Obsession is the first element of success.

Written by: jack

Compiled by: Luffy, Foresight News

At the beginning of 2021, when everyone was obsessed with perpetual contracts and NFTs, I came across a post by a now-deleted user "CLs intern". This was my first real exposure to the world of on-chain transactions.

Before this, I only knew that there were three ways to make money in the cryptocurrency field: perpetual contracts, spot trading, and NFT. In this obscure post, he boasted that he had achieved a 500-fold profit by sniping a variant of Shiba Inu Coin for the tenth time this week, ridiculed people's madness about 25x leverage trading, and explained that for people with less capital, on-chain trading is the biggest opportunity.

“Every transaction must be scanned, every wallet must be tracked, and every Etherscan page must be carefully investigated.” In addition to the profit and loss data that was shown off, this sentence left the deepest impression on me.

This made me, a teenager at the time, very excited. As the academic difficulty increased, my interest in learning quickly waned, so I set on-chain trading as my life goal. Without any guidance, I spent three or four months trying to figure out where to start, and made some transactions on the FTM and ETH chains, but nothing came of it.

At this time, BTC has fallen from its historical highs, and the dark age of cryptocurrency has followed, with inevitable plunges and crashes. With the end of the previous cycle and the troubling financial problems in reality, I gradually lost my initial enthusiasm.

Time flies. One night in the spring and summer of 2022, I came across a "BSC Trading Guide" on YouTube. There was a Discord server link in the introduction. After I joined, I found that this was a BSC shit coin on-chain trading community consisting of hundreds of people. My enthusiasm was ignited again, and my life began to revolve around squatting on Poocoin to deploy new contracts and screen projects.

I spent weeks like a madman watching Telegram channels and newly deployed contracts 18 hours a day, and finally learned how to distinguish scam coins from real project coins. The next stage is to predict which tokens will actually gain user acceptance, and I found that I have amazing intuition in this regard.

“Oh my god, I finally found something I’m good at?” When I started real trading with the $30 I saved, the Discord server administrator noticed my ability and “hired” me to analyze the market every day, with a monthly salary of 1 BNB. This was the best thing for me at the time.

In 3 months, $30 became $10,000; in another month, $10,000 became $100,000. In the first 6 months, I paid off my family's huge debt and helped my family start a new life.

When the financial pressure was no longer like a sword hanging over my head, I started investing again with 5-6 thousand dollars and doubled my net worth to six figures again within a year. But misfortunes followed one after another. In the same week when I planned to take profits and withdraw most of my assets, FTX collapsed and my holdings plummeted by 95%.

So I was forced to start over for the third time, but I accepted the reality without complaint and focused on successful trading. In mid-2023, I made back three times my losses on FTX, and at the end of the year, I achieved my lifetime financial goal, all thanks to on-chain trading.

In 2023, I created this Twitter account with the intention of posting content related to on-chain transactions to provide guidance for novices; because my most difficult and frustrating times were the days when I was groping alone when I had no clue.

But the subject of this article is not only my plain story, which is just a necessary self-introduction as the last post of the account. The purpose of this article is to summarize my trading experience: to keep up with this ever-changing, maze-like market, you need to reshape your way of thinking. Therefore, this is not a technical guide, but I hope to change your view of on-chain transactions and the entire market.

Obsession: The first element of success

obsession – noun, a persistent and intense thought or feeling that controls the mind

Every genius you meet, every reliable trader you know, had a similar beginning. They may have different personalities, but they all have one thing in common at their peak: obsession.

They stare at charts and click on screens for 20 hours straight, and we wonder, "How does he do that?" But if you've ever been obsessed with something, the answer is obvious.

Just like when Fortnite was first released, you were willing to spend 12 hours immersed in it, enjoying every "Victory Royale" and eager to win continuously. This is obsession.

To invest enough time and energy in on-chain transactions, you have to reach a state of obsession. If your brain doesn’t enjoy it, you will never be able to focus on doing the same thing over and over again for more than 10 hours a day.

This is the first threshold for screening out truly capable people: you either enjoy it enough and are obsessed with it, or give up. This is not something that can be triggered instantly through subjective will.

The person who spends 3 hours a day just to make $500 off the line will be far behind the obsessed person (the one who puts in 20 hours a day for months on end).

"I don't understand what this means, what are you trying to tell me?"

I want to tell you: change your mindset and make trading the focus of your life. What is the first thing you think of when you wake up? Does the first thing you do help you understand the market better and get closer to winning?

Are you really doing everything you can to win the game?

If obsession hasn’t arrived yet, then take the initiative to approach it: use every waking free moment to keep an eye on newly deployed contracts, observe charts, and sort out patterns.

No matter how tired, boring, or "useless" you feel at the moment, after a few weeks of persistence, you will find that you are thinking about trading from morning to night every day, and even when you are watching a movie, new contracts are emerging in your mind.

Well, congratulations, you have entered the state of obsession.

“I’ve been online 12 hours a day for months and I still suck! It’s useless! Don’t mislead people, it’s all about gambling and luck!”

You are absolutely stupid.

For months, you screened every newly deployed contract and watched every rising coin, but your mediocre brain didn’t notice any exploitable patterns?

Once again: change your mindset. How? Start by clearing your mind.

Throw away all your silly notions about on-chain transactions, and throw away your inherent ideas about “money”.

(“Memescope is gambling! It’s all about luck! It’s a loser’s game!” This is all garbage. Throw it all away.)

On-chain transactions are a game, and dollars are your points.

It’s a business model where you earn points in two ways: either by discovering market asymmetries and inefficiencies before your competitors do, or by offering a service in a high-demand niche.

Your core goal throughout should be to find and target market inefficiencies.

Think! Think! Think! Most people never think before trading, blindly follow the movement of their wallets, and rely on the shill, just like an incompetent loser. You must eliminate your dependence on any external factors and only trust yourself.

Ask yourself: "What information have I seen that most people haven't noticed yet?" "What trends can I foresee that others have not yet noticed?" "Are there such opportunities in the targets I am currently paying attention to?" - If not, leave immediately.

Eventually, among hundreds of targets, you will notice opportunities that most people have not yet noticed. If you are wrong, change your mindset again: you must have misread the information or overestimated the potential of the target. Correct your mistakes and move on.

Repeat this process until you have perfected the ability to spot lagging tokens. The easiest and most common opportunities are not tweets from Musk or Trump, but lagging opportunities that you seize earlier than others.

In short, the core weapon for identifying "narratives" is this way of thinking. No matter how long it takes, you must master it.

Obsession is beneficial, at least it gives you enough inner strength to sustain a few brutal months of sitting around before it wears off.

The only reason an obsession fades is if it fails to produce any results. If a person devotes their full attention to something for months and nothing comes of it, the passion will die.

How to avoid this?

You have completed the first step: you are ready to spend more than ten hours a day in front of the screen for several months. How can you ensure the gains and results?

The answer lies in how to truly focus.

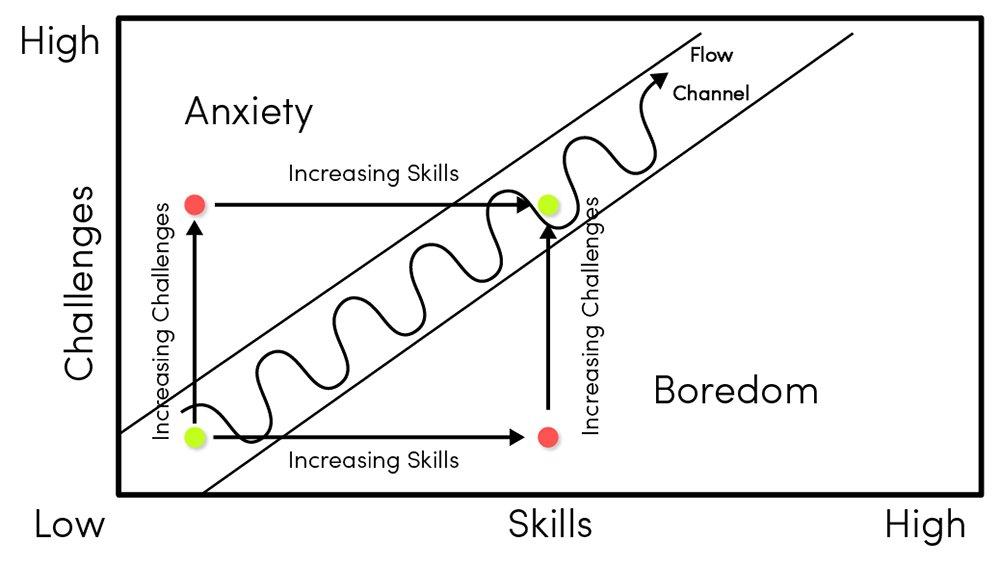

Under ideal conditions, humans enter a "trance" state: the brain is deeply immersed in the current activity, begins to capture more patterns that would normally be ignored, and achieves absolute concentration.

Don't just be "online", be immersed and engaged in what you observe. It's not enough to stare at the screen, you need to understand it.

In basic psychology, this is called the "flow state."

The famous F1 driver Ayrton Senna once described the state of concentration during a race:

“I was no longer driving consciously, I was just driving intuitively, it was like entering another dimension. I was way beyond my limits, but I was still pushing them. It was terrifying because I realized I was in a state beyond rational understanding.”

The first time I experienced flow, I was confused: 10 hours seemed like 30 minutes. I was zipping through all the available data, processing information and thinking quickly about the most likely outcomes.

How to enter the flow state?

Set challenges based on current skills and talents for maximum focus:

- The challenge is too easy: you will quickly get bored and lose focus (e.g. a trader with an average monthly income of $15,000-20,000 sets a goal of making $5,000 per month);

- The challenge is too difficult: Unrealistic goals can lead to anxiety and a lack of focus (e.g. a trader with a net worth of $10,000 trying to make $500,000 in a single month).

The correct approach is to set realistic goals, for example, a trader with a net worth of 100 SOL sets a goal of making 2.5 SOL on the day, which is very likely to be achieved. With this goal, he will focus on the market with absolute precision because the goal is feasible.

In this state, you will not be perfunctory or drowsy in the chaotic market, but will push yourself to improve, understand the nature of the market, and perform beyond your expectations.

Summary: Strive to master the ability to enter a state of absolute focus where you will notice the most patterns, make the best split-second decisions, and truly grow as a trader.

Current market structure and response strategies

It is undeniable that on-chain transactions are becoming increasingly difficult. Four years ago, you could make money simply by buying liquidity-locked tokens.

But as the market matures, the importance of technical indicators decreases. In short: the more you focus on the technical indicators of a token (such as the number of holders, liquidity, trading volume, charts), the more misleading it is and the more confusing the market will appear.

The only thing that needs to be watched constantly is how participants react to the token. This has not changed in the past four years. Human emotions remain constant, and we want to take advantage of this.

Today, the starting point and core of the transaction is undoubtedly Memescope/Pulse.

People repeatedly ask me about my trading style, and I spend my entire trading session manually screening every graduating token, looking for narrative or technical outliers. Any project that looks non-repetitive and interesting, I will buy a 1-2% position when the market cap is under $200k and then wait and see.

“Why not trade before graduation?” Not sure. Nowadays, the style of “buy 5 SOL when the market value is 5,000 US dollars, sell 12 SOL when the market value is 12,000 US dollars” is becoming more and more popular in streaming media. This is the initial understanding of on-chain transactions by the outside world.

But I am convinced that sticking to this style for the long term is detrimental. You have to be flexible and adapt to the PVE and PVP markets. When the token peak cycle extends from hours to weeks, these traders will find it difficult to adapt and perform far worse than those who can still catch clear anomalies in the PVP market.

The PVP market will not exist forever, nor will it rely solely on BTC price movements. When funds flow from inexperienced players to experienced players and harvesters, the market will turn.

“Are volume tools useful? What about tracking wallets?”

I never use volume tools or related “alerts”. Tracking wallets helps to understand on-chain activity and popular targets, but I never blindly copy any trades.

Information overload (using too many tools, tracking too many wallets) only benefits those who can sift the valuable signals from the noise.

I know some traders who track thousands of wallets at the same time and make good profits because they are familiar with the patterns of activity of these wallets.

In any case, your mission is to stay rooted in these platforms for the rest of your life, screening every trading pair after graduation until you figure out what will rise and why. I guarantee that even if you start from scratch, you will make huge progress (not necessarily in terms of profit and loss, but in terms of understanding) by squatting on tokens and screening every day for two months.

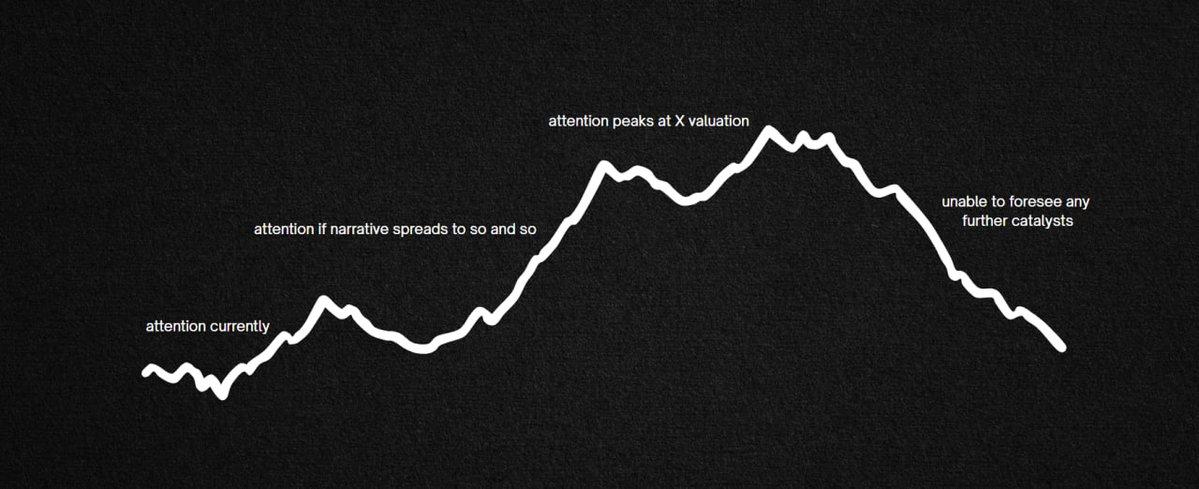

When you see a banner that might last longer than 5 minutes, you need to do a brief but thoughtful reflection: understand how others will perceive it and assess how much attention it might attract from now on.

I draw an "attention chart" in my mind; although it doesn't exist in reality, you can construct it in your imagination.

After formulating a reasonable strategy, determine your position (simple formula: the position size should allow you to feel a sense of accomplishment when you make a profit, but not to severely damage your account when you lose money), and then wait patiently for the results.

If you are wrong, reevaluate and leave; if you are right, congratulations, you see further than the average participant!

Being good at identifying and interpreting the market's attention to the target and linking attention to price is a way to assess the value of the narrative before it is repriced. I have always said that entries, positions and exits are all technical aspects that can be gradually improved; but being good at independently evaluating technical/narrative value is crucial.

The same is true for technology-based transactions. When the AI concept broke out, hundreds of projects hovered below $1 million in market value for hours or even days, and then soared to more than $10 million. Those who understood the value of their technology before others captured the inevitable repricing opportunities in advance.

A project could sit at $100k for a few hours when its fair valuation should be at least $5m (compared to current high-valued mature token market caps/charts) and this is a delayed anomaly opportunity for utility.

Sometimes, a token looks good at first glance when there is a lack of information but a surge in trading volume. I will first build a position of 1/3 of the regular position and continue to evaluate: if it is mediocre, exit immediately; if it is indeed high-quality and not close to the expected ceiling, then increase the position.

Key Points: The key to pre-empting narrative and technology repricing lies in your ability to read the inflow and outflow of attention.

“Is news trading worth doing? What about Musk’s tweets?”

It’s certainly worth it, but many people lose money by blindly chasing fast volume and steep price curves.

They don't even want to spend 10 seconds thinking: Has this news trade peaked? A month old piece of news has no potential to catalyze attention, while Musk's new pet coin may attract a lot of attention. Hopefully you understand the difference.

To participate in this type of trading, you need to make rational decisions within 10 seconds: assessing value, planning the best position and exit point. This is why I emphasize increasing screen time, because only in this way can you hone this skill.

The top traders I know build their entire trading systems around “assessing narrative value in advance.”

Why is engagement high but progress stagnant?

The most common reason among experienced traders is a lack of responsibility. They miss out on trades that they shouldn’t have missed due to lack of experience, but they blame external factors and don’t seriously analyze the reasons for their failures.

Missing an obvious opportunity is equivalent to a loss and should be taken seriously. Humans are wired to make excuses for their own incompetence: "So what if I missed X coin? There's another one!" This happens hundreds of times over and over again, and they keep comforting themselves. When you miss an opportunity that you shouldn't have missed, you have to be hard on yourself and really feel the failure to understand the problem and grow, rather than ignoring it.

I saw this clearly after the Trump trade. There are two types of reactions among those who missed out: one completely ignores the failure and stops trying to make progress; the other falls into deep despair and loses focus for long periods of time. Those who reflect on their miss out are doing the best now.

Feeling desperate about failure is a necessary step to growth. You can't keep saying "next time" without knowing it. You must make changes to prevent "next time" from happening. Excuses can bring temporary relief, but if nothing changes, what will be waiting for you in a few months? You will be standing still and exhausted.

Is it really worth dedicating part of my life to this?

I will believe until my death that it is worth it. If you have the ability to change your trading strategy multiple times according to market demand, it is all worth it. For those who have little capital but are motivated, on-chain trading is the best opportunity.

I wish I could give you a simple blueprint for success, but there is no such formula. It's like asking a successful football player how he scores so many goals. His most detailed answer is probably: "Kick the ball in front of the goal."

Some people are born stupid and will never realize that on-chain transactions require a mental game, and will never understand that you are competing with thousands of similar brains and need to learn how they think.

But many of you have potential, but you are replacing action and commitment with doubt. Don't waste your potential by living a mediocre life.

Commit to solving this puzzle, follow your trading process, and rebuild the process as many times as necessary to win.

Conclusion and Personal Reflection

The above is a complete summary of my trading style. I have tried my best to describe my way of thinking in words. It may seem simple, but it is the core of my amazing profits.

I have published dozens of technical guides on on-chain transactions, but I have never really explored the psychological aspects because it is difficult to express in words. I tried to convey how to achieve focus and also pointed out the direction of focus.

There is no doubt that this game is difficult, but don't be intimidated, don't be afraid of the market, face the challenge head on. Embrace the puzzle and enjoy the process.