I. The Infrastructure King of Web3 Forged Over Seven Years

As the most widely used interoperability protocol in the crypto world, WalletConnect has completed over 275 million wallet and DApp connections since its birth in 2018, covering 600+ wallets and 61,000+ applications.

This "connection layer" protocol with over 90% penetration rate finally launched its token WCT on April 15, 2025, debuting on major exchanges like Binance, OKX, and Bybit.

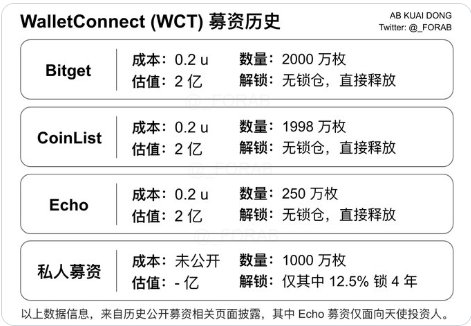

According to crypto researcher @AB Kuai.Dong, WCT previously completed 4 rounds of fundraising, with the last 3 rounds having a cost price of 0.2 USDT.

However, as of the time of writing, WCT started with a circulating market cap of $53 million and an FDV of $288 million, only rising 1.5 times from the private sale cost, reflecting the complex sentiment towards infrastructure tokens in the current market.

From a technical architecture perspective, WCT is rooted in the Optimism mainnet, achieving cross-chain communication encryption transmission through relay servers. Its innovative "connection as a service" model adopts a commercialization path based on monthly active users (MAU), transforming originally free infrastructure services into a token economic system. However, data shows WalletConnect's annual revenue is only $2 million, corresponding to a 60x price-to-sales ratio (PS), far exceeding the valuation levels of competitors like MetaMask.

II. The Double-Edged Sword Effect of Token Economic Design

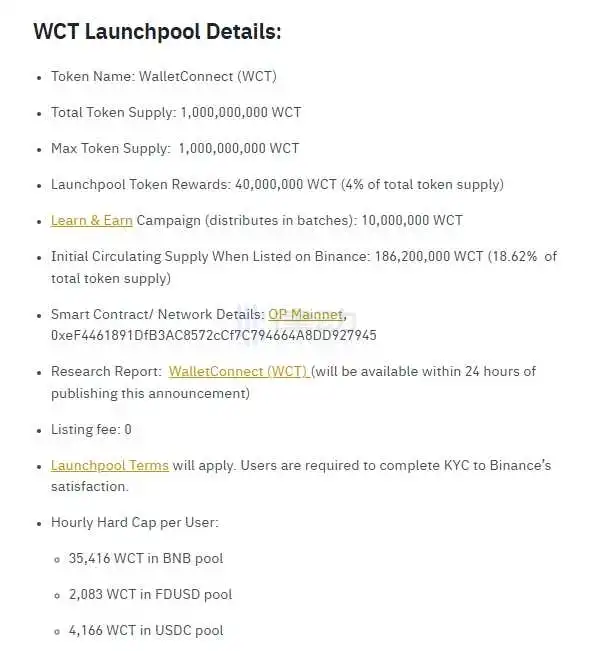

WCT's token allocation structure (total 1 billion tokens) presents typical infrastructure project characteristics: 27% allocated to the foundation for ecosystem building, 18.5% for airdrop incentives, with the team and early supporters holding a total of 30%. This design ensures community governance rights while planting multiple potential market risks:

Circulation Dilemma

Of the initial 18.62% circulation (186.2 million tokens), 44% comes from Binance Launchpool mining release, with early institutions like Coinbase holding 32%, leading to concentrated selling pressure on the first day. Compared to projects like RedStone (28% circulation) and Berachain (21.5%), WCT's seemingly lower circulation rate becomes a price suppression factor - private investors with a 0.1-0.2 USDT cost price create selling momentum under 2x profit stimulation.

Utility Lag

Currently, of WCT's four functions (governance, staking, fees, rewards), only staking and exchange trading are activated. Key fee payment scenarios require community voting, and the 17.5% rewards pool will be gradually released over the next few years. This "launch token first, build later" approach leaves the token lacking short-term value capture scenarios, falling into "air token" suspicions.

Market Maker Double-Edged Sword

GSR Markets and Flow Traders, two market makers, control 8% of initial circulation, using 7.5 million tokens through high-frequency quantitative strategies to maintain liquidity. While stabilizing prices, this mechanism also intensifies market volatility - the 15% amplitude after OKX opening on April 15 was a chain reaction from market makers testing transfers.

III. The Market Cap Ceiling Debate in the Wallet Track

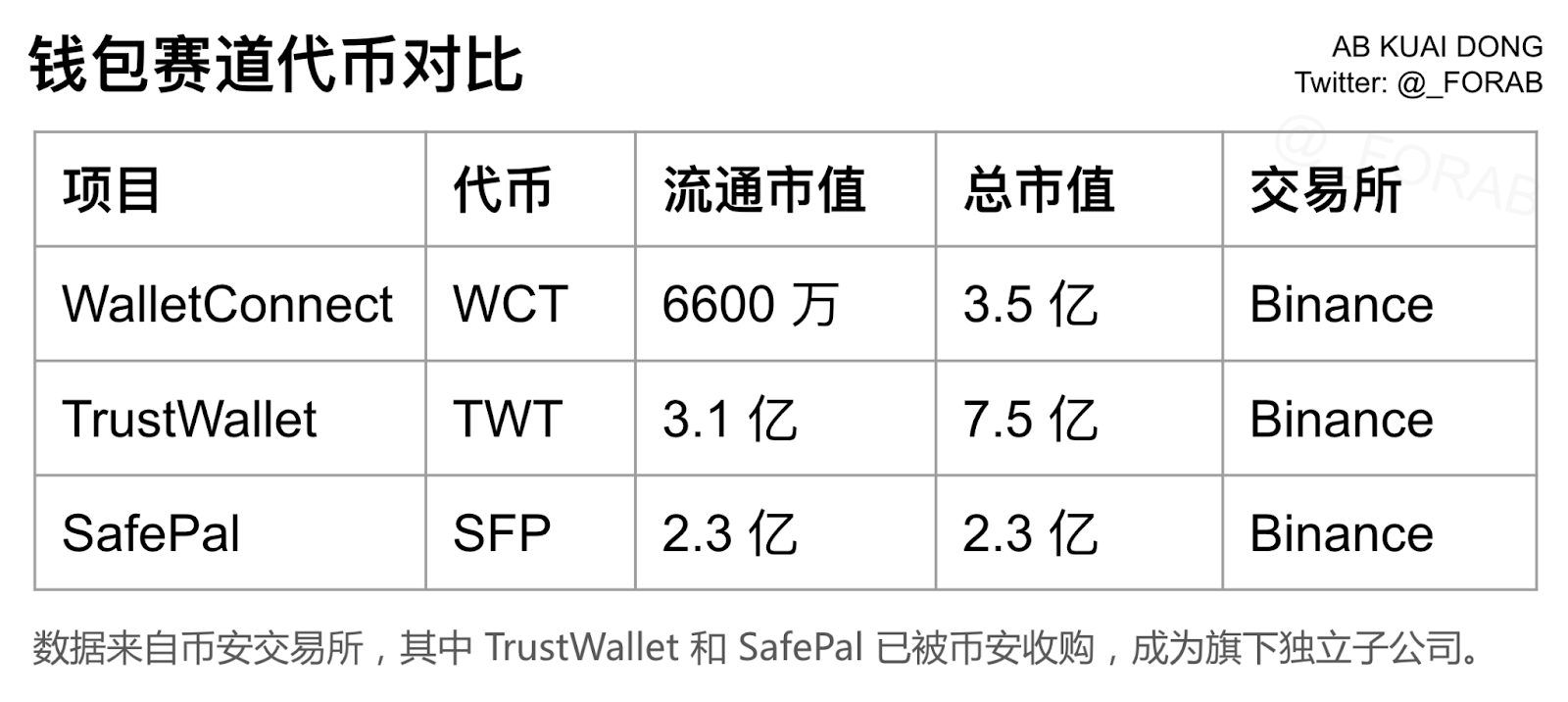

As a token attempt for the connection layer protocol, WCT faces a dual valuation coordinate system: benchmarking against wallet tokens like SFP (SafePal, $120 million market cap) and TWT (Trust Wallet, $350 million market cap), while competing with veteran infrastructure projects like Chainlink (LINK) and The Graph (GRT).

From a usage scenario perspective, WalletConnect's protocol layer attributes give it network effect advantages. Each new wallet integration can exponentially expand connection combinations (600 wallets × 61,000 applications = 366 million potential connections), theoretically supporting higher valuation. However, the practical dilemma is that 90% of existing 274 million connections are free services, with token economic conversion rate under 5%.

Horizontal comparison of ecosystem competitors:

- MetaMask: Building an app store through Snaps plugin system, but yet to issue tokens

- Rainbow: Focusing on NFT social, with DAU only 1/10 of WalletConnect

- Phantom: Solana wallet leader, 5 million monthly active users but weak cross-chain capabilities

WCT's breakthrough point is transforming technical advantages into economic value. Its planned "connection fee tiering" model aims to charge 0.1-0.3 WCT per MAU for high-frequency applications (like exchanges, chain games), theoretically creating $30 million annual revenue. If this model successfully lands in Q3, the FDV/revenue ratio will fall to a reasonable 10x range.

IV. Structural Contradictions Behind Market Coldness

WCT's sluggish performance on its first day essentially reflects the mismatch between crypto market cycles and project fundamentals. In the Altcoin bear market of 2025 Q2, investor tolerance for high FDV projects has dropped to freezing point.

Data shows that the average opening circulating market cap/FDV ratio for mainstream projects launched in the past three months is 18.5%, while WCT reaches 18.62%, almost touching the market's tolerance threshold.

The deeper contradiction comes from token release mechanisms:

Staking Trap

Despite an 85% staking APY, 50% of rewards come from inflationary issuance, essentially forming a "mine-claim-sell" closed loop. Early participants are forced to stake to break even, further aggravating the death spiral of circulation contraction and selling pressure.

Governance Rights Emptiness

Current governance proposals focus on technical upgrades, lacking token buyback or burning mechanisms to add value. Community voting participation is under 5%, reducing the token to a speculative tool rather than a governance certificate.

Airdrop Backlash

Of the first season's 185 million token airdrop, actual claims are under 15 million tokens, with remaining tokens rolling into subsequent incentive pools. While designed for long-term ecosystem building, the market interprets this as a "potential selling pressure reserve", creating psychological suppression.

Conclusion: A Paradigm Test of Infrastructure Tokenization

WCT's challenging launch essentially reflects the collective confusion in the crypto world about infrastructure tokenization paths. When technical adoption rates cannot directly convert to token value, project teams must walk a tightrope between community incentives, economic models, and regulatory compliance. Historical data shows that among similar projects, only Chainlink successfully crossed the "valley of death", key to constructing a strong binding relationship between critical data price feeding and token collateral.

For WCT, the $0.29 price contains both market panic about the bear market and hidden overselling opportunities. If it can achieve three major breakthroughs in the second half of 2025 - fee income exceeding 30%, real yield (excluding inflation) turning positive, and Web2 giant integration - its valuation system might undergo fundamental reconstruction. All of this depends on whether the protocol can evolve from a "connection tool" to a "value gateway", injecting true token blood into Web3's vessels.