Trump's long-discussed "Tariff Liberation Day" is approaching, and global markets are experiencing a new wave of volatility. After suffering a "Black Friday" last week, U.S. stocks fell again on Monday, with the Nasdaq declining 8.21% in March. The crypto market was also affected, with Bitcoin dropping 18% in February and another 3.5% in March. Ethereum disappointed investors, falling nearly 50% in the first quarter, with market sentiment extremely negative.

Macroeconomic Deterioration and Continuing Decline in Consumer Confidence

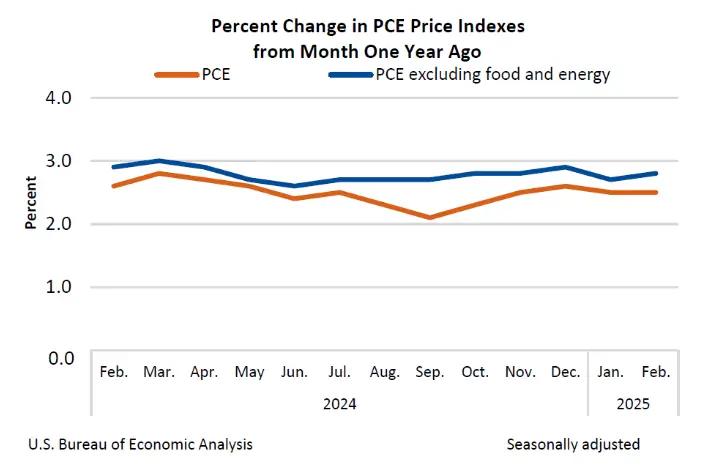

The Fed's preferred inflation indicator, the PCE Price Index, showed that inflation remains stubbornly high, with consumers becoming more cautious in their spending. February's core PCE monthly and year-on-year increases were higher than expected, with core service costs rebounding significantly, driving "super core inflation" upward.

As key inflation indicators rise, savings rates have notably increased. February consumer spending was again below expectations, with a clear trend of personal consumer goods expenditure growing faster than service expenditure, indicating that the consumption willingness of high-income groups—which supported U.S. GDP growth over the past two years—is also declining, with people becoming cautious about the future.

Consistent with the consumption data, the University of Michigan's latest Consumer Confidence Index dropped to 57, with consumers' inflation expectations for the next year rising to 5%, both at their worst levels in over two years.

On the Federal Reserve's side, multiple committee members have spoken out, emphasizing patience as a consensus, while acknowledging that the deviation of the inflation path and increased tariff uncertainty have made the economic outlook for 2025 more unclear.

With consumer and business sentiment weakening and the economy entering a fragile stage, policy risks are more influential than in recent years. Goldman Sachs raised the probability of a U.S. economic recession from 20% to 35% last week, with GDP growth slowing to 1.0%.

Trump's Tariffs as a Market Turning Point, Potential Peak of Volatility This Week

Trump's planned "reciprocal tariffs" to be implemented on Wednesday are the direct trigger for recent market turbulence. Goldman Sachs expects tariffs to be imposed at an average of 15% on all trading partners, a 5 percentage point increase from previous expectations, potentially raising import costs and provoking global retaliatory actions.

Citi's latest report summarized three main scenarios with corresponding market impacts: first, announcing reciprocal tariffs with limited market reaction; second, reciprocal tariffs plus VAT, potentially causing the dollar index to immediately rise 50-100 basis points and global stocks to fall; third, including industry-specific tariffs in addition to reciprocal tariffs and VAT, which could trigger an even more intense market reaction.

As these policies are not yet announced and given Trump's unpredictable and inconsistent style, the market is primarily positioning based on expectations, which often change with various news. This week could become a peak of volatility. Additionally, once policies are finalized or their impact becomes apparent, the market may readjust its positioning, causing further fluctuations.

Risk Aversion as the Current Market Theme

Investors tend to avoid risks as major events approach. U.S. stocks continue to be sold off, with last week's potential rebound quickly derailed, and the crypto market experiencing low trading volumes, with funds accelerating towards safe-haven assets.

Bitcoin spot ETF has seen net inflows exceeding net outflows for 10 consecutive days since March 14th. However, from March 21st, net inflows have not exceeded $100 million, and on March 28th, the 10-day consecutive net inflow streak ended, with institutional funds experiencing consecutive net outflows.

Meanwhile, gold is performing extremely strongly. Spot gold rose 1.25% on Monday, reaching a historic high of $3,145, breaking records 19 times this year. It rose 9.33% in March and 18.48% in the first quarter, the strongest performance since 1986, becoming the most impressive global asset.

Trump will announce reciprocal tariffs at 3 AM on April 3rd, with the current market on high alert. Under risk-averse sentiment, the market is extremely fragile. If tariff measures are severe and trigger global trade friction, risk assets may further decline. 4E Exchange, as an official partner of Argentina's national team, offers a USDT stablecoin financial product with an annualized return of 8%, providing investors with a potential hedging option. Additionally, 4E supports large-scale gold trading, allowing investors to potentially capture growth opportunities in safe-haven assets during market turbulence.