This article is machine translated

Show original

🔥 [Analysis] Buyback and Burns - A Potential Tokenomics Mechanism for Investment?

1. Buybacks and Burns Trend

2. How Do Buybacks and Burns Work?

3. Successful Case Study

4. Failed Case Study

5. Can Buybacks Help Increase Token Price?

6. When Should You Invest in a Project with <twitter.com/gm_upside/status/1...>

2025/04/15 22:55 :

🔎 Revealing Binance Listing Costs & Strong Dump Signals 🎯

Yesterday, Yi He - Binance's CoFounder shared that the exchange does not charge listing fees from projects, listing at 0️⃣ dollars!

I. Controversies about listing fees on Binance

II. How much do projects spend on Binance Launchpool?

III.

1. Buybacks and Burns - New Trends in Tokenomics

First, you need to understand what Buybacks and Burns are and why they are hot. This is a trend that many crypto projects are applying to increase the value of their Token (in theory, guys) 👀

- The main idea is

2. How Do Buybacks and Burns Work?

Although it sounds similar to a traditional stock buyback, it is actually different.

Traditionally, shares are bought back to reduce supply, increasing shareholder value through real profits.

(1 second advertisement😆)

If the article is useful, I hope you guys support @gm_upside with a follow & retweet 😍

🛫 There is no shortage of good articles, just comment:

"Help me analyze project ABC, trend XYZ,..." and Upside will post it right away ✍️

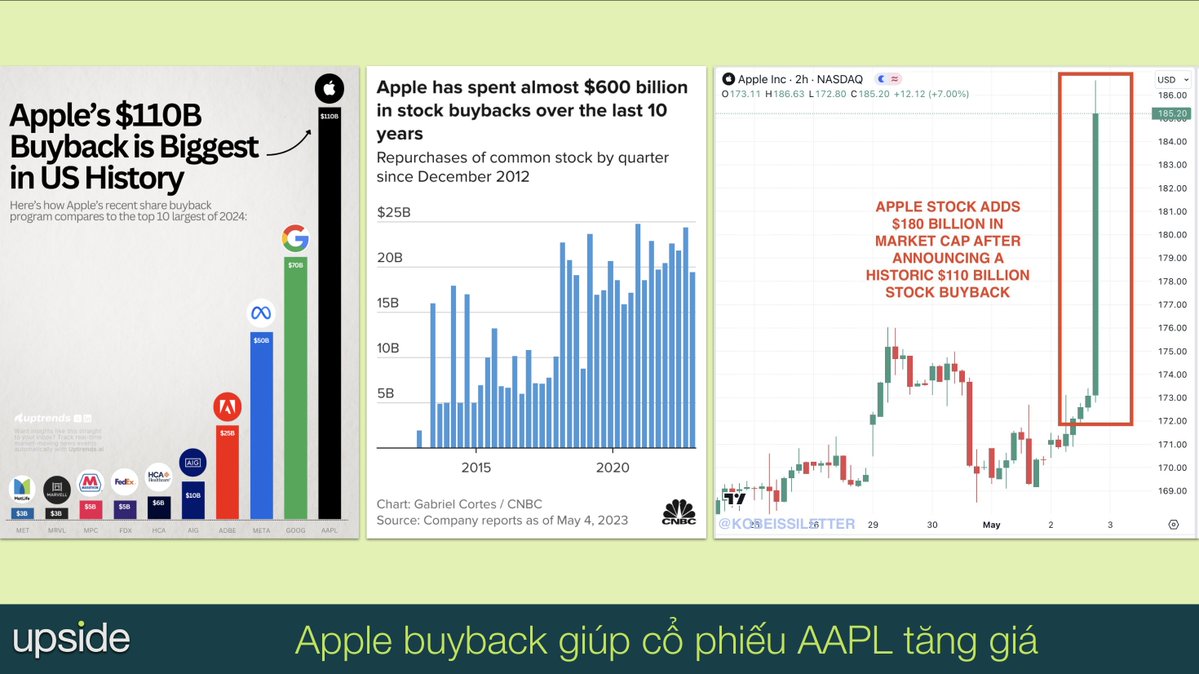

3. Successful case studies

3.1 Binance Coin (BNB)

First, we cannot fail to mention BNB— the giant that has been burning Token since 2017.

As of April 2025, Binance has burned 56.67 million BNB, worth $33 billion (price $577/ BNB). The most recent burn (April 2025) burned 1.58

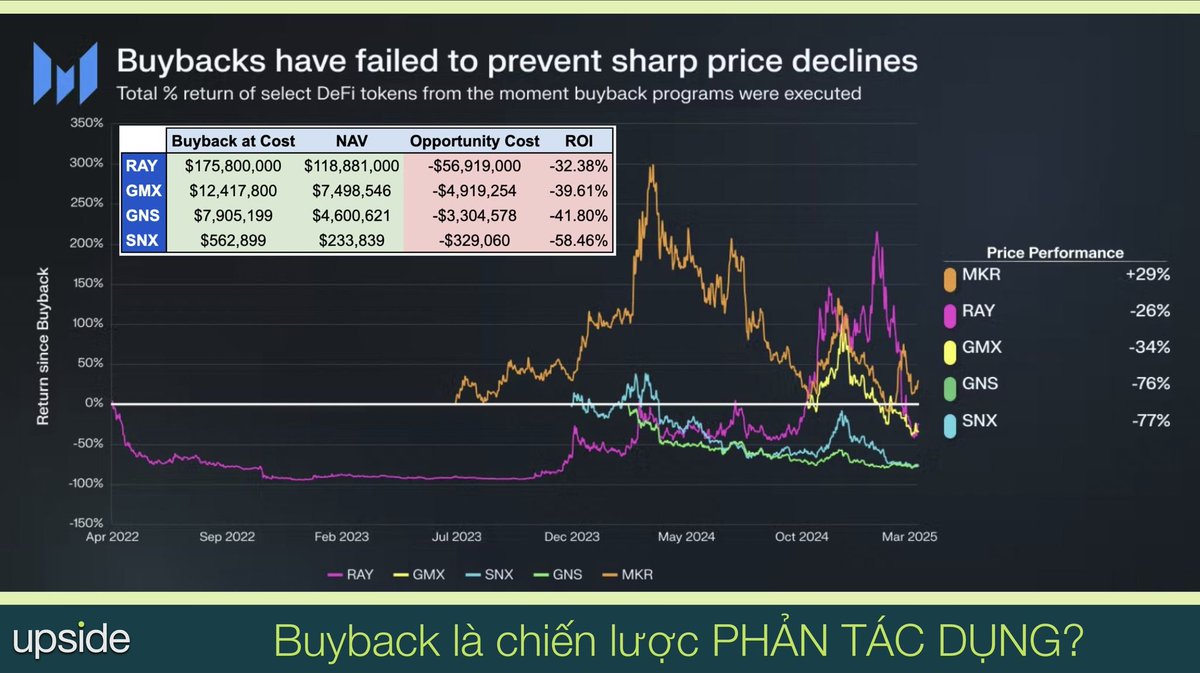

4. Failed case study

On the contrary, if you look at the data from Messari, you will see that

- RAY spent 175.8 million USD to buyback, now only has 118.88 million USD left, a loss of 32%.

- GMX spent 12.42 million USD, now has 7.5 million USD, a loss of 39%.

- GNS spent 7.9 million USD, now has 4.6

5. Will buying back help increase Token price?

To verify, I looked at the YTD 2025 price list of some Token.

🟢Buyback available:

- Raydium (RAY) increased by 47.2% ($1.25 → $1.84)

- Metaplex (MPLX) up 18.9% ($0.37 → $0.44)

- Helium (HNT) increased by 7% ($6.79 → $7.27).

6. When should you invest in a project with Buyback?

Buybacks and Burns are not a “magic wand” to increase Token prices, but they are still a plus if done correctly. So when should you invest?

📚 I have drawn some criteria from personal experience, you guys can refer to it and DYOR.

1/ First,

👀 In addition to Buyback & burn, there is also a new trend of Project Revenue Chia , including Uniswap $UNI and some other DeFi OGs are doing.

See you next post 😁

x.com/gm_upside/status/1914627...

Hope you guys support @gm_upside and author @jackvi810 with a like & retweet😍

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content