A few days ago, I saw a post saying:

"Now that Solana's Staking amount has exceeded ETH's Staking amount, does it mean that Solana's chain security has surpassed ETH's?"

This statement is so misleading that many people actually believe it.

However, that's not the case.

Let's look at some data first:

ETH's Staking data is 34M ETH, worth around $61 billion;

SOL's Staking data is 388M SOL, worth around $58.7 billion.

SOL has indeed reached the same level as ETH, and before ETH's recent rebound, it was even slightly lower than SOL.

(Data source: Beaconcha & Solana Beach).

Considering that both have a PoS attack threshold of around 33%, the theoretical attack difficulty seems consistent.

33% can obstruct block production, 51% can create a new longest chain, and 67% can directly perform double-spending.

However, in practical terms, attacking ETH is significantly more difficult than Solana.

PS: Assuming the success rate of attacking SOL is 0.001% and attacking ETH is 0.0001%, although the difference is significant, it's important to note that both are still extremely low-probability events.

The reasons are (1) node concentration (2) Staking infrastructure maturity.

I. Node Concentration

Let's assume a scenario: A miraculous hacker uses a 0-day vulnerability to successfully hack Amazon and major cloud service providers' data centers.

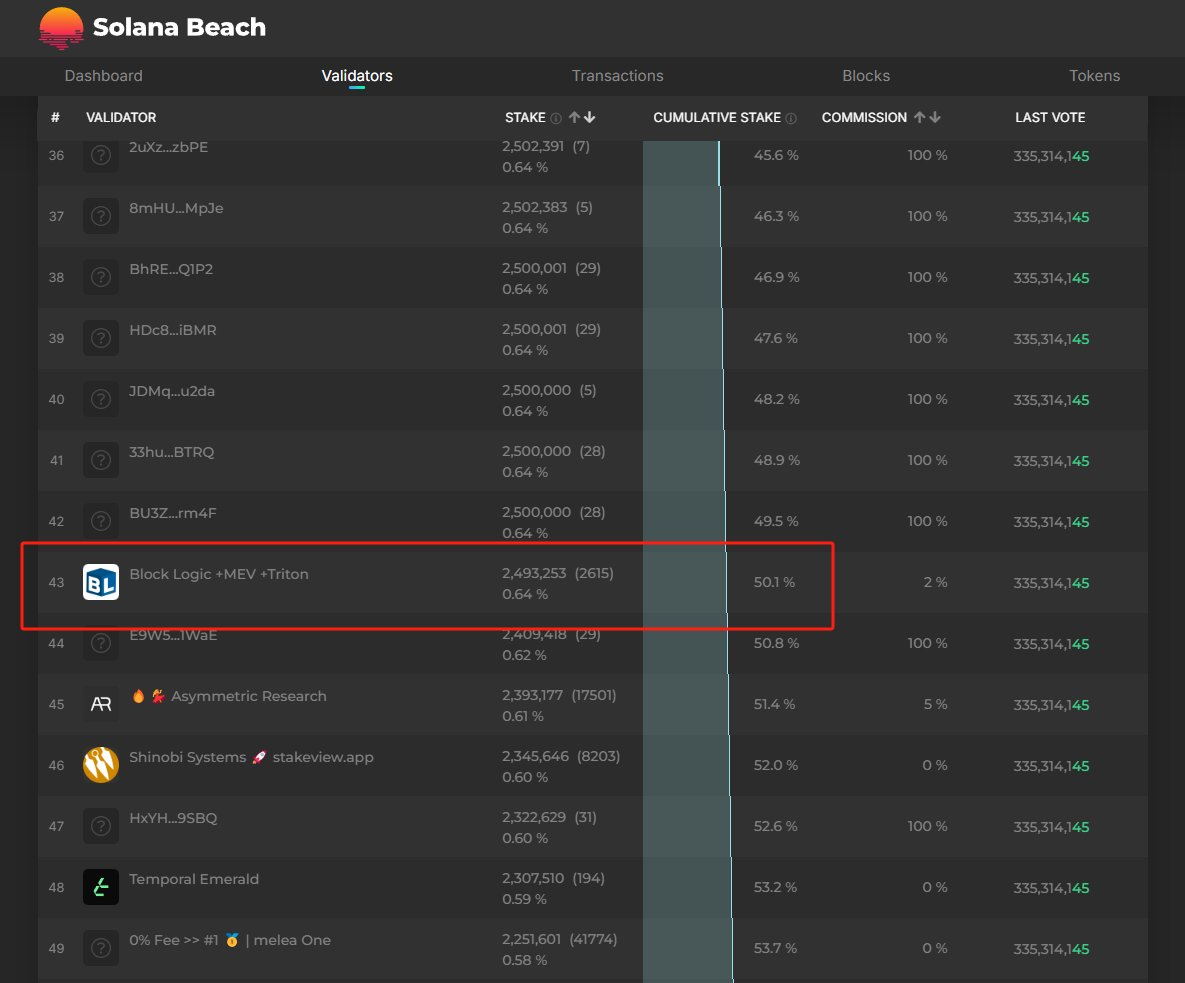

Controlling Solana > 50% requires taking over the top 43 nodes. It's difficult, but not impossible.

For ETH, each node can stake a maximum of 32 ETH, so it would require taking over 1,187,000 nodes, which sounds impossible.

Of course, this calculation is unfair to SOL, because essentially ETH is also run by many node operators, and one entity might own tens of thousands of nodes. Looking at the operators listed on Rated...

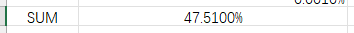

You'll find that all registered ETH node operators combined only account for 47.5%, not even reaching the 50% threshold. It remains an impossible task.

The reason is that ETH, as an ancient public chain, has truly experienced PoS attacks in the past and has indeed made many preparations to prevent this potential danger, such as encouraging retail participation in Staking.

Ethereum's 32 ETH threshold is not high, while Solana has high server requirements, with monthly costs 5-10 times that of ETH, and this is just the entry point. So, for retail investors to break even, they would need to stake at least 10K SOL, and the yield is still lower than Jito.

II. Infrastructure Maturity

Many ETH Staking infrastructures, including @LidoFinance and @Obol_Collective, have also done a lot of groundwork.

For example, Lido requires nodes to use fewer Amazon data centers and more niche data centers. Use fewer mainstream clients and support more niche clients. Additionally, Lido has set aside 4% ETH for DVT infrastructure like Obol and SSV.

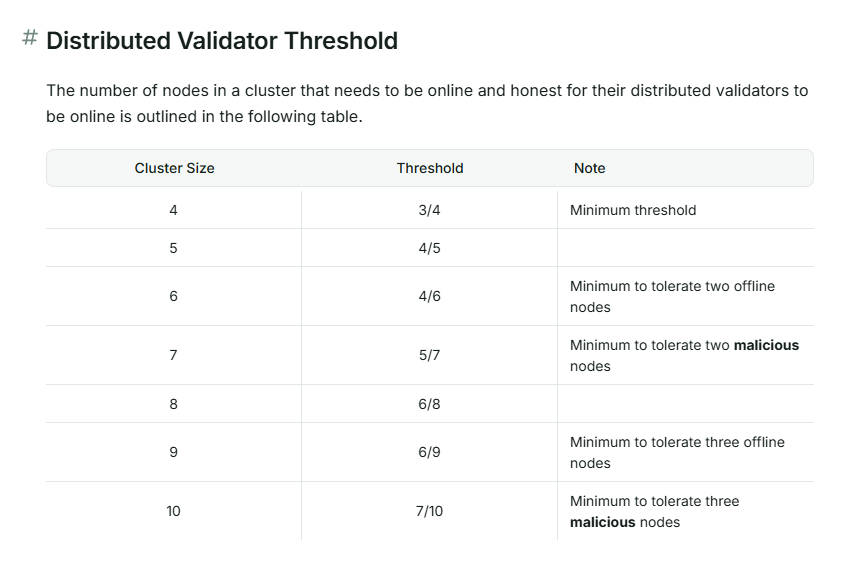

Obol uses DVT technology. You can think of it as a node managed by a cluster rather than a single entity.

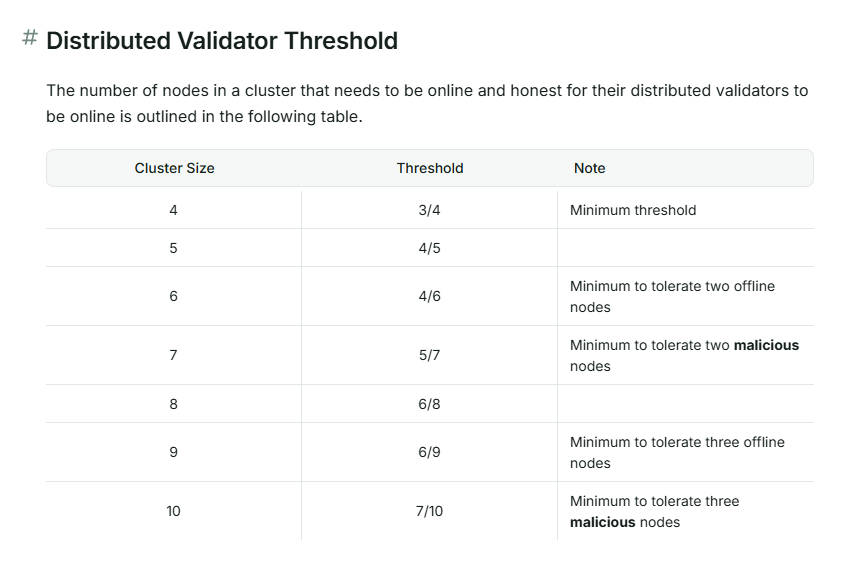

For instance, 4 people co-manage a node, and you can require it to be 3/4, so if one node goes offline, others can immediately take over. If you set it to 10, you can set 7/10, tolerating up to three nodes going offline.

Note: On ETH and most PoS chains, going offline is also a form of misbehavior. If 33% of nodes go offline, the chain will collapse.

Moreover, Obol's unique feature is that it implements the cluster through a single client, so your private key (fragments) will not be uploaded to the chain, making it more secure, which is achieved through DKG (I can share more about DKG later).

Obol just launched on mainnet recently, and those interested can explore it via @ebunker_eth.

So, infrastructures like Obol specifically prepared for Staking are currently not available on Solana.

Of course, this isn't about disparaging one and praising another; both chains are very secure. However, although the financial stakes have reached the same level, in terms of security, due to node concentration and infrastructure maturity, ETH still has a slight edge.

"Now that Solana's Staking amount has exceeded ETH's Staking amount, does it mean that Solana's chain security has surpassed ETH's?"

This statement is so misleading that many people actually believe it.

However, that's not the case.

Let's look at some data first:

ETH's Staking data is 34M ETH, worth around $61 billion;

SOL's Staking data is 388M SOL, worth around $58.7 billion.

SOL has indeed reached the same level as ETH, and before ETH's recent rebound, it was even slightly lower than SOL.

(Data source: Beaconcha & Solana Beach).

Considering that both have a PoS attack threshold of around 33%, the theoretical attack difficulty seems consistent.

33% can obstruct block production, 51% can create a new longest chain, and 67% can directly perform double-spending.

However, in practical terms, attacking ETH is significantly more difficult than Solana.

PS: Assuming the success rate of attacking SOL is 0.001% and attacking ETH is 0.0001%, although the difference is significant, it's important to note that both are still extremely low-probability events.

The reasons are (1) node concentration (2) Staking infrastructure maturity.

I. Node Concentration

Let's assume a scenario: A miraculous hacker uses a 0-day vulnerability to successfully hack Amazon and major cloud service providers' data centers.

Controlling Solana > 50% requires taking over the top 43 nodes. It's difficult, but not impossible.

For ETH, each node can stake a maximum of 32 ETH, so it would require taking over 1,187,000 nodes, which sounds impossible.

Of course, this calculation is unfair to SOL, because essentially ETH is also run by many node operators, and one entity might own tens of thousands of nodes. Looking at the operators listed on Rated...

You'll find that all registered ETH node operators combined only account for 47.5%, not even reaching the 50% threshold. It remains an impossible task.

The reason is that ETH, as an ancient public chain, has truly experienced PoS attacks in the past and has indeed made many preparations to prevent this potential danger, such as encouraging retail participation in Staking.

Ethereum's 32 ETH threshold is not high, while Solana has high server requirements, with monthly costs 5-10 times that of ETH, and this is just the entry point. So, for retail investors to break even, they would need to stake at least 10K SOL, and the yield is still lower than Jito.

II. Infrastructure Maturity

Many ETH Staking infrastructures, including @LidoFinance and @Obol_Collective, have also done a lot of groundwork.

For example, Lido requires nodes to use fewer Amazon data centers and more niche data centers. Use fewer mainstream clients and support more niche clients. Additionally, Lido has set aside 4% ETH for DVT infrastructure like Obol and SSV.

Obol uses DVT technology. You can think of it as a node managed by a cluster rather than a single entity.

For instance, 4 people co-manage a node, and you can require it to be 3/4, so if one node goes offline, others can immediately take over. If you set it to 10, you can set 7/10, tolerating up to three nodes going offline.

Note: On ETH and most PoS chains, going offline is also a form of misbehavior. If 33% of nodes go offline, the chain will collapse.

Moreover, Obol's unique feature is that it implements the cluster through a single client, so your private key (fragments) will not be uploaded to the chain, making it more secure, which is achieved through DKG (I can share more about DKG later).

Obol just launched on mainnet recently, and those interested can explore it via @ebunker_eth.

So, infrastructures like Obol specifically prepared for Staking are currently not available on Solana.

Of course, this isn't about disparaging one and praising another; both chains are very secure. However, although the financial stakes have reached the same level, in terms of security, due to node concentration and infrastructure maturity, ETH still has a slight edge.