The Aptos community is currently evaluating a new governance proposal, AIP-119, which could halve staking rewards in the next three months. This proposal aims to reduce the current annual staking yield from around 7% to 3.79%.

Aptos Labs' senior engineer, Sherry Xiao, and the network's core developer, Moon Shiesty, introduced this proposal on 04/18.

Aptos Considers Cutting Staking Rewards to Fund New Initiatives

Proposal AIP-119 describes staking rewards as a "risk-free" standard, similar to the role of interest in traditional finance. According to the proposal, the current 7% yield rate is too high and does not encourage efficient capital use in the ecosystem.

Instead, the authors want to reduce the yield to around 3.79%. They hope this change will encourage network users to pursue more dynamic economic activities beyond passive staking.

According to them, this could stimulate demand for more active strategies, such as reStaking, MEV extraction, and participation in DeFi.

"I expect any decrease in staking demand [will] be offset by reduced inflation from this AIP and new reward opportunities launching in the next 6 months, and other DeFi reward sources," Shiesty added on X.

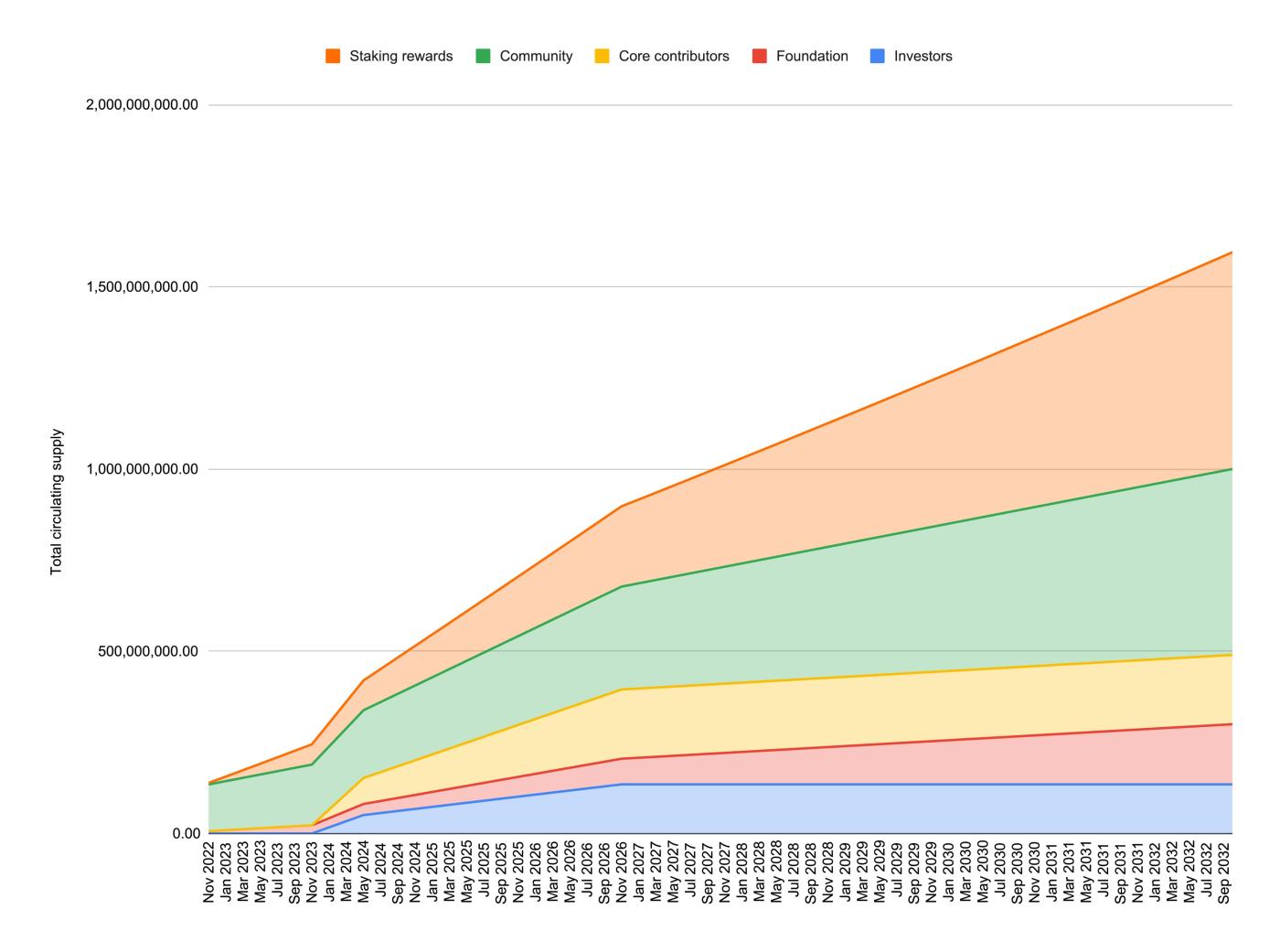

Aptos Total Circulating Supply. Source: X/Shiesty

Aptos Total Circulating Supply. Source: X/ShiestyFurthermore, Shiesty pointed out that part of the saved emissions could support initiatives like liquidity incentives and gas fee subsidies. He also mentioned that stablecoin-related programs could benefit, especially in early-stage Layer 1 experiments.

Although the proposal has broader ambitions, AIP-119 raises concerns about validator sustainability. According to the proposed changes, smaller operators with low stake volumes might face financial difficulties.

Shiesty noted that operating a validator node in a cloud environment can cost between $15,000 and $35,000 annually. Currently, over 50 validators manage less than 3 million APT each, representing about 9% of the network's total stake.

For this reason, the proposal introduces a validator delegation program to support these smaller players. This initiative will allocate funds and delegate tokens to help maintain decentralization, geographical diversity, and community participation.

Meanwhile, the community's reaction to the proposal has been divided.

Yui, COO of Telegram game Slime Revolution based on Aptos, warned that smaller validators might be pushed out. The director emphasized the importance of finding a balance that encourages innovation without sacrificing decentralization.

"While it may drive innovation, I'm concerned about the potential impact on smaller validators and decentralization. We need to ensure this move doesn't push smaller members out! Aptos should focus on long-term balance and resilience," Yui wrote on X.

However, Kevin, a researcher at BlockBooster, argued that the change could benefit Aptos in the long term. He noted that high inflation often masks weak product-market fit. Conversely, low inflation forces developers to build real demand.

Kevin also suggested that reducing token emissions could improve APT's scarcity and increase its price, potentially balancing out lower staking yields.

"We expect APT price to rise due to reduced inflation rate, and validators' actual profits may offset APY decline through price appreciation, creating a positive cycle," Kevin concluded.