Author | Wu Blockchain

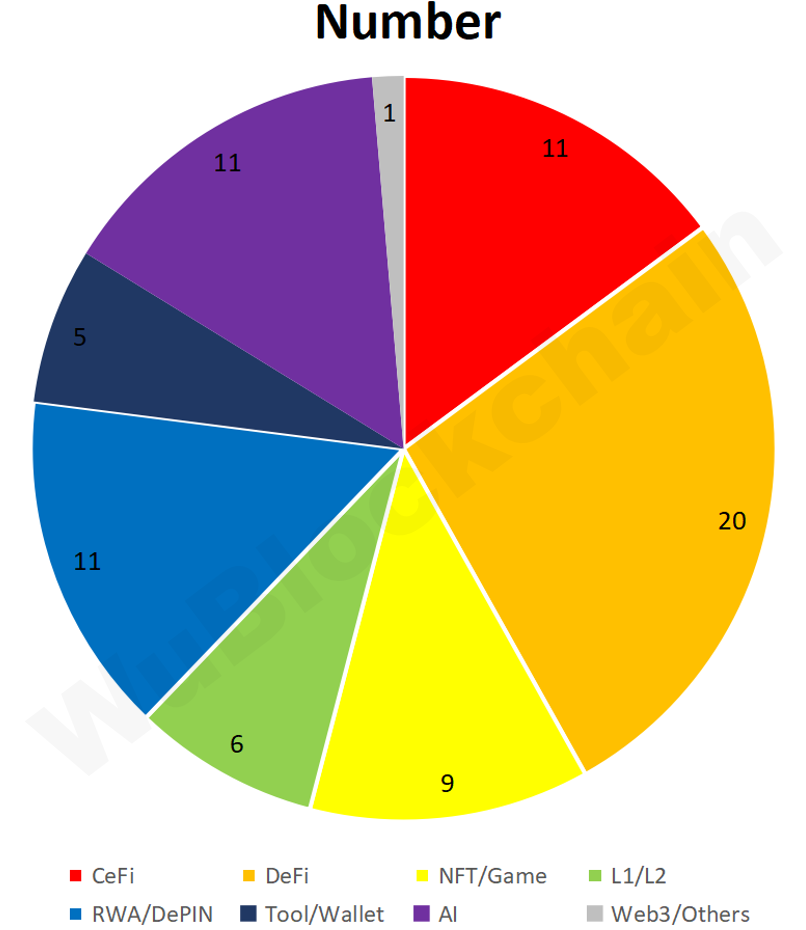

According to RootData statistics, there were 74 publicly disclosed Crypto VC investment projects in March 2025, a month-on-month decrease of 28.8% (104 projects in February 2025), and a year-on-year decrease of 61.3% (191 projects in March 2024). Note: As not all financing is announced in the same month, the above statistical figures may increase in the future. The number of projects in each track in January this year is as follows:

Among them, CeFi accounts for about 14.9%, DeFi accounts for about 27%, NFT/GameFi accounts for about 12.2%, L1/L2 accounts for about 8.1%, RWA/DePIN accounts for about 14.9%, Tool/Wallet accounts for about 6.8%, and AI accounts for about 14.9%.

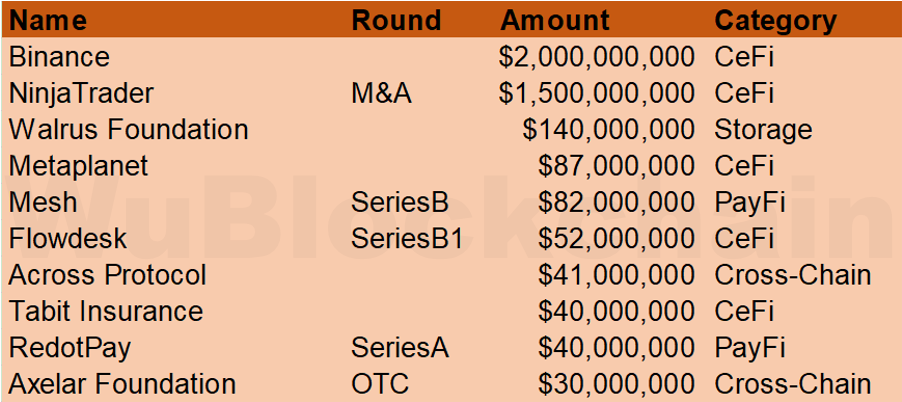

The total financing amount in March 2025 was $2.883 billion, a month-on-month increase of 198.1% ($967 million in February 2025), and a year-on-year increase of 153.1% ($1.139 billion in March 2024). Among them, the top 10 rounds by amount are as follows, with 7 being centralized platforms (exchanges or payment platforms):

Abu Dhabi MGX invested $2 billion in Binance on March 12, acquiring a minority stake. This transaction was completed 100% with crypto assets (Stablecoin), becoming the largest crypto asset investment transaction to date. Abu Dhabi MGX is primarily funded by the Abu Dhabi government and is fully controlled by the Abu Dhabi royal family.

Kraken acquired the US futures trading platform NinjaTrader for $1.5 billion (subject to specific price adjustments) on March 20. NinjaTrader has a CFTC-registered FCM license, enabling Kraken to provide crypto futures and derivatives trading in the US, while leveraging Kraken's licenses in U.K. MiFID, EU MiFID, and Australia to accelerate its expansion in European and Australian markets. Kraken co-CEO Arjun Sethi stated that this transaction is an important step in building a 24/7, cross-asset, institutional-level trading platform, achieving seamless integration of traditional finance and crypto markets.

Walrus Foundation completed a $140 million private Token sale on March 20, led by Standard Crypto, with participation from a16z crypto, Electric Capital, Creditcoin, and other institutions. The funds will be used to expand and maintain a decentralized data storage protocol and application development platform. Additionally, the Walrus mainnet will go live on March 27, supporting AI datasets, rich media files, website and blockchain history storage, promoting the widespread application of programmable storage, and helping secure and efficient data management across industries.

Metaplanet Inc. exercised the 13th stock purchase right issued by EVO FUND on March 3, with large-scale exercise of the 14th stock purchase right. Additionally, the company has redeemed the 7th ordinary bond (total of 2 billion yen) in advance, originally due on August 26, 2025, with funds sourced in accordance with the purpose adjustment plan announced on February 27, 2024. Metaplanet plans to continue accumulating Bitcoin with these funds.

Crypto payment company Mesh completed a $82 million Series B financing on March 11 to expand its stablecoin-based payment settlement network. The round was led by Paradigm, with participation from ConsenSys, QuantumLight, Yolo Investments, Evolution VC, Hike Ventures, Opportuna, and AltaIR Capital. Mesh aims to build a payment network connecting crypto wallets, exchanges, and payment service providers, supporting users paying with BTC, ETH, SOL, and other crypto assets, while merchants can choose to settle in USDC, PYUSD, or RLUSD.

Flowdesk raised $52 million in its Series B financing on March 4, with investors including HV Capital, BlackRock, Eurazeo, Cathay Innovation, and ISAI. Flowdesk is a French crypto market maker providing comprehensive crypto financial services. Its core businesses include market-making, over-the-counter (OTC) trading, and fund management.

Cross-chain interoperability protocol Across Protocol raised $41 million on March 4 by selling its Token ACX to investors, led by Paradigm, with participation from Bain Capital Crypto, Coinbase Ventures, Multicoin Capital, and others. This latest round brings Across's total financing to $51 million, following a $10 million Token financing in November 2022.

Tabit Insurance, an insurance company founded by former Bittrex executives, completed a $40 million reserve fund collection on March 24, consisting of Bitcoin, to conduct traditional insurance and reinsurance business. Reportedly, Tabit Insurance primarily provides Bitcoin-backed liability insurance and is a regulated risk underwriting institution that relies on Bitcoin reserves to define traditional insurance priced in USD, holding a Level 2 insurance license from the Barbados Financial Services Commission.

RedotPay completed a $40 million Series A financing to support global crypto payment solutions. The financing was reportedly completed in December 2024, led by Lightspeed, with significant investments from HSG and Galaxy Ventures.

Axelar Foundation completed a $30 million AXL sale on March 11 to enhance its interoperability protocol, with investors including Arrington Capital, Distributed Global, Electric Capital, and other well-known venture capital firms. Some of the sold AXL came from community plan allocations, with a 6 to 12-month lock-up period. Additionally, OTC derivative activities related to AXL have emerged in the market, with major holders adopting hedging strategies to address crypto market volatility, similar to practices in traditional finance.