The current cryptocurrency exchange industry shows a significant Matthew effect: the spot trading volume of the top exchange Binance accounts for 29% of the market share, while the market share of the remaining second- and third-tier exchanges is stable in the single digit. Behind this polarized pattern, it reflects the systemic challenges that centralized exchanges may face in 2025. By analyzing the business data of the four major exchanges (Binance, Bybit, OKX, Coinbase), we found several phenomena worthy of attention:

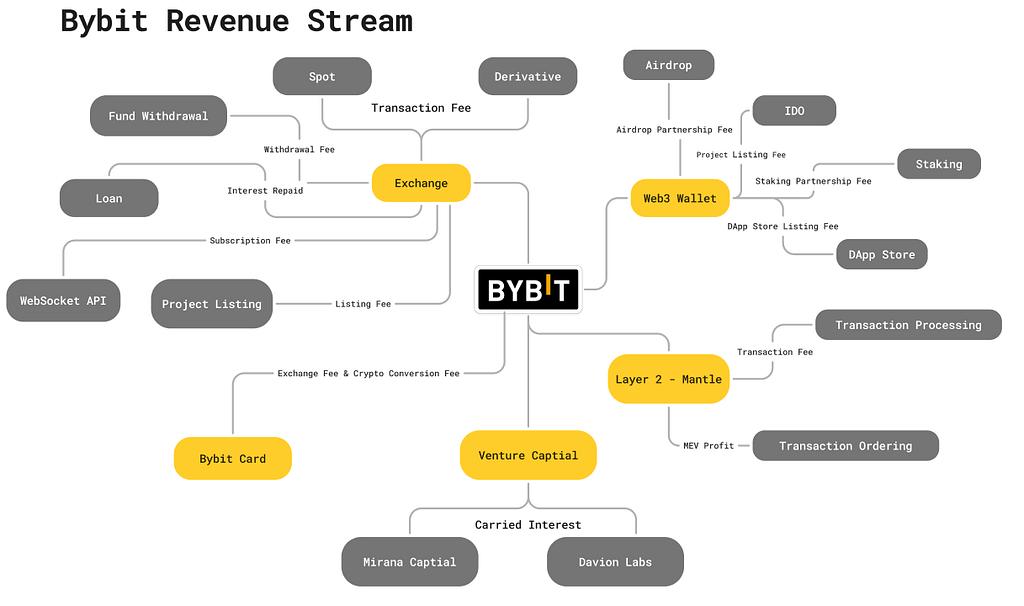

- Highly concentrated income structure : From the data, it can be seen that the income of these exchanges mainly depends on transaction fees, especially contract transactions. Take Bybit as an example. Before the exchange was hacked, its futures trading volume reached 25 billion US dollars, which is more than 4 times the spot trading volume. The singleness of this income structure brings significant risks when the market fluctuates or the regulation is tightened.

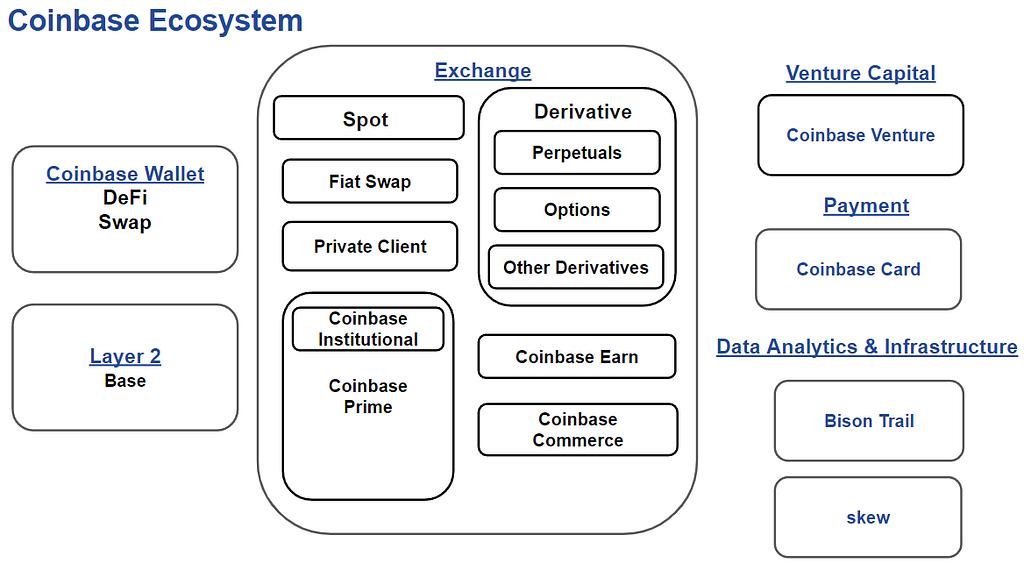

- The effects of Web3 ecosystem construction vary : Although all exchanges are developing Web3 wallets and on-chain ecosystems, the effects vary:

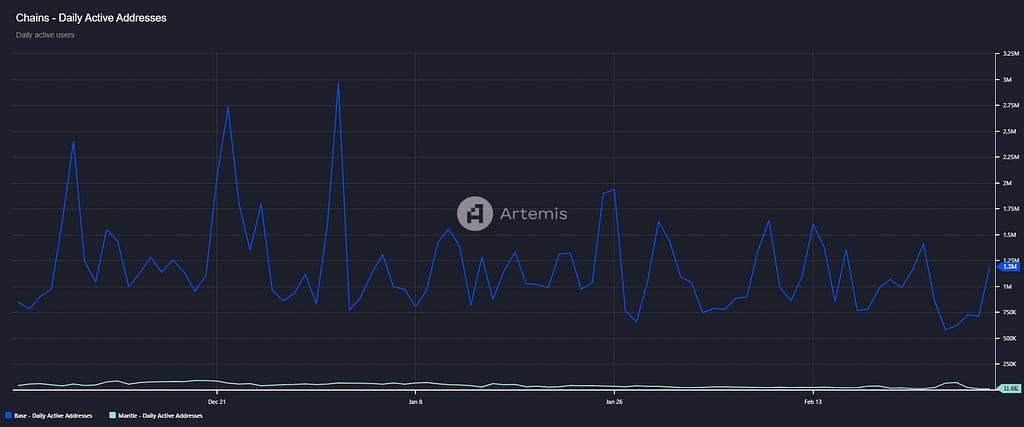

- The number of daily active addresses on the Base chain reached 1.2 million in this cycle

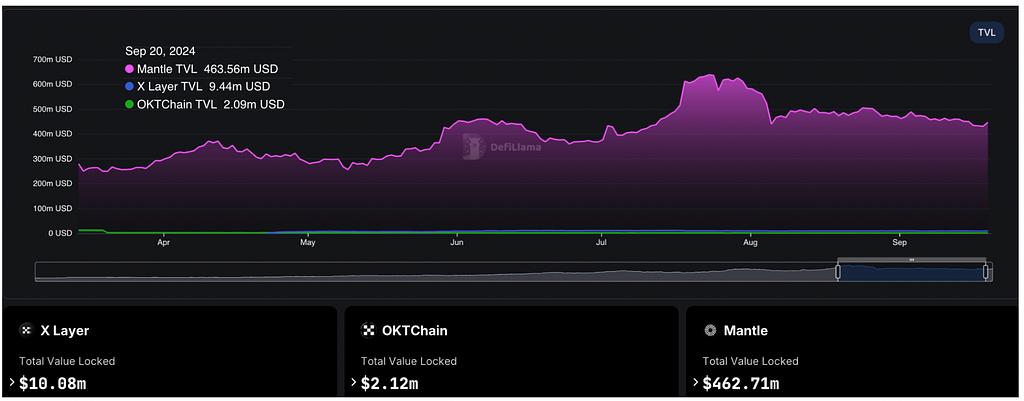

- In comparison, Mantle has only 10,000 daily active addresses.

- OKT Chain and X Layer have relatively low TVL (total locked value)

3. Institutional business differentiation is obvious : Coinbase actively expands institutional customers through Prime services, with quarterly institutional trading volume reaching US$346 billion and custody assets reaching US$404 billion. The proportion of institutional services of other exchanges is relatively low.

This study aims to explore the common bottlenecks faced by CEX business models:

- Sustainability issues of excessive reliance on fees

- Input-output efficiency of Layer1/Layer2 ecological construction

- The contradiction between rising user acquisition costs and declining stickiness

Bybit: An innovative fee-driven trading platform

Web3 Wallet

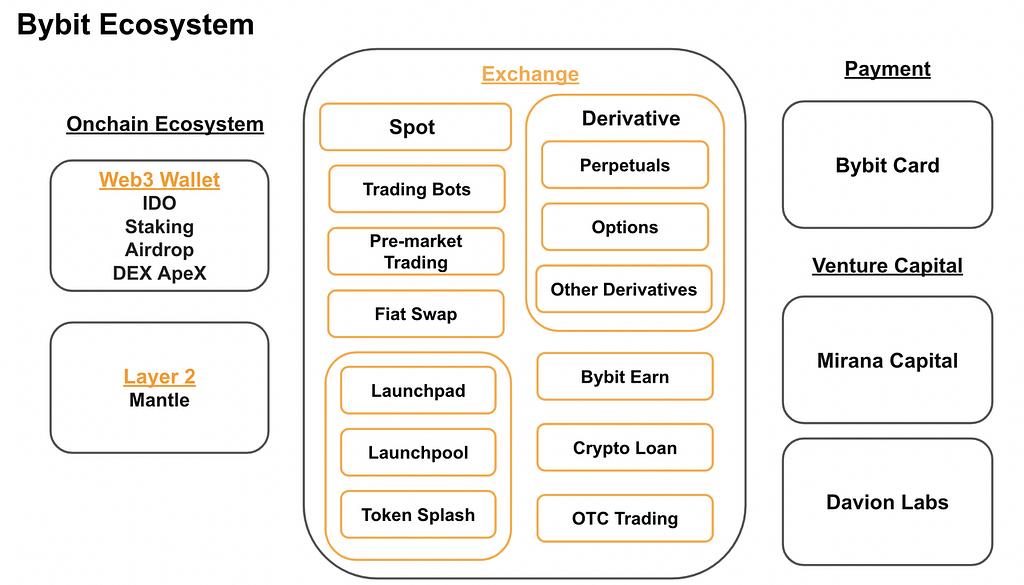

Bybit is building an on-chain ecosystem and has launched its own Web3 wallet, which supports more than 10,000 tokens and more than 20 public chains, and provides services such as airdrops, IDOs, on-chain staking, NFT markets, and integrated Apex DEX transactions.

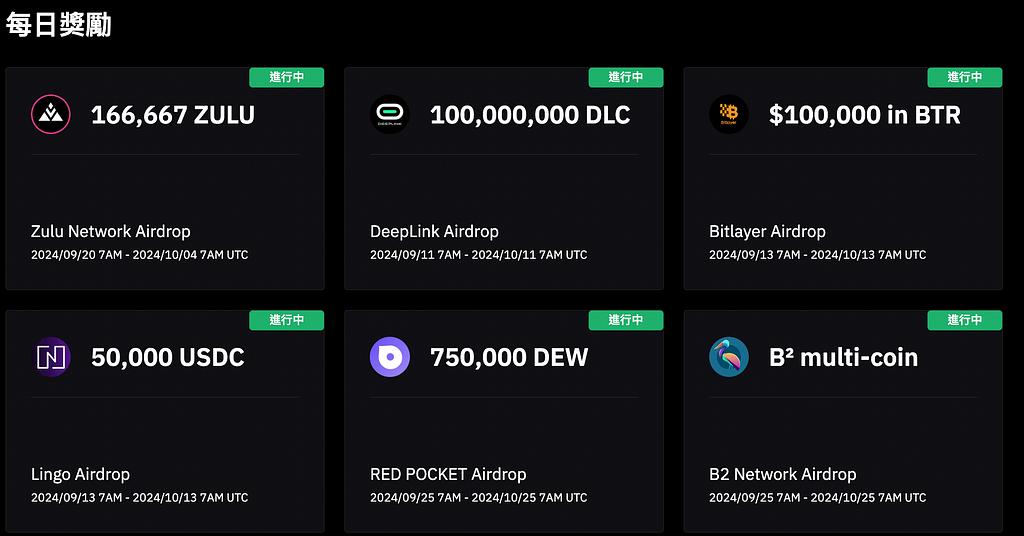

airdrop

Through the Bybit Web3 Airdrop Center, users can explore and interact with the latest Web3 dApps and projects while receiving exclusive rewards and airdrops.

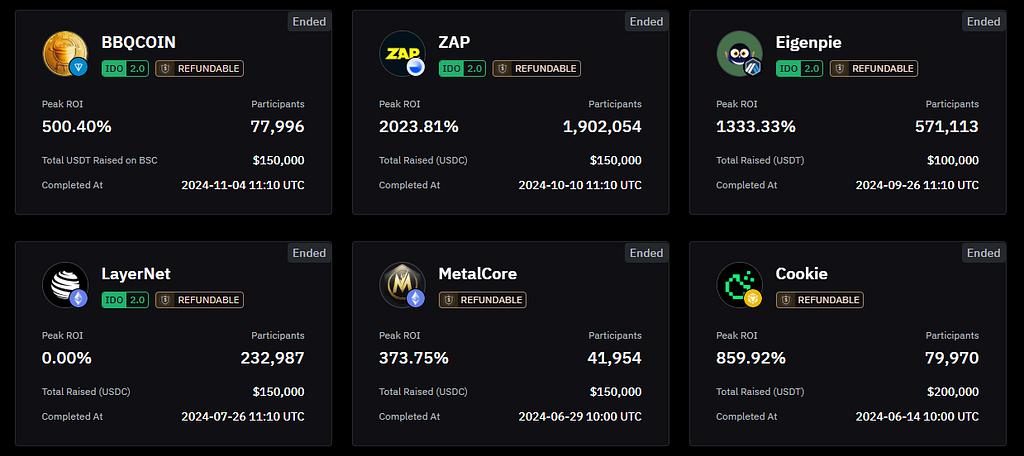

IDO

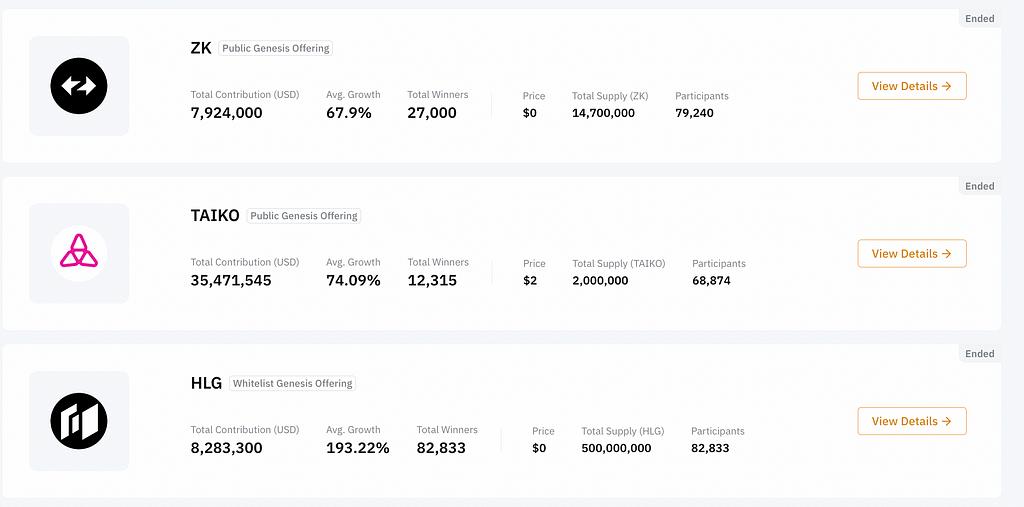

Bybit initiated its own on-chain token issuance, and participants can participate in token investment at the issuance price first, and the rate of return can often be greatly increased after the token is launched. So far, Bybit's IDO has raised $3.1 million, launched a total of 37 projects, and the average rate of return exceeds 2000%

Currently, Bybit has launched IDO 2.0, and participants need to complete points tasks to get a chance to win a lottery. The higher the points, the higher the chance of winning, and up to 60 lottery tickets can be obtained.

On-chain staking

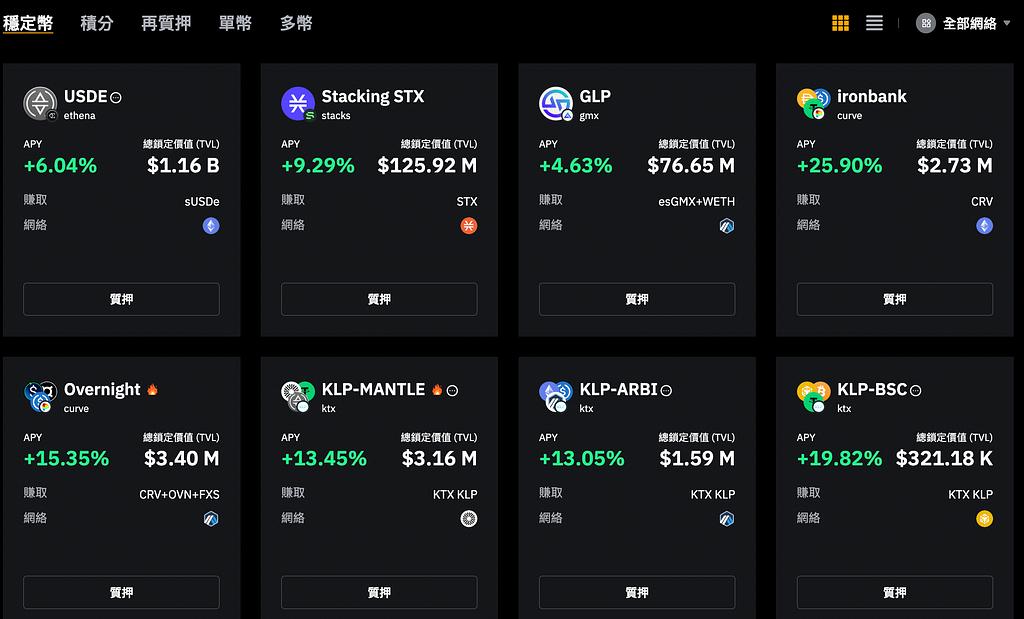

Bybit's on-chain staking function enables one-stop operation without the need to frequently switch between different protocols or perform multiple transactions. Simply top up or claim supported tokens to easily enjoy a smooth DeFi experience. Currently, staking services cover a wide range, including: ETH re-staking, stablecoins, single-coin staking, and dual-coin staking.

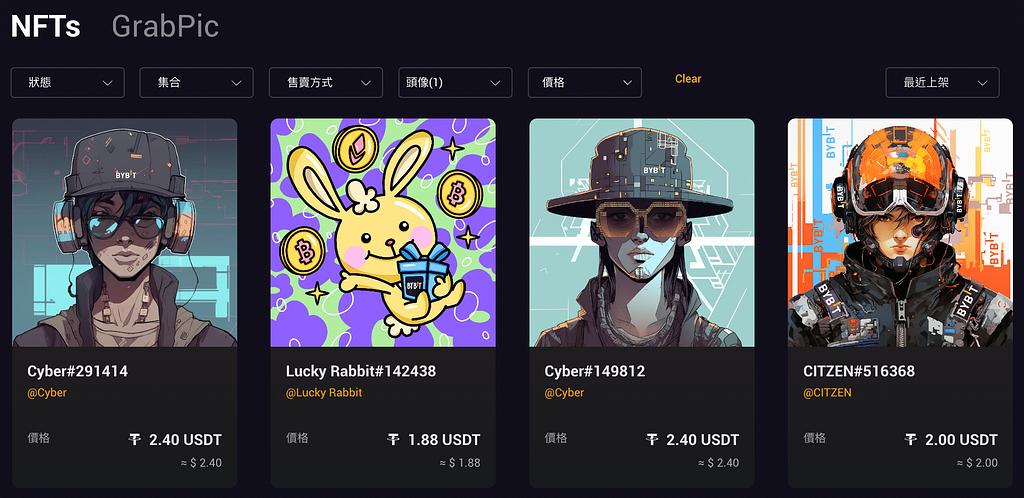

Bybit NFT Pro

Bybit NFT Pro is a decentralized NFT market aggregator where users can browse lists of different NFT markets and list and trade NFT collectibles at the lowest market fees. It also supports batch listing and trading. The platform does not charge NFT buyers a handling fee and only charges a 1% handling fee to sellers. Therefore, sellers need to pay the following fees each time they sell an NFT:

- Bybit’s platform fees

- Royalties paid to creators

Apex DEX

ApeX Protocol is a multi-chain decentralized derivatives protocol that was independently incubated by Bybit and has been integrated into Bybit's Web3 wallet ecosystem. As a non-custodial trading platform, ApeX provides unlimited cross-spread perpetual contracts through its order book model, making it the only platform among the four major exchanges to provide on-chain order book services.

ApeX currently offers more than 70 USDT perpetual and USDC perpetual contracts. According to trading data, its total trading volume reached 50.8 billion US dollars, with a total of 70.89 million transactions completed and the current open interest is 21.15 million. The maker fee of DEX is 0.02% and the taker fee is 0.05%.

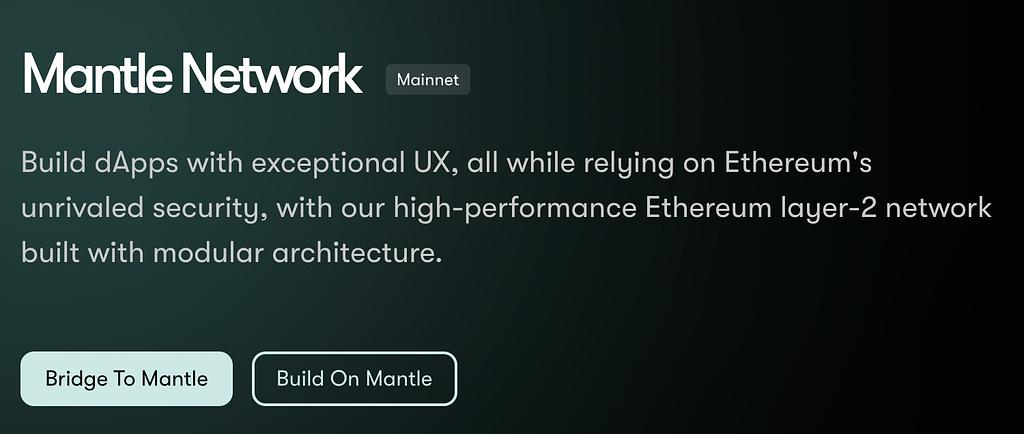

Mantle — L2 governed and developed by BitDAO

Mantle is a Layer 2 scaling solution based on Ethereum, designed to improve scalability and reduce transaction costs while maintaining security through Ethereum's Layer 1. The relationship between Mantle and Bybit stems from BitDAO being responsible for the governance and development of Mantle. Bybit is an important supporter of BitDAO, providing it with funding and ecosystem development support. In order to fully support and integrate into the Mantle ecosystem, BitDAO's ecological token $BIT will also be transferred from BIP-21 to MIP-22 standard $MNT.

As part of BitDAO, Mantle will become the core link of its multiple projects, connecting Game7's game projects, EduDAO's research programs, and the decentralized application ecosystem supported by BitDAO. Mantle also cooperates with Ethereum middleware platform EigenLayer, using EigenDA as the data availability layer to support major technologies such as optimistic roll-up and ZK-roll-up.

In order to promote the adoption of developers and DApps on the Mantle network, BitDAO's Mantle Core team has also proposed a $200 million Web3 Fund plan. The fund will provide funding for early Web3 startups over three years, with the goal of promoting the development of the Mantle ecosystem. Funding will be provided by BitDAO's treasury and external strategic partners, with a focus on supporting projects in the Pre-seed, Seed and Series A stages.

However, Mantle's performance as a Layer 2 is not ideal, and there is a big gap compared with the leading Layer 2 network Base. Taking the daily active wallet addresses as an example, Mantle has only about 10,000, while Base has as high as 1.2 million, a difference of more than 120 times.

Exchanges

Before the assets were stolen, Bybit Exchange had a daily trading volume of more than 5.6 billion US dollars, and its spot trading volume ranked third in the world, with a market share of about 13%. Its futures trading volume ranked second, with a market share of about 28%. However, its current ranking is only second to competitors such as OKX and Bitget, and its futures trading volume market share has also dropped sharply to about 4%.

Spot Trading

Bybit offers more than 600 spot token trading pairs, and supports fiat currencies including USD, GBP, EUR, etc. The transaction fee for both maker and taker orders is 0.01%.

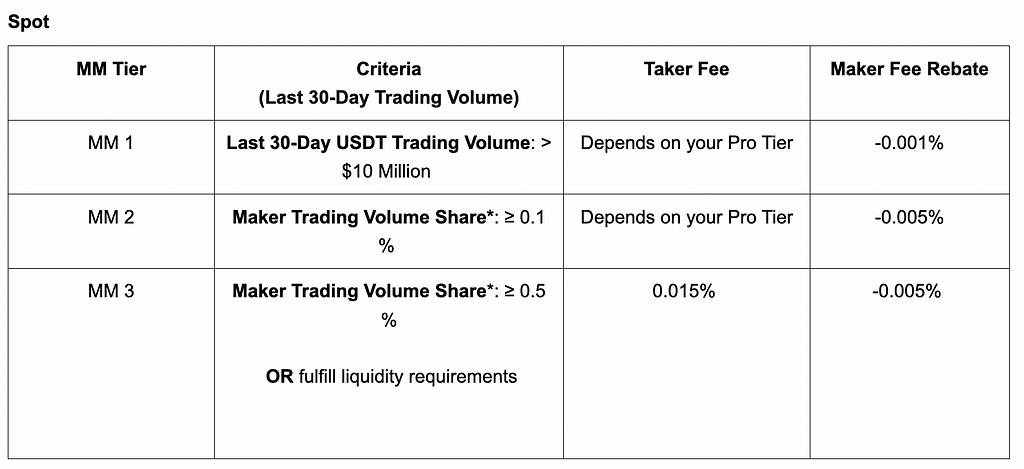

Market makers include Amber Group, Auros, CyantArb, DWF Labs, Flow Traders, Pulsar Trading and Raven . Bybit's spot market market maker system divides market makers into three levels based on their trading volume and liquidity contribution in the past 30 days, and provides corresponding handling fee rebates and fee discounts:

- MM 1 level: USDT trading volume exceeds 10 million USD within 30 days, and the rebate is -0.001%.

- MM 2 level: Market maker volume share reaches ≥ 0.1%, and the rebate is -0.005%.

- MM 3 level: If the trading volume share reaches ≥ 0.5%, or liquidity requirements are met, the rebate is also -0.005%, and the buyer's fee is 0.015%. By increasing trading volume and liquidity contribution, market makers can obtain higher rebates and lower transaction fees, thereby maximizing market profit opportunities.

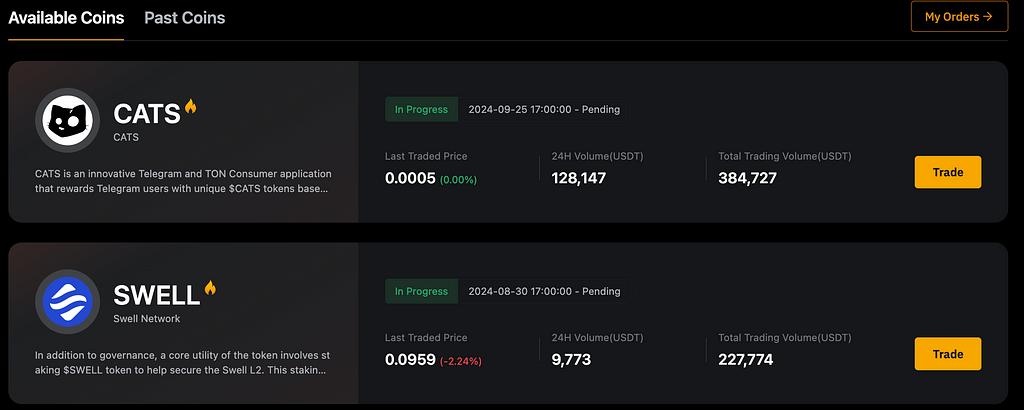

Pre-market Trading

Pre-Market trading is an over-the-counter (OTC) platform designed for trading new tokens before they are officially listed. The platform allows buyers and sellers to set quotes and execute transactions at a predetermined price. When participating in Pre-Market trading, you must ensure that you prepare sufficient funds in advance and complete the transaction within the specified time, otherwise the collateral assets may be confiscated.

Derivatives Trading

- Futures/Perpetual Contracts

Bybit is a futures trading platform second only to Binance, Coinbase, OKX, and Bitget, with a daily trading volume of $4.9 billion and 400 futures token trading pairs. The standard market maker and taker fees are 0.02% and 0.055% respectively.

- Options

Currently, options trading pairs of BTC, ETH and SOL are supported, and the fee structure is as follows:

- Trading Fee: When opening or closing a position, the fee rate for both market maker and taker orders is the same, which is 0.02%. The trading fee for each contract shall not exceed 12.5% of the option price.

- Delivery Fee: When an option is exercised, a delivery fee of 0.015% is charged. There is no delivery fee for unexercised options, and there is no delivery fee for daily options. The delivery fee for each contract does not exceed 12.5% of the option value.

- Forced liquidation fee: When a position is forced to close, a forced liquidation fee of 0.2% is payable, calculated based on the option trading volume and index price.

- Copy Trading

Bybit allows traders to copy the trades of other professional investors in the market. The target of copy trading is divided into followers and master traders. Followers will copy the trading strategies of the master traders they choose. Master traders can promote their strategies, attract followers, and receive a certain percentage of the net profit each follower earns on Bybit, depending on the master trader's level.

- Trading Robots

Bybit provides a variety of automated trading robot systems. Users only need to set basic parameters, and the platform will assist in investment according to the corresponding program trading strategy. For example: grid trading robot, DCA robot, etc.

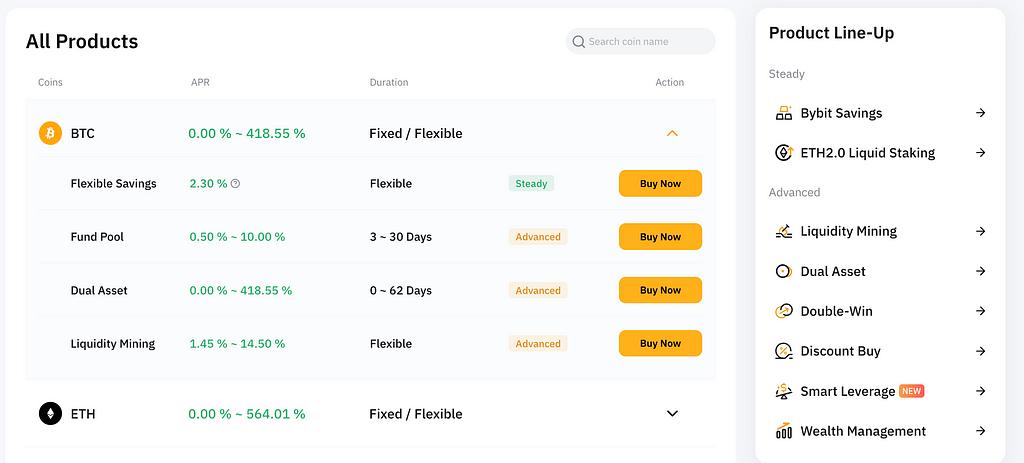

Bybit Earn

A one-stop investment management platform covering a variety of income products:

- Bybit Savings : Get almost risk-free returns through flexible or regular savings, suitable for investors seeking stable returns.

- Liquidity mining : Providing funds to the liquidity pool to earn income, and using leverage to expand returns, suitable for long-term returns and investors interested in DeFi.

- Dual Currency Investment : A short-term trading tool that increases returns through a “buy low, sell high” strategy, suitable for users who are willing to hold USDT or crypto assets.

- ETH2.0 Liquid Staking : Participate in Ethereum network verification, stake ETH to earn income, while maintaining the liquidity of assets, suitable for investors who want to maintain flexibility.

- Win-win product : a short-term structured product with no principal protection, suitable for investors who expect greater market volatility.

- Discount Buy : Buy assets at a discount in low volatility markets, suitable for experienced investors and HODLers.

- Wealth Management : Grow crypto assets through professional investment strategies suitable for investors seeking income and risk diversification in various market conditions.

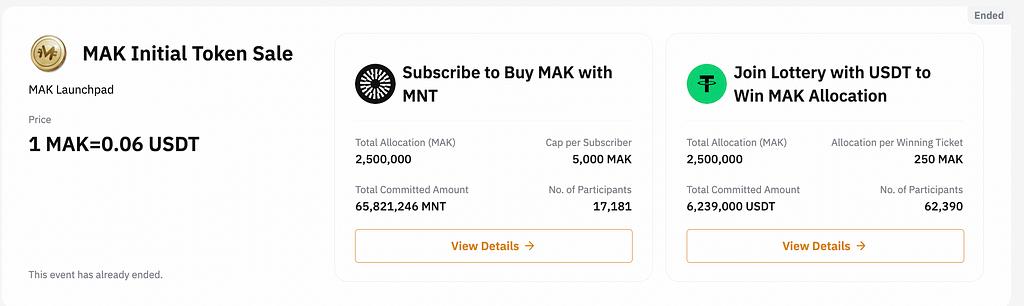

Launchpad + Launchpool

- Bybit Launchpad

Bybit Launchpad is a platform designed for users who want to participate in the issuance of new project tokens. Users can participate in the issuance of new tokens on Launchpad and use their crypto assets (usually USDT or MNT) to subscribe for new tokens. Launchpad projects are usually newly launched cryptocurrency projects, and users participate in the subscription and allocation of tokens by locking up assets.

- Bybit Launchpool

Bybit Launchpool is a product that allows users to earn new tokens by staking crypto assets. Users can stake their tokens (not limited to USDT or MNT, it can be a certain project token) to Launchpool. The staked tokens can be redeemed at any time, and users can obtain new tokens or corresponding income based on the amount of stake.

- Bybit Launchpad is a platform for participating in the issuance of new project tokens. Users subscribe to new tokens by locking up assets, which is suitable for early investors.

- Bybit Launchpool is a flexible way to earn new tokens by staking crypto assets, suitable for users who want to earn income through staking.

Bystarter

ByStarter is a token distribution platform that allows early users to participate in projects that have not yet been listed on any centralized exchange, although token listing is not guaranteed. ByStarter is usually aimed at early-stage projects that have been strictly reviewed and have not yet been listed on any exchange, but the platform also accepts projects that have already conducted an initial exchange offering (IEO) to raise funds. Currently, a total of 5 projects have successfully raised funds through the platform, with a total of more than 70 million raised and an average return rate of more than 300%.

TokenSplash

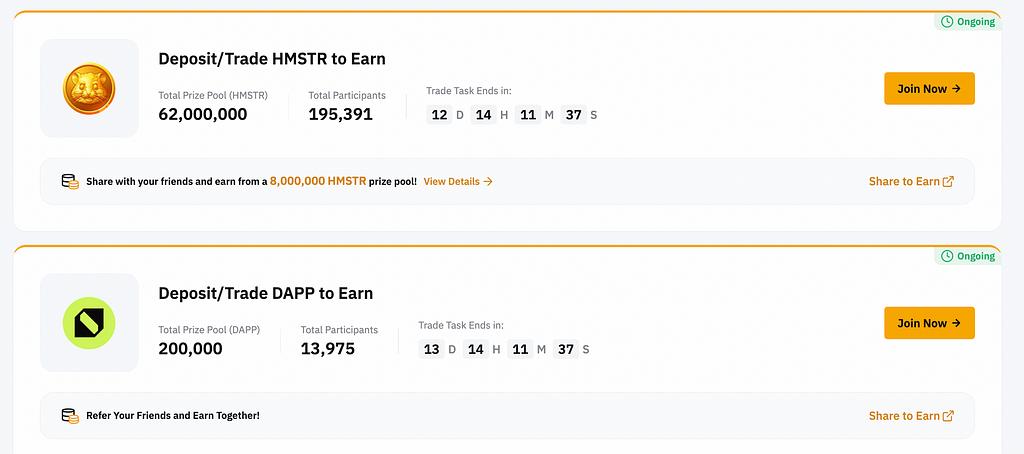

Token Splash is an event for all users that showcases multiple new token listing opportunities. Users can earn rewards in three ways: deposit or purchase the minimum required number of relevant tokens during the event, or meet the corresponding trading volume requirements in spot trading. This provides users who are optimistic about the future potential of new tokens with the opportunity to earn additional rewards by participating in transactions and deposits. Currently, 171 projects are supported, with an average return of about $20.

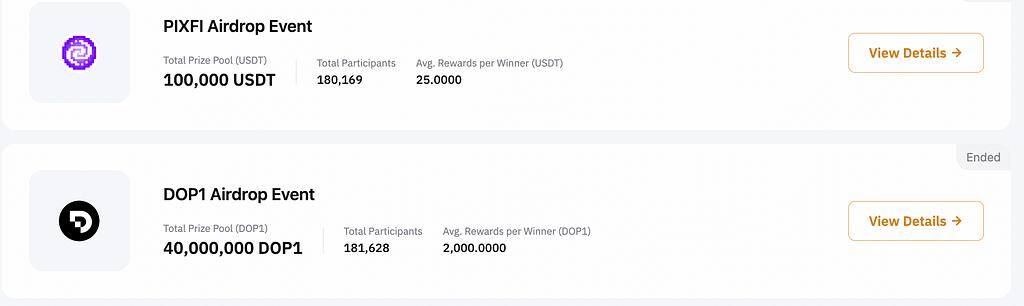

airdrop

Unlike airdrops through Web3 wallets (which require connection to relevant dApps for interaction), exchanges will also allocate a certain number of airdrop tokens. Users need to earn points by completing various tasks, such as following social platforms, reaching a specified deposit or transaction amount, completing quiz questions, etc., in order to receive airdrop tokens.

loan

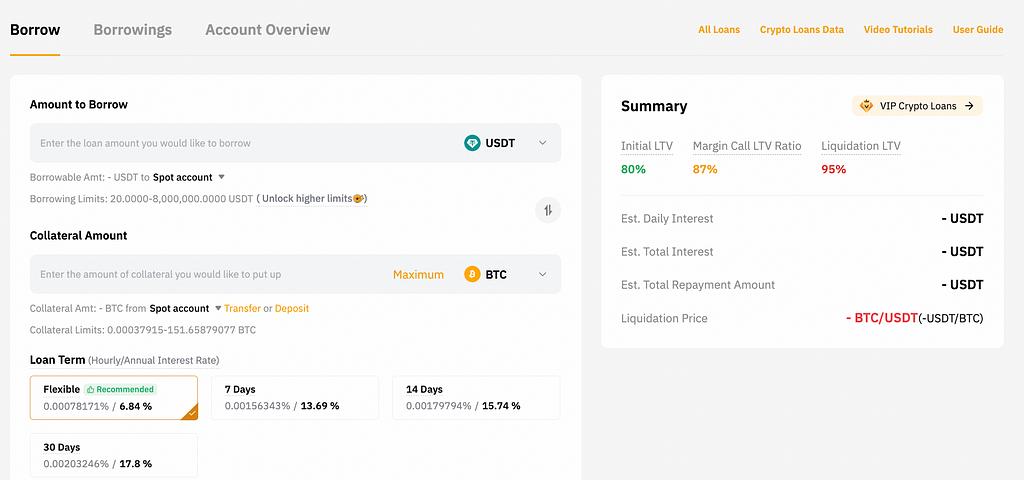

Bybit's cryptocurrency lending service provides lending services to individual users and institutions. Users can use cryptocurrencies such as Bitcoin and Ethereum as collateral to borrow other digital assets for trading or investment, while maintaining ownership of the original crypto assets. The service provides flexible collateral options and loan amounts, and users can choose different loan terms according to their needs, and there is no need for credit checks.

OTC Trading

OTC trading allows traders to directly execute orders between two parties at an agreed price outside the Bybit platform. Bybit's role is to act as an intermediary to match transactions, with a maximum transaction amount of $10 million, and Bybit does not charge any intermediary fees. Currently, OTC Trading supports the following exchange methods: converting USDT to ETH or BTC, or converting USDC to ETH or BTC. In addition, you can also convert ETH or BTC to USDT or USDC, or convert between USDT and USDC.

Bybit Card

Bybit Card is a Mastercard credit card that supports over 90 million merchants worldwide. Users can choose from a variety of crypto assets as payment methods and enjoy EMV 3-D Secure fund protection, loyalty rewards programs and 24/7 multilingual customer support. Currently supports 1 fiat currency and 8 cryptocurrencies. The fiat currency is determined by the user's identity verification country. For example, the card of a German user will be denominated in euros. If the euro balance in the account is insufficient, the system will use cryptocurrency payment in priority order. Currently supported cryptocurrencies include BTC, ETH, XRP, USDT, USDC and TON. Supported regions include Argentina, Brazil, the European Economic Area (EEA), Switzerland and Australia.

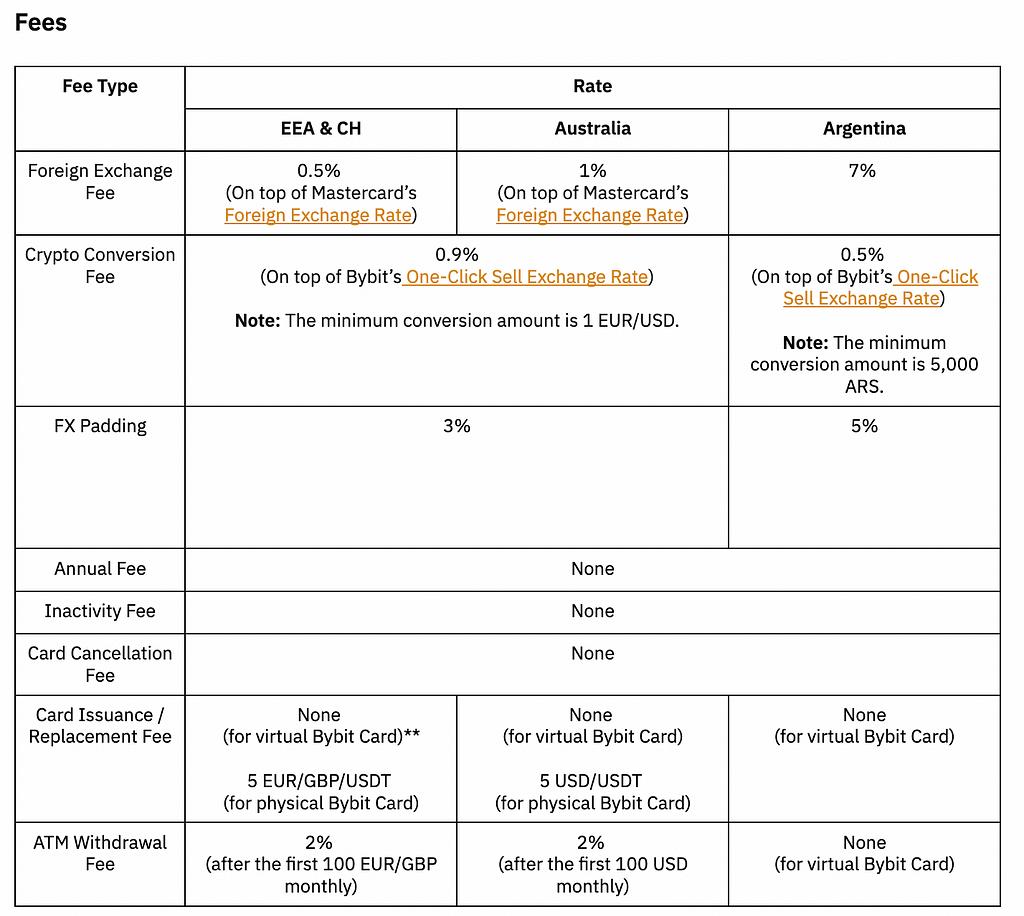

Bybit Card fees vary by region. For the EEA and Switzerland, the foreign exchange conversion fee is 0.5% , while it is 1% in Australia and a whopping 7% in Argentina. The cryptocurrency conversion fee is 0.9% in the EEA and Switzerland and 0.5% in Argentina, with a minimum conversion amount requirement. The FX price floating surcharge is 3% in the EEA and Switzerland and 5% in Argentina. Card issuance and replacement fees are free for virtual cards, while physical cards are 5 EUR/GBP/USDT in Europe and 5 USD/USDT in Australia and Argentina. ATM withdrawal fees are waived for the first 100 EUR/GBP or 100 USD per month, and a 2% fee is charged for the amount above that. Annual fees, account inactivity fees, and card cancellation fees are all zero.

Mirana Capital

An early-stage cryptocurrency fund that invests in crypto companies that are strategically relevant to Bybit and BitDAO and adopts a longer-term investment horizon, with transaction sizes ranging from $200,000 to $20 million.

Davion Labs

It is an incubator founded by Bybit. Its main work includes three aspects: producing research content; connecting developers and creators; and providing development, financing and incubation support for potential projects.

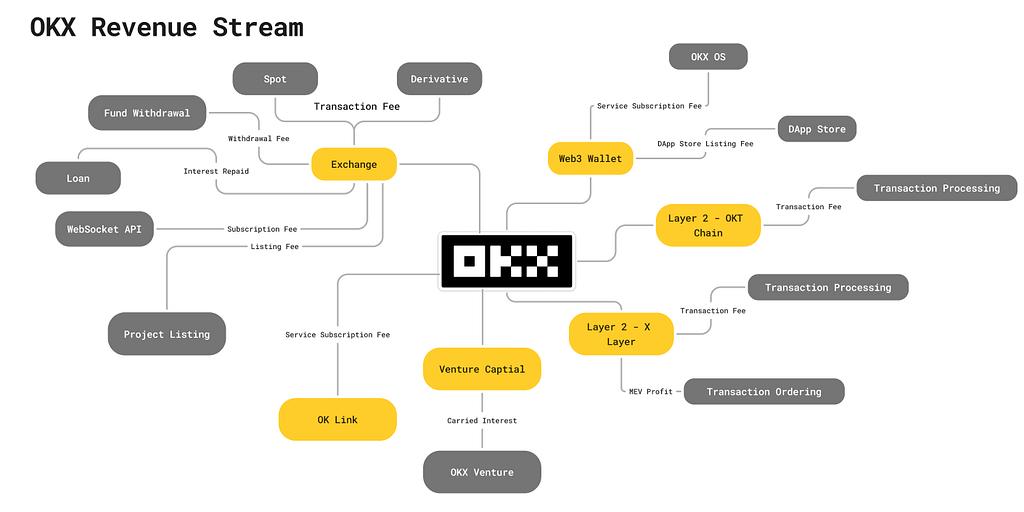

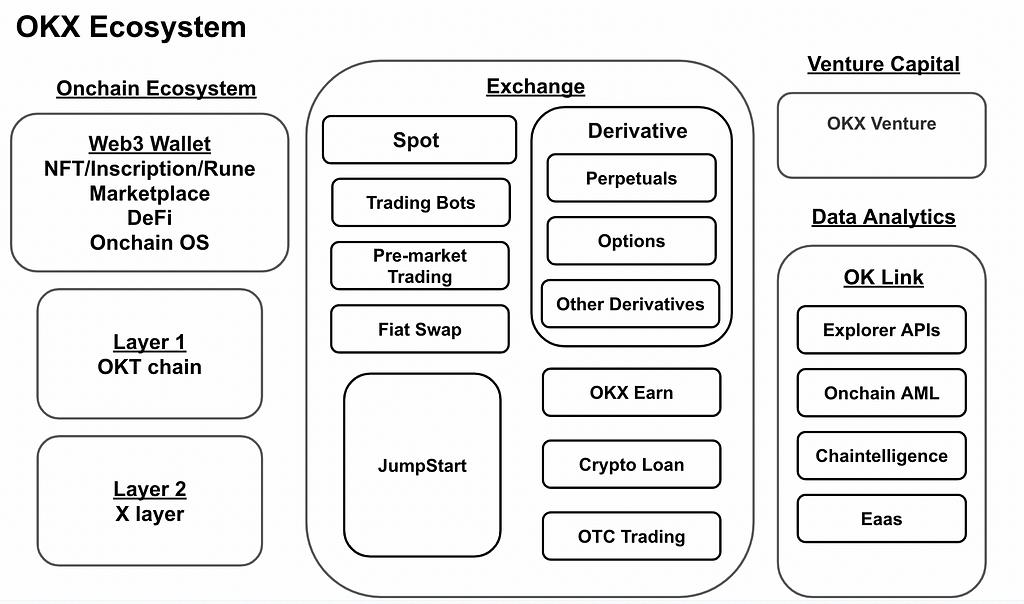

OKX: A full-chain integrator that puts user experience first

Web3 Wallet

OKX's on-chain wallet was the first to appear among all the major exchanges, and it also has the smoothest user experience. Web3 security company CertiK ranked OKX wallet as the number one crypto wallet for cybersecurity among the 43 most popular wallets. According to data from the Chrome Extension Store, there are more than 1 million download users worldwide.

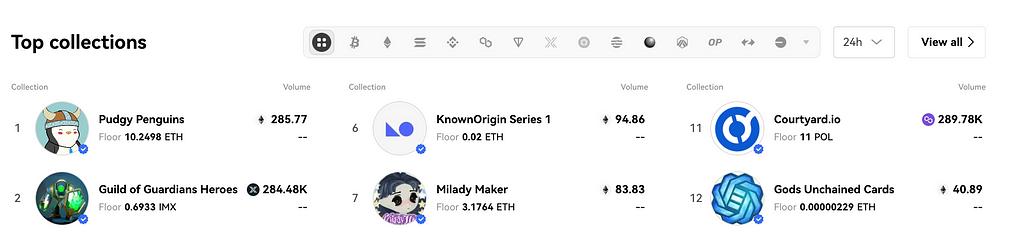

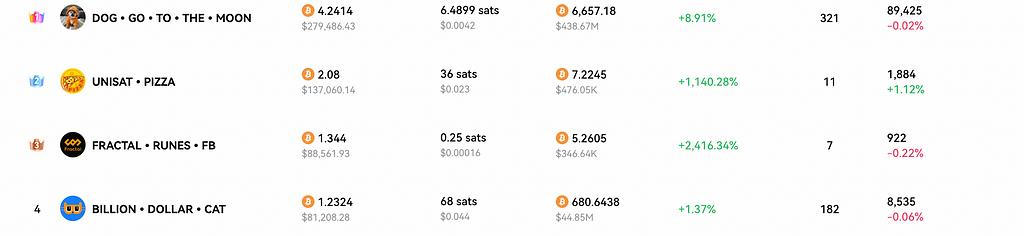

NFT/Inscription and Rune Market

OKX's NFT, inscription and rune markets are all in the leading position in the industry. With a rich variety and a daily trading volume of more than 50 million US dollars at its peak, it even surpassed Blur at one time. Its NFT market offers a 0% listing fee, which has become a major advantage in attracting users. By connecting to more than 20 public chains such as Ethereum, zkSync, Polygon, Solana, and integrating more than 30 NFT platforms such as Tensor, OpenSea, Magic Eden, etc., OKX provides users with the best quotes and liquidity, and simplifies cross-chain trading operations.

The market also improves user experience through intelligent interaction strategies and multiple security guarantees, supports multi-platform orders, one-click signatures, smart contract calls, and reduces Gas fees. The optimization of various user experiences also enables OKX to stand out among many competitors in the NFT market.

In the inscription and rune market, OKX also adopts a 0-fee strategy to lower the entry threshold and become the first platform to integrate SRC-20, ARC-20, DRC-20 and Rune Alpha. With its wide product coverage and first-mover advantage, OKX quickly occupied the ecological market, and users can achieve one-stop operations from batch inscription casting to trading on OKX Marketplace.

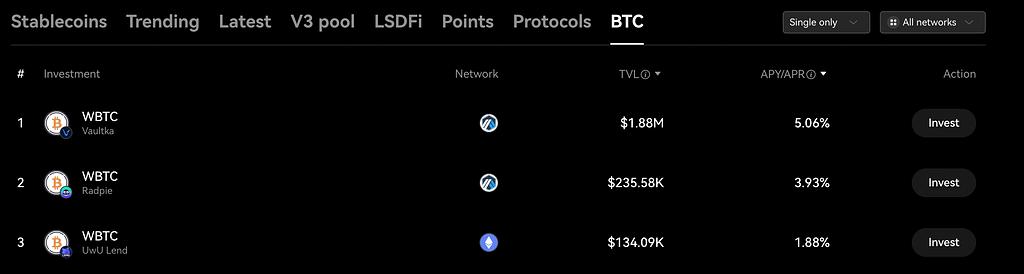

On-chain DeFi

OKX DeFi also connects to more than 30 public chains and nearly 200 project platforms. The platform also does not charge additional fees. DeFi projects include ETH re-staking, stablecoins, single-coin staking, dual-coin staking, the latest Bitcoin staking, etc.

Swap

OKX's on-chain DEX only adopts the AMM Pool interaction mode, and does not integrate ApeX for Orderbook transactions like Bybit. It supports 200+ tokens, 20+ public chain interactions and cross-chain. Swap also provides MEV-protection to protect users' order opening interests.

OKX OS

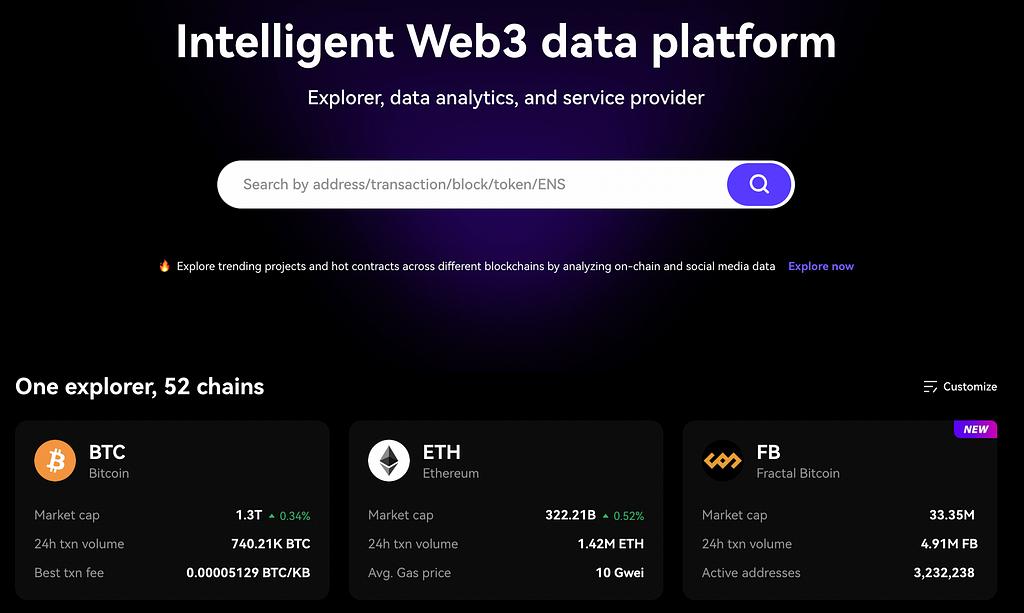

OKX OS is a Web3 development solution that significantly reduces development time and costs through the integration of standardized public chains and protocols. It covers four major scenarios: wallets, DEX, markets, and DeFi. OKX OS also provides data query capabilities, in-depth analysis of asset data, transaction history, project information, etc., and supports more than 60 networks, including EVM, UTXO, Solana, TON, TRON, and the cutting-edge Inscription ecosystem. Currently, more than 10,000 developers have participated in the construction, and the number of API calls has exceeded 200 million times.

OKX Link

OKLink Explorer APIs

OKLink Explorer APIs is a scalable and easy-to-use API solution for Web3 developers, supporting blockchain data from more than 40 mainstream Layer 1 and Layer 2 networks, as well as token data from more than 200 blockchain networks, covering more than 7 million different tokens and NFTs. The API provides comprehensive on-chain data, including basic blockchain data, UTXO data, EVM and Cosmos-specific data, DeFi and NFT data, token prices, reserve proof data, stablecoin issuance and destruction records, etc.

OKLink Onchain AML

OKLink Onchain AML APIs is a set of blockchain and crypto compliance tools that help law enforcement monitor transactions and ensure compliance with anti-money laundering AML and counter-terrorism financing regulatory requirements. The core advantage is the use of the industry's largest and most authoritative address tag database, which covers hundreds of categories and associates tens of thousands of entities. The high standard quality of the database is ensured through internal security and forensics experts, 24/7 OSINT research and scanning, advanced AI engines, and a wide network of customers and partners.

Chaintelligence

Chaintelligence has 5.2 billion address tags, supports 256 blockchains and 7.4 million crypto assets, and has analyzed more than 1,160 cases to date. The platform also provides forensic reports, encryption training and on-site support services, providing strong technical support for case investigation and evidence preservation.

Eaas

EaaS (Explorer as a Service) is a blockchain exploration service provided by OKLink, which supports multi-chain assets, transactions, and address data queries, and provides a full-featured browser, a powerful search engine, smart contract verification, and reliable API services. Through one-stop connection to wallets, DEX, and NFT markets, EaaS helps users easily manage blockchain applications, achieve a comprehensive ecological experience, and greatly simplify the development and integration process.

Layer1 — OKT Chain

OKT Chain is designed for dApps and Web3 ecosystems, based on the EVM architecture, compatible with smart contracts and supports cross-chain functions. As of now, the transaction volume of OKT Chain has exceeded 220 million, the pledged amount has exceeded 4 million OKT, the number of active addresses has exceeded 100 million, the market value has exceeded 160 million US dollars, and the on-chain TVL has exceeded 500 trillion.

Layer2- X Layer

X Layer is a Layer 2 network based on ZK technology that connects OKX and the Ethereum community. It not only simplifies the interoperability between multiple blockchain networks and supports cross-chain transfer of assets and information, but also provides development tools to help developers build dApps in a multi-chain environment.

As can be seen from the above figure, the total locked value (TVL) of X Layer and OKT Chain is quite insufficient compared with Bybit's Mantle, and the liquidity is relatively scarce. In addition, since mainstream stablecoins such as USDT and USDC have not yet been launched on these chains, the prototype of the DeFi ecosystem has not yet been formed, resulting in limited overall financial activities and user participation.

Exchanges

The daily trading volume of OKX Exchange is about 7.7 billion US dollars, and its spot trading volume ranks fourth in the world, with a market share of about 7%. Its futures trading volume ranks tenth, with a market share of about 5%.

Spot Trading

It provides more than 300 spot token trading pairs and supports more than 40 fiat currencies, mainly in South America, the Middle East, and Southeast Asia. The transaction fees for market makers and takers are 0.08% and 0.1% respectively.

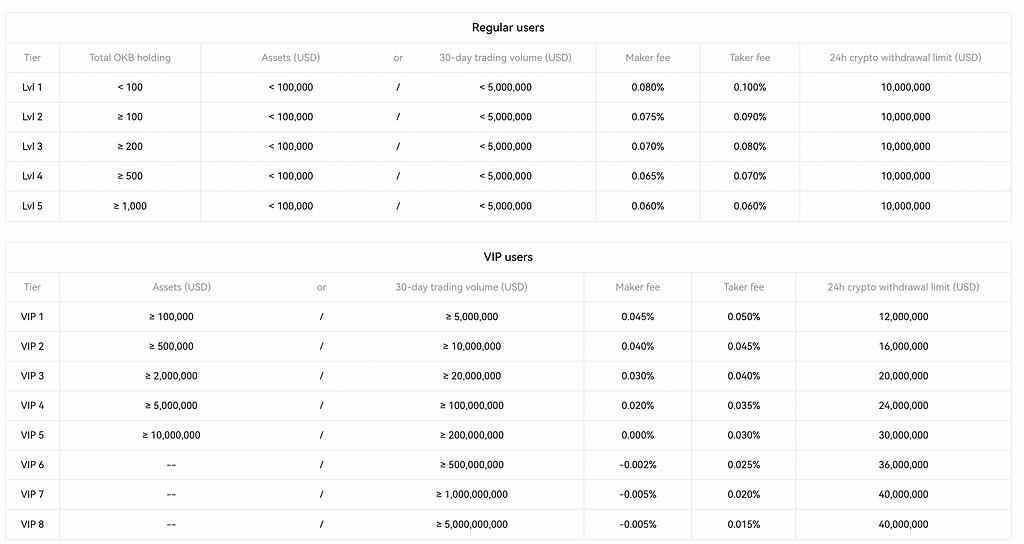

OKX’s fee structure is adjusted according to the user’s account level and is divided into two categories: ordinary users and VIP users.

Ordinary users: The levels are divided according to the amount of OKB they hold, from Lvl 1 to Lvl 5. The more OKB they hold, the lower the transaction fees. The maker fee rate drops from 0.08% to 0.06%, and the taker fee rate drops from 0.10% to 0.06%.

VIP users: The level is mainly determined by account assets and trading volume within 30 days. VIP 1 to VIP 8 users enjoy lower transaction fees, with the order fee rate gradually reduced from 0.045% to -0.005%, and as the level increases, the user's 24-hour cryptocurrency withdrawal limit also gradually increases, from 12 million US dollars to a maximum of 400 million US dollars.

Derivatives Trading

- Futures/Perpetual Contracts

OKX’s futures trading platform ranks third in terms of trading volume, with a daily trading volume of $20 billion and offers about 200 futures token trading pairs. The standard market maker and taker fees are 0.02% and 0.05% respectively.

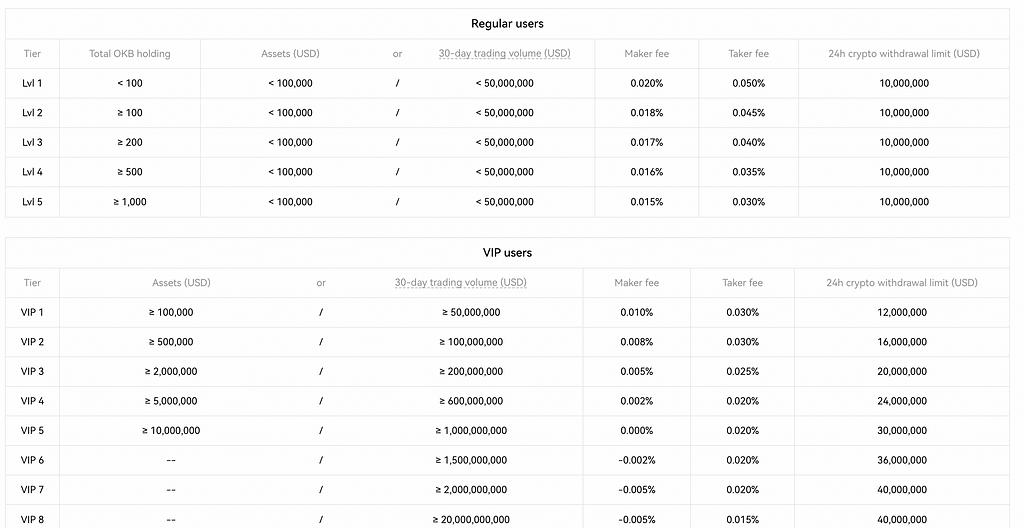

OKX's futures trading fees are adjusted according to the user's account level and are divided into two categories: ordinary users and VIP users.

Ordinary users : Account levels are divided according to the number of OKB held by the user or the 30-day trading volume, from Lvl 1 to Lvl 5. The more OKB held or the larger the trading volume, the lower the transaction fee the user enjoys. The order placing fee rate is reduced from 0.020% to 0.015%, while the order taking fee rate is reduced from 0.050% to 0.030%. The 24-hour cryptocurrency withdrawal limit for each level of users remains at 10 million US dollars.

VIP users : VIP levels are mainly divided based on account assets or trading volume within 30 days. The higher the trading volume, the more favorable the fees. From VIP 1 to VIP 8, the lowest order maker fee rate can be as low as -0.005%, while the lowest order taker fee rate is 0.015%. At the same time, the 24-hour cryptocurrency withdrawal limit for VIP users increases from US$12 million to US$400 million as the level increases.

- Pre-market Trading

Pre-market trading refers to trading futures contracts before a token is officially listed for spot trading. In pre-listed futures trading, the price of a token before spot listing is based on the last traded price of the futures contract on the OKX platform. Once the token begins trading in the spot market, OKX will use index rules to calculate a composite index price based on spot prices on multiple exchanges. This index price will be used to calculate the settlement amount when the futures contract expires.

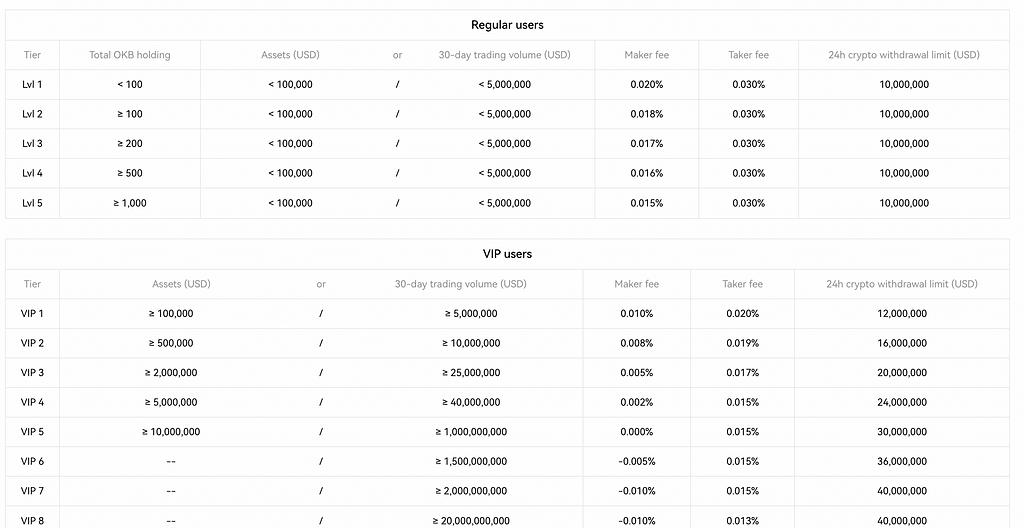

- Options

OKX's option trading fee structure is divided into ordinary users and VIP users based on the user's account level. The user's assets or 30-day trading volume determine their level. The order placing fee rate for ordinary users has been reduced from 0.020% to 0.015%, and the order taking fee rate has remained at 0.030%. VIP users enjoy more favorable rates, with a minimum order placing fee rate of -0.010% and a minimum order taking fee rate of 0.013%. As the level increases, the user's 24-hour withdrawal limit increases from US$12 million to US$400 million. In addition, trading fees are calculated based on option premiums, contract size, and quantity. Exercise fees are only charged for exercised options, and unexercised options are not required. Forced liquidation fees are calculated based on the user's order taking fee rate and market conditions. This mechanism encourages large transactions while ensuring market liquidity and system stability.

- Copy Trading

OKX allows traders to copy the trades of other professional investors in the market. The target of copy trading is divided into followers and master traders. Followers will copy the trading strategies of the master traders they choose. Master traders can promote their strategies, attract followers, and receive a certain percentage of the net profit each follower earns on OKX, depending on the master trader's level.

- Trading Robots

OKX trading robots help users perform trading tasks in the market through automated strategies. They automatically execute buy and sell orders based on set parameters to achieve specific investment goals or optimize returns under market conditions. OKX provides a variety of trading robot tools suitable for different trading strategies and market conditions: spot grid, futures grid, smart arbitrage, spot DCA, futures DCA, etc.

OKX Earn

OKX Earn allows users to earn passive income on crypto assets by participating in a variety of interest-bearing products. These products vary in risk and return profiles and are suitable for a variety of investment strategies. OKX Earn includes options such as staking, savings, and structured financial products.

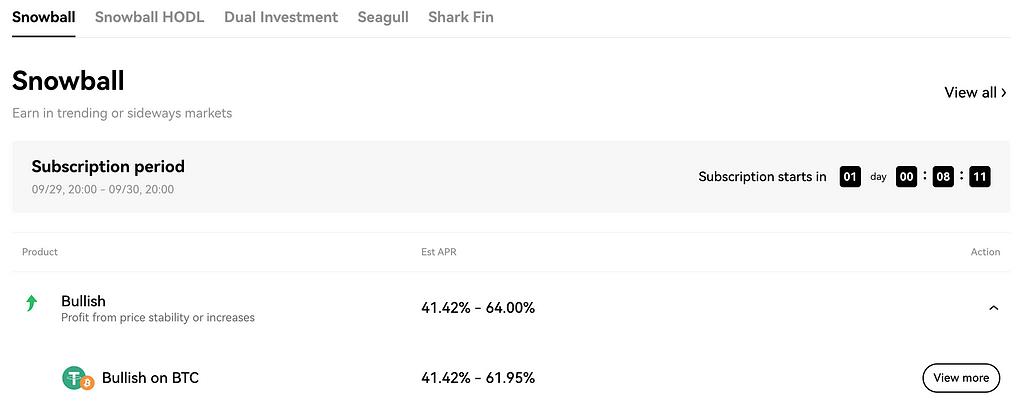

- Snowball : This is a structured product that offers higher potential returns while limiting risk. Depending on market trends, users can accumulate returns if asset prices remain within a certain range.

- Snowball HODL : Similar to the Snowball product, it is designed for users who want to hold cryptocurrencies for the long term (HODL). During the lock-up period, if market conditions are favorable, this product can provide higher returns.

- Dual Investment : A short-term investment tool that allows users to deposit one asset and receive returns in another asset based on market price changes. It is suitable for hedging or speculating on price fluctuations.

- Seagull : A structured product that combines multiple options, typically providing downside protection while limiting potential gains. Suitable for users who expect slight or moderate price fluctuations.

- Shark Fin : This product is designed to provide a minimum guaranteed return with the potential for higher returns based on asset price performance. If prices remain within a predetermined range, the return increases, shaped like a “shark fin”.

loan

OKX's cryptocurrency lending service provides lending services to individual users and institutions. Users can use cryptocurrencies such as Bitcoin and Ethereum as collateral to borrow other digital assets for trading or investment, while maintaining ownership of the original crypto assets. The service provides flexible collateral options and loan amounts, and users can choose different loan terms based on their needs, without the need for credit checks.

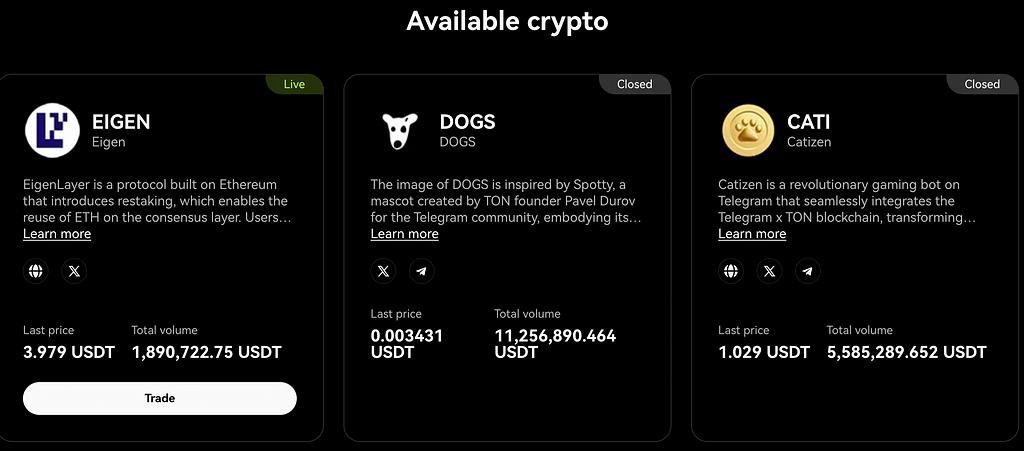

JumpStart

OKX's own Launchpad platform has successfully raised more than $5.7 billion and supported the financing of 14 projects, including well-known projects such as Runecoin, Sui and NOTcoin. Users can participate in the issuance of new tokens on Launchpad and subscribe to these new tokens using their crypto assets (such as BTC or ETH). Projects on Launchpad are usually cryptocurrencies that are launched for the first time, and users participate in the distribution of tokens by locking their assets. This method not only provides financial support for new projects, but also provides users with the opportunity to obtain potential benefits through early participation.

OTC Trading

OKX's OTC Block Trading service is a form of over-the-counter trading designed for high-net-worth market participants, allowing them to buy and sell assets in bulk without affecting market prices. Typically, OTC Block Trading involves institutional investors, hedge funds, or relatively wealthy individual investors. When these traders wish to buy or sell large amounts of assets, they submit a request for quote (RFQ) to the Block Trading platform. The platform (usually a broker-dealer) breaks the trade into smaller blocks and the market maker provides the execution price. If the trader accepts the price, the trade is conducted over-the-counter and does not appear in the order book of the open market, thereby avoiding market price fluctuations.

OKX Venture

OKX Ventures is an investment arm of OKX, focusing on promoting innovation and development in the blockchain and Web3 ecosystem. OKX Ventures invests in projects covering blockchain infrastructure, DeFi, NFT, decentralized storage and other fields. The portfolio includes some of the most popular projects: Celestia, zkLink, io.net, ether.fi.

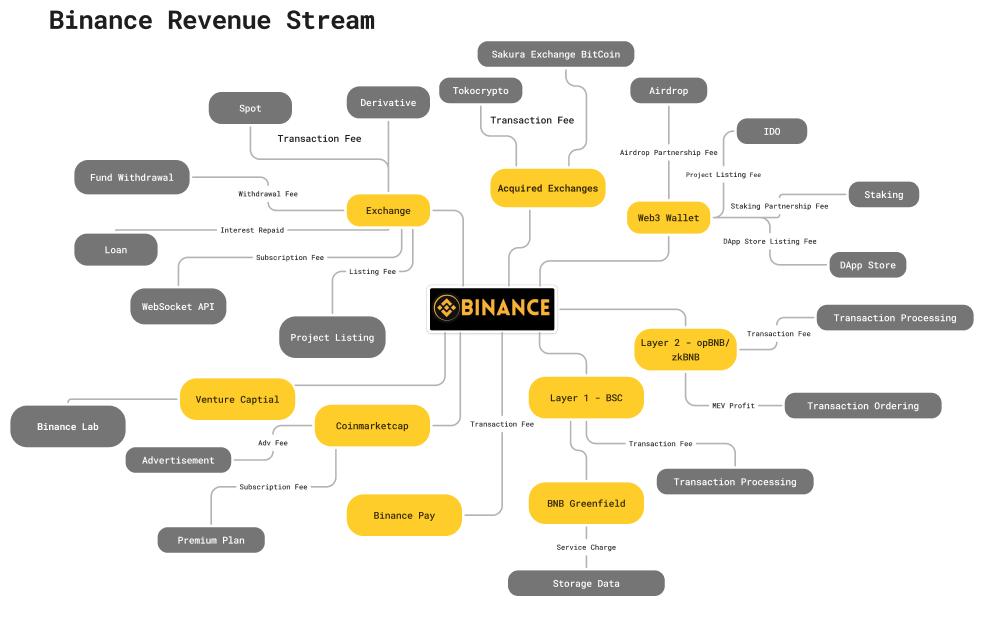

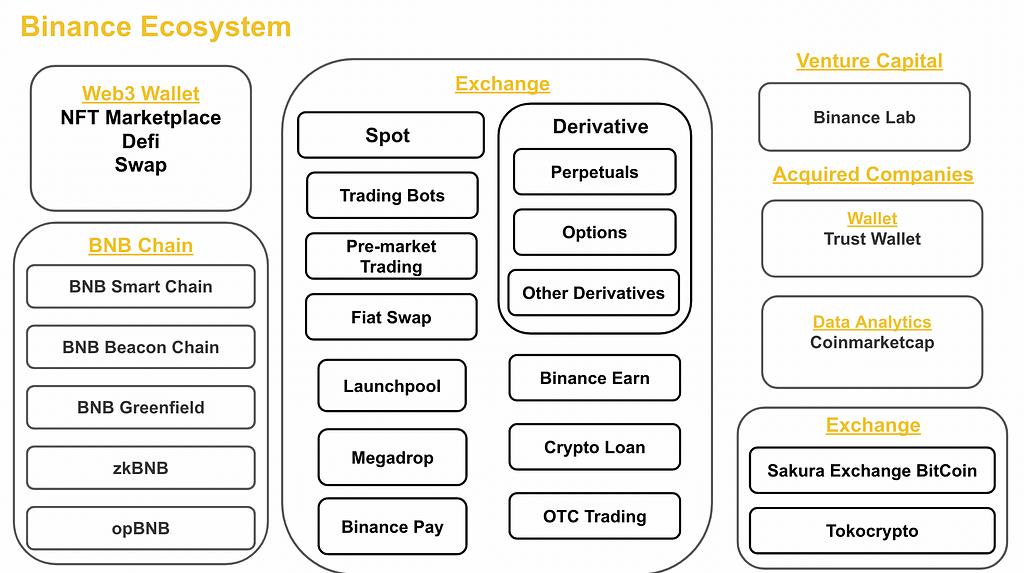

Binance: The global liquidity leader

Web3 Wallet

Binance's Web3 wallet basically provides functions and services that are very similar to those of Bybit and OKX's Web3 wallets. However, Binance's Web3 wallet does not support downloading plug-ins to the browser through the Chrome Extension Store, but requires users to download through the Binance application, which invisibly raises the threshold for use and makes user access and use more complicated.

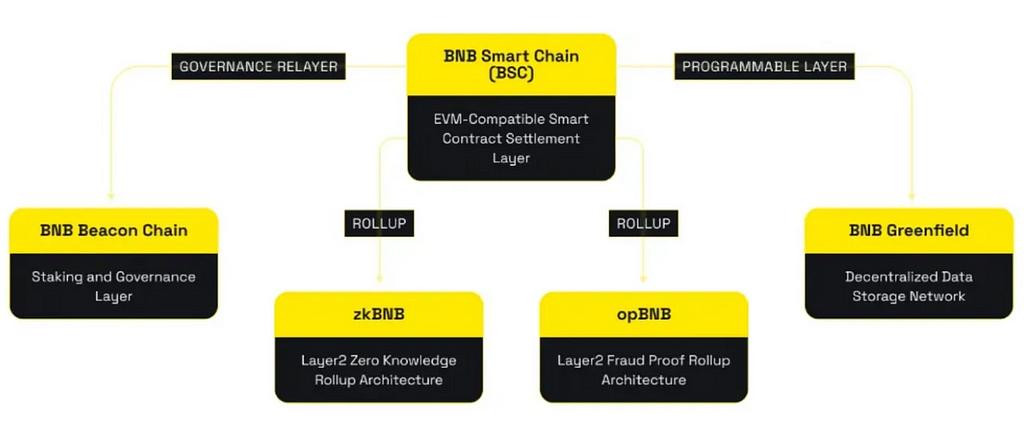

BNB multi-chain structure

The BNB Chain is a multi-chain architecture system, which mainly includes the BNB Beacon Chain (BC), BNB Smart Chain (BSC) and BNB Greenfield, and enhances its performance through two L2 expansion solutions: opBNB and zkBNB.

- The BNB Beacon Chain is responsible for the governance and management of the BNB chain. It is developed using the Cosmos SDK and supports the issuance of BNB native assets, token management, and on-chain decentralized trading (DEX).

- BNB Smart Chain is compatible with EVM, supports smart contract migration and high-throughput low-transaction-fee operations, and serves as a multi-chain hub to achieve cross-chain interoperability.

- As a decentralized storage chain, BNB Greenfield combines data storage and financial assetization to create new value opportunities for users.

- zkBNB improves privacy and scalability and reduces transaction fees through zero-knowledge proof technology.

- opBNB provides developers with more innovative tools and services to further expand the ecosystem.

Exchanges

The daily trading volume of Binance Exchange exceeds 8 billion US dollars, and its spot trading volume ranks first in the world, with a market share of more than 30%. Its futures trading volume also ranks first, with a market share of about 25%.

Spot Trading

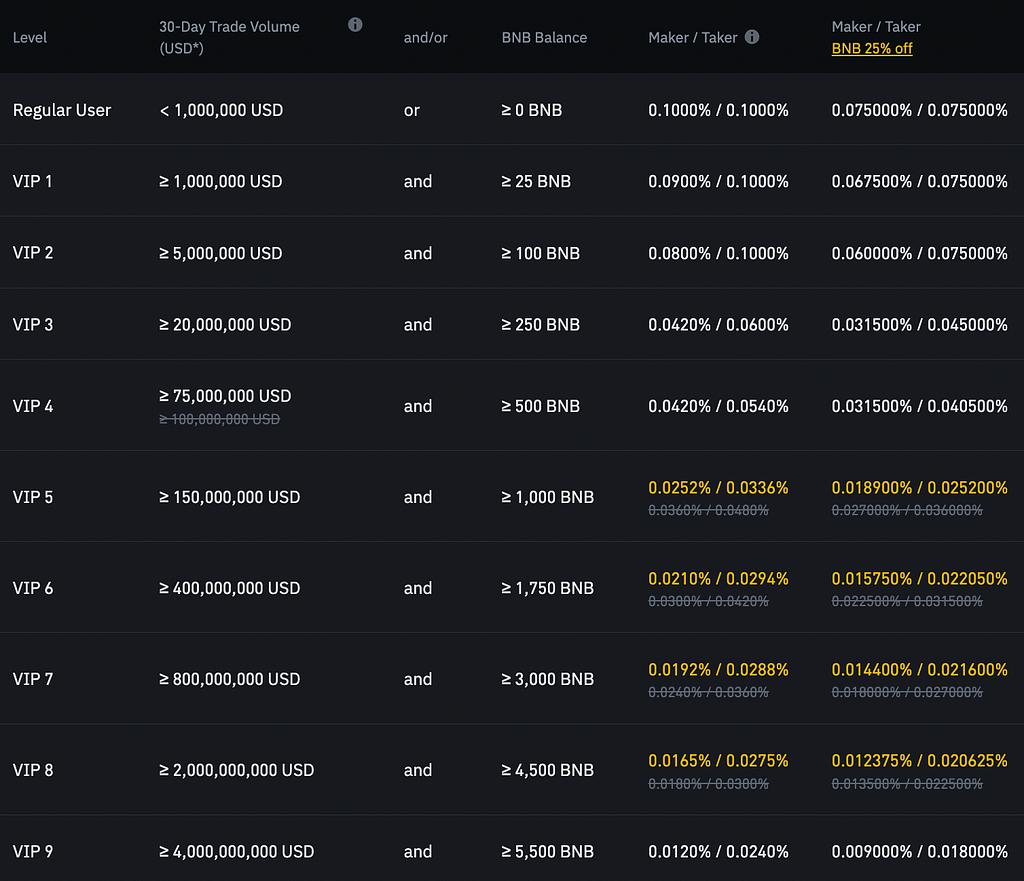

Binance offers more than 400 spot token trading pairs and supports about 10 fiat currencies. The transaction fee for basic market maker and taker orders is 0.1%.

Binance spot trading has a fee structure based on a user's 30-day trading volume and the amount of BNB held. Fees are divided into different levels based on user tier, divided into "maker fees" and "taker fees". For regular users (trading volume less than $1 million and holding 0 BNB), both maker and taker fees are 0.1%. VIP-level users enjoy lower fees based on their trading volume and BNB holdings. For example, VIP 1 level requires a minimum of $1 million in trading volume and 25 BNB, with a maker fee of 0.09%, while paying with BNB can enjoy a 25% discount. As VIP levels increase, fees gradually decrease, with the highest VIP 9 level users enjoying 0.012% maker fees and 0.018% taker fees.

Derivatives Trading

- Futures/Perpetual Contracts

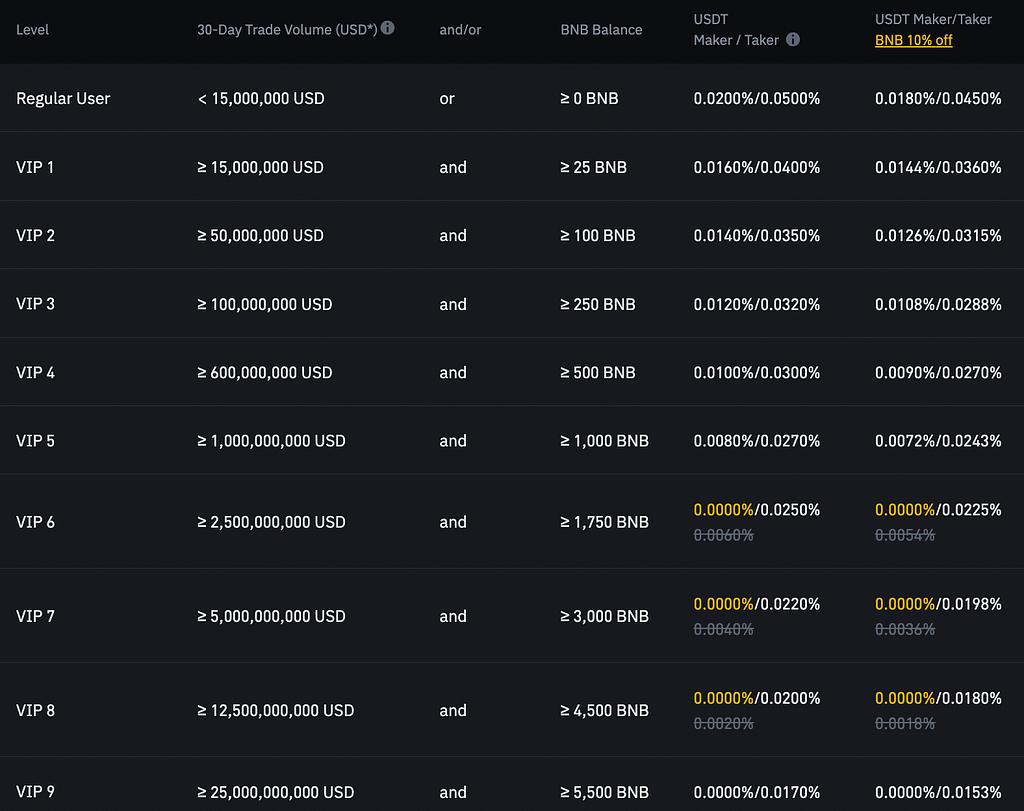

Binance’s futures trading platform ranks first in terms of trading volume, with a daily trading volume of $23.3 billion and offers about 400 futures token trading pairs. The standard market maker and taker fees are 0.02% and 0.05% respectively.

The fee structure for Binance futures trading is based on the user's 30-day trading volume and the amount of BNB held, and is divided into two parts: "maker fee" and "taker fee". Regular users (trading volume less than $15 million and holding 0 BNB) have a maker fee of 0.02% and a taker fee of 0.05%. VIP-level users enjoy lower fees based on their trading volume and BNB holdings. For example, VIP 1 requires a minimum of $15 million in trading volume and 25 BNB, with a maker fee of 0.016% and a taker fee of 0.04%. As the VIP level increases, the fees gradually decrease, with the highest VIP 9 level users enjoying no maker fee and a taker fee of 0.0170%.

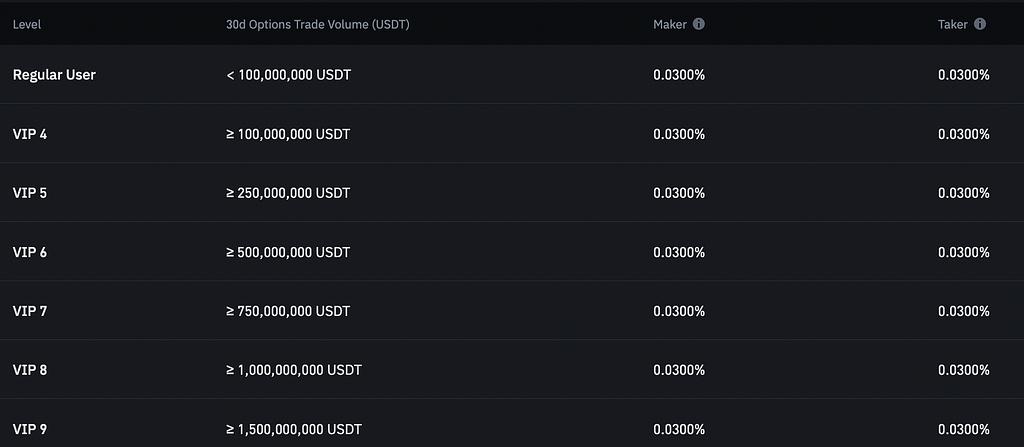

- Options

Binance options trading’s fee structure is also tied to the user’s 30-day trading volume, with both the maker and taker fees for all users being 0.03%.

Pre-Market Trading

Binance Pre-Market trading allows users to trade tokens before they are officially launched. Launchpool users can sell their tokens from Launchpool rewards in advance through the pre-market to lock in profits, while non-Launchpool users can also buy and sell tokens through the platform before the token is launched. This feature provides users with an opportunity to seize the first opportunity in the crypto market, especially in the context of Binance Launchpool's historically high returns, Pre-Market trading will become a hot trend.

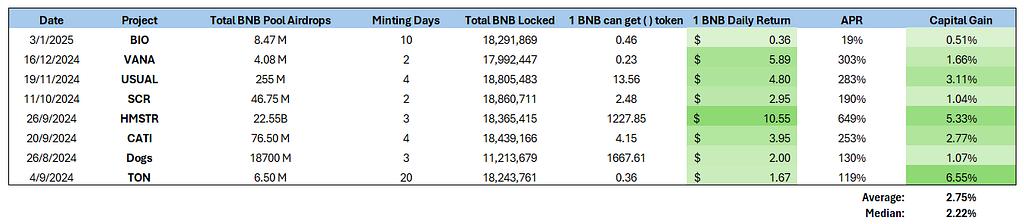

Launchpool

The return rate of Binance Launchpool has always been considerable, with an average return of about 2.75%, and it usually drives the growth of BNB holdings and the rise of its coin price. Historically, Launchpool has listed more than 100 projects and raised more than 180 million US dollars in cumulative funds. It mainly obtains tokens of new projects by staking FDUSD and BNB. This method not only helps new projects obtain initial financial support, but also allows users to participate in advance before the listing of new project tokens, further promoting the development of the entire Binance ecosystem.

Megadrop

Binance Megadrop is a new token issuance platform that allows users to get early access to Web3 projects before the tokens are listed on Binance. Users can earn points through BNB, and the longer the lock-up period and the more the amount, the greater the reward. In addition, users can also increase their points by completing Web3 tasks.

Binance Pay

Binance Pay is a cryptocurrency payment solution that allows users to send and receive cryptocurrency payments instantly and without any fees. It supports more than 200 cryptocurrencies, and users can use Binance Pay for personal transfers, payments in online and offline stores around the world.

In terms of fees, Binance Pay does not charge any transaction fees for personal transfers and payments between users. However, for merchants using Binance Pay, certain fees may be charged depending on their integration settings.

Copy Trading/Trading Robot/Binance Earn

Basically the same as Bybit and OKX.

loan

Binance Loans allows users to borrow cryptocurrencies or stablecoins using existing digital assets as collateral.

Binance Loans has three main products: Flexible Loans, Fixed Rate Loans, and VIP Loans.

- Flexible Loans : Allows users to get more liquidity on top of their existing crypto assets. This loan product supports isolated collateral, and users can hold the loan indefinitely as long as they maintain the specified “loan-to-value ratio”. In addition, users can still earn APY rewards through the Binance Earn product.

- Fixed-rate loans : provide stable, predictable fixed interest rates for users who want to borrow or lend stablecoins. The annual interest rate is fixed during the loan period, bringing users a more stable experience.

- VIP Loans : An institutional-grade service designed specifically for Binance VIP users, supporting fixed and flexible interest rates, and can aggregate assets across multiple accounts to improve capital efficiency.

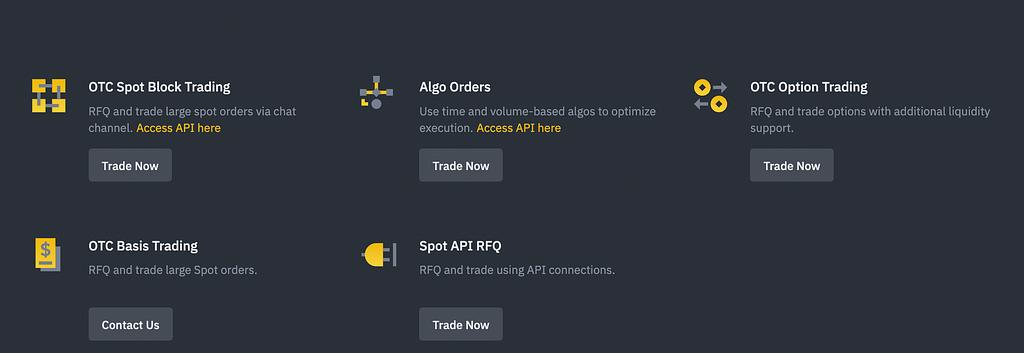

OTC Trading

Binance OTC trading service provides institutional-grade liquidity and supports large orders. Users can conduct large spot transactions through spot RFQ (request for quotation) to obtain liquidity including trading pairs not listed on the spot order book. In addition, it supports connection through REST API and provides 24/7 real-time price quotes. Futures RFQ and basis trading allow users to execute spot-futures basis trades across perpetual and quarterly contracts in a single transaction, avoiding the risk of partial transactions. The algorithmic order platform reduces slippage and optimizes execution through strategies such as time-weighted average price (TWAP). The options RFQ service provides real-time option prices and supports personalized quote trading.

Binance Labs

Binance's venture capital fund focuses on infrastructure and DeFi, and well-known projects in its portfolio include Aptos, Altlayer, and Layerzero. Most of its investments are between $1 and $10 million, and lead projects with more than $10 million account for about 10% of its portfolio.

Acquisition of Company

Binance has expanded its ecosystem through a series of acquisitions, including several well-known platforms and tools:

CoinMarketca

Binance acquired CoinMarketCap in 2020, the world's leading crypto asset price tracking platform that provides market information for various cryptocurrencies.

Trust Wallet

In 2018, Binance acquired Trust Wallet, a cryptocurrency hot wallet that gives users full control over their funds. Trust Wallet’s core features include a built-in decentralized application (DApp) browser, as well as cryptocurrency staking and token swaps directly within the app.

Swipe

Binance acquired the payment platform Swipe in 2020, and the two parties jointly launched a cryptocurrency Visa card, promoting the application of cryptocurrency in real-world payments.

Exchange Acquisition

Binance has also acquired several local exchanges, including Japan’s Sakura Exchange Bitcoin and Indonesia’s Tokocrypto, and continues to maintain its operations locally and expand into international markets.

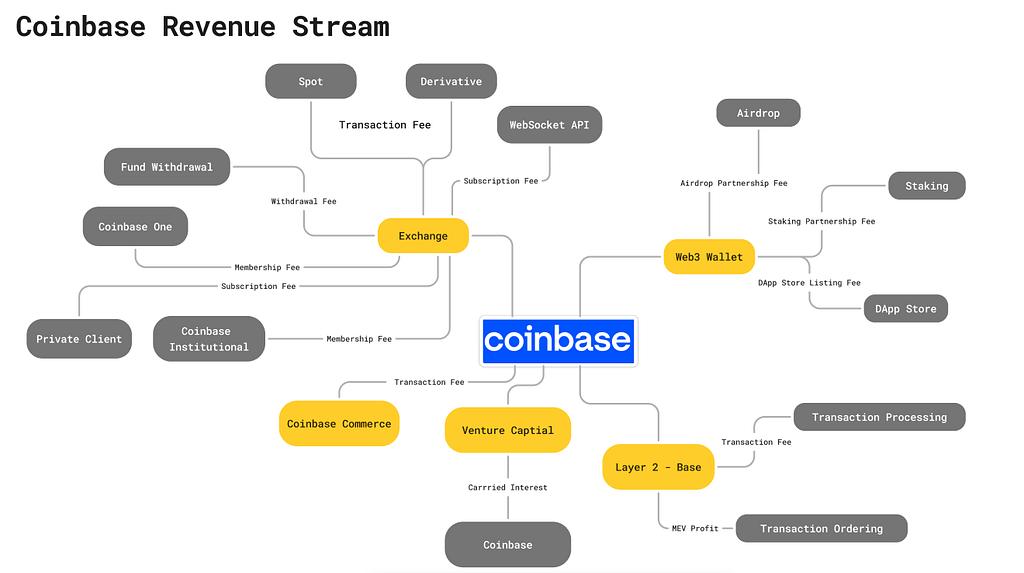

Coinbase: A compliance-driven institutional service provider

Web3 Wallet

The functionality is basically the same as OKX and Bybit Wallet, and supports integration in the Chrome extension store.

Layer 2 — Base

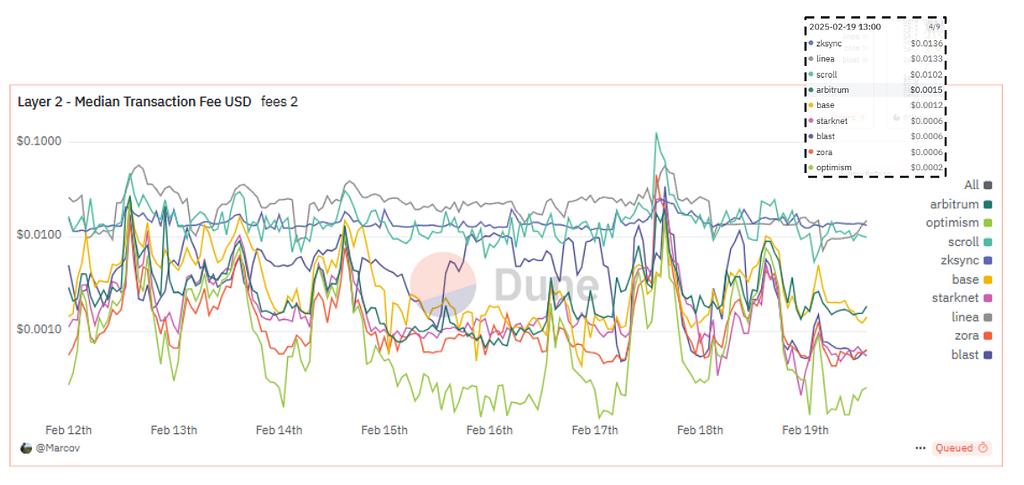

Base is a second-layer scaling solution for Ethereum launched by Coinbase, which aims to provide faster and cheaper transactions while maintaining the security and decentralization of Ethereum. Based on the Optimistic Rollup technology, Base batches a large number of transactions and submits them to the Ethereum mainnet, greatly reducing the transaction costs of users. At present, the total locked amount of DeFi of Base has reached 4.08 billion US dollars, among which Aerodrome is the decentralized exchange with the highest TVL on the chain, with a locked amount of 871 million US dollars. Base occupies nearly 40% of the entire L2 market share, and the average gas fee per transaction is 0.00012 US dollars, which is lower than the average of all L2 solutions.

Exchanges

The daily trading volume of Coinbase Exchange is approximately US$1.3 billion, and its spot trading volume ranks sixth/seventh in the world. Given that Coinbase places greater emphasis on compliance, it currently only serves the United States.

Spot Trading

Coinbase offers about 250 spot token trading pairs, and the only supported fiat currencies are USD, GBP and EUR. The transaction fee for basic market maker and taker orders is about 0.4%-0.6%.

In Coinbase's transaction fee structure, users with smaller trading volumes, such as those with a transaction volume of less than $10,000, have a taker fee of 0.60% and a maker fee of 0.40%. For users with larger trading volumes, such as those with a transaction volume between $1M and $15M, the taker fee drops to 0.18% and the maker fee is 0.08%. When the transaction volume further increases to more than $400M, the taker fee drops to 0.05% and the maker fee is completely waived. This tiered system encourages more high-frequency and large-volume traders to participate in trading by reducing the fees for large transactions.

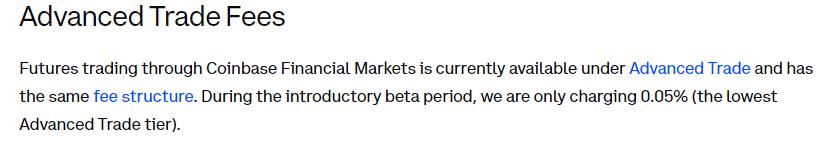

Futures/Perpetual Contracts

In Coinbase's futures trading, the platform charges a uniform fee of 0.05% to both takers and makers.

Coinbase Earn

Basically the same as Bybit, OKX, and Binance.

Coinbase One

Coinbase One is a monthly subscription service launched by Coinbase. Subscribers can enjoy zero transaction fees, higher staking rewards (applicable to ADA, ATOM, SOL and XTZ), crypto market analysis and discounts provided by partners, 24-hour customer support, and simplified crypto tax filing process.

Private Client

Coinbase Private Client Services is a premium service for ultra-high net worth individuals, personal investment vehicles, trusts, and family offices. The service provides personalized support with dedicated account managers to assist with account opening and account management, while providing institutional-level research and insights through the coverage team. To ensure the safety of assets, the service integrates Coinbase Custody's isolated cold storage and provides insurance policies. In addition, Coinbase Private Client provides physical and network security protection, regular financial and security audits, and supports multi-user account access, allowing team members to manage accounts and set different access rights.

Coinbase Institutional

Provides a comprehensive suite of services for institutional clients, including investment in digital assets through Coinbase Prime and deep liquidity across multiple trading venues. The platform also provides custody solutions to ensure asset security through storage in Coinbase Vault and regular financial and security audits. Customers can also use staking options and participate in governance through manual or delegated voting.

Coinbase Prime

A solution for institutional investors. Helps customers connect to multiple exchanges and trading venues, simplifying the process of executing trading strategies. Coinbase Prime also provides comprehensive financing services, supporting cryptocurrency lending, margin trading and short selling. In addition, the platform supports the secure custody of more than 430 assets and is one of the largest regulated qualified crypto custody services. Users can freely withdraw or deposit assets from cold wallets, pledge or participate in governance. The Coinbase Prime platform has more than 250 tradable assets, with a quarterly institutional trading volume of US$346 billion and total custodial assets of US$404 billion. It is a trusted solution for institutional crypto trading.

Coinbase Card

The Coinbase Card is a Visa credit card available to U.S. residents. Users can use this card to spend cryptocurrencies (including USDC) and U.S. dollars anywhere Visa is accepted, supporting both cash and cryptocurrency transactions. There is no application fee or credit check during the application process.

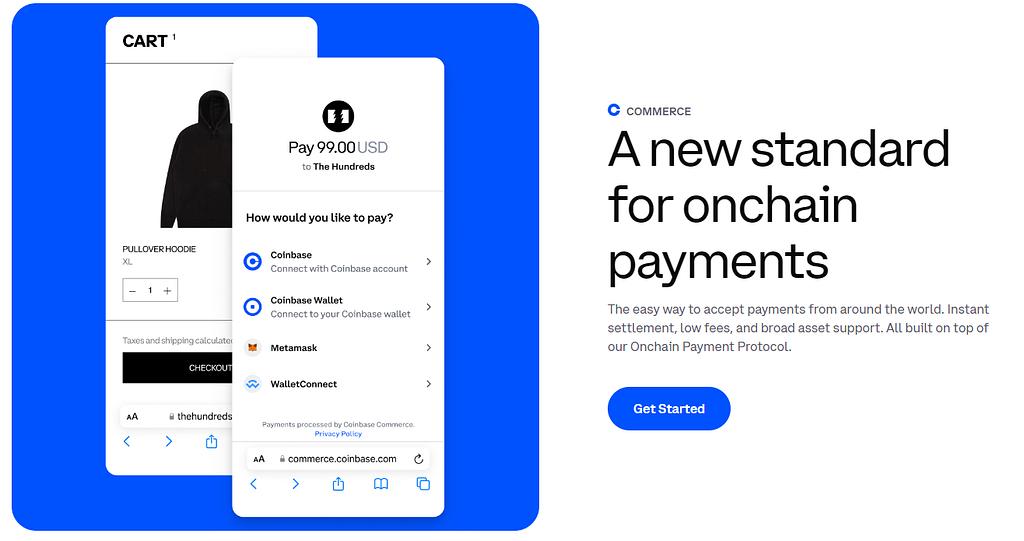

Coinbase Commerce

Coinbase Commerce is a digital payment service provided by Coinbase that supports merchants to accept payments in multiple cryptocurrencies. Customer payments go directly into the merchant's crypto wallet, and the platform is also seamlessly integrated with e-commerce platforms such as Shopify and WooCommerce. The service eliminates the risk of fraud through on-chain payments and reduces fees in traditional payment processing, such as foreign exchange fees. Merchants are required to pay a 1% transaction fee and may incur network processing fees. They can also choose to convert cryptocurrencies into fiat currencies.

Coinbase Ventures

Coinbase Ventures is the investment arm of Coinbase, focusing on investing in early-stage cryptocurrency and blockchain startups. So far, Coinbase Ventures has invested in more than 300 projects, mainly in the fields of infrastructure, decentralized finance, and centralized finance. Well-known investment projects include Animoca Brands, Aptos, and Eigenlayer.

Skew

Skew is a data analysis platform focused on the cryptocurrency market. It was integrated into Coinbase Prime in 2020, enabling customers to track cryptocurrency spot and derivatives markets in real time.

Bison Trails

Bison Trails, now part of Coinbase, provides advanced blockchain infrastructure solutions that enable developers and companies to build, operate, and scale blockchain applications. Their services focus on simplifying blockchain participation and reducing associated risks.

The Coinbase Developer Platform (CDP) provides APIs that allow users to query rich on-chain data on the Base network. Users can access these APIs directly or use them through the CDP SDK. Its services cover multiple application scenarios:

- Wallet management : Create and manage wallets for yourself and users programmatically, supporting trading applications, AI wallets, etc.

- Fiat-to-Crypto Conversion : Enable your customers to seamlessly convert fiat to crypto through your app.

- Transaction fee payment : Provide users with a gas-free experience on the Base network and support transaction payment.

- Staking service : Through a unified interface, programmatic staking is implemented in applications across protocols.

Research on the evolution and breakthrough strategies of exchange platform coins

In order to further understand the correlation between CEX's platform token and its exchange operating performance, we analyzed the performance of the platform token at the following levels.

Bybit

$MNT Token Economy

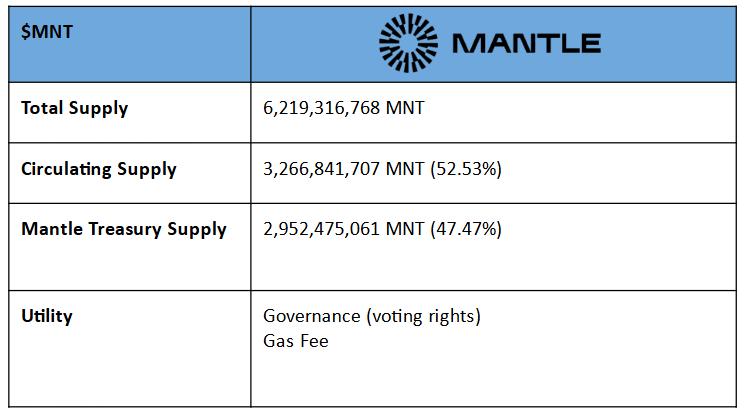

As Mantle's public chain token, $MNT currently has a circulation market value of more than half of the total market value, and the rest is managed by Mantle Treasury. Each newly released $MNT needs to be approved by Mantle Treasury.

Mantle Treasury

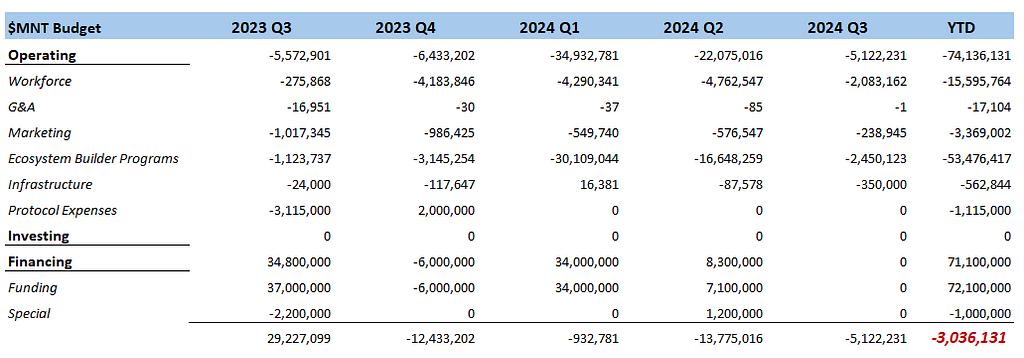

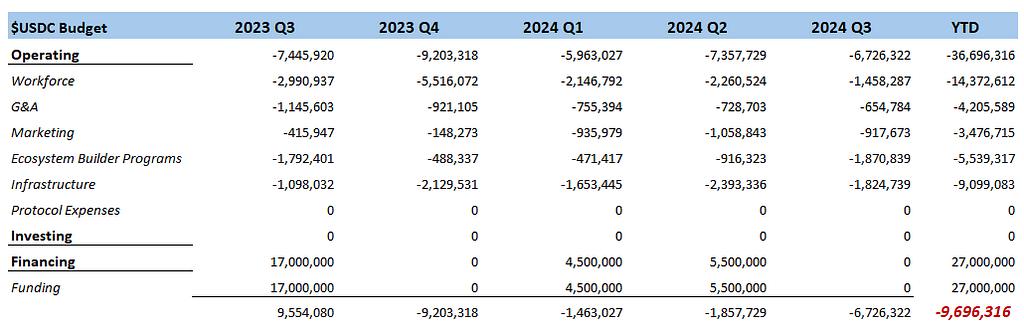

According to Mantle Treasury's financial report for the past year, the $MNT and $USDC reserves in the treasury are both in a floating loss state. Among them, the $MNT reserve lost about $3.03M in one year, and the main expenditure was the Ecosystem Builder Program related to ecological construction, which cost about $53.47M.

In terms of $USDC reserves, the annual loss was about $9.69M, mainly used to pay for the labor costs of Mantle DAO, which amounted to $14.37M. Overall, the treasury lost about $12.72M in the past year.

In addition to relying on financing and working capital advances, according to Artemis data, the Mantle public chain's revenue in the past year was about $2.1M, which is still not enough to cover the treasury expenditure. In order to maintain the normal operation of the public chain, Mantle has adopted a high-expenditure strategy. However, these expenditures have limited contribution to the overall revenue and have increased the financial burden.

Since the operation of Mantle public chain is currently in a negative expectation state, why does Bybit still choose to continue operating Mantle public chain? The following analysis will explore whether Mantle public chain can bring enough traffic to Bybit to support its development, so that Bybit can retain and invest in the construction of its own chain ecosystem instead of choosing to abandon this business.

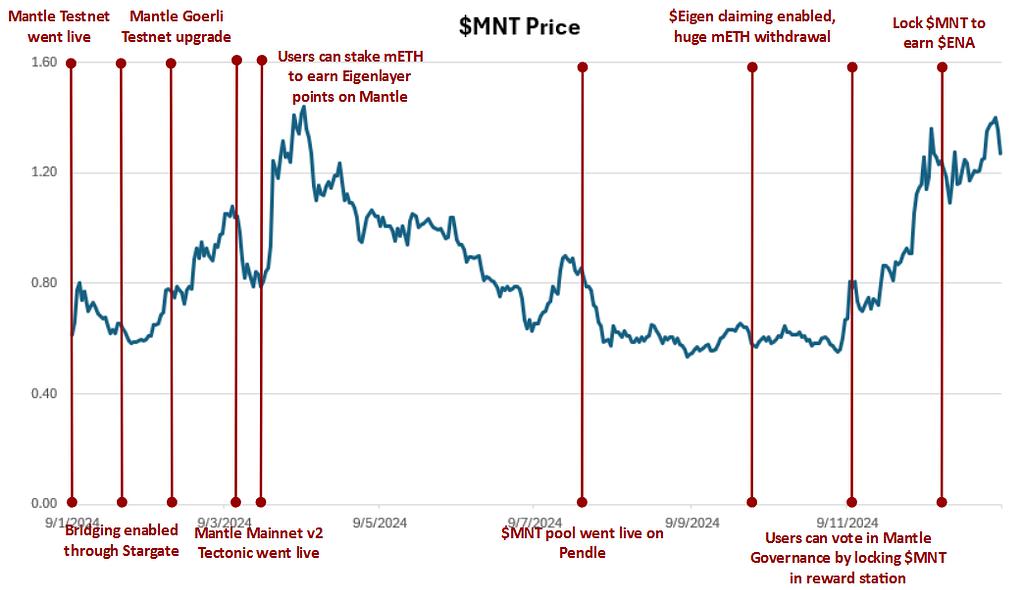

$MNT Price History

First, by observing the price trend of $MNT and the growth of Bybit users, no obvious correlation is shown. The price fluctuations of $MNT are mostly consistent with the overall market trend. For example, the recent price increase in November was mainly affected by Trump's election, rather than driven by Bybit reaching a user milestone. Judging from the price trend, Bybit is not the main catalyst for $MNT.

- 12/01/2024 : Mantle Network v2 testnet launched on Sepolia, retaining the modular design and using Mantle DA powered by EigenDA technology to improve performance and reduce fees, while being securely guaranteed by Ethereum.

- 25/01/2024 : Stargate cross-chain bridge is launched. Users who connect to Mantle Network through Stargate for the first time can receive