US Stocks Experience Largest Drop Since March 2020

On Friday local time, US stocks continued to plummet at opening! By market close, the Dow Jones dropped 5.5%, the Nasdaq fell 5.82%, and the S&P 500 declined 5.97%. Large tech stocks generally fell, with Tesla plummeting 10.42%, NVIDIA dropping 7.36%, and Apple falling 7.29%.

CNBC reported that people are worried that the trade war could lead to a global economic recession, causing a sharp drop in the US stock market.

Nomura Securities stated that tariffs are "worse than expected", lowering the US GDP growth forecast from 1.5% to 0.6% (quarterly), and raising the year-end core PCE (the Federal Reserve's preferred inflation indicator) forecast from 3.5% to 4.7%. Therefore, the institution expects the Federal Reserve to start cutting rates in December, with policy rates dropping to 4.125%, and two additional 25 basis point cuts in the first quarter of 2026.

Meanwhile, the US Bureau of Labor Statistics released the highly anticipated March non-farm employment report. The data showed that the US seasonally adjusted non-farm employment increased by 228,000 in March, far exceeding the market expectation of 135,000, representing the strongest recent performance; the unemployment rate slightly rose to 4.2%, in line with expectations; average hourly wages increased by 3.8% year-on-year and 0.3% month-on-month.

On April 4th local time, US President Trump posted on the social media platform "Truth Social", stating that now is the perfect time for Federal Reserve Chairman Powell to cut rates. Powell responded that US tariffs could lead to increased inflation, slowing economic growth, and rising unemployment risks. Powell stated that it is "too early" to adjust monetary policy regarding tariff issues.

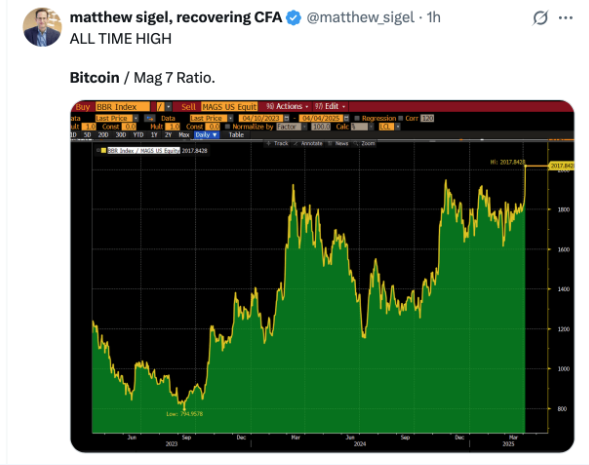

Bitcoin Maintains Resilience During This Market Downturn

However, unlike previous downturns, Bitcoin's price remained relatively stable, even slightly increasing during Friday's market volatility. This difference has sparked widespread discussion about Bitcoin's function as a "hedging" tool.

This resilience sparked heated discussions on X platform, with many offering views on Bitcoin's potential as a hedging tool. Tether CEO Paolo Ardoino stated: "Bitcoin is a hedging tool. Today's market reaction to tariffs again reminds us that inflation is just the tip of the iceberg." Strategy founder Michael Saylor also commented on X: "Capital faces challenges from taxes, regulation, competition, elimination, and unexpected events. Bitcoin provides stability in a risky world." Bitcoin historian Pete Rizzo shared an image of a massive wave, saying: "Wall Street is gradually realizing that Bitcoin is an uncorrelated asset tied to energy, whose value grows over time and space." Cory Bates noted on X: "Bitcoin is experiencing its first decoupling, and investors are gradually recognizing its importance in their portfolios." Wayne Vaughan commented: "Bitcoin is becoming an important part of a diversified investment portfolio."

Similarly, in March 2023, when regional banks like Silvergate, SVB, and Signature collapsed, Bitcoin rose by 35%, demonstrating investors' risk-averse sentiment towards the traditional financial system. Despite the S&P 500 Regional Banking Index falling 28%, Bitcoin rose from $20,000 to $27,000 in just one week, significantly outperforming gold's 9% increase. As market trading accelerated, Bitcoin's correlation with stocks turned negative, with capital flowing to self-custody, reigniting its role as a safe haven during turbulent times.

This rise was also influenced by expectations of potential Federal Reserve policy relaxation, as bank crises prompted the central bank to lean towards lowering rates. Bitcoin's dual nature became increasingly apparent: both a safe haven during financial turbulence and a speculative tool based on liquidity expectations. This contradictory characteristic reveals Bitcoin's multiple identities: a hedge against system instability and an indicator of monetary changes. Bitcoin's performance in 2020, 2023, and 2025 further solidified its position as a crisis refuge and risk-sensitive tool, challenging the dominance of traditional asset classes.