statement:

Arf has a powerful Treasury Management system based on Circle Ominbus to complete various transactions with customers and their partners. Suppose a customer's loan period is three days. Every day, the customer will repay the USDC borrowed three days ago. At the same time, upload today's remittance voucher and apply for today's loan. After verification, Arf will transfer the USDC to the customer's partners around the world. The customer's partners will use these USDC to complete the settlement and then notify the remitter, that is, Arf's customer.

First of all, the purpose of this article is to introduce the product and business model, not to sell or promote the product. The starting point is to objectively and neutrally describe what Huma does and how it works.

This article does not constitute investment advice. Any investment behavior is accompanied by risks. Please make sure to conduct sufficient independent research before making any decision.

1. What are Huma’s products and business model?

Huma is the first PayFi network, including the PayFi basic platform and a series of killer apps. Some apps are owned by Huma, and some will be third-party apps. For example, Google has the Android platform, and also has some of its own super apps, such as YouTube and Gmail, and also supports many third-party apps. The platform creates imagination space, third-party apps help expand the scale, and its own super apps are "cash cows". Since recent discussions are mainly around Huma's business model, this article will focus more on our super app Arf. In the future, there will be another article to describe the functions and roadmap of our PayFi basic platform.

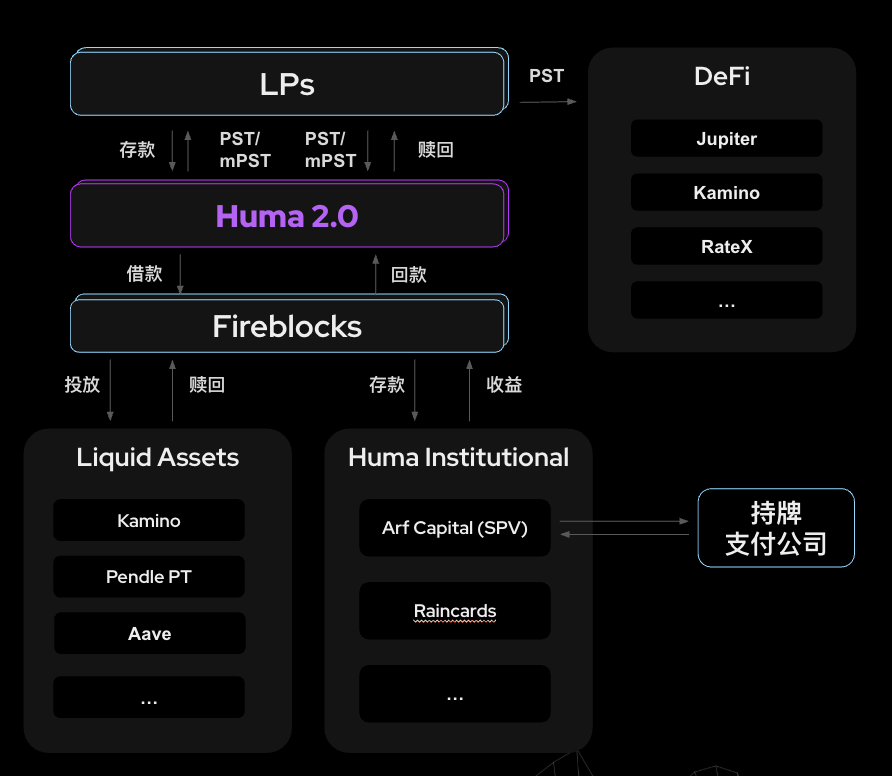

With the launch of Huma 2.0, Huma has two products:

- Huma 2.0, permissionless, retail investors can participate. Provide real yield from PayFi Strategy, the current APR is 10.5%, this interest rate may change every month, but the expected change is relatively small. At the same time, Huma Foundation will provide incentive Feathers. Huma 2.0 runs a PayFi Strategy, most of the funds will be invested in various PayFi assets in PayFi Institutional, and another part of the funds will be invested in market-neutral liquid DeFi protocols to meet LP redemption requirements.

- Huma Institutional requires KYC/KYB, and professional investors or institutions can participate. The main investment directions include cross-border payment advance business and some applications of credit card T+0 settlement. The cross-border payment business is implemented by the subsidiary Arf, and the credit card business is a third-party partner that currently includes Raincards. In the second half of this year, there will be more partners released.

When users participate in Huma 2.0, they can choose Classic mode or Maxi mode. After investing funds, they will receive LP tokens of $PST (PayFi Strategy Token) or mPST (Maxi mode). PST tokens can be integrated with mainstream DeFi on Solana, allowing LPs to participate in DeFi composability.

Huma's business model is relatively straightforward. The APR provided to LPs will be adjusted every month based on the macro situation, but will be relatively stable overall. Huma will invest these funds in PayFi assets and DeFi protocols with liquidity, and the income mainly lies in the spread between these two aspects. The Huma Institutional pool will also have protocol fee income.

2. What is the relationship between Huma and Arf? What does Arf do?

Arf was a client of Huma before. In 2024, Huma and Arf merged. Since both brands are strong in their own fields, we did not force the two brands to merge, but continued to use both brands. Huma focuses on the connection with the capital side and the demand side other than cross-border payments, while Arf continues to deepen its presence on the demand side of cross-border payments.

Arf is a financial institution registered in Switzerland and is supervised by the SRO (Self Regulatory Organization) system under the Swiss Financial Market Supervisory Authority (FINMA). It currently holds the VQF (Verein zur Qualitätssicherung von Finanzdienstleistungen) license and can provide stablecoin-based settlement services to licensed payment institutions around the world. Arf is the most successful application of USDC in payment. Everyone is welcome to learn more about it through the case study of Arf and Circle.

Arf does not directly serve end customers of cross-border payments, whether 2B or 2C. It can only serve licensed payment institutions and financial companies. These customers are also under strict supervision, and their customer funds are stored in Safeguarding Accounts protected by supervision and can only be used for settlement purposes. Arf's customers are currently concentrated in developed countries, including the United States, the United Kingdom, France, Singapore, and the United Arab Emirates. Arf does not serve countries with strong foreign exchange controls, such as China. Currently, the customers that have been announced to the public include Lulu Financial.

3. How does Huma earn 10.5% of its profit? Is it a Ponzi scheme? Is the fee charged to customers sustainable?

There are two main accounts to be settled here, one is Huma, the other is Arf

Huma side:

Cost of capital: 10.5%

Income: The goal is to use 80% of assets for PayFi assets, with an annualized return of at least 12.5%; about 20% for liquid digital assets, currently with a return of 7%, and an overall return of 11.4%. After deducting overhead and various fees, it will be around 11%. Even if all funds enter the Classic mode, there will be a certain surplus. In fact, 12.5% of PayFi assets is the lower limit. When more funds mature from the Huma Insitutional end and enter Huma 2.0, the proportion of PayFi Assets will also increase, thereby pushing up the overall return. In addition, the Maxi mode will also bring more income surplus to the protocol.

Arf side:

Cost of capital: 12.5%

Revenue: Arf charges 6-10 basis points from clients every day, and usually only generates revenue on weekdays, with an annualized rate of about 15%-25%. Arf's clients mostly require committed liquidity, which means that even if they don't need that much liquidity, they still have to pay committed fees. When we designed the business process of Huma 2.0 and Arf, we gave Arf greater flexibility to decide when to borrow and repay money from Huma 2.0, helping it achieve a capital utilization rate close to 100%. This ensures that Arf has a relatively reliable margin.

Are the charging standards sustainable?

If you simply look at it from the perspective of APR, compared to the regular Trade Finance interest rate, this APR is relatively high, but this reference is unreasonable. Arf is engaged in Payment Transaction Financing, and a more reasonable reference is the fees of various cross-border payments. Many transactions will be 200-500 basis points, and paying dozens of basis points to the advance payment party is acceptable.

- Traditional remittance services such as Western Union or Moneygram charge 2% to 5% per transaction.

- Wire transfer: Regardless of the amount, it usually costs $20 to $60. If calculated based on an average amount of $1,000, it is also 2%-6%.

- In the same industry, the daily cost of clearing loans between sister companies is also 10 basis points per day, which further proves that the pricing is reasonable.

4. Is Huma a P2P platform? What is the difference between it and similar platforms at home and abroad? How to avoid similar risks?

The problems with traditional P2P are:

- After the money is lent, it is difficult to know what it is used for;

- Many loans have long loan periods (6 months, 12 months), and the risks are difficult to control;

- Inadequate supervision of borrowers

Huma is completely different:

- The purpose is very clear: 80% of the funds are targeted to be used for Payment Transaction Financing, with major applications including short-term advance payment of cross-border payment settlement and credit card settlement funds; 20% of the funds are targeted to be invested in highly liquid DeFi protocols to meet user redemption needs.

- The capital utilization cycle is short, usually only a few days;

- The use of funds is transparent and traceable. All fund flows are displayed on Dune. Huma 2.0 will have monthly reports every month. Huma Institutional also has monthly reports for its LPs, and PWC will have an audit report every year.

- Except for DeFi (for which there is no regulatory framework globally), all other parts are under strict supervision (Arf is a regulated entity and its clients are all regulated licensed financial institutions).

5. What are the substantive differences between Huma and supply chain finance?

First of all, there is a huge difference in risk between Invoice Financing/Supply Chain Finance and Payment Transaction Financing.

In supply chain finance, repayment relies on accounts receivable, but it is only accounts receivable, not money!!! When the loan is due, there is more or less uncertainty as to whether the borrower has the money, and the risk is higher than we are willing to accept.

What is the difference between Payment Transaction Financing and Payment Transaction Financing? Money has entered the financial system. What is lacking is not money, but a method to reach its destination quickly. We help money reach its destination quickly and achieve faster settlement, and the borrower returns the money to us on the chain at the original place. To put it bluntly, many payments in real life need to go through various levels of banking systems, just like traditional mail, which needs to be delivered one level at a time. We use stablecoin to transfer to the destination directly, just like email, which reaches the destination quickly, speeding up and creating value. We only need to ensure that the money of the remitter is locked in safeguarding or other custodian accounts, and we have a legal claim.

Secondly, the value that blockchain technology brings to these two is also substantially different. The account period of supply chain finance is generally 90 to 180 days, and a one or two day faster will not have much impact. Payment Transaction Financing can change payment from T+3/T+4 to T+0/T+1, which will speed up the entire financial system in the world, just like China's evolution from green trains to high-speed trains, which is a substantial change. Improving 0.1 seconds in running 100 meters and improving 0.1 seconds in running 5,000 meters have completely different impacts and values.

6. How does Arf manage risk?

First, Arf’s clients are all licensed financial institutions, and most of them are in developed countries, such as the United States, the United Kingdom, France, Singapore, and the United Arab Emirates.

Second, Arf has a complete transaction financing risk control model. It rates clients based on their financial and compliance, as well as the risks of their payment paths. Currently, it only serves Tier 1 and Tier 2 clients, and does not serve Tier 3 or below clients.

Third, the client must deposit the end customer's money into the Safeguarding Acount and upload the remittance voucher to Arf before Arf will approve the loan. According to S&P statistics over the past 20 years, the bad debt rate is 0.25% after the money enters the financial system. Since Arf's service targets are mainly Tier 1 and Tier 2 in developed countries, and the account period is relatively short, the bad debt risk should be lower.

Fourth, the payment period is 1-6 days. If the customer shows any signs of difficulty, Arf will know it very early and will lower the limit or stop lending.

Fifth, the money deposited into the Safeguarding Account should be used for a specific purpose. In the most extreme case, when the client goes bankrupt, we believe that we have a legal claim on the funds in these Safeguarding Accounts. Because we have never had such bad debts, there is no actual verification of this link.

Sixth, all funds are managed through Arf Capital, a bankcrypto-remote special purpose vehicle, which is completely separate from Arf’s operating company, Arf Financial.

Seventh, the Private Placement Memorandum requires Arf Capital to use its own profits to set up a 2% first loss cover. When bad debts occur, this first loss cover will be the first to be affected.

To date, Huma has completed transaction flows of US$3.9 billion without any bad debts.

7. How big is the market size? If we want high returns and low risks, will the market be very small?

If you look at it from the perspective of traditional APR, 10% is quite high. However, Arf's charging model is not APR, but payment transaction fee for each transaction. The entire payment industry charges in this way. I have explained in detail the general charging standards of this industry in question 3, and our charging is generally consistent with the industry. I have also explained in detail our risk control model in question 6. We believe that using stablecoins to provide liquidity for global payment settlements best utilizes some of the technical advantages of blockchain and is a dimensionality reduction attack on existing solutions. We are confident that we will continue to manage risks and expect today's earnings to be sustainable.

Secondly, the overall scale of the PayFi market is quite large. There are three main known PayFi segments. At the same time, we also believe that PayFi may have a significant impact on other areas, such as foreign exchange rates.

- Cross-border payment funding: Globally, $4 trillion is tied up in various funding accounts.

- Credit card payments: Sixteen trillion US dollars are used for credit card settlements worldwide.

- Trade Financing: The volume is 10 trillion US dollars per year - the payment period is long, and the income is only slightly higher than 10% in many places. We are not doing this business at this stage.

Cross-border payments have locked up $4 trillion in various funded accounts, and all of this is our potential business. Even if we deduct the client's counter-trading, the demand is still very strong. Now there are many clients waiting to go online, and the demand from clients already in the pipeline is 10 times that of Arf's current business (~$60M active liquidity). The question is not whether there is enough demand, but how to help these clients pass bank regulatory approval and go online as quickly as possible.

Credit cards put greater pressure on cash flow for small and micro businesses, so they are willing to pay reasonable fees in exchange for T+0 or T+1 payment. The entire market is 16 trillion, so even 1% is a huge market. The team has currently negotiated with several card organizations, acquirers, or issuers for cooperation, and the funding requirements are often hundreds of millions of dollars.

In short, we believe that PayFi will bring disruptive changes to cross-border payment advances and credit card payments, and the long-term market size is huge. At the same time, we must also admit that this is a very new track, not everything can be seen clearly today, and if I really say a very specific market size, it is mostly unreliable. But as long as we see that this is the best application of blockchain and stablecoins, and we already have a certain scale of traffic of billions of US dollars to verify, and continue to work hard, more and more opportunities will be discovered and the market size can be quantified.

8. What are the similarities and differences between you and Ripple XRP?

Huma and Ripple are on the same track, but there are actually two very key differences:

First, Ripple used to rely mainly on $XRP as a medium to settle transactions. XRP will inevitably have relatively large fluctuations, which brings great risks and uncertainties to customers and their own systems. Huma firmly chose to use the stablecoin USDC from the beginning. There is no need to carry the huge burden of price fluctuations. In fact, Ripple is now aware of this problem and they are also trying to issue their own stablecoin.

Second, Ripple prefers to adopt a "closed loop" system, and they hope to complete all links by themselves. Huma's concept is to create an "open architecture (Open Stack)", and open cooperation can bring greater ecological effects. In July last year, PayFi's Open Stack was released. From the underlying public chain, stablecoin, custody (custodian) and other dimensions, it has united many top partners, such as strategic cooperation with Solana and Stellar at the payment protocol level, cooperation with Circle in stablecoin, and Fireblocks in custody. In each link, the strongest partners in the industry are selected to jointly build an open, efficient and compliant payment solution. This allows us to gather the power of major ecosystems relatively quickly to accelerate development.

Back to the data, Ripple claims that its transaction volume has reached 70 billion US dollars, which took 11 years. Huma has achieved nearly 4 billion US dollars in transaction volume in just over two years. At Huma's current development speed, it is expected to exceed 10 billion US dollars by the end of this year. If all goes well, it is expected to catch up with Ripple's announced transaction volume in the next two to three years.

9. Do you provide Invoice Financing or Credit Loans?

Invoice Financing and credit loans are mentioned in our old documents. Although the Huma protocol is flexible enough to support these applications well, based on our risk analysis of this track, we will not enter this sub-track in the foreseeable future. When the time is right, we will introduce third-party ecological applications with strong professional backgrounds in related directions.

10. After users deposit USDC, what is the life cycle of the entire fund and the process of profit repatriation?

The following figure includes several links:

- User interaction with Huma 2.0

- Strategy Manager borrows money from Huma 2.0 and invests it in PayFi assets and Liquid DeFi assets

- Arf's process with its clients

- Composability of PST and DeFi

LP and Huma’s business process:

After users deposit money through Huma DApp, they will get the corresponding PST or mPST. The value of PST will go up over time. If the current APY remains unchanged for one year, the value of PST will be 1.105 after one year. Under the current design, the value of mPST will be stable at 1.0 (we found that some people burned their own mPST, and the corresponding USDC was distributed to other mPST holders in proportion, making the value of other people's mPST higher than 1.0. This was unexpected to us, and everyone was happy to make a little money). If the user chooses a current account, he can request redemption at any time. After the redemption request is submitted, the money will generally be deposited into your wallet within 1-2 days, and in some cases it may take seven days.

PayFi Strategy Funding

This step is currently being done in Fireblocks using a strictly controlled multi-signature process. Once all the processes are finalized, this part will also be written into the smart contract.

The money deposited into the pool every day will be taken into the Fireblocks wallet by the Strategy Manager (multi-signature) and then invested in pre-approved investment channels. Currently approved are the Arf pool on the Huma Institutional side, Kamino, Pendle PT, and AAVE.

Huma Strategy Manager will decide which liquid DeFi protocols to withdraw money from to meet redemption needs based on the day's redemption requests.

Arf’s Funding

If you want to transfer money from Australia to Hong Kong, individuals or merchants usually do not transfer money directly, but through a payment company. Such payment companies may be Arf's customers.

Since SWIFT is slow and expensive, most payment companies do not use SWIFT. The norm in the payment industry is to deposit 20-25% of a month's turnover with a partner at the destination as a prepayment to achieve same-day settlement and a good user experience. But these prepayments are a heavy burden on payment companies. Arf abstracts prepayments into a service, which is implemented with stablecoins at the bottom. After receiving a remittance request from a customer, payment company A in Hong Kong deposits the customer's funds into a Safeguarding account and sends the voucher to Arf. After confirming the voucher, Arf will send the required USDC to the USDC account of payment company B at the destination. The destination off-ramp, after settling with the payee, notifies A, who then uses the money in the Safeguarding account to pay Arf, completing the entire process, which takes about 1-6 days.

Arf has a powerful Treasury Management system based on Circle Ominbus to complete various transactions with customers and their partners. Suppose a customer's loan period is three days. Every day, the customer will repay the USDC borrowed three days ago. At the same time, upload today's remittance voucher and apply for today's loan. After verification, Arf will transfer the USDC to the customer's partners around the world. The customer's partners will use these USDC to complete the settlement and then notify the remitter, that is, Arf's customer.

DeFi composability

We have launched the PST-USDC trading pair on Jupiter and Meteora to meet everyone's swap needs. We will integrate with Kamino and RateX in the future. In this way, users can swap, mortgage, loop, and buy and sell PT/YT according to their needs. The specific operations are completed in the DApps of these DeFi protocols. There are a few points to note:

- The current liquidity of the pool is relatively shallow. We will launch the Kamino Liquidity Vault later, and Huma will also provide Feather incentives to the LPs of the Vault. This will be launched in one or two weeks.

- Currently we only support PST. If you have mPST, you can first exchange it for PST in Huma DApp

- If your PST is locked, when you transfer your PST out, your PST will be treated as a current account, and the extra points you previously earned will be deducted, but the current points will be retained.

- Someone on X said there is a loophole that can be exploited: first save for 6 months, get more points, and then sell it immediately on Jupiter after the airdrop. The actual deposit is a current account, and the points you get are multiples of 6 months. I would like to tell you in advance that this way will not work. The specific reason will be very clear when we airdrop. So please decide how many months to save according to your actual fund layout.

11. Since the assets have to be moved off-chain, there is suspicion of black box operations. How can you be more transparent?

This is what we have learned the most from this incident. We did not do enough in terms of transparency. In fact, most of our information is on the chain, and we can do much better than we are now.

Arf is a Swiss regulated structure that has been strictly implementing the corresponding compliance requirements:

- LP reports will be issued to investors every month;

- We undergo financial audits every year, and our partner is the leading audit firm PWC (PricewaterhouseCoopers);

- All fund flows and asset situations are operated within the regulatory framework and are fully recorded.

At the same time, since Arf lent out USDC and returned USDC, we can enrich our Dune to improve transparency. We have added Arf's daily borrowing and repayment information to our Dune on April 15. Next, we will seek solutions to further increase transparency.

In terms of Huma 2.0, since all capital flows are on-chain, we will improve our Dune. Under the premise of legal permission, we will show the capital flow more clearly. In addition, although there is no requirement in this regard, we will proactively provide monthly reports to LPs. Today's compliance framework is in BVI. In the medium and long term, we hope to land on the compliance framework in the United States.

12. Where is the bottleneck of your development? Funding or demand?

First of all, a point of view that is different from the current understanding of Crypto: We believe that TVL is the Vanity Leaderboard, a vase, and should not be the core indicator to measure the value of a project. We use Active Liquidity, which is the part of the funds that are actually used. On the contrary, TVL is just the idle funds that we put in the pool without generating any income.

Based on this understanding, we hope that our fund utilization rate is close to 100%, that is, we do not want to raise funds and then leave them idle here. Many crypto projects "raise money first and then find demand", but we do the opposite, first determine the demand, then design activities to raise matching funds. This is why our pool is often full in a few days.

At different times, the bottleneck of our development will be different. In the early stage of entrepreneurship, the difficulty is fundraising. When the market is highly enthusiastic about participating in our activities, the bottleneck is no longer on the funding side, and the focus should return to the demand side.

Therefore, the current development focus is on the expansion of demand, especially around our two main business directions:

1. Funding requirements for cross-border payments

2. Credit Card

Especially in the area of credit cards, we are advancing in-depth cooperation with some large partners, hoping to push this business to a larger scale. We believe that the potential of this part is even greater than cross-border payments, because the transaction volume of the entire credit card market has reached 16 trillion US dollars.

If there are very reliable cooperation opportunities in the field of trade finance in the future, with a strong structure and risk control capabilities, we will remain open to it. But this will never be our core direction in the foreseeable future, and our focus will still be on developing cross-border payment scenarios on the Arf side.

13. Imagine a worst-case scenario with a very low probability: Assuming that there is a problem on the demand side and bad debts occur, will the impact on different lock-up periods in Huma's funding pool be different?

First, please read Question 6 to understand our risk control model.

In the most extreme case, first, Arf's First Loss Cover (2%) will be paid. If this is not enough, PayFi Foundation will use the margin it has accumulated through Lin Run to pay. If that is still not enough, the pool will have a write-off, and all PST and mPST will be affected in proportion, regardless of your model and lock-up period.

14. As a project with real protocol income, why did Huma still choose to issue coins and become the first project with both real business income and coin issuance? What is our real motivation for issuing coins and what is the value creation mechanism?

We don’t have to issue coins. With the current business model, the entity can achieve break-even this year, and traditional financing and IPO are completely feasible. We chose to issue coins for both core reasons and actual business considerations.

1. Concept level: Let ordinary people participate in truly high-quality asset opportunities

PayFi is not just a technological revolution, it is also a redistribution of opportunities.

My old company EarnIn provides “salary advance” services, with a loan scale of $10 billion per year. It is also profitable in nature, but it is not so easy to raise debts, for a simple reason: it makes money by rewarding, which does not sound “traditional” enough. In the end, they can only go to PE to borrow money, and PE uses itself as the only channel to lower the price. What touched me even more was that those high-yield assets eventually went into the pockets of Family Office, PE, and banks, and ordinary people could not touch them at all.

I thought at the time: Wouldn’t it be more meaningful if I could create a mechanism that allows ordinary people to legally and compliantly participate in these low-risk, high-return structured assets?

Web3 and DeFi make this possible. Without issuing coins and using DeFi, this would be impossible under the pure Web2 regulatory framework. Therefore, issuing coins is to change the game of "the rich get richer", lower the threshold for participation, and allow value to truly flow to the community.

2. Business level: Issuing coins can break the balance between capital and demand growth and accelerate the construction of moats

From a business perspective, the current growth of the business side is the result of the mutual restraint between the capital side and the demand side:

- There are customers online, but they lack funds and the speed is slow;

- There is money coming in, but there is no corresponding demand, and the efficiency is low.

This linear growth is safe, but also limits the speed.

By issuing coins, we can:

- Unlock more funding sources and do not rely on the pace of traditional institutions;

- Realize decentralized supply and make “liquidity” a driving force for business development;

- Match supply and demand more quickly, so that customers can get services whenever they want, without being tied up by money.

In the highly open field of Web3, the moat relies on scale, efficiency, and team execution. Before the model is copied, we must first achieve an unreplicable scale.

So, from this perspective, issuing coins is not only driven by values, but also a business accelerator - it can both reflect our philosophy and serve our growth.

15. When will the details of Tokenomics be released? What other functions does your token have besides governance?

The details of Tokenomics have not been fully determined yet and will be finalized closer to TGE. Token is not just a simple governance token, but a key gear in our protocol mechanism, which connects the incentive structure and enhances the product experience. The governance token functions that have been determined include:

- ve mechanism, strengthening long-term binding and LP & Token bilateral incentives

- The Maxi model will also greatly enrich the economic model of the protocol, accumulate considerable protocol capital reserves, feed back to the protocol ecosystem, support new features, emergency guarantees, and future product innovations

- Token-driven priority mechanisms, such as accelerated redemption, redemption above the redemption limit, etc.

16. When a risk event occurs, what is the compensation priority between different "protection mechanisms"?

The Huma protocol introduces several core mechanisms in traditional structured finance to ensure risk control and investor rights. The most important of these is First-Loss Cover:

All the money invested in Arf goes through a Bankcrupcy-remote SPV. The SPV has various covenants to protect the rights of investors, among which the most important one is the first loss cover, which will not affect the capital provider.

The Huma Protocol is not a simple capital pool, but a structured asset platform with a complete risk isolation mechanism.

Huma is committed to creating a reliable protocol for users that they can "understand, dare to participate, and be protected" through a three-layer design of self-guarantee, layered protection, and simplified design.

17. Why did Huma choose on-chain financing (which is costly and requires giving back to the community) instead of lower-cost Web2 financing (such as an interest rate of 6%-7%) to conduct its business?

Without sufficient scale, it is extremely difficult to obtain low-cost funds from banks or traditional financial institutions.

DeFi is the most realistic and efficient financing path in the early stage. TradFi will not provide timely assistance, but will wait until you reach a larger scale before providing resources; as a new DeFi protocol, our top priority is to expand ourselves first, and then graft low-cost funds from traditional finance. This is a classic "chicken and egg" problem. DeFi provides an opportunity to accelerate early development and directly connect to market funds.

In the short term, DeFi is not a substitute, but an accelerator. DeFi helps us achieve rapid start-up and liquidity activation on the capital side, allowing us to respond immediately when customer demand is released, rather than "missing customers due to lack of money."

In the long run, DeFi and PayFi are dual-wheel drives, not a choice between the two, but mutual assistance. The relatively cheap funds from TradFi will not only bring us financial stability, but also enrich the economic model of the protocol. The flexibility and incentive mechanism of DeFi will enable us to run efficiently and flexibly. In the end, the two complement each other and constitute the "dual engines" of our growth.

18. After depositing funds in the protocol, you will get PST tokens (regardless of whether they are locked or not), but PST is the same token, without distinguishing between "current" and "locked". I am worried that if the extra income (Feathers) obtained from locking can be sold before the expiration of PST, will it lead to the dilution of the rights of users who have not locked their positions.

In order to achieve integration with other DeFi protocols, PST must be homogenized, otherwise it cannot be shared among various DeFi protocols. If a user declares to lock for 3 months, but only locks for 2 months and then sells or transfers out through the official cooperation path (such as Jupiter), the excess points will be deducted and no longer enjoy the "extra income". In other words, the Feathers obtained by locking the position are bound to "completing the lock-up expiration as agreed". If you exit before the promised period, you will lose those "excess bonuses".

19. How to exit or redeem in the primary market (official platform) or the secondary market, especially when the current actual liquidity of the protocol is not large, can the funds be retrieved in time?

We will plan how much liquid DeFi assets to have based on the current amount in order to arrange the asset portfolio and meet redemption requirements.

The original intention of the project was to hope that users would redeem mainly through the official platform, rather than directly sell PST in the secondary market. After all, there will be wear and tear in the secondary market.

The PST-USC pool on DEX did not provide any liquidity incentives at the beginning, but still attracted about $140,000 in funds, exceeding expectations. The team will use Feathers incentives to increase liquidity in the future.

20. Where is your moat?

First, in terms of compliance framework. Today, few companies have figured out how to do business like ours under a compliance framework. Arf's compliance framework allows it to provide liquidity to financial funds around the world, which gives it a big first-mover advantage. Huma 2.0 allows permissionless under compliance, and it will take others half a year to copy it.

Secondly, it is the scale. We have processed 3.8 billion U of water flow, and it is still growing rapidly, and it is expected to reach 10 billion U by the end of the year. Once a certain scale is reached, it is difficult for latecomers to catch up.

Third, it is Partnership. Everyone already knows about our formal cooperation with Solana, Circle and SDF. A larger partnership will be released in the second half of this year.

Fourth, it is the team. All the core members of our team are real names. Erbil Karaman and I have both had successful entrepreneurial experience and have been responsible for world-class products. We have also worked as CPO and CTO at EarnIn, the largest personal loan company in the United States. There may not be many people in the world who understand Payment Financing better than us. Our Chief Business Officer Patrick Campos is an expert in structured finance and tokenization compliance, and is at the forefront of tokenization legislation in the United States and UAE.

Of course, anyone can choose to copy any Crypto project. But PayFi is not a meme coin, it requires hard knowledge and experience in the industry. If others want to compete with us, I can only say welcome, I wish you good luck!