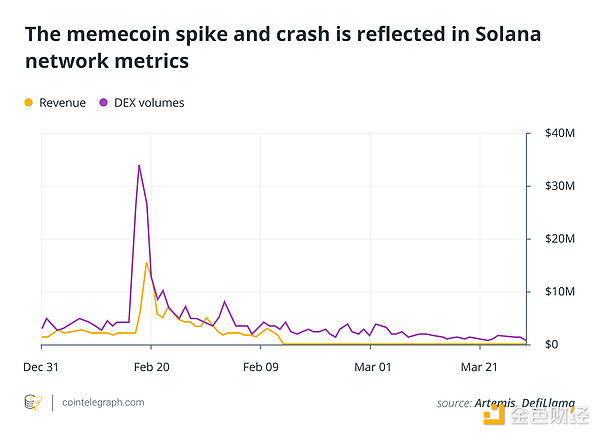

The cooling of the Memecoin market significantly impacted Solana's revenue. After reaching an impressive high of $34 billion in January, Solana's trading volume on decentralized exchanges sharply declined. In March, the volume rarely exceeded $1 billion.

Here are the data for March.

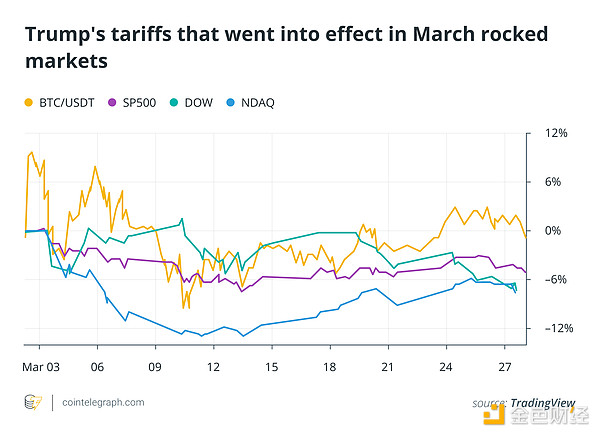

Trump's Trade War Caused Bitcoin to Drop 5% This Month

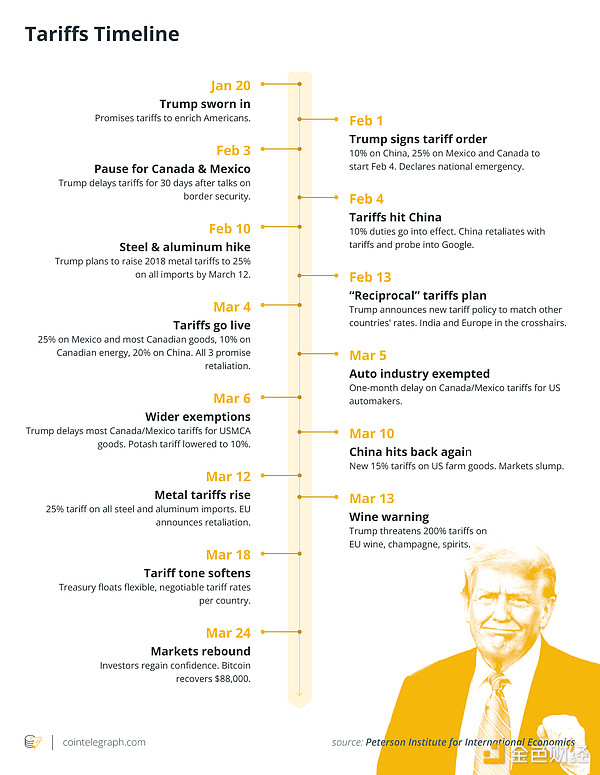

In the first month of Trump's presidency, several controversial trade policies underwent multiple reversals, even confusing and angering the president's political allies.

After a month of delay, tariffs took effect on March 4 - 25% on Mexican and Canadian goods, and 20% on Chinese goods. Just one day later, the Trump administration postponed tariffs on automakers; on March 6, it announced a delay on tariffs for most Canadian and Mexican goods.

China's retaliatory tariffs escalated the situation, and on March 12, Trump announced 24% tariffs on aluminum and steel. On March 18, the U.S. Treasury, affiliated with the presidential office, announced that tariff rates for countries could be negotiated.

Due to the estimated impact of tariffs changing weekly, both Bitcoin prices and major U.S. stock indices were impacted. On March 24, Bitcoin successfully rebounded to $85,000, briefly surpassing the early month level.

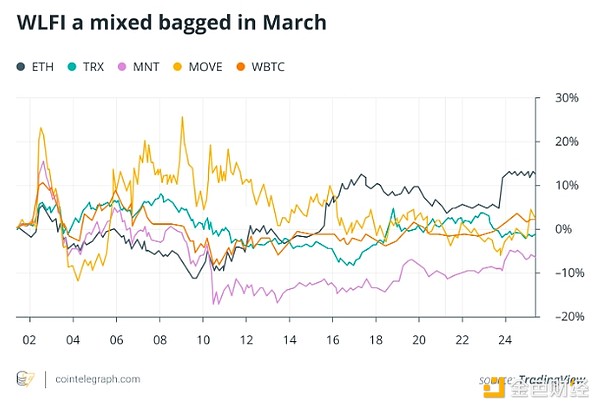

The trade war affected the cryptocurrency investments of the Trump family through World Liberty Financial (WLFI). The fund's performance was mixed in March, with many Altcoins in its portfolio, such as Mint (MNT) and TRON (TRX), trading at or below early month levels.

As traders prepared for "Liberation Day" on April 2, cryptocurrencies and traditional finance trended downward at the end of March, when Trump promised to impose equivalent tariffs on all countries that had levied tariffs on U.S. goods.

Two States Enact Cryptocurrency Legislation

Utah and Kentucky enacted cryptocurrency legislation in March. Both laws defined different aspects of digital assets and blockchain technology. They also provided zoning definitions and protections for crypto miners and established guidelines for businesses to accept cryptocurrencies.

In March, 13 other states also advanced multiple crypto bills. Texas, Georgia, and Illinois have introduced new bills in their respective legislatures.

The Illinois bill will establish regulations and consumer protection measures for the industry, while Georgia senators seek to create a Senate research committee on digital assets and artificial intelligence.

Texas has been busy. In March alone, it proposed three separate bills that would create a stablecoin backed by oil, allow state government officials to invest state funds in cryptocurrencies, and establish a blockchain pilot program for the state's information resources department.

Solana Ecosystem Faces 99% Revenue Decline

Several high-profile scandals, including Argentine President Javier Milei, have begun to create panic among meme coin investors.

Since most issuances occurred on the Solana network, the massive exodus of traders caused revenue to drop 99% from the $15 million high on January 19 to just $119,000 at the time of writing.

In March, decentralized exchange on-chain trading volume and daily active addresses continued to decline. DEX trading volume steadily dropped from $3.9 billion on March 2 to $782 million at the time of writing.

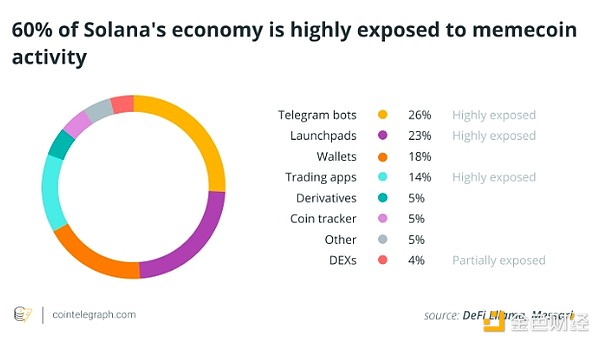

In late February, Messari analyst Sunny Shi highlighted that the "meme coin economy" constituted most of the Solana ecosystem's value. He added, "A significant contraction in meme coin trading volume could lead to a substantial revenue decline."

The future of Memecoins remains uncertain, but Synthetix founder Kain Warwick noted that the network was better for them.

"A big highlight of meme coin speculation is that it drove massive infrastructure investment in Solana," Warwick said. "Solana as a chain is 100 times better than before meme coins appeared."

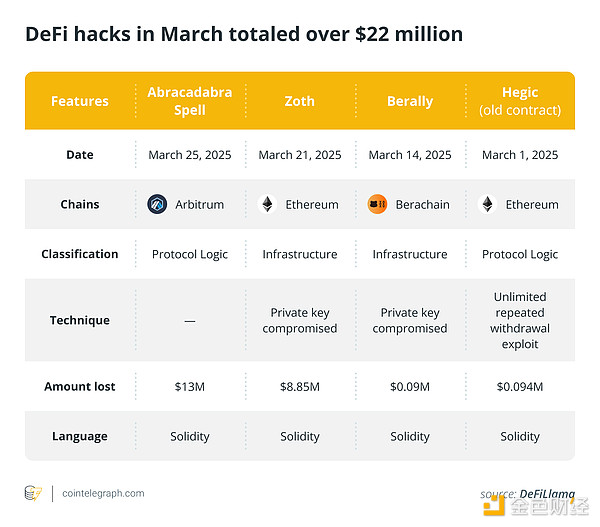

DeFi Loses $22 Million in Hacks, Analysts Warn About Security

February saw the largest DeFi hack in history, with the North Korean government-affiliated Lazarus Group stealing $1.4 billion from Bybit. In comparison, March was modest - four hacks collectively stole $22 million (note: these attacks differ from exploit or short squeeze).

Blockchain security firm Lookonchain stated that the Bybit incident is ongoing, with reports suggesting hackers successfully transferred "100%" of funds - primarily through THORChain.

Persistent expensive DeFi hacks led blockchain detective ZachXBT to post on his Telegram channel on March 18 that DeFi is "incredibly bad with vulnerabilities/hacks, and unfortunately, I don't know if the industry will solve this problem on its own unless the government mandates regulations that damage the entire industry."

He said that nearly "100%" of monthly fees or trading volume for many protocols came from Lazarus and "refuse to take any responsibility".

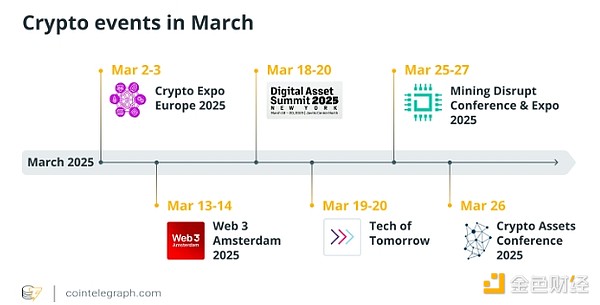

Despite concerns about security and macroeconomic factors, the crypto industry continues to develop and gather at international conferences. Six major international crypto conferences were held in Europe and North America in March.

Overall, March was a volatile month. Major currencies remained range-bound or experienced significant declines - Ethereum.

In April, the market will be tested as Trump launches massive tariffs on April 2 (dubbed "Liberation Day"). However, the past inconsistency of tariff policies suggests the impact may not be as significant as anticipated.

Next month, the House Financial Services Committee will also debate the U.S. Stablecoin Act. Many in the industry believe that this bill is the green light needed for cryptocurrency development in the United States.

On April 18, Avraham Eisenberg, who was found guilty of fraud and market manipulation on Mango Markets DEX, will face sentencing.