The MANTRA price crash on Monday raised immediate alarms about possible insider activity and price manipulation, with whales selling their holdings, suggesting that the most informed wallets are reducing their risk. However, industry experts are confident that this incident is just a temporary blip in the long-term bottoming process of the real-world asset (RWA) market.

BeInCrypto spoke to experts from Blocksquare, Credepi, and Quanthive to discuss what went wrong during the token crash, the aftermath, and how it affected the current enthusiasm for tokenized assets.

Price crash

On Monday, the MANTRA (OM) token suffered a devastating price crash . It fell over 90% in less than an hour, wiping out over $5.5 billion in market cap. The sudden drop took OM from $6.33 to under $0.50.

This action immediately raised concerns about insider trading and price manipulation , as the MANTRA team was known to hold nearly 90% of the total token supply.

According to on-chain data, 3.9 million OM tokens were deposited to the OKX exchange from a wallet believed to be associated with the MANTRA team. This large deposit raised immediate alarm within the investor community. The main concern was that the team was preparing for a large-scale sell-off.

“This seems like a classic case of low transparency and high concentration risk. A massive token transfer to a centralized exchange, especially one that is believed to be associated with the core team, is enough to cause panic in an already volatile market.” – Ivo Grigorov, CEO of Credepi

The token experienced a sudden surge of forced liquidations amounting to $66.97 million in 12 hours . This accelerated the fall of OM. The MANTRA team controlled a significant portion of the OM supply, holding 792 million tokens, or approximately 90%, in a single wallet.

As a result, very little of the token was available for public trading, leaving the token vulnerable to significant selling pressure and raising serious concerns about insider activity.

According to recent data, the MANTRA community is still reeling from this week's crash.

Impact on investor confidence

After Monday’s incident, investor confidence in the MANTRA project has been severely damaged. The future of the project also looks bleak.

QuantHive, an AI trading platform, continuously monitors blockchain activity and tracks the movements of key ‘alpha’ traders. According to recent analysis, QuantHive has identified a significant change in sentiment towards the OM token.

“Generally, alpha wallets were net buyers of OM, which shows confidence. However, in the last 48 hours since the crash, $2.5 million of OM has been sold and $1.6 million has been bought. This change suggests a coordinated exit, indicating a lack of confidence in the project’s recovery.” – Felix Huang, Marketing and Community Lead, QuantHive

At the same time, the news of the price crash has attracted significant attention to the project. As a result, there has been a significant increase in on-chain activity for OM tokens over the past two days. However, sentiment remains bearish.

“The surge in address interactions and searches indicates increased interest from investors, speculators, or simply observers following the aftermath. However, despite this interest, the sentiment signals on our platform have shifted to [fear, uncertainty, doubt].”

At the same time, large investors are actively leaving the market.

Whale selling, what does it mean?

During the MANTRA incident, there was a significant sell-off due to large-scale selling by large holders. Blockchain analytics firm Lookonchain tracked 17 wallets depositing a total of 43.6 million OM tokens, worth $227 million, into exchanges starting on April 7.

Who dropped the price of $OM ?

— Lookonchain (@lookonchain) April 14, 2025

Before the $OM crash (since Apr 7), at least 17 wallets deposited 43.6M $OM ($227M at the time) into exchanges, 4.5% of the circulating supply.

According to Arkham's tag, 2 of these addresses are linked to Laser Digital.

Laser Digital is a strategic… pic.twitter.com/zB8yAPRPSO

This amount represents 4.5% of OM’s circulating supply, highlighting a massive sell-off by major investors. Huang believes this data is significant evidence that whales are reducing their exposure to MANTRA.

“The data suggests that the most informed wallets are now reducing their risk. This is a reaction to the overall chaos. Whatever the cause, retail and institutional observers should be cautious. The whales have spoken, and they are now heading for the exits,” he explained.

This conclusion was readily accepted, given the long-standing concerns about the project's fundamentals.

Early Signs of Mismanagement

Last year, there were accusations that the MANTRA team used market manipulators to manipulate the token price . There were also reports that they changed the token’s economic structure and repeatedly postponed community airdrops. There were also reports that MANTRA offered tokens at significant discounts through private over-the-counter (OTC) trading, including at half the market value.

What happened this week has fundamentally changed our outlook on the sustainability of our project.

“These kinds of collapses don’t happen overnight. They reflect deeper concerns that have built up over time. When a project leaves too many questions about supply dynamics, communication, and past promises, the negative triggers are amplified,” Grigoroff said.

The lack of public disclosure has permanently damaged public confidence in the project.

“In crypto, the community is not just a bystander. It is essential to the success of the project. If concerns about change, tokenomics, and transparency are not addressed, a trust deficit can develop, which can quickly escalate, especially in volatile markets,” Denis Petrovcic, CEO and co-founder of Blocksquare, told BeInCrypto.

He also emphasized open, honest, and consistent communication with the community.

“Once trust is broken, even small incidents can cause overreaction. This incident underscores how important it is to treat the community as a long-term partner, not a short-term audience,” Petrovcic added.

Meanwhile, the fact that the project's leaders held nearly the entire token supply quickly raised suspicions of insider trading.

“This is one of the biggest vulnerabilities in crypto, especially in an area like RWA where we are trying to build serious capital and trust. If a team holds too much supply, it is not only a market risk, but also a narrative risk. Even the perception of internal activity can scare users,” Grigoroff added.

Despite the severity of the MANTRA collapse, industry leaders are optimistic about the prospects for the RWA industry .

RWA's Sustainable Potential

For Grigoroff and Petrovčić, MANTRA was a minor issue in the process of developing tokenized assets. However, their integrity remains intact.

“This is a blow to one project, not to the entire concept of RWA. If anything, it further underscores why standards are so important in this space. RWA is not just a DeFi narrative. It is an entry point for real-world institutions, investors, and borrowers,” Grigoroff said.

Petrovcic agreed with this sentiment, arguing that while short-term confidence may be affected, the broader RWA market does not face systemic risks.

“This space is much larger than a single token or project. In fact, many teams have been working in this space for years, long before RWA became a market narrative. These projects are based on legal frameworks, real-world integrations, and infrastructure that goes beyond token price speculation. This case further clarifies the line between narrative-driven high-interest and serious developers who value long-term utility and regulatory compliance,” he said.

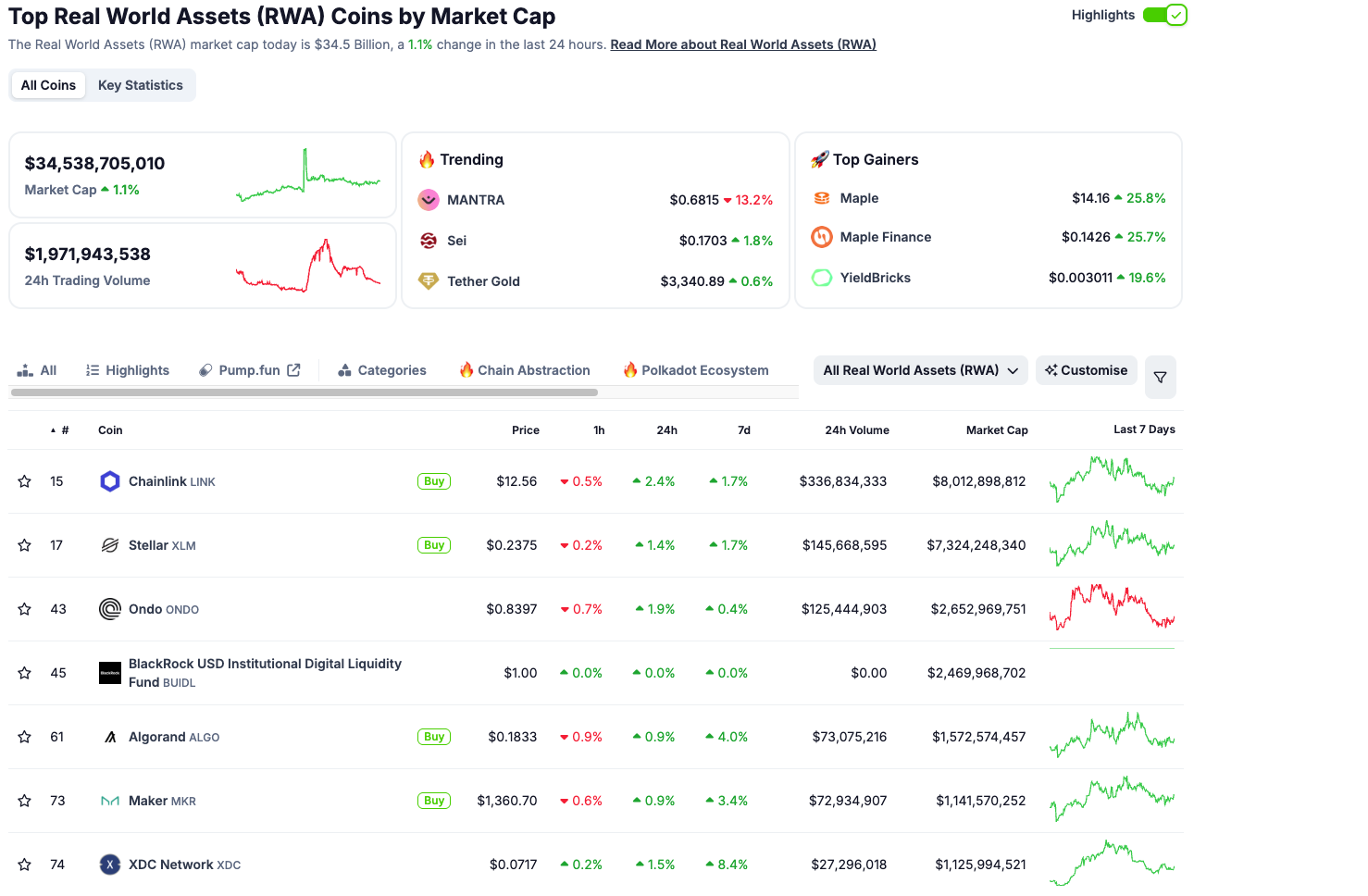

The overall momentum and potential of the space is evident in key metrics. According to CoinGecko, the total market cap of RWA coins is currently over $34.5 billion, with nearly $2 billion traded in the last 24 hours.

This week's MANTRA incident should serve as a lesson for the future .

What can we learn from the MANTRA price manipulation allegations?

For Petrovčić, the key lesson from the MANTRA situation is that Web3 requires building public trust and validation without relying on centralized authorities.

He emphasizes that transparency, clear token allocation, long-term vesting, and open communication are key to building this trust.

“Ambiguity, especially when it comes to large token movements, undermines trust and creates confusion. RWA projects have to meet particularly high standards. We are not just building a protocol, we are connecting the on-chain system to real-world assets and legal frameworks. This requires maturity, not just momentum,” Petrovcic told BeinCrypto.

Grigoroff shared similar sentiments, emphasizing the need for effective communication.

“If a team is moving a large amount of tokens, even for operational reasons, they need to explain it up front. Accountability is not just about doing the right thing internally, but also showing it to the public. This emphasizes the importance of predictable token release schedules, public wallet tracking, and ideally a gradual transition of control to decentralized governance as the project matures,” he said.

MANTRA Incident, a turning point?

The MANTRA incident shocked the cryptocurrency market and reminded investors of the dangers of opaque practices and concentrated token ownership.

However, the broader future of the RWA industry remains bright. The market size of this sector demonstrates genuine interest and continued development in this field.

While it may be painful for those directly affected, the MANTRA incident is an important learning opportunity. It highlights the difference between projects driven by sustainable principles and those vulnerable to high stakes and mismanagement.

The significance of the MANTRA incident going forward lies in the valuable lessons it provides to the RWA sector. By applying these lessons diligently, the RWA industry can reduce the risk of similar incidents, increase investor confidence, and ultimately realize its vast potential.