On April 18, 2025, market maker Wintermute announced that its investment firm Wintermute Ventures has invested in the DeFi lending protocol Euler Finance.

Wintermute Ventures also published an investment thesis on Euler on the same day, compiled by Jinse Finance's AIMan, as follows:

In this investment paper, Wintermute Ventures believes that Euler Finance v2 has cracked the code and become the complete DeFi liquidity layer, which is also the reason why Wintermute Ventures announced its investment in Euler.

Current Status

The current status of on-chain money markets can be classified through three architectural design frameworks: monolithic, isolated, and modular.

Monolithic lending protocols limit lending by restricting asset selection, imposing strict loan-to-value (LTV) requirements, and high liquidation penalties. These protocols help improve capital efficiency by pooling collateral for different purposes and allowing re-collateralization. However, they only allow adding new collateral types under limited economic conditions, typically through governance measures.

Isolated lending markets offer greater flexibility but also fragment liquidity and hinder re-collateralization, thereby reducing capital efficiency. Additionally, traders often must navigate multiple protocols, governance systems, and interfaces, incurring extra costs. Isolated lending protocols like Compound Finance v3 or Morpho Blue allow more flexibility in collateral usage but also disperse collateral and impede re-collateralization, reducing capital efficiency. These inefficiencies drive traders towards centralized finance (CeFi) and perpetual contracts instead of decentralized spot markets, reducing DeFi lenders' returns and overall DeFi liquidity and efficiency.

Euler v2 is a modular lending platform designed to address these issues and become the primary liquidity layer for DeFi.

Euler's Core Concepts

In brief, Euler v2 is a highly modular DeFi money market infrastructure. It streamlines DeFi lending markets to core components and modularizes them, allowing the creation of almost any type of DeFi money market to suit various risk appetites, from conservative lenders seeking high-quality collateral to high-yield investors willing to participate in high-risk markets. We believe this modular framework makes Euler v2 an attractive monetary market foundation, as this enhanced flexibility can attract borrowers and asset managers with different risk preferences. Unlike traditional monolithic lending protocols with strict collateral requirements, Euler v2 introduces a highly flexible ERC-4626 vault-based system, significantly improving capital efficiency and liquidity utilization. Euler v2 is based on two core concepts: the Ethereum Vault Connector (EVC) and the Euler Vault Kit (EVK). The EVK supports permissionless vault deployment, which can be interconnected via the EVC, recognizing existing vault deposits as collateral. Creators define all risk/reward parameters and choose whether to maintain governance for active management or permanently relinquish governance control, allowing lenders to manage risks independently.

[Images omitted]

Flywheel Effect

Euler vaults can identify deposits in other vaults as collateral, solving the bootstrapping problem and enhancing liquidity. In this context, we are particularly excited that when new vaults accept deposits from existing vaults as collateral, existing vaults gain additional utility, and new vaults can leverage existing TVL, accelerating adoption. This creates a flywheel effect: more use cases increase utility, attracting more deposits. Conversely, increased deposits lead to broader vault adoption as collateral, further enhancing TVL growth and the ecosystem's capital efficiency. Since its launch, Euler has proven this theoretical approach translates well into actual data: the current average utilization across all vaults is around 47%, with Euler's capital efficiency far surpassing other market participants.

[Images omitted]

Liquidation Mechanism

Another notable feature of Euler v2 is its liquidation mechanism, which is among the most efficient in DeFi, allowing vault creators to customize the liquidation process. By default, it uses Euler v1's reverse Dutch auction mechanism, which minimizes liquidation costs and protects borrowers and lenders. This mechanism allows liquidations to occur near execution marginal cost. Smaller positions often pay relatively high liquidation fees, while larger positions enjoy proportionally reduced fees. This is because liquidations typically have fixed costs that decrease relative to position size. The mechanism ensures fair compensation for liquidators without unnecessary MEV or overly punitive fees for borrowers, which fixed liquidation fees often cause. Moreover, Euler does not charge additional liquidation fees that many other lending protocols impose for extra revenue.

On the frontend, Euler offers a comprehensive suite of product features tailored for passive users and advanced traders. Beyond standard lending protocol functions, its standout features include:

Multiplication Feature: Facilitates leveraged trading and yield cycling. Users can create leveraged positions by providing collateral, borrowing, swapping, and re-supplying.

Transaction Batching: Executing multiple operations in a single transaction via EVC. Built-in delayed state checks allow flexible operation sequencing, while simulation mode enables previewing results to reduce risk.

Portfolio Management: Helps users monitor and manage positions. Health scores indicate liquidation likelihood, and quick actions allow users to supplement collateral or repay debt. Advanced analytics provide insights for position optimization and maximizing returns.

Euler Vault Explorer: Euler simulates real-world credit market complexity while offering a transparent risk view. Users can analyze vault risks through Euler's Vault Explorer or third-party dashboards.

Growth Momentum

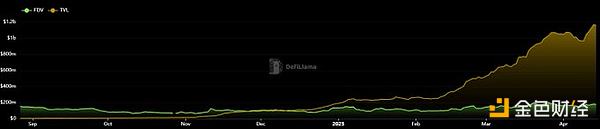

Since launch, Euler v2 has gained significant attention, with its TVL surging over 250 times, making it currently the fastest-growing lending protocol in DeFi. Monthly active users grew from under 1,000 to 10,000 in April 2025, steadily setting new records. Additionally, active loan amounts have grown from $88 million to $510 million this year, an increase of approximately 480%. Notably, this growth was achieved with only about $2 million in protocol incentives deployed. These metrics are highly significant to us. In an environment where liquidity mining often attracts short-term, opportunistic capital leading to meaningless engagement metrics, Euler has proven that true organic growth with genuine users is possible with minimal financial incentives—provided the product experience is truly exceptional like Euler's.

Since its launch, Euler's market cap has remained relatively stable while daily fees and TVL have rapidly increased.

[Images omitted]

Source: defillama

Source: defillama

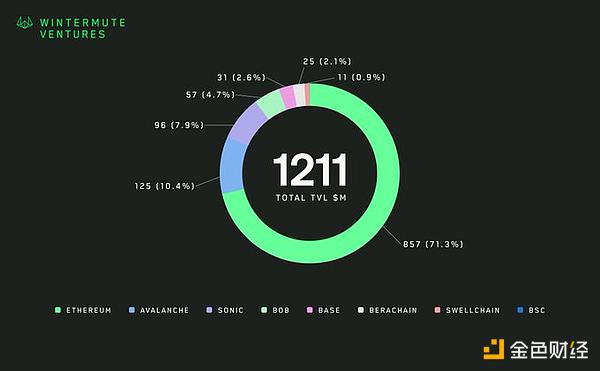

Multi-Chain Expansion

Multiple factors are driving Euler's recent TVL growth: Euler focuses on multi-chain expansion, rapidly deploying on emerging EVM chains over the past six months, attracting significant TVL and establishing its dominance as a leading money market on emerging networks. In 2025, Euler v2 will expand to fast-growing blockchains such as Base, Sonic, Berachain, Bob, and BNB Chain, gaining substantial attention and steadily announcing new chain expansions, such as Optimism.

So far, Euler's blockchain expansion has been successful, with smaller blockchains currently accounting for approximately 27% of total TVL.

Source: defillama

EulerSwap

Lastly, crucial for Wintermute Ventures is the vision of Euler's upcoming EulerSwap product (an automated market maker AMM directly integrated with its money market), aimed at solving liquidity fragmentation issues and enhancing yields. This swap product is not only uniquely and efficiently designed, but by integrating the swap market, Euler is also positioning itself as a one-stop platform for DeFi liquidity, thereby making the protocol a complete ecosystem. We are excited about this vision and look forward to supporting it with our expertise.

Summary

Wintermute Ventures is thrilled to invest in what we consider one of the most promising protocols in the DeFi space. Since the v2 release, Euler has become the fastest-growing lending protocol, with its fully diluted valuation remaining relatively stable. Its modular architecture can serve as DeFi money market infrastructure, catering to various risk appetites from conservative institutional strategies to experimental retail products. This marks the beginning of Euler's limitless possibilities and the start of an exciting journey for Wintermute Ventures as Euler's partner and investor.