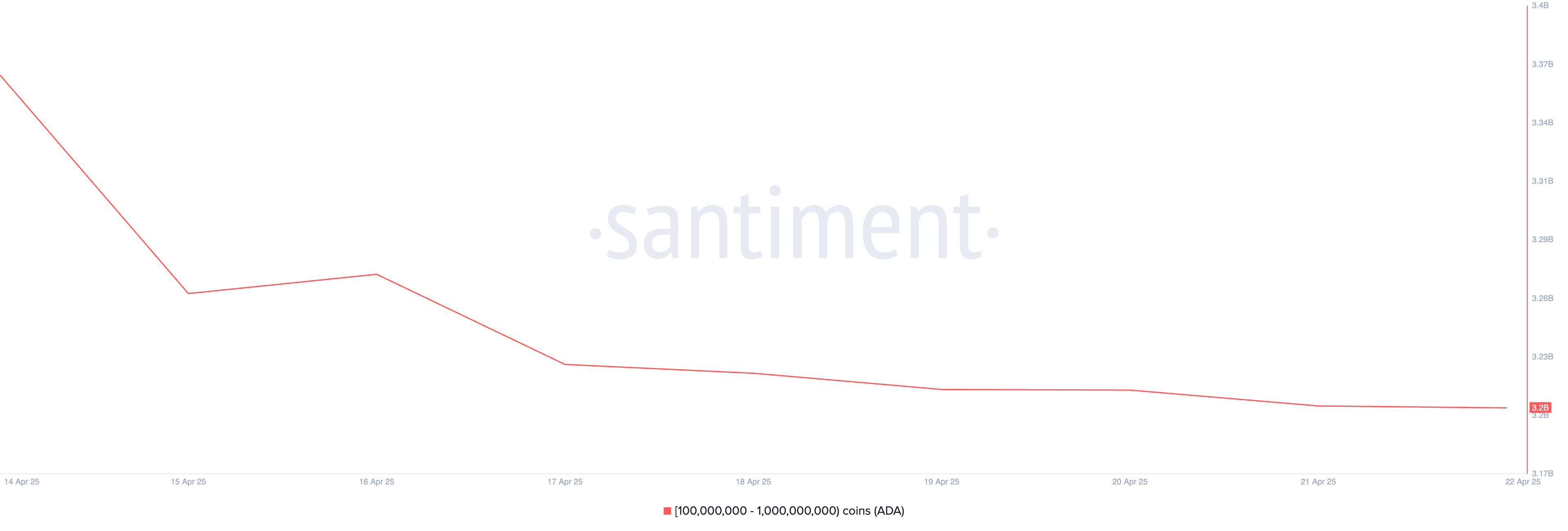

Due to Cardano's poor performance last week, some large holders have started selling their coins. According to on-chain data, whales holding between 100 million and 1 billion ADA collectively sold assets worth over $160 million in the past 7 days.

This wave of distribution suggests a weakening of confidence among ADA's large holders, putting additional pressure on an already fragile market.

Cardano Whale Sell-off…Intensifying Weakness

According to Santiment, a cryptocurrency online data platform, Cardano whale addresses holding between 100 million and 1 billion ADA sold 170 million coins last week, which is worth over $106 million at current market prices.

This wave of distribution indicates a change in negative sentiment among whales. Their decision to sell large quantities of tokens is putting pressure on ADA's already struggling price.

Moreover, this trend may also impact retail traders, increasing selling pressure and further reducing the possibility of a short-term ADA price rebound.

The coin's weighted sentiment is currently negative, confirming an increasing downward bias across the market. At the time of reporting, this is -0.20.

This on-chain indicator measures the overall tone (positive or negative) of an asset by analyzing social media and online platforms. When this value is below 0, the overall market sentiment for the asset is declining.

According to Santiment, ADA's weighted sentiment has remained below 0 since March 8, with downward discussions and prospects continuing to overwhelm upward discussions.

This persistent negativity suggests an increased risk of price decline and indicates that traders are hesitant to increase their exposure or re-enter the asset.

ADA, Increasing Downward Momentum

The Relative Strength Index (RSI) reading for ADA on the daily chart supports this downward outlook. At the time of writing, this key momentum indicator, which tracks the asset's overbought and oversold market conditions, is located at 46.47.

The RSI indicator ranges from 0 to 100, with values above 70 indicating that an asset is overbought and likely to decline. Conversely, values below 30 signal that an asset is oversold and may rebound.

ADA's RSI declining slope at 46.47 suggests momentum weakening, and without buying pressure returning soon, there is a possibility of additional losses. In this case, ADA's price could drop to $0.50.

However, if buying activity surges, the coin could rise to $0.69.