I spoke to 200+ unprofitable traders and found the worst-performing trade setups.

Remove these from your trading, and your PnL will skyrocket.

Full breakdown + PDF Download:

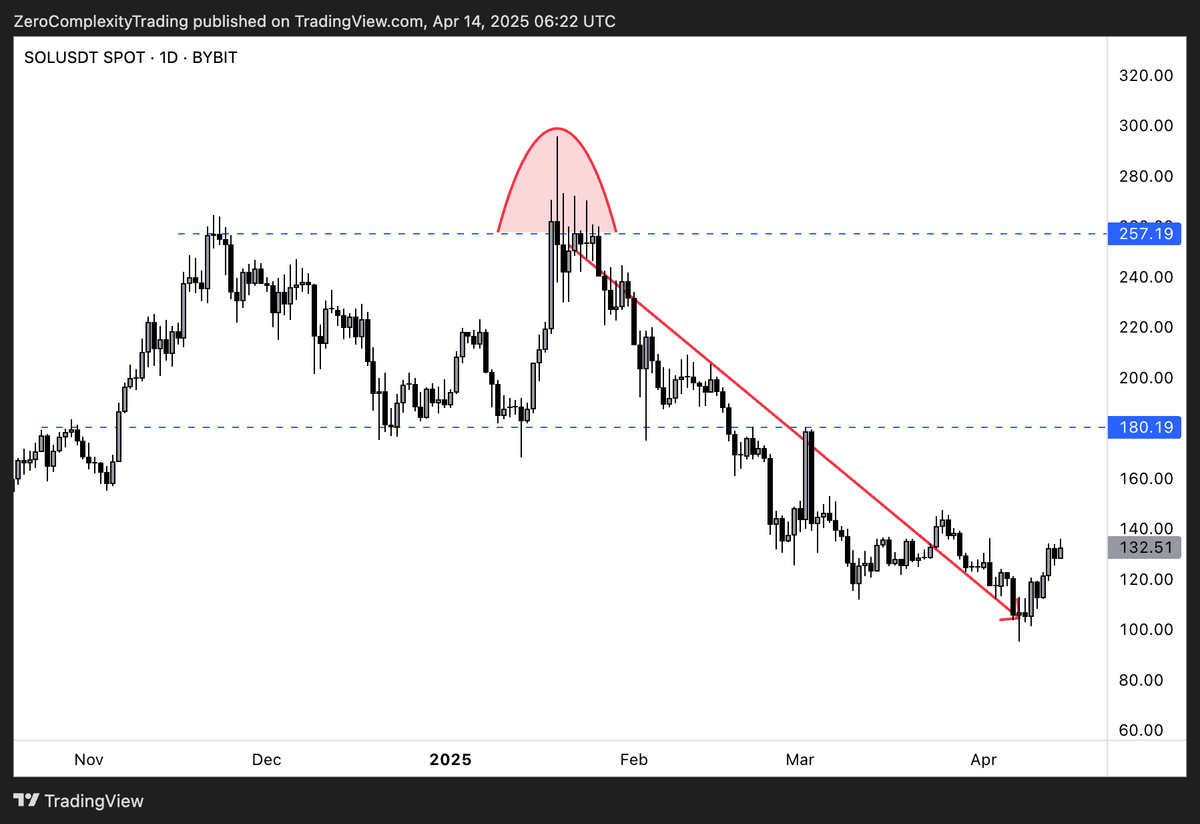

1. Mean Reversion Longs In a Downtrend

People try to long the market/ catch a reversal/ bounce without any clear sign of reversal or bottom formation.

Price Characteristic: Steady downtrend with no sign of chop/ slowing down, or showing a reaction at a key level.

Example:

In this SOL chart, the price was in a steady downtrend as it approached many LTF support/resistance levels.

Trying to short this without clear exhaustion means losing money on every attempt.

What to do instead:

In a trending market, it's better to;

-Trade momentum shorts on key support level breakdowns

-Trade mean reversion shorts on rejections of resistance levels

Do this until the trend reverses with a clear structure shift

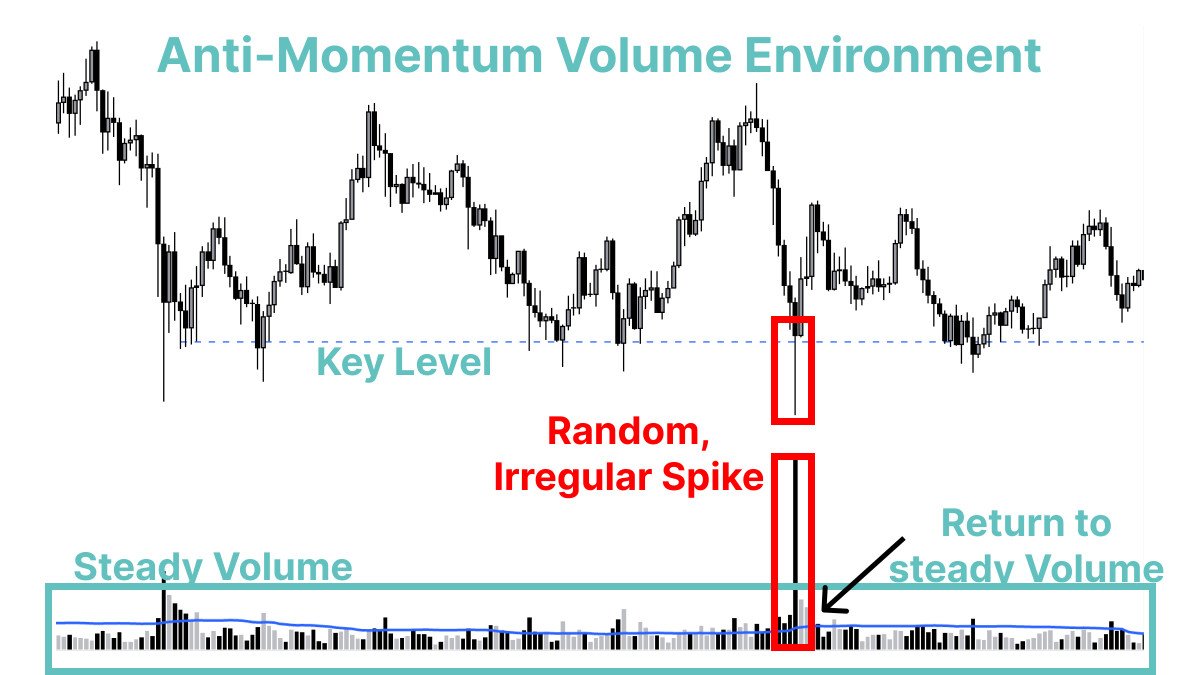

2. Volume Misalignment Momentum

Traders don't understand how to use Volume and get wiped out by entering on fakeouts.

Volume Characteristic: Choppy/ low, steady volume in a sideways market often means random volume spikes are fakeouts and real momentum.

Example:

Here, price tried to break down at a key support level, but the volume spike was random and met with no follow-through selling or a steady increase leading to the breakdown

This was an indication that the trigger was false and the price will not continue to break down

What to do instead:

Avoid trading random breakout spikes in low-volume chop.

If you have a mean reversion strategy, watch for a spike without follow-through and use that as a trigger to fade the move.

Journal this scenario before applying on live trading.

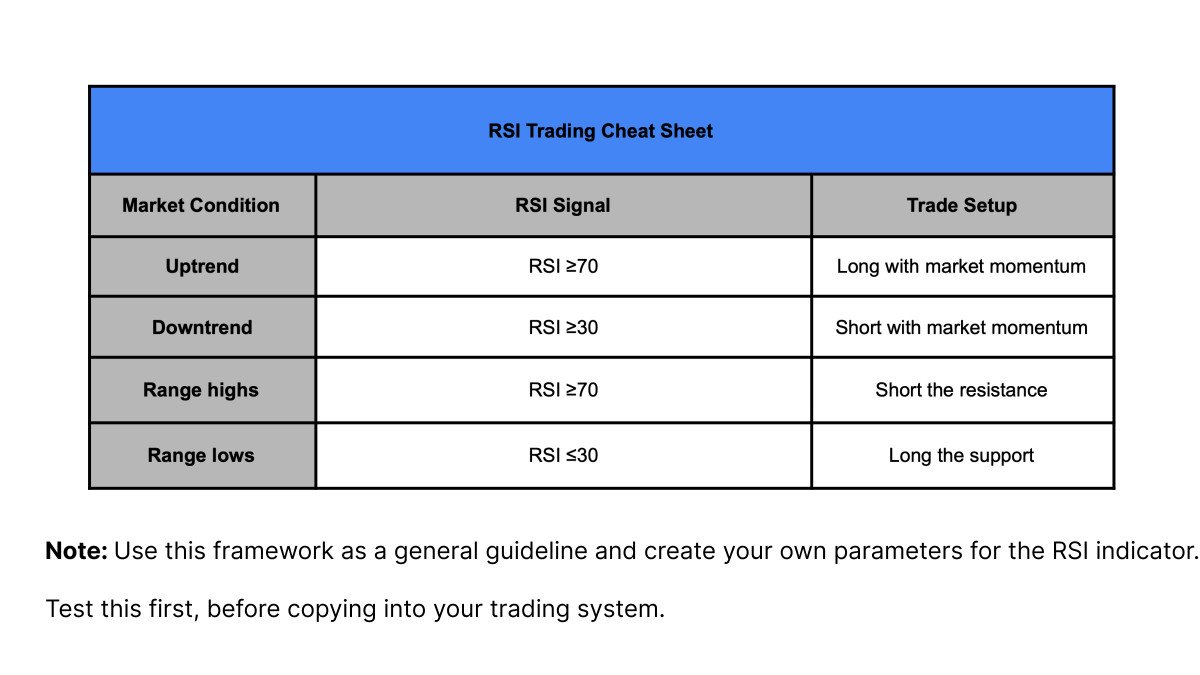

3. Shorting Overbought RSI

Many traders think an “Overbought” RSI is a signal in itself to take a short trade. This is wrong, and the actual signal has a lot more nuance to it.

RSI Characteristics: In the overbought area (70 and above), and price is likely in an uptrend.

Example:

Traders will use the oversold RSI in confluence with a key level to short the market and lose money.

Most traders do this without a sign of exhaustion and end up losing major profits.

What to do instead:

Don’t blindly short an overbought RSI in an uptrend as it often signals strength, not weakness.

Only short if the price starts to chop, volume confirms a shift, and the trend breaks

Here's a cheat sheet for RSI+ Price-based confirmations:

Bonus:

Always use market structure as the core motivator for any price bias you have in the market.

False beliefs like “You need to short resistance” are not entirely true, and traders always miss nuance in advice like this, then end up losing money.

Next: Download my full Anti-Trade Setups PDF guide

This will help you make way more money trading altcoins.

Scroll up in the chat for your free copy (Expires in 24 hours): http:/go.koroushak.io/telegram

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content