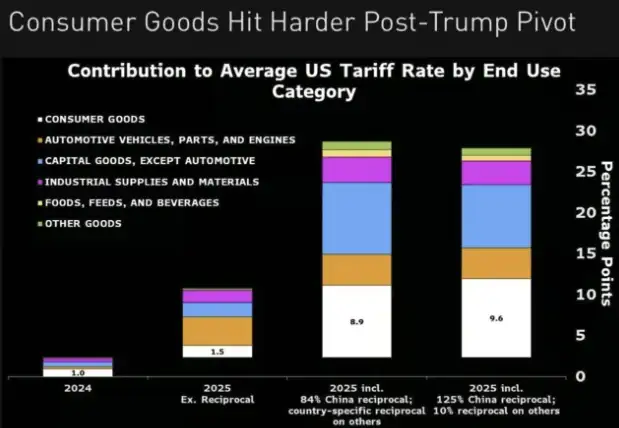

Now everyone is focusing on tariff issues, with the Americans fantasizing about using tariffs to pressure other countries against the Eastern Dragon, with the aim of exerting pressure on China.

VX: TZ7971

Trump is not truly trying to generate income through tariffs on these countries, but rather wants to use tariffs as a bargaining chip to corner them. His purpose is to negotiate and encourage them to exclude Chinese products. In return, he might propose lowering tariffs on them, increasing trade with the US, and providing security guarantees.

What's the next step for tariffs?

There might be a larger game behind this, concerning the changing world order.

The Americans' next step will definitely be negotiations, with the Trump team seeking talks with all countries except China.

In terms of market conditions, after announcing a 90-day tariff suspension, the crypto market rebounded, but the extent was weaker than stocks, and it's still a short-term rebound without a complete market reversal.

China remains the largest influencing factor in this game. However, Trump doesn't want to negotiate with China; he wants to gain support from other countries and try to shift supply chains away from China, which seems more like a power struggle unrelated to tariffs and "fairness".

If the US reaches agreements with countries like Vietnam to exclude China, China might also adopt corresponding macro policies in retaliation. The market might initially view the US agreements positively, but China's counter-policies will bring the market back to reality, as it gradually realizes that the trade war could escalate into a capital war, or even potentially a hot war.

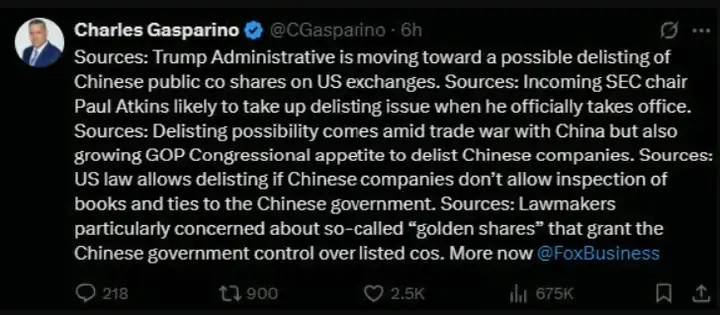

Although there's a 90-day cooling-off period, no solution currently exists that would give investors and businesses more confidence in future planning. As Trump again raises tariffs on China to 145%, the situation is worsening. As revealed by a Forbes senior reporter, Trump might delist Chinese companies from US exchanges.

Bitcoin Might Rise in the Tariff War Context

Looking forward, Bitcoin's fundamentals are improving. Despite many uncertainties, why do I say buying the dips is a good position now? Based on the following signals, liquidity conditions are improving:

Inflation rate is 1.4% (according to Truflation data);

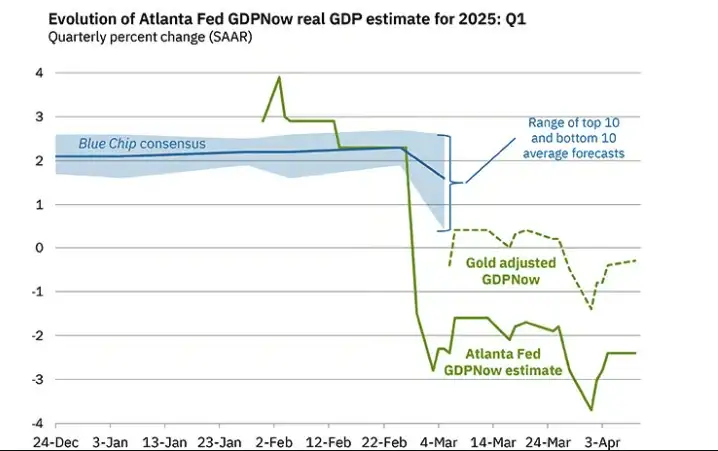

Economic growth is slowing down. Tariffs will accelerate this process

Probability of economic recession increasing (possibly over 50%)

The US Treasury needs to refinance $2.5 trillion in debt by year-end and issue another $2 trillion (to cover deficit), with more issuance needed in 2026.

US Dollar Index has significantly dropped (below 100 dollars)

Additionally, China has begun economic stimulus and is expected to introduce more stimulus measures. As the RMB faces pressure, Bitcoin will receive some buying pressure (similar to the RMB devaluation in 2015 and trade war escalation in 2019).

However, given Bitcoin's volatility, its close correlation with the stock market, and the uncertainty of tariffs and Chinese policies, caution is still advised.

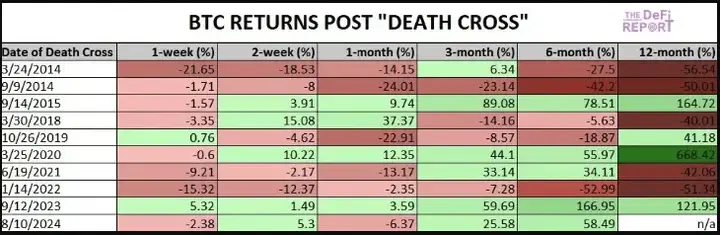

In terms of momentum indicators, Bitcoin's 50-day moving average broke below the 200-day moving average last week (a "death cross"), and is currently trading below the critical 200-day moving average ($85,000). If Bitcoin breaks below its previous high ($70,000), the decline could continue longer, so caution is needed.

However, as this situation develops, we're beginning to see signs of seller "fatigue", which can be observed in Bitcoin's performance after the "death cross".

Importantly, if the Fed begins to ease policies and bond yields rise again in this more stagflationary environment, Bitcoin should perform well. However, the challenge is that stocks (and Altcoins) might not, and given Bitcoin's correlation with the Nasdaq and other risk assets, this could pose short-term resistance to Bitcoin's rise.

Possible scenarios to address next

China participates in negotiations;

Trump backs down;

US Supreme Court intervenes to stop or reduce tariffs, potentially quickly changing the situation.

The US's true intent is to exclude Chinese goods from the global market, and it's unclear if this strategy will work, but tensions might further escalate. Trump's aggressive approach has been effective in many cases, but this might fail because he cannot intimidate the bond market. The more pressure he puts on China, the more resistance he'll face from the bond market.

Despite the 90-day tariff suspension, the market still hasn't found a long-term solution.

If great power tensions escalate and economic conditions continue to deteriorate, market prices are expected to fall further, with the Fed likely to implement (or signal) quantitative easing. This will become a key catalyst for investors to actively allocate to risky assets like Bitcoin.

Today's panic index is 29, maintaining a state of panic.

Yesterday, I told everyone that BTC could use 8.3 as a short-term first entry point, which was reached at four in the afternoon. During the evening, US stocks opened low but rallied, briefly breaking 85,500 before being brought down by Yellen's speech, currently oscillating around 84,000. 8.3 remains a good short-term entry point to watch. The tariff impact has been digested, 8.1 is currently a healthy support, and as long as BTC price remains above this level, the price will continue to recover. Hoping Trump doesn't speak recklessly again.