Bybit Leads Capital Inflow in March and Regains Global Second Trading Volume

Dubai, UAE, April 1, 2025 - The global second-largest cryptocurrency exchange Bybit makes a strong comeback, with capital inflow reaching $3.61 billion in March, reclaiming the second position in global trading volume. This surge in capital inflow fully demonstrates the effectiveness of Bybit's rapid recovery strategy and its unwavering commitment to user security and transparency.

Top Capital Inflow in One Month

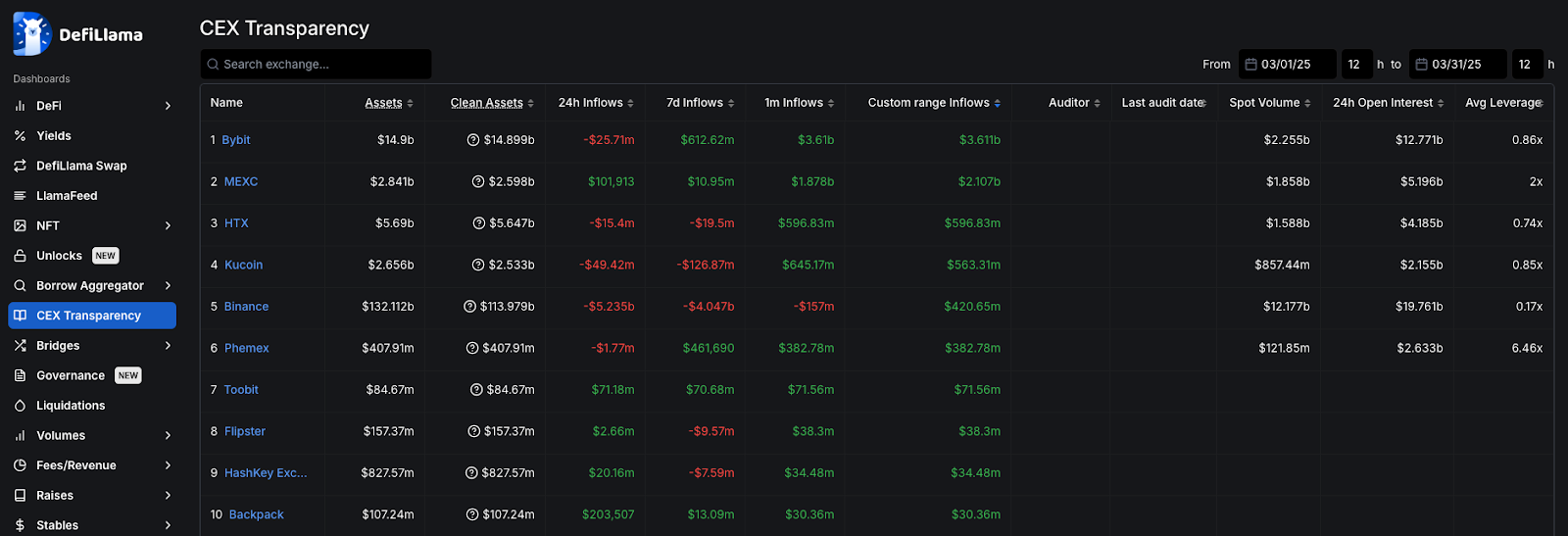

According to defillama data, Bybit ranked first in capital inflow among centralized exchanges (CEX) in the past month, adding $3.61 billion in March alone. As of March 31, 2025, Bybit's total locked value (TVL) reached $14.9 billion. Within 31 days, Bybit showed impressive capital inflow across different time periods (7 days: $611.262 million, 1 month: $3.61 billion), demonstrating high user trust in the Bybit platform.

Bybit has withstood one of the most severe tests in crypto industry history, setting new industry benchmarks in security reconstruction, operational and financial resilience, and user trust building, showcasing its exceptional recovery capabilities.

Bybit Reclaims Global Second Trading Volume

After experiencing a security incident, Bybit introduced the Retail Price Optimization (RPI) mechanism, significantly boosting spot trading volume and further consolidating its leading position in retail liquidity. The RPI order is designed specifically for retail users, bringing unprecedented liquidity to core trading pairs like BTC/USDT and ETH/USDT. Data shows that during the period from February 27 to March 3, Bybit's liquidity in 12 major trading pairs reached 3 times that of market leaders.

During this period, Bybit maintained full platform functionality, ensuring users could smoothly withdraw funds, participate in new token activities, and enjoy multiple reward programs. Thanks to these strategic measures, Bybit not only won user trust but also accelerated market return and solidified its position as the preferred platform for global traders.

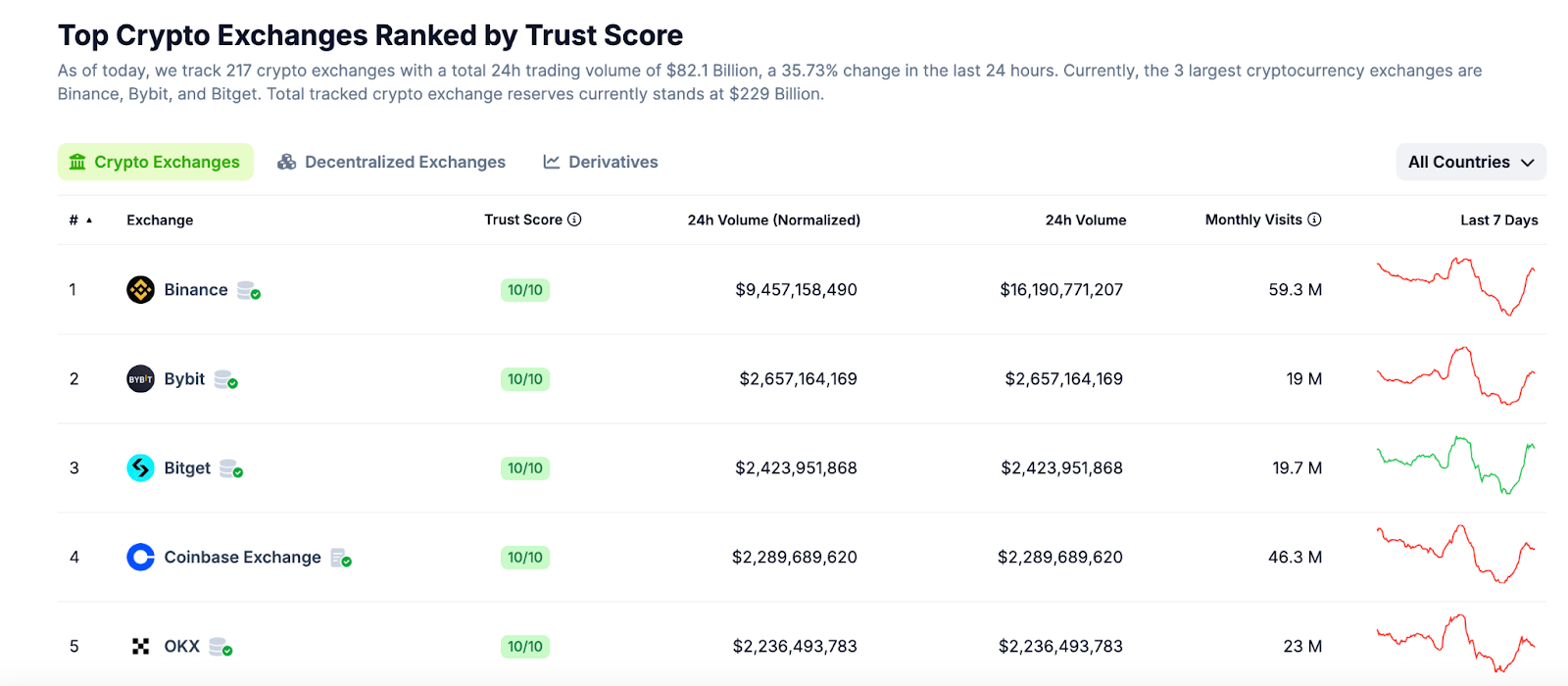

The latest CoinGecko data (April 1, 2025) confirms that Bybit has returned to the second position in global trading volume.

Business as Usual: New Token Activities, Innovative Upgrades, and Reward Paybacks

Bybit's swift recovery and strong comeback are primarily due to multiple factors, including market recovery and a more constructive regulatory environment introduced by the new US government. More importantly, Bybit has consistently focused on providing users with an excellent trading experience, continuously launching innovative products and reward programs while maintaining efficient service.

Recently, Bybit listed multiple new tokens, including WAL, PARTI, CORN, and NEAR, and simultaneously launched incentiveAirdrop activities. Meanwhile, Bybit Web3 also initiated the AI-DOL Superstar Competition - the world's first Web3 idol contest, demonstrating the platform's ability to drive innovation and user interaction in the DeFi space.

These new initiatives and reward activities not only helped Bybit quickly navigate the industry crisis but were also validated by the growth in March's capital inflow.

"We will not let setbacks define us. Bybit remains committed to users and the broader crypto community, ensuring continuous innovation and platform stability. Our ability to maintain normal operations and continuously launch new plans during challenging times reflects Bybit's resilience, commitment to long-term growth, and the steadfast support from the industry."said Joan Han, Bybit's Sales and Marketing Director.

Additionally, Bybit is dedicated to long-term establishment of trust, transparency, and accountability mechanisms. Users and industry stakeholders can always track Bybit's regularly publishedProof-of-Reserves updates. Simultaneously, Bybit is actively leading crypto industry efforts to combat illegal fund circulation through the LazarusBounty program, which encourages individuals and groups to combat bad actors and provides rewards and recognition. Currently, over $2.2 million in bounties have been distributed to eligible contributors.