Author: Ice Frog

In the crypto world, liquidity determines everything. Without sufficient liquidity, even the most excellent DeFi is just a "stagnant pool", unable to truly realize its value. As public chain ecosystems continue to expand, the fragmentation of fund liquidity between chains has become the biggest obstacle to industry development.

StakeStone precisely targets this industry pain point, attempting to become the ""UnionPay + Alipay" of the crypto world, building cross-chain liquidity infrastructure that allows funds to flow freely between different public chains, bidding farewell to fragmented, inefficient, and involution-driven liquidity dilemmas.

It can be said that StakeStone is trying to build the the financial infrastructure of the DeFi 3.0 era, allowing the entire blockchain industry to move beyond meaningless liquidity battles and truly enter a new era of free capital flow.

Especially, due to its dual-token model, it can bring a significant yield multiplier effect: protocol fees and bribe income are directly linked to TVL, forming a flywheel of "income growth - ecosystem expansion - TVL rise".

3⃣ Strategic Depth of Ecosystem Linkage

Through the LiquidityPad product, StakeStone has reached deep cooperation with top ecosystems such as Plume (raised $10 million) and Story Protocol, providing on-chain initial liquidity for them.

This "liquidity infrastructure supplier" role brings triple benefits: fees paid by cooperative projects and bribe sharing directly enhance protocol income; each new chain accessed allows StakeStone to capture incremental users and assets of that chain.

In summary, StakeStone's valuation logic should go beyond single-track benchmarking. Its positioning as a cross-chain liquidity hub, high TVL monetization capability, and ecosystem expansion snowball effect together constitute strong support for a $50-100 million FDV.

3.2 Project Participation Yield Analysis

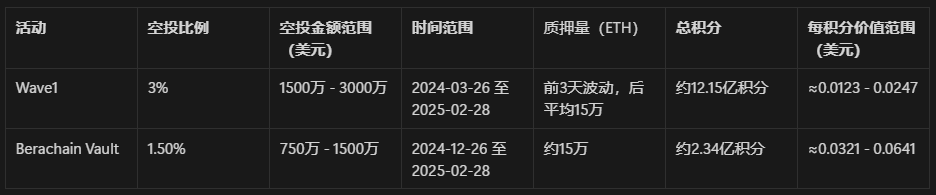

The project has clearly defined airdrop proportions. The first stage of the cross-chain carnival Wave1 rewards pool accounts for 3% of total supply, with Berachain Vault activity rewards at 1.5% airdrop. Due to low BTC proportion, the following calculation of potential yield is based only on average ETH staking volume.

1) Wave1

Activity period: March 26, 2024 - February 28, 2025 (approximately 340 days)

Staking situation: First 3 days: 342,000, 275,000, 259,000 ETH; afterwards: ≈150,000 ETH

Points calculation: First 3 days points: approximately 2,102,400 points generated; remaining 337 days points, taking average daily: 150,000 × 24 = 3,600,000, 3,600,000 × 337 = 1,213,200,000

Total first stage points: 1,215,302,400

Point value:

Lowest: $15 million ÷ 1,215,302,400 ≈ $0.0123 per point

Highest: $30 million ÷ 1,215,302,400 ≈ $0.0247 per point

2) Berachain Vault

Activity period: December 26, 2024 - February 28, 2025 (approximately 65 days) Full-stage average staking volume: ≈ 150,000 ETH

Points calculation: Daily points: 150,000 × 24 = 3,600,000, total points: 3,600,000 × 65 = 234,000,000

Point value:

Lowest: $7.5 million ÷ 234,000,000 ≈ $0.032 per point

Highest: $15 million ÷ 234,000,000 ≈ $0.064 per point

The above calculation shows point values at approximately $0.0123-$0.064 per point in different stages, not including point bonus coefficients. You can refer to this based on your point quantity. Other points include referral points and some boosts, which are not calculated here.

Due to average value calculation and high data uncertainty, prices are for reference only. Based on feedback from the official team, they may consider increasing Wave1 share, with the final result subject to official announcement.

IV. Conclusion

StakeStone recently announced two major updates: snapshot and dual-token model launched simultaneously, further consolidating its position as a cross-chain capital hub and optimizing the token economic model to enhance sustainability.

In the DeFi 3.0 era, cross-chain liquidity is the core narrative, and StakeStone's layout is highly forward-looking:

Capital free flow: Allowing BTC, ETH, and assets from various public chains to break ecosystem barriers and achieve efficient cross-chain movement.

Upgraded revenue model: Through the veSTO mechanism, binding user and protocol long-term benefits, reducing short-term speculation.

Industry-wide efficiency improvement: Ending the "mine-withdraw-sell" mode, guiding liquidity from competition to collaboration, improving capital utilization rate.

For the industry, the project provides a viable path from liquidity internal consumption to value creation. In the DeFi world where liquidity is king, StakeStone is building core financial infrastructure for the crypto industry.

If successfully implemented, this would be not just a protocol victory, but an important step towards industry maturity.

Special reminder: Various calculations in the article are based on public information and reasonable assumptions, and should not be taken as investment advice. Please make your own decisions and participate cautiously!