Ethena Labs officially closes its branch in Germany and suspends operations in the EU after its previous MiCA application was rejected. Over the past month, the company has been preparing to withdraw from this market.

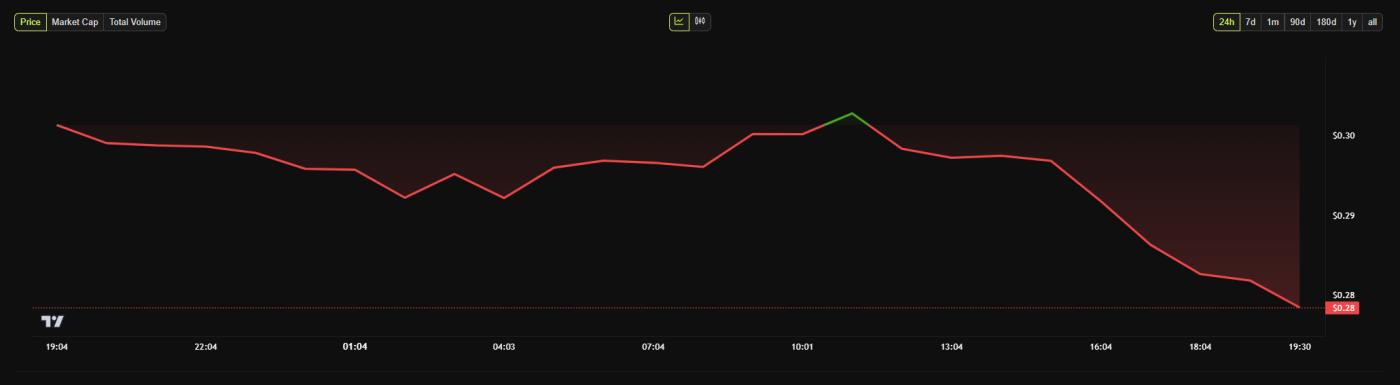

Although the withdrawal was anticipated, ENA reacted significantly, with the altcoin dropping over 7% following today's announcement.

Ethena Labs' Failed MiCA Effort

Ethena Labs has continuously faced regulatory challenges in Europe. At the end of March, German authorities rejected Ethena's MiCA compliance application.

At the time, the company considered it a minor obstacle and focused on other markets. Today, they announced that their German branch will completely cease operations.

"We have agreed with BaFin to discontinue all activities of Ethena GmbH and will not continue pursuing MiCAR licensing in Germany. All users... have been transferred to Ethena (BVI) Limited at their request. Therefore, Ethena GmbH no longer has any direct customers," they stated.

The statement also noted that Ethena GmbH, the German branch, "has not performed any mint or redeem activities" since the regulatory decision.

Specifically, regulators banned all USDe stablecoin transactions, imposing severe restrictions on the company. In other words, this outcome was quite predictable. Ethena (BVI) Limited has taken over the users from the German branch.

The network's Governance Token, ENA, has experienced significant price volatility around its MiCA efforts. In early March, when Ethena Labs was believed to be on track for regulatory approval, ENA escaped its months-long low and nearly reached $2.5 billion in market capitalization.

However, since being rejected, ENA has been under continuous price pressure, which was exacerbated by macroeconomic conditions across the market. Today's announcement further drove down the price.

Daily price chart of Ethena. Source: BeInCrypto

Daily price chart of Ethena. Source: BeInCryptoMiCA, the new EU stablecoin regulation, has created challenges for many companies beyond Ethena. For example, Tether's stablecoin was delisted from EU exchanges when MiCA took effect, leading to significant changes in their business operations.

Many other issuers have raced to fill the gap left by these companies by achieving compliance. Most recently, large centralized exchanges like Crypto.com and OKX have obtained licenses, further consolidating their presence in the EU market.