This article is machine translated

Show original

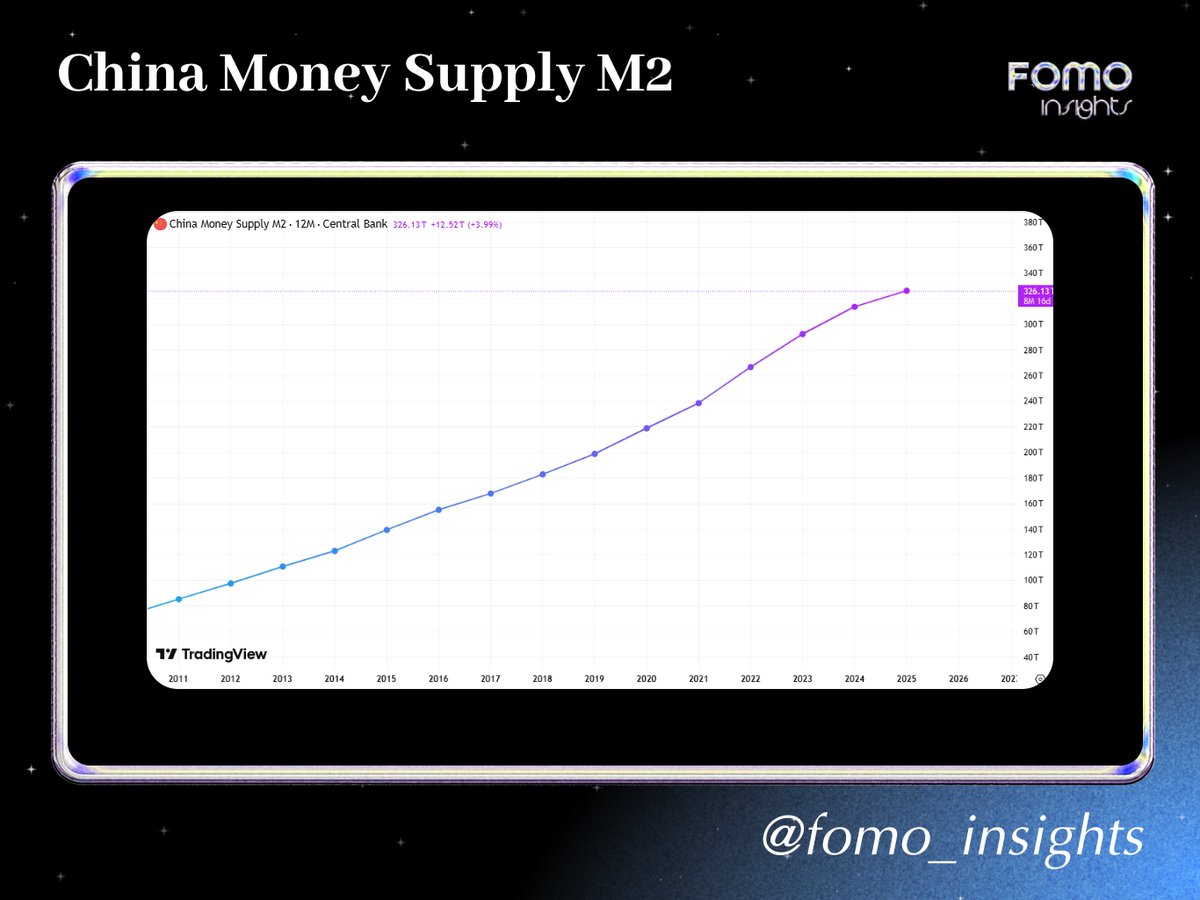

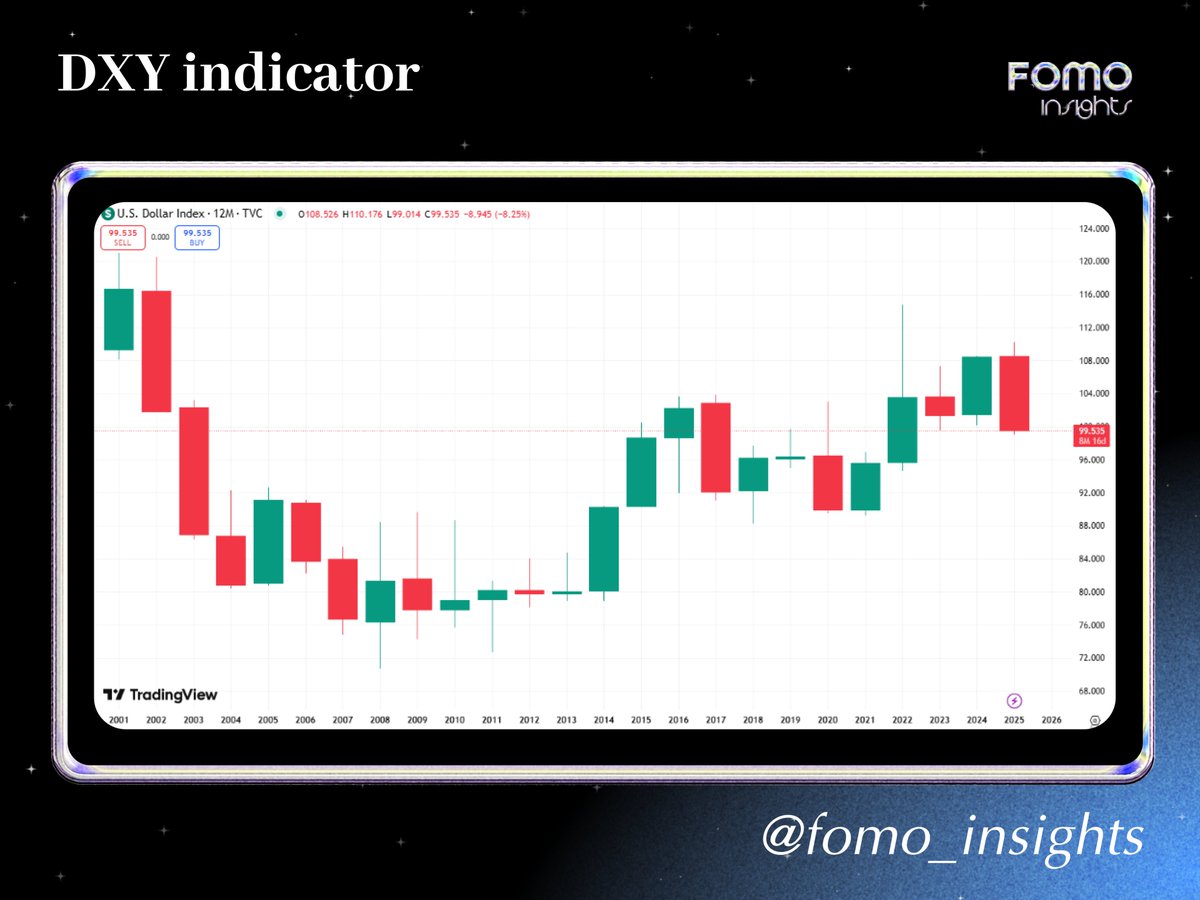

DXY WEAKENS, INTEREST RATES DROP, M2 INCREASES - WHERE WILL THE NEW CASH FLOW GO?

Amid the volatile global economic landscape, with high interest rates feeling like sitting on a pile of fire, and increasingly tense geopolitical uncertainties, investors are struggling with the question: Where will the cash flow twitter.com/FOMO_insights/stat...

2025/04/15 15:41 :

@Ethereum Loses Its Momentum - A Realistic Perspective on the Decline of $ETH's Power

Throughout many years, Ethereum was the perfect model for those wanting to invest in crypto beyond Bitcoin. It was the platform for thousands of DeFi, Non-Fungible Token, DAO applications,...

👉 Link twitter.com/FOMO_insights/stat...

I. GLOBAL ECONOMIC SITUATION - CASH FLOW IS LOOKING FOR A WAY OUT

1/ High interest rates but cannot be maintained for long

The US, Europe, and Japan have all raised interest rates to the highest level in many years to control inflation.

However, economic growth is slowing down significantly:

II. WHY WILL CRYPTO BE MENTIONED?

1/ ETFs signal the legitimization of large cash flows

After many years of rejection, a Bitcoin spot ETF was approved by the SEC in the US in early 2024.

This paves the way for hundreds of billions of dollars from pension funds, banks, and institutions

III. WHAT SHOULD INVESTORS PREPARE BEFORE MONEY FLOWS INTO CRYPTO?

1/ Rethink your investment strategy

Crypto is no longer just a quick and dirty move, but is becoming part of a global asset allocation strategy.

No need to go all in, but need a strategic position

👉 Follow @FOMO_insights to not miss the next ALPHA deals! 🚀

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content