I. The Origin of Vine Token: A Collision of Nostalgic Marketing and Technical Narrative

From Short Video Pioneer to Crypto Legacy

Vine's history can be traced back to 2012, a platform of 6-second loop short videos that once inspired applications like TikTok and Instagram Reels. Although its co-founder Rus Yusupov sold Vine to Twitter (now X platform) and did not directly participate in subsequent operations, he remained deeply connected to this cultural symbol. In January 2025, after Musk repeatedly hinted at "considering reviving Vine", Yusupov issued a meme coin VINE on the Solana chain in the name of "commemorating unity and creativity", instantly igniting market sentiment.

Founder's Dual Narrative Strategy

Yusupov's issuance statement was full of idealistic color: developer tokens locked until April 20, 2025, with proceeds donated to X platform, emphasizing "decentralized creative freedom". However, the market was more focused on the speculative value of his "Vine founder" endorsement and potential Musk linkage. This combination of "emotional packaging + celebrity effect" became the core driving force behind VINE's early market value soaring to $400 million.

Solana Ecosystem's Boost

Choosing the Solana chain precisely hit the industry trend of "high-performance public chain + meme coin explosion" in 2025. Solana's low gas fees and high TPS characteristics lowered the entry barrier for retail investors, while the wave of on-chain AI and social protocols provided VINE with the imagination of a "Web3 short video platform".

II. Vine Token's Roller Coaster: A Three-Way Game between Whales, Exchanges, and Retail Investors

Early "Speed Run Myth"

On January 23, 2025, VINE's market value broke through $100 million within an hour of listing, and then briefly surged to $240 million due to Yusupov's public lock-up commitment. During this stage, market narrative focused on the possibility of "Musk reviving Vine", and on-chain data showed that the top ten holders accounted for 39.52%, with clear whale control characteristics.

Bloody Harvest in Contract Market

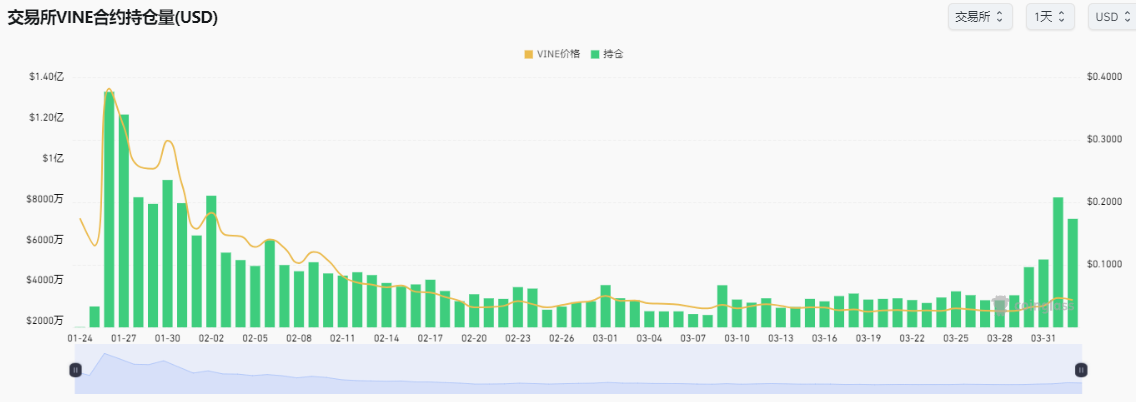

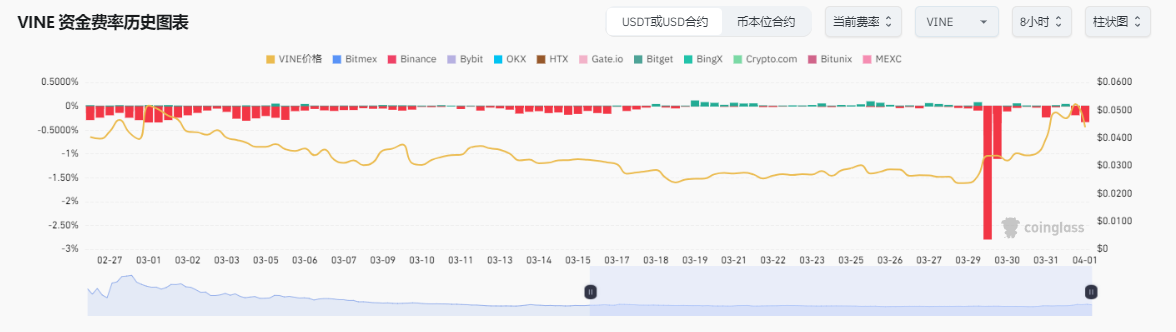

After VINE landed on Binance contracts on January 26, the plot took a sharp turn. Short selling funding rates continued to be negative, with whales causing 300% liquidation of short positions, then selling spot and shorting, completing a "long and short double kill". This harvesting strategy designed using exchange data transparency directly caused the price to halve from $0.43 to $0.26, trapping many high-chasing retail investors.

Price Pulse Triggered by Musk's Dynamics

On March 29, Polymarket prediction platform released a message about "Musk approving Vine revival", causing VINE to surge 90% before falling back. This "news-driven volatility" exposed the project's fundamental flaws: price disconnected from substantial progress, completely dependent on external event stimulation.

III. Current Situation After 10-Fold Collapse: Value Reassessment and Ecosystem Dilemma

Data Perspective: Liquidity Crisis and Chip Distribution

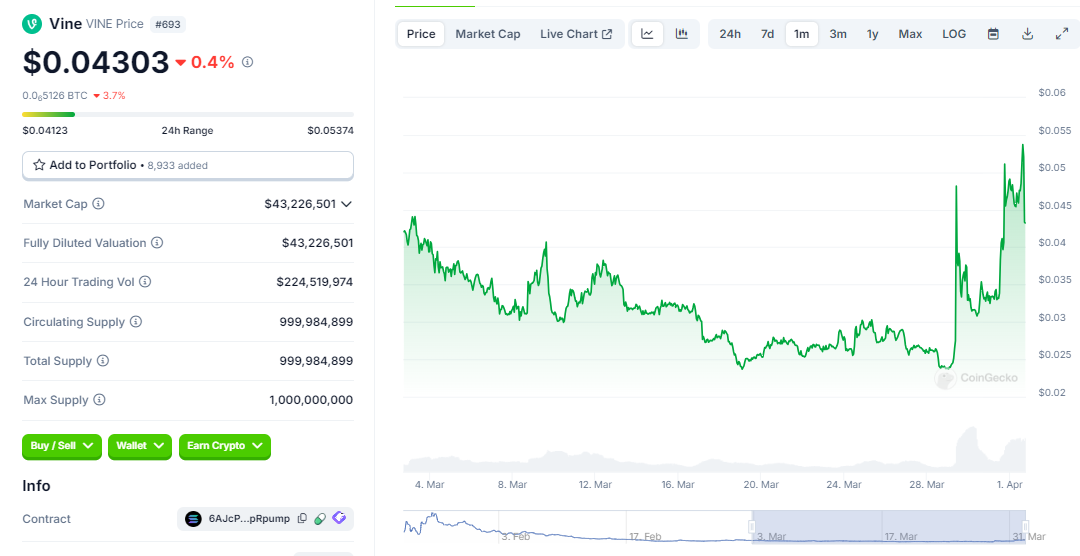

As of April 1, VINE's price dropped over 90% from its historical high, with Vine quoted at $0.043, circulating market value less than $44 million, and 24-hour trading volume shrinking to $83 million. More critically, on-chain holding concentration did not significantly improve, with the top ten addresses still controlling over 40% of the supply.

Ecosystem Progress Stagnation: Narrative Failure Warning

Despite Yusupov claiming "VINE will empower decentralized video creation", actual implementation is zero. The project's official website has not disclosed any technical roadmap, and the so-called "donation to X platform revenue" lacks transparent audit. Meanwhile, Musk's ambiguous attitude towards Vine revival (Polymarket prediction probability only 26%) further weakened the narrative's credibility.

Divergent Exchange Attitudes: Liquidity Trap Emerging

Although VINE has been listed on top exchanges like Binance and OKX, platforms have not recently included it in key operational targets. Taking OKX as an example, VINE's trading volume has continued to decline after leverage and contract functions went online, with some exchanges removing it from homepage recommendations.

IV. Buy the Dips Logic Breakdown: Quantitative Assessment of Risk-Reward Ratio

K-Line Cycle Reveals "Golden Pit" Opportunity

From technical analysis, VINE's daily RSI has fallen to 22 (severely oversold area), with MACD histogram showing bottom divergence signal, where similar patterns historically averaged a 380% rebound. Weekly support is in the $0.018-0.022 range, with the previous price ($0.025) already entering an extremely undervalued "net present value" zone. Currently, Vine is breaking above the 5-day moving average, with MACD showing bullish signals.

Fundamentals: Possibility of Narrative Restart

The key variable is whether Musk releases clear positive news before April 20 (token unlock date). If Vine 2.0 is bound to the VINE token economic model, it might trigger short-term FOMO; otherwise, unlock selling pressure will intensify the decline. It's crucial to note that Yusupov's lock-up commitment only covers 5% of tokens, with the remaining 95% still freely circulating.

Community Consensus "From Dispersed to Concentrated"

Although Twitter discussion volume has dropped 87% from its peak, two positive changes have emerged in the core community:

Increased token concentration: Top 100 addresses' holdings ratio rose from 39.5% to 52.3%, reflecting whale buy the dips actions

Rising developer activity: GitHub shows Vine 2.0 code repository's weekly submission reached 127 times, involving key modules like "AI video editing tools" and "on-chain copyright protocol"

Institutional Entry Signals: Exchange and Capital Undercurrents

Within two months of listing, VINE has been listed on top exchanges like Binance and OKX, with contract trading volume peaking over $500 million. On-chain data shows market makers Wintermute and Amber Group have continuously increased VINE holdings, with 1.2 million and 800,000 tokens respectively (worth about $480,000 and $320,000), suggesting professional capital sees bottom value.

Additionally, Coinglass data shows Vine contract positions exceed $70 million, far surpassing Vine's current circulating market value.

Vine's funding rate has exceeded -0.05%, and combined with recent position volume surge, the possibility of whales using contract market to short cannot be ruled out.

Conclusion

When the market labels VINE as a "zero coin" due to panic, true opportunities are often quietly brewing. At $0.04, Vine is worth buying the dips. Whether it's Musk's resource endowment, Solana's technical dividend, or the wave of meme coins transforming into utility tokens, VINE has already occupied a scarce ecological position. For rational investors, this "moment of fear" is precisely the perfect window to layout future Alpha.