Original | Odaily (Odaily China's @OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies primarily focused on stablecoins (and their derivative tokens) in the current market, to help users seeking ideal interest-generating opportunities to gradually expand their capital scale (Odaily Note: Systemic risks can never be completely eliminated).

Previous Records

Lazy Finance Strategy | Focus on Berachain, Raise Reslov Airdrop Expectations (March 31)

New Opportunities

Unichain Liquidity Incentives

Unichain's incentive program's first phase officially launched on April 15, with 12 liquidity pools sharing $5 million in UNI incentives over two weeks.

Merkl data shows that the only stablecoin pool USDC/USDT 0 (Note: USDT 0 is the cross-chain version of USDT based on LayerZero) currently has a TVL of $113 million, with an APR of around 13.65%.

For users with low risk tolerance who only want to invest in top DeFi protocols, Unichain is expected to provide considerable incentives in the coming months, and users can choose to cross-chain transfer when gas is low.

Superform Confirms Token Issuance

On April 16, cross-chain yield market Superform announced the establishment of a foundation and will launch the token UP this year.

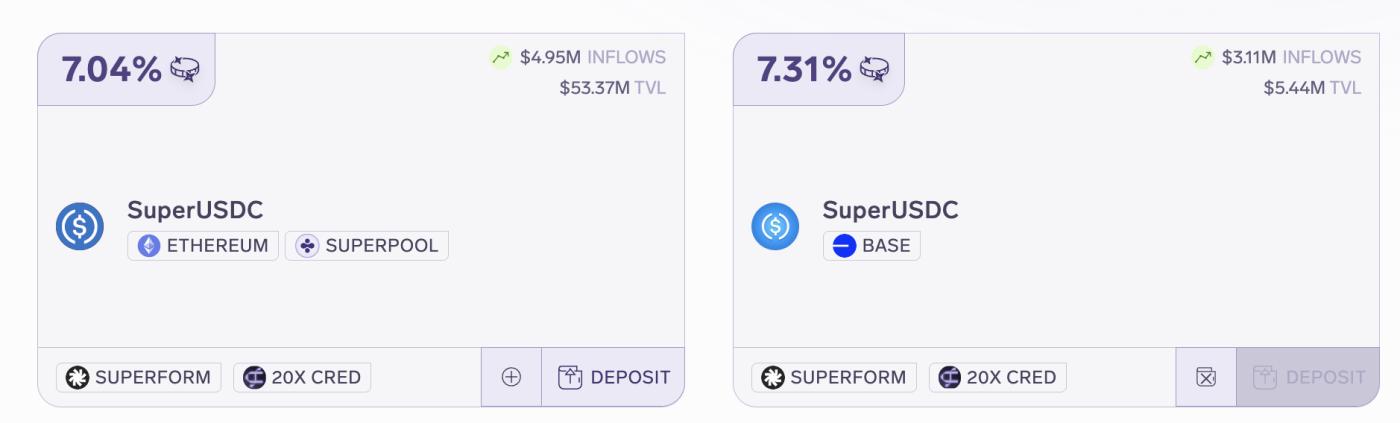

Simultaneously, Superform (portal: https://www.superform.xyz) also announced a new points program. It's worth considering - Superform's USDC main pools on Ethereum and Base both have APYs over 7%, and even higher in Pendle pool groups, with mining returns not bad either.

Resolv Raises Funds

On April 16, Resolv Labs announced completing a $10 million seed round, led by Cyber.Fund and Maven 11, with participation from Coinbase Ventures, Susquehanna, Arrington Capital, and Animoca Ventures.

We mentioned raising expectations for Resolv's airdrop in the March 31 article, as USR already has a certain advantage among the new batch of interest-bearing stablecoins, and the founders have a clear vision for the protocol's future development.

Resolv's points activity has been open for a while (portal: https://app.resolv.xyz/ref/azuma), and users who haven't participated can consider joining now.

Binance Wallet Sei DeFi Season 2

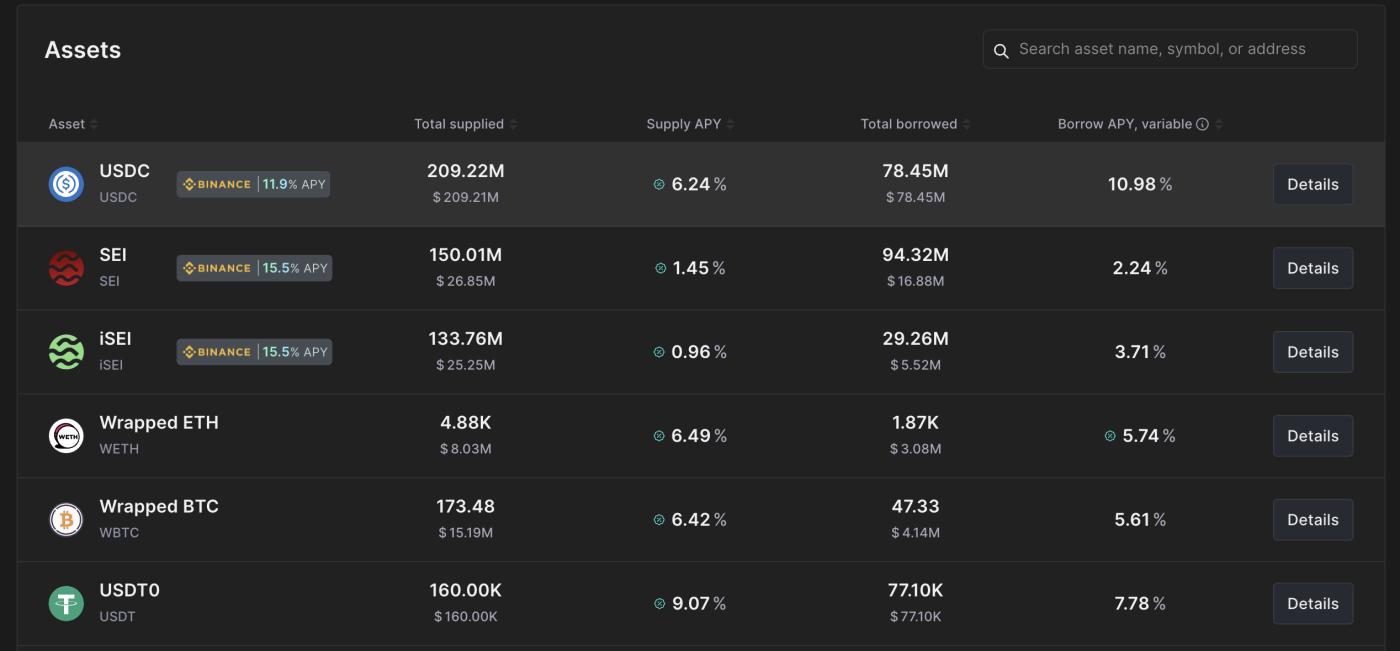

On April 15, Binance Wallet announced the launch of the second Sei DeFi season, which will last 6 weeks with a total prize pool of $1.4 million, with the main partner (occupying $1.3 million of the pool) still being Yei Finance.

Currently, by depositing USDC on Yei Finance through Binance Wallet (portal: https://app.yei.finance/referral/?ref=auzma), the real-time APY is reported at 11.9%, and users can also receive points rewards with potential airdrop expectations.

For details, refer to 《Analyzing Sei Ecosystem Leader Yei Finance: Binance Wallet's Stablecoin "Gold Mine"》.

Falcon Points Program

DWF Labs partner Andrei Grachev stated that the institution's stablecoin Falcon Finance will release its public beta product and announce points program details during Token 2049 in Dubai.

Token 2049 will be held from April 30 to May 1, so just wait a bit longer for specific information, and stay patient.