Hashprice drops below 40 USD/PH/s, pushing Bitcoin Miners into the most difficult situation since the beginning of 2023, with significantly narrowed profit margins.

The Bitcoin mining market is facing serious challenges as hashprice – an indicator measuring income per computing unit – has fallen below 40 USD per petahash per second (PH/s) in early April. According to the latest report from Wolfie Zhao, Research Director of theminermag.com, this decline marks the lowest profit margin for Miners since 2023.

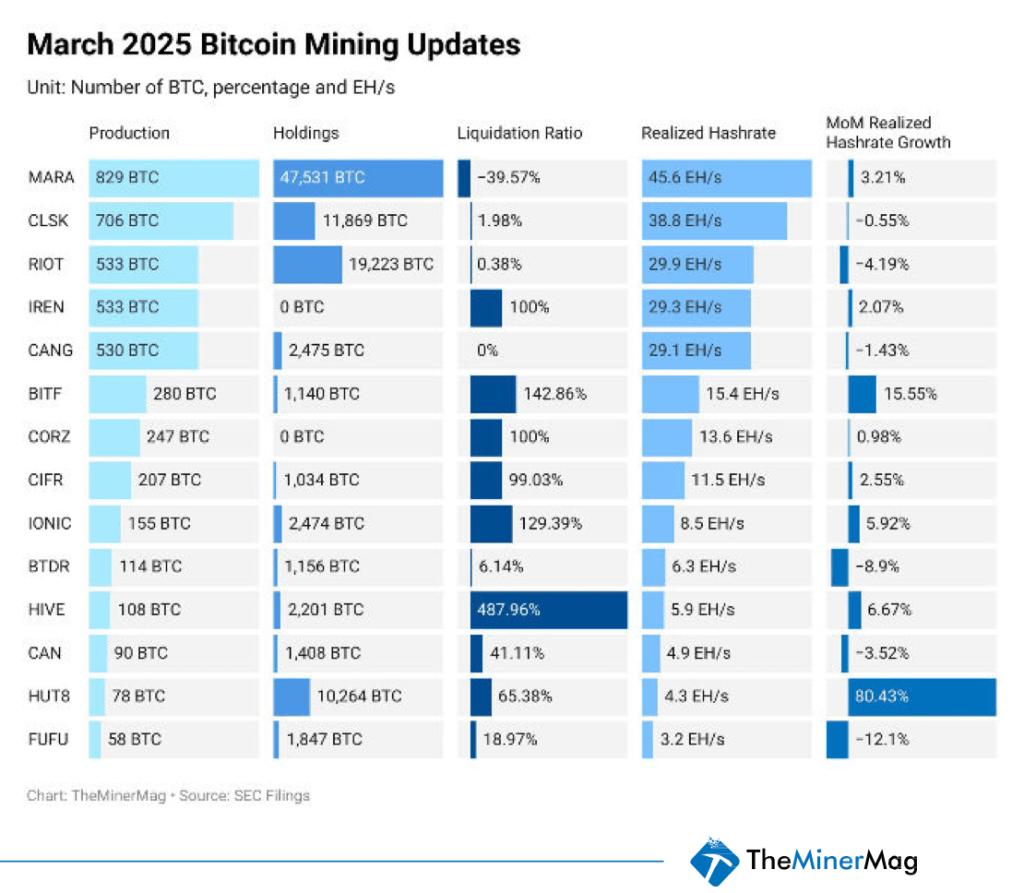

This figure has significantly decreased compared to the 45-50 USD recorded in March and raises major concerns as the 40 USD threshold is considered an important break-even point, even for publicly listed mining companies. This situation could trigger an industry-wide consolidation wave as small units are forced to exit the market.

Multiple Factors Pressuring Miners

Research from theminermag.com identifies several causes leading to the current difficulties. In March, there were two consecutive difficulty increases of 1.43%, followed by a significant 6.81% increase in April. Meanwhile, transaction fees on the Bitcoin network have severely declined, now contributing less than 1.2% of the total block reward.

Zhao calculates that the decline in transaction revenue, combined with increasingly high electricity costs, has pushed the median hash cost for public mining companies to nearly 34 USD per petahash – dangerously close to the break-even point.

Additionally, new tariff proposals from the Trump administration are creating significant concerns about the supply chain for specialized ASIC (Application-Specific Integrated Circuit) mining equipment. This is reflected in the hash price index developed by Zhao, which has halved from its post-election peak to 50 USD per terahash (TH/s), pulling the industry's total Capital below 20 billion USD.

Nevertheless, some companies are still expanding operations. Bitfarms and Hut 8 are two notable cases, increasing their actual hashrate by approximately 16% and 80% respectively. Currently, MARA is the only mining unit exceeding 40 exahash. However, the research also points out that listed mining companies have sold 42% of their mined Bitcoin in March – the highest liquidation rate since October 2023.

Notably, many companies have changed strategies, such as Cleanspark shifting from a "full hodl" approach to selling assets to maintain operations. Zhao predicts that if hashrate continues to increase from efficient mining units, while trade uncertainty persists, a wave of "surrender" by small private Miners could occur quickly if hashprice does not recover in the near future.