The US Department of Labor released the latest employment data last night, showing that non-farm employment in March increased by 228,000, which is not only far higher than the previous 117,000 but also significantly exceeds the market expectation of 130,000, representing the strongest performance in the past three months, highlighting the continued heat of the US labor market.

However, the unemployment rate slightly rose from 4.1% in February to 4.2%, reaching a new high since November last year and slightly higher than market expectations, creating a contradictory employment data pattern of "strength with weakness".

This data was released at a time when US President Trump is promoting reciprocal tariffs, causing trade tensions to escalate, and the overall economic outlook remains shrouded in uncertainty, adding variables to whether the Federal Reserve can cut rates as scheduled.

Powell: Labor Market Is Not the Source of Inflation

In response, Federal Reserve Chairman Powell stated in a speech last night that the data shows the economy maintains steady growth, with the labor market in a "good balance", and inflation remains slightly above the 2% policy target. He added that due to new federal policies, especially trade-related measures, corporate expectations have weakened and economic uncertainty has increased.

Powell emphasized:

"We are closely observing the relationship between hard data and soft data. The unemployment rate remains at a historical low, and the labor market is not the source of inflation."

US Stocks Plummet Near Circuit Breaker Threshold

Simultaneously, China announced a 34% retaliatory tariff on all US imported goods yesterday, escalating the US-China trade war and causing high market concerns.

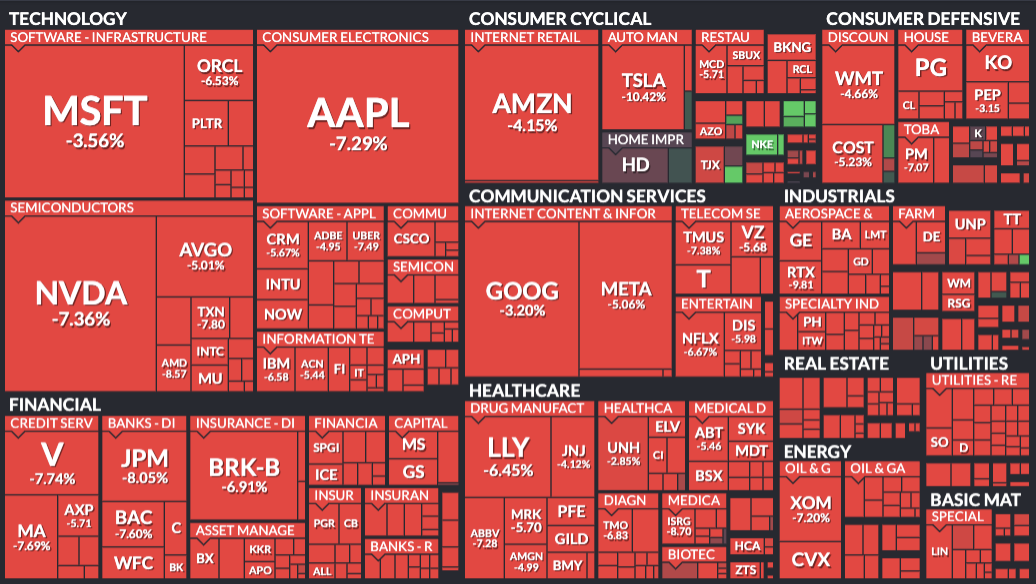

Under the dual uncertainties of geopolitics and interest rate policies, US stocks plummeted last night, with all four major indices falling more than 5%:

Dow Jones Industrial Average dropped 2,231.07 points (-5.50%), closing at 38,314.86 points, the largest decline since June 2020

S&P 500 Index plunged 322.44 points (-5.97%), closing at 5,074.08 points, the worst day since the COVID-19 outbreak in March 2020

Nasdaq Index fell 962.82 points (-5.82%), closing at 15,587.79 points

Philadelphia Semiconductor Index fell even more, dropping 7.60% and closing at 3,597.655 points

In individual stocks, TSMC ADR fell 6.72%, while Apple and Nvidia both dropped over 7%.

Bitcoin Rises Against the Trend, Safe-Haven Attributes Gain Attention Again

Notably, while US stocks were plummeting, Bitcoin showed resilience. According to Binance spot data, Bitcoin once touched $81,849 before rebounding, reaching as high as $84,620, and remained stable around $84,000 at the time of writing, rising 1.37% in the past 24 hours.

Bitcoin's performance of "decoupling" from traditional assets sparked market discussion, with some supporters again raising the argument of "Bitcoin as a safe-haven asset", becoming one of the few highlights in the past 24 hours of market volatility.