Introduction: When Financial Instruments Become a "Campus Trojan"

In April 2025, a "Campus Trojan Plan" led by crypto trading platforms emerged: Through designs like "contract experience funds" and "campus ambassador rebates", college students are systematically being drawn into the vortex of high-leverage contract trading. This promotion disguised as "blockchain education" is identical to the "zero down payment iPhone" logic of campus loans in 2015 - using low barriers and high returns as bait to precisely harvest groups with weak risk awareness.

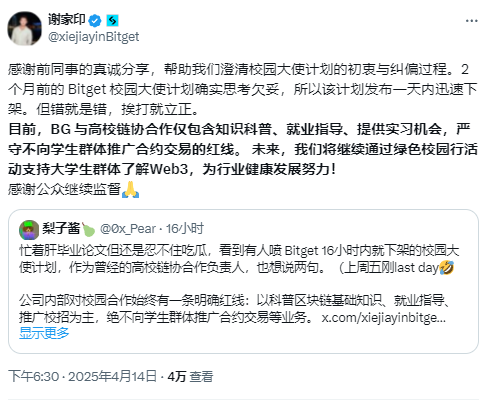

Although platforms like Bitget and Bybit temporarily took down campus ambassador programs under public pressure, the industry still has numerous disguised promotions. Data shows that a top exchange's contract business contributes over 80% of revenue, with college students accounting for 35% of new users.

This capital game disguised as "financial enlightenment" is replicating the campus loan era's tragic script, and the global nature and regulatory vacuum of crypto contracts make it a cross-regional, cross-generational human hunt.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating to English.]- User Stratification: Set income proof, risk testing, and simulated trading duration as triple entry thresholds, prohibiting students from opening leverages above 10x;

- Product Transformation: Convert perpetual contracts into "risk decay type", where the leverage ratio automatically decreases the longer the position is held;

- Profit Redistribution: Extract 20% of contract fees to establish an "Investor Protection Fund" for compensating liquidation losses and financial education.

Conclusion: Crypto Contracts Need a "Humanistic Operating System"

From campus loans to contract experience funds, capital's harvesting of young people has never stopped, and the global nature of the crypto industry has amplified the scale and concealment of this harm. When 125x leverage becomes a "one-click order" on mobile screens, and a college student's first financial lesson becomes a "liquidation simulator", the industry has deviated from the original empowerment intention of blockchain technology.

The real solution is not at the technical level, but at the value level: to continue being the "arms dealer of human weaknesses" or become a "risk awareness evangelist"? The answer determines whether the crypto world will become a soil nurturing innovation or a graveyard burying youth. The historical lessons are painful enough - the naked loan crisis of 2015 destroyed countless families, and the contract trap of 2025 is creating a larger-scale cognitive collapse. Preventing this disaster requires not more code, but the remaining sense of responsibility and reverence.

As a trader who has experienced three liquidations said: "There are no heroes in the contract market, only survivors and corpses. And the platforms pushing college students into this battlefield are worse than hyenas - they specifically target the most tender prey."