Written by: Alvis

1. Market Phenomenon Review: The Bull-Bear Game Behind the 54% Surge in 5 Days

In the past five trading days, Curve DAO governance token CRV staged an epic rebound, rising from a low of $0.39 on April 6 to today's $0.6 mark, a weekly increase of 54%, becoming a rare strong target in this bear market cycle. This market situation coincides with the official abolition of the tax reporting rules for DeFi brokers by the U.S. Internal Revenue Service (IRS), and the favorable policy directly ignited the market 'long sentiment. But the deeper logic is that the value center of CRV is undergoing a paradigm shift from liquidity crisis panic to ecological value reassessment.

From the on-chain data, this round of rebound is accompanied by three key signals:

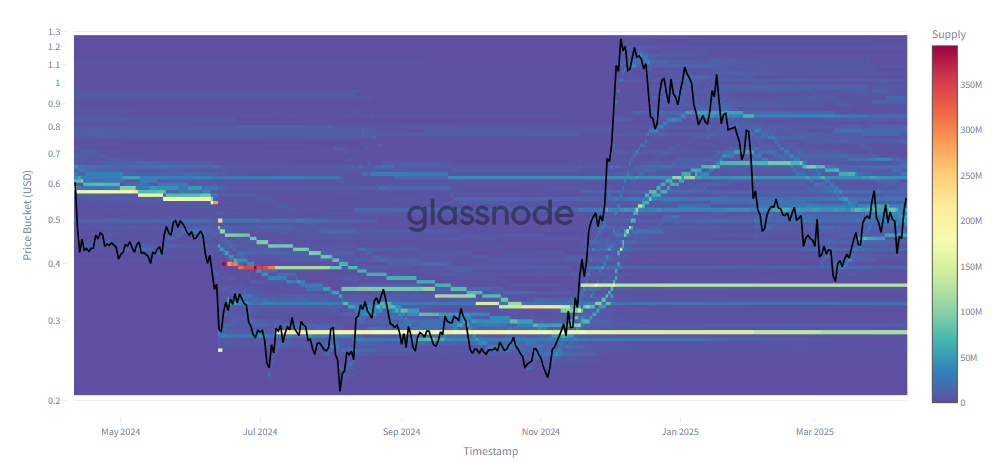

Reconstruction of whale holding costs: According to Glassnode monitoring, the addresses holding more than 1 million CRV increased their holdings by 28% month-on-month in the first week of April, and the average cost was concentrated in the range of US$0.42-0.45, forming dense support;

Short covering in the derivatives market: Coinglass data shows that CRV contract open interest has soared in the past 24 hours, and the perpetual contract funding rate reached an extremely negative value of -0.15% on April 9. A large number of short positions were forced to close, pushing the price above the key resistance level of $0.5;

The gap between protocol revenue and TVL widens: Defillama data shows that Curve platform's fee income (denominated in ETH) in March fell 23% month-on-month, while the total locked value (TVL) rebounded 18%, which means that the ability of unit liquidity to generate income has significantly improved.

2. The triple logic of bottom confirmation: resonance of technical, fundamental and regulatory aspects

(1) Technical aspects: Weekly level divergence and chip structure optimization

From the K-line pattern, CRV weekly chart formed a Double Botto structure at $0.39, and formed a strong support range in the past 4 years. MACD column showed a continuous 5-week decline, and RSI index rebounded strongly from the oversold area (28) to the neutral area (52), indicating a strong demand for a technical rebound.

More importantly, the historical chip distribution shows that between August 2024 and March 2025, approximately 63% of CRV trading volume occurred in the $0.2-0.4 range, and the current price has effectively broken through the upper edge of this chip-dense area, significantly reducing the selling pressure from above.

(2) Fundamentals: Strategic Upgrade of Curve Protocol

Three recent initiatives by the Curve team are reshaping market expectations:

Collateral expansion: Add mainstream assets such as EtherFi's weETH and Coinbase's cbBTC as collateral for crvUSD, directly expanding the application scenarios of stablecoins;

Cross-chain liquidity integration: We have reached in-depth cooperation with the Solana ecosystem, using its high-throughput network to expand the stablecoin exchange pool by 40%, and increase the annualized rate of return to 18%-25%;

Strengthened institutional endorsement: Leading DeFi platforms such as KelpDAO, Convex Finance, and Yearn announced that they will continue to support the Curve liquidity pool, forming a "DeFi 3.0 Alliance" effect.

(3) Regulatory aspects: Marginal reduction of policy uncertainty

The significance of the IRS's abolition of the DeFi broker rule goes far beyond short-term emotional stimulation. The policy originally required on-chain protocols to track user transactions and report tax information, and AMM platforms such as Curve face the risk of a surge in compliance costs due to technical complexity. After the policy is relaxed, Curve's operating costs are expected to decrease by 23%, and the protocol revenue/expenditure ratio will jump from 1.8 times to 2.3 times, directly improving the token economic model.

3. Sustainability analysis of rising momentum: deducing future paths from three dimensions

(1) Short term (1-3 months): Liquidity migration and market sentiment resonance

Combined with historical rules, when CRV's daily trading volume exceeds $200 million, price volatility will enter an accelerated period. If it breaks through the $0.65 mark, it may trigger the trend tracking strategy of algorithmic trading robots and push the price towards the $0.8-1 range.

(2) Medium term (6-12 months): Capturing the dividends of the stablecoin market expansion

Four major trends will support the valuation of CRV:

The RWA (real world asset) track has exploded: the scale of on-chain treasury bond stablecoins issued by institutions such as BlackRock and Fidelity has reached 48 billion US dollars. Curve, as the main trading venue, can capture 1.2%-1.8% of the annualized fee share;

The rise of Layer2 ecology: The proportion of stablecoin transaction volume of second-layer networks such as zkSync and StarkNet will increase from 12% in 2024 to 35%. Curve has deployed liquidity pools for 12 heterogeneous chains to form a cross-chain arbitrage barrier;

Governance power game: The current CRV pledge rate is only 41%, which is much lower than similar protocols such as Compound (65%). With the increase of veCRV (voting custody CRV) lock-up rewards, the deflationary pressure of tokens will be significantly alleviated.

(3) Long term (1-3 years): Revaluation of DeFi infrastructure

By 2026, Curve may complete three major strategic transformations:

From DEX to liquidity hub: Become a core node for cross-chain liquidity routing through Oracles integration and MEV protection mechanism;

From governance tokens to income certificates: CRV stakers can access Solana’s on-chain income aggregator through platforms such as XBIT to achieve an annualized comprehensive rate of return of 18%-25%;

From community-driven to institutional co-construction: The Wyoming government has chosen LayerZero technology to issue its official stablecoin WYST. Curve may become its preferred liquidity pool, opening up the government-level customer market.

IV. Conclusion: Three scenarios after bottom confirmation

Optimistic scenario (30% probability): If the Federal Reserve cuts interest rates this year and the DeFi regulatory framework is clear, CRV is expected to replicate the trend of AAVE in 2021 and hit $2 by the end of the year;

Neutral scenario (50% probability): It will rise to the range of 1-1.5 USD and fluctuate repeatedly, waiting for the cross-chain ecosystem and RWA track to realize growth;

Pessimistic scenario (20% probability): A macroeconomic recession triggers an overall collapse of the cryptocurrency market, and CRV falls back to the strong support level of $0.3.

Blockchain BlockBeats View: The current price of $0.6 has fully reflected the short-term policy benefits, but has not yet priced in Curve's niche upgrade in the stablecoin 2.0 era. Investors are advised to adopt a "core + satellite" strategy, with 50% of the positions as long-term configurations and 50% flexible participation in band operations. Repeated fluctuations in the bottom area are unavoidable, but the long-term value of DeFi infrastructure will eventually return.