Against the backdrop of Trump's sudden tariff policy shift, BTC quickly stabilized, rebounding from last week's low point near $75,000 to over $85,000, sweeping away the market's previous downturn. With the price recovery, the options market has clearly turned bullish, with "options at $100,000" becoming the main battlefield for traders.

VX:TZ7971

According to Deribit derivatives exchange data, investors have recently abandoned the previously heavily traded "$75,000 - $78,000 put options" and instead increased their "$85,000 - $100,000 call options", betting that BTC will see a breakthrough rise in the coming weeks.

Trump's Softened Stance Boosts Market Confidence

This rebound is closely related to policy news. Trump recently announced a new round of tariffs on multiple countries' goods, with import tariffs on Chinese goods reaching up to 125%, causing market turmoil. However, within days, the White House suddenly relaxed conditions, announcing exemptions for tech products like smartphones. Although Trump later denied making concessions, the market interpretation remained optimistic, with funds clearly flowing back into risk assets.

Debt market crisis pressures have caused Trump's policy to shift from "aggressive attack" to "forced retreat", transforming market sentiment from "panic selling" to "rebound and chase".

As BTC surged from $75,000 to $85,000, the previously widespread $75,000 - $78,000 put options were sold off, while call options in the $85,000 - $100,000 range were again heavily subscribed.

Options Skew Recovers as Market Panic Subsides

From a technical perspective, observing the "options skew" indicator also reveals improving market sentiment. Skew measures the difference in demand between call and put options, and can be used to track market mood trends.

According to Amberdata, BTC's 30, 60, and 90-day options skew have all turned from negative to positive, indicating panic is subsiding and bullish expectations are returning.

Although the 7-day skew remains negative, it is far lower than the -14% a week ago, clearly showing market sentiment has rebounded from its low point.

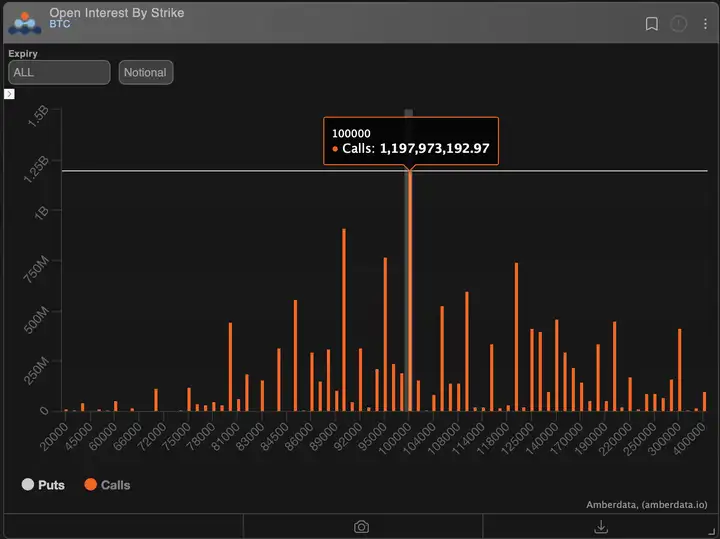

"$100,000" Call Options Regain Popularity with Nearly $1.2 Billion in Open Interest

Another signal worth noting is the overall open interest distribution trend on Deribit.

Data shows that $100,000 call options have again become the most popular trading option, with total open interest amount approaching $1.2 billion. This represents a significant market bet that BTC may see another strong price surge.

The chart shows call option contracts in the $95,000 - $120,000 range are also clearly clustering, indicating the market's growing willingness to bet on a "new high scenario".

Meanwhile, the bearish side is not completely absent, with the $70,000 put options' open interest at $982 million, the second most popular choice, showing that bears have not fully retreated and maintain a certain defensive line.

Today's fear index is 38, still in a state of fear.

BTC maintains oscillation around the $85,000 mark, while Ethereum hovers around $1,600. Stabilizing at these levels would be best, at least preventing significant drops in the near term. Trump's tariffs change daily, so no direction can be taken lightly. However, since the tariffs, the market has largely digested the impact, and even with potential negative news, a major drop is unlikely. The market is expected to oscillate in the $80,000 - $88,000 range until rate cuts, with short-term traders advised to trade high and low within this range.