The "World War 3" of Trade Wars Has Begun:

Americans are waking up to the first MAJOR tariff retaliation against President Trump.

China has announced 34% tariffs on ALL US goods with the S&P 500's 2-day losses now at -$3.5 TRILLION.

Here's what just happened.

(a thread)

This was the move that we all knew was coming, but wanted to pretend it wasn't.

China has announced that ALL US imports will be subject to this 34% tariff.

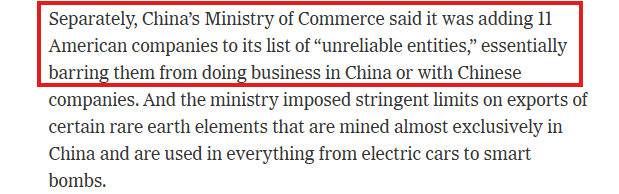

And, they added 11 American companies to their list of "unreliable entities" and 16 to their "export control" list.

Furthermore, China announced NEW rare earth metal controls:

They are imposing export controls on samarium, gadolinium, terbium, dysprosium, lutetium, scandium and yttrium.

As President Trump has made clear, he wants more US access to rare earth metals.

This was personal.

This morning, oil prices are down ANOTHER -6% in a clear sign a recession is coming.

Over the last 2 days, oil prices are now down nearly -15%.

This marks the largest 2-day drop since April 2020, when the pandemic sent the global economy into a lockdown.

Markets are worried.

On March 26th, we posted the below alert for our premium members taking SHORTS in oil.

We called for a drop below $64.00 and prices just fell to $62.00, puts up over +150%.

This has been our BEST start to a year ever.

Subscribe to access our alerts:

http:/thekobeissiletter.com/su...

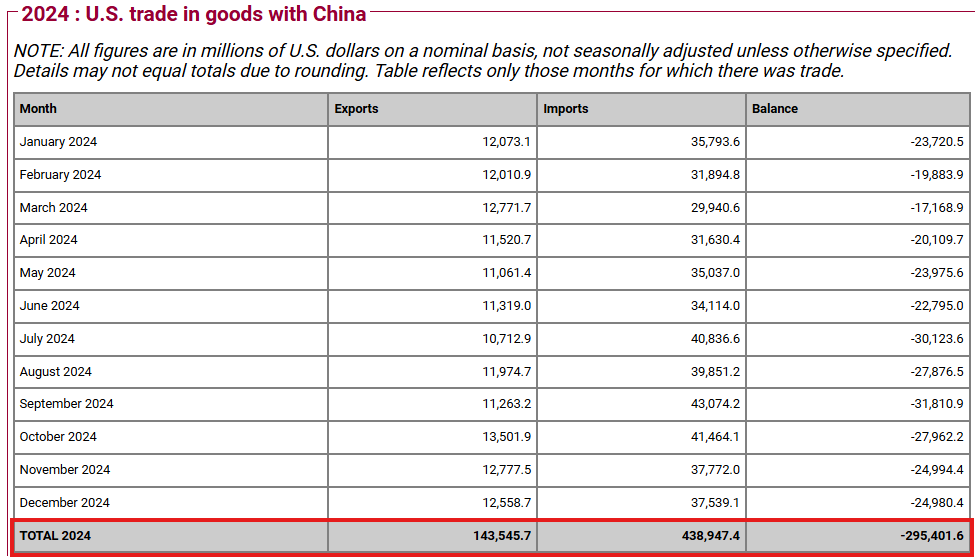

In 2024, the US imported $439 BILLION from China while China imported $143 billion from the US.

That's ~$582 billion in total US-China trade per year.

Including JUST the 34% tariffs imposed by the US and China over the last 24 hours, that's ~$198B PER YEAR.

This is a TAX.

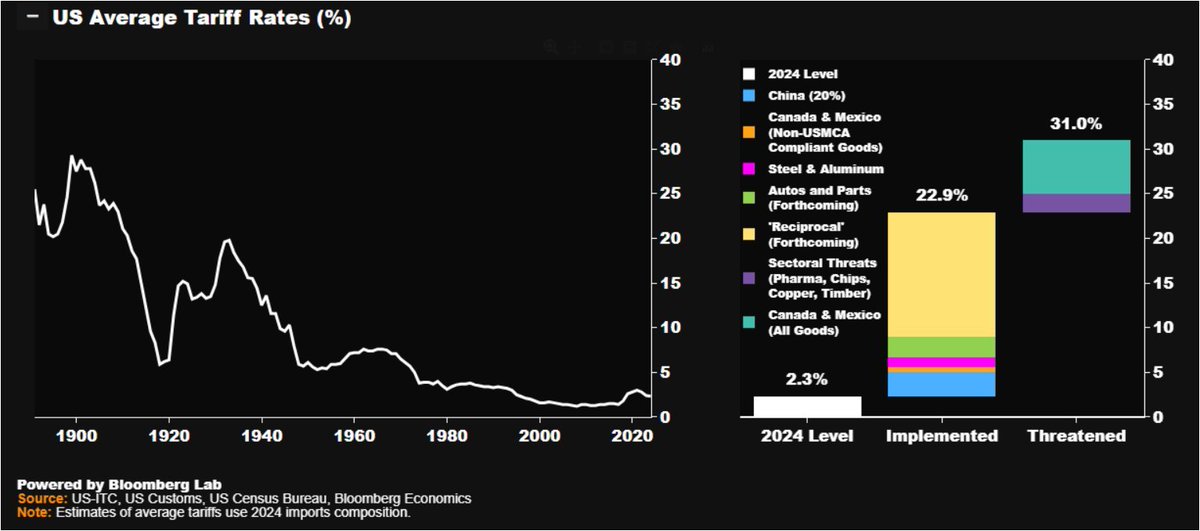

In fact, NOT including retaliation, Wednesday's reciprocal tariffs are objectively the largest tax increase in US history.

These tariffs are roughly 1.6% of US GDP, or 50 basis points MORE than the previous record in 1968.

This math is still NOT accounting for retaliation.

We believe the new tariffs announced by Trump and the coming retaliation will reduce GDP and increase inflation.

We see GDP contracting between -3% and -4% if these tariffs remain long-term.

PCE inflation should rise toward 4% over the coming months as price increases begin.

Bond markets know a recession is coming IF these tariffs hold.

The 10-year note yield is now down 90 BASIS POINTS in ~2 months.

The yield on the 10-year is currently below 3.90% for the first time since September 22nd, 2024.

This is when the "Fed Pivot" began.

On March 6th, we took LONGS in $TLT and posted this alert for our premium members.

We called for $TLT to rally above $95.00 as President Trump ramped up the trade war.

Today, our target is set to be crossed.

Subscribe to access our alerts:

http:/thekobeissiletter.com/su...

S&P 500 futures are currently down -3% on track for a -8% loss in 2 days.

This would be the largest 2-day loss since the pandemic in 2020.

We have seen nearly $4.5 TRILLION of market cap erased since the after hours high on Wednesday.

The race to the sidelines has begun.

So, what's next?

As we have been cautioning for weeks now, MORE retaliatory tariffs on retaliatory tariffs are coming.

Mexico has already said more tariffs are coming, the EU has prepared "countermeasures," and Canada is ready to respond.

This is the WW3 of trade wars.

Here's the worst part:

Both Treasury Secretary Bessent and Commerce Secretary Lutnick have provided the same message.

They said that if countries retaliate, the US will INCREASE tariffs again.

"If you retaliate there will be escalation," Bessent says in an interview.

Today's selloff is the first true sign of panic, according to the Volatility Index, $VIX.

The $VIX is above 40 for the first time since August 2024.

The last time the $VIX spiked above 40 was during the Yen Carry Trade collapse.

We are monitoring for signs of capitulation.

We are set to see the most volatile 2-day period for stocks since March 2020.

Our subscribers continue to capitalize on the swings in the market.

Want to see how we are trading it?

Subscribe at the link below to access our latest analysis and alerts:

http:/thekobeissiletter.com/su...

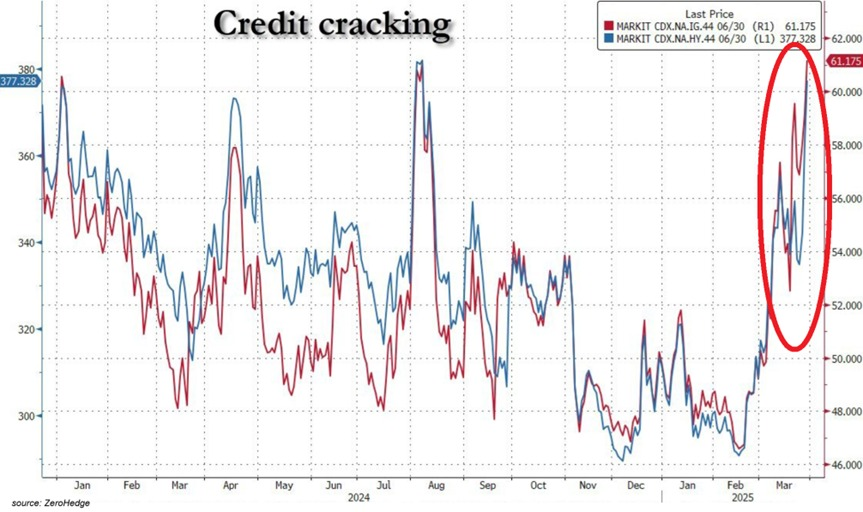

Today, the US Credit Risk Index has spiked to its highest level since the Regional Bank Crisis.

The S&P 500 has officially erased over $7 TRILLION of market cap since February 19th.

US markets are breaking.

Follow us @KobeissiLetter for real time analysis as this develops.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content