Author: WOO X Research

In April 2025, Trump's tariff policies brought severe volatility to the global financial markets. On April 2nd, he announced "reciprocal tariffs" on major trading partners, setting a 10% baseline tariff and imposing higher rates on specific countries: 34% on China, 20% on the EU, and 32% on Taiwan (with semiconductor products exempted). On April 5th, the 10% baseline tariff officially took effect, further tightening global supply chains. On April 9th, Trump suspended high tariffs for 75 countries that did not implement retaliatory measures for 90 days (until July 8th), but raised tariffs on China to 145%, citing China's 34% retaliatory tariffs on US goods. The EU announced a suspension of retaliatory tariffs on $21 billion of US goods until July 14th to create negotiation space.

These policies triggered strong market reactions. The S&P 500 saw a market value evaporation of $5.8 trillion within four days after the tariff announcement, the largest single-week loss since the 1950s. Bitcoin prices oscillated between $80,000 and $90,000. Federal Reserve Chairman Powell stated on April 17th at the Chicago Economic Club that tariffs might drive up inflation and suppress growth, but the Fed would not intervene in the market through rate cuts, focusing instead on long-term data. Goldman Sachs and JPMorgan respectively raised the US economic recession probability to 20% and 45%. Corporate profits and prices could be affected, with market prospects shrouded in uncertainty. In such times, how should investors proceed? Low-risk stablecoin yield products in DeFi might be a good choice to maintain stability during this turbulent period, and the following will introduce four stablecoin-based yield products.

This article does not constitute investment advice, and investors should conduct their own research.

Spark Saving USDC (Ethereum)

Connect wallet through the Spark official website (spark.fi), select the Savings USDC product, and deposit USDC.

Note: Spark is a decentralized finance (DeFi) platform providing the frontend interface for SparkLend, a blockchain-based liquidity market protocol. Users can participate in lending and borrowing activities through this platform.

Yield Source: USDC savings yield comes from the Sky Savings Rate (SSR), supported by crypto mortgage loan fees, US Treasury investments, and income from providing liquidity to platforms like SparkLend. USDC is exchanged 1:1 for USDS through Sky PSM and deposited in the SSR vault to earn yield, with sUSDC token value growing with accumulated earnings. Spark handles USDC liquidity.

Risk Assessment: Low. USDC has high stability, and Spark's multiple audits reduce smart contract risks. However, market volatility's potential impact on liquidity should be noted.

Current Data Situation:

Data Source: Spark Official Website

Berachain BYUSD|HONEY (Berachain)

Visit the Berachain website, enter BeraHub, connect a Berachain-compatible wallet, select the BYUSD/HONEY pool on the Pools page, and deposit BYUSD and HONEY to provide liquidity. Users receive LP tokens that can be staked in the Reward Vaults to earn BGT.

Note: Berachain is a high-performance, EVM-compatible Layer 1 blockchain using an innovative Proof of Liquidity (PoL) consensus mechanism that enhances network security and ecosystem vitality by incentivizing liquidity providers. This product is the BYUSD/HONEY liquidity pool deployed on BEX, Berachain's native DEX, where HONEY is Berachain's native stablecoin (multi-asset collateralized, soft-pegged to the US dollar), and BYUSD is another stablecoin on the chain.

Yield Source: Primarily from BGT rewards (3.41% APR, based on staking weight and validator-distributed BGT emissions, updated every 5 hours) and pool transaction fees (0.01% APR from fee sharing). BGT is Berachain's non-transferable governance token that can be irreversibly burned 1:1 for BERA and share fee income from core dApps like BEX, HoneySwap, and Berps (specific proportions determined by governance). The BYUSD/HONEY pool has low price volatility risk due to its stablecoin pair characteristics.

Risk Assessment: Low to medium. BYUSD and HONEY are stablecoins with stable prices; Berachain's PoL mechanism has been audited by Trail of Bits, with low smart contract risks. However, BGT rewards depend on validator allocation and governance decisions and may fluctuate due to emission adjustments.

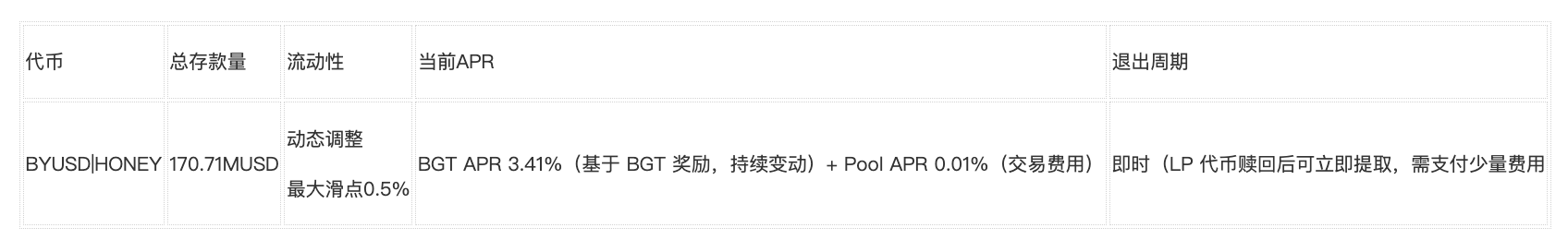

Current Data Situation:

Data Source: Berachain Official Website

Provide Liquidity to Uniswap V4 USDC-USDT0 (Uniswap V4)

Connect wallet through the Merkl website (app.merkl.xyz), deposit USDC or USDT into the "Provide Liquidity to Uniswap V4 USDC-USDT0" product to provide liquidity for Uniswap V4.

Note: Merkl is a DeFi investment aggregation platform offering one-stop solutions covering liquidity pools, lending protocols, and other opportunities. This product provides liquidity to the USDC/USDT pool on Uniswap V4 through Merkl. Uniswap V4, launched in 2025, introduces "hooks" mechanisms allowing developers to customize pool functions like dynamic fee adjustments and automatic rebalancing, enhancing capital efficiency and yield potential.

Yield Source: UNI token incentives.

Risk Assessment: Low to medium. The USDC/USDT pool is a stablecoin pair with low price volatility risk, but smart contract risks and potential yield reduction after incentive periods should be noted.

Current Data Situation:

Data Source: Merkl Official Website, Uniswap Official Website

Echelon Market USDC (Aptos)

Visit the Echelon Market website (echelon.market), connect an Aptos-compatible wallet, select the USDC pool on the Markets page, and deposit USDC to participate in supply. Users receive supply certificates with earnings accumulated in real-time.

Note: Echelon Market is a decentralized cryptocurrency market based on the Aptos blockchain, developed using the Move programming language. Users can borrow or lend assets through non-custodial pools, earning interest or using leverage. This product allows users to deposit USDC into liquidity pools on the Aptos mainnet to participate in supply and earn yields. Echelon Market is integrated with the Thala protocol, which provides stablecoins and liquidity layers on Aptos, generating deposit receipt tokens like thAPT.

Yield Source: Yields include USDC supply interest (5.35%) and Thala's thAPT rewards (3.66%). thAPT is Thala's deposit certificate, minted and exchanged 1:1 for APT, with a 0.15% redemption fee that goes into the sthAPT (staked yield token) reward pool.

Risk Assessment: Low to medium. USDC has high stability, but Aptos ecosystem smart contract risks and thAPT redemption fees' impact on yields should be monitored. Immediate exit provides high liquidity, but market volatility may affect thAPT reward value.

Current Data Situation:

Data Source: Echelon Market Official Website

Summary

The table is sorted by TVL from largest to smallest, for reference only, and does not constitute investment advice.